Dogecoin's price is currently fluctuating near a critical support level at $0.17, which will determine its future trajectory. Analysts suggest that holding above $0.17 could trigger a price increase, while a break below this level might lead to further declines. The price will be influenced by technical factors, Fibonacci levels, and investor sentiment.

Dogecoin Price Needs to Hold $0.17 to Maintain Uptrend

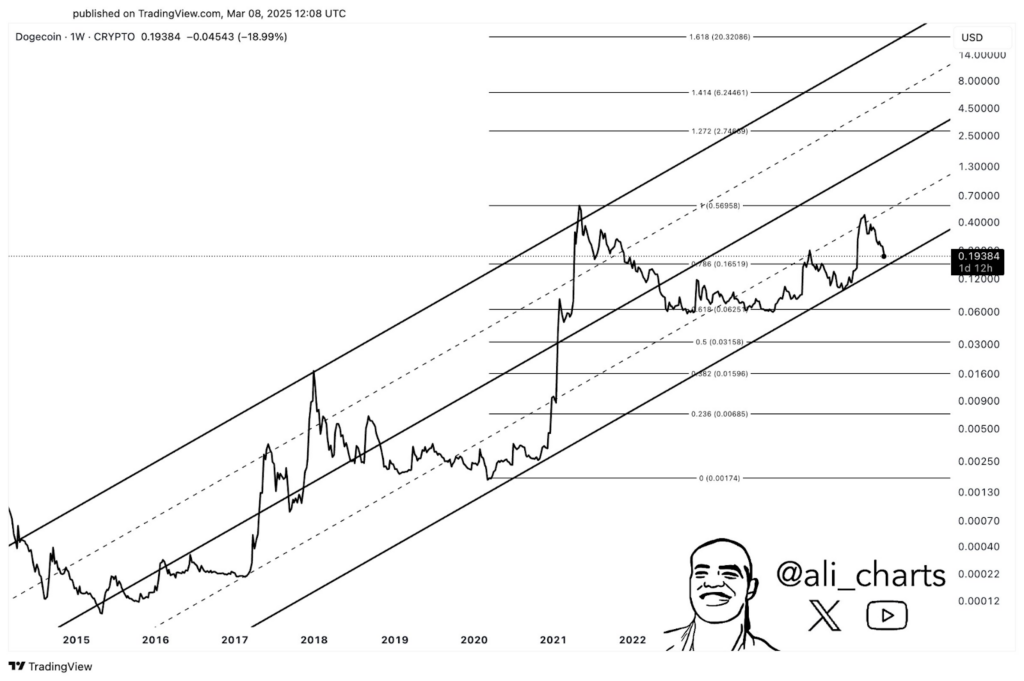

DOGE is currently testing the lower boundary of a long-term ascending channel near $0.17. Analyst Ali Martinez notes this level has historically acted as strong support before significant price increases. Maintaining this support would bolster the bullish trend and potentially drive DOGE's price higher. However, a breakdown below $0.17 could invalidate this bullish pattern and trigger bearish sentiment, potentially pushing DOGE towards lower support levels. Staying above $0.17 is crucial for maintaining the upward trend.

Source: X

Breaking the $0.786 Fibonacci Level Could Spark a Rally

DOGE is approaching the 0.702 and 0.786 Fibonacci retracement levels, which represent significant resistance. Charting Guy identifies these levels as key indicators of DOGE's future price direction. Historically, breaking above the 0.786 level has resulted in strong bullish momentum. A successful break could increase buying pressure and potentially propel DOGE towards $1. Conversely, rejection at these levels could signal weakness and lead to a price pullback.

Momentum Indicators Show Weakness in DOGE's Uptrend

Momentum indicators suggest weakening price trends for DOGE. The RSI remains below 50, indicating a lack of confirmed bullish signals. A rise above 50 would signal increased demand and investor confidence. The On-Balance Volume (OBV) is also declining, suggesting reduced buyer participation. Without strong trading volume and positive social sentiment, a sustained breakout may be challenging for DOGE.

Dogecoin's Future Depends on Key Support and Resistance Levels

At the time of writing, DOGE traded at $0.1700, down 11.84% in the last 24 hours. 24-hour trading volume increased by 11.44% to $1.36 billion. The $0.17 support level is critical. A rebound from this level could lead to a rally towards higher resistance levels, potentially reaching $2.74. However, failure to break key Fibonacci levels could trigger a substantial decline. Technical indicators, investor sentiment, and whale activity will all influence DOGE's price movements. High trading volume suggests potential for an uptrend, while low volume could indicate a downward trend.

CoinPedia News

CoinPedia News CoinPedia News

CoinPedia News CoinPedia News

CoinPedia News suncrypto.in

suncrypto.in TheCoinrise Media

TheCoinrise Media CoinPedia News

CoinPedia News BH NEWS

BH NEWS Optimisus

Optimisus DogeHome

DogeHome