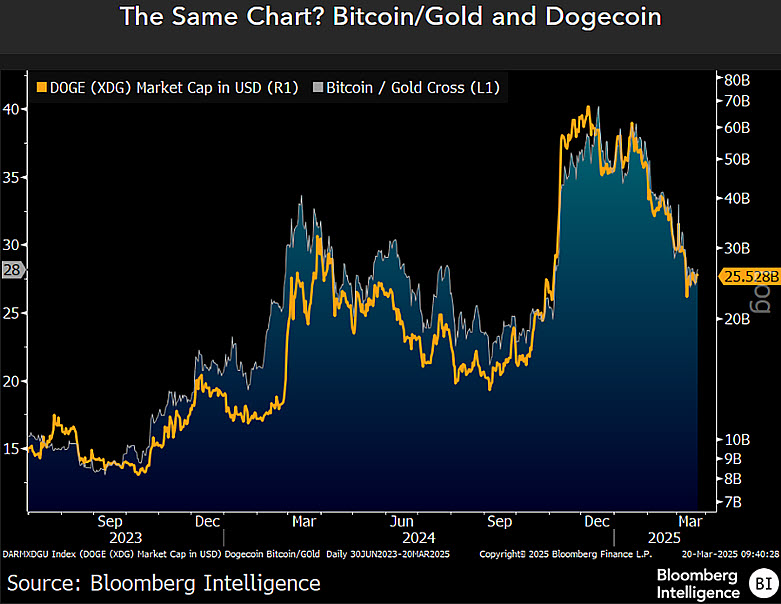

Bloomberg Intelligence commodity strategist Mike McGlone warns that Dogecoin (DOGE) may be mirroring historical bubbles like those of 1929 and 2000, potentially leading to sharp price reversals typical of speculative assets. He suggests Bitcoin could similarly plummet to $10,000, echoing the Nasdaq's 2000 crash. Furthermore, he points to a correlation between the gold-to-Bitcoin ratio and Dogecoin's volatility, suggesting potential downside for both.

McGlone, in a recent X post, drew parallels between current cryptocurrency market conditions and major historical financial collapses. He highlighted the risk of rapid price corrections in speculative assets like Dogecoin, comparing them to past high-risk investments that experienced sudden and significant value losses. He noted: "Dogecoin, 1929, 1999 Risk-Asset Silliness and Gold – The ratio of #gold ounces equal to #Bitcoin trading almost tick-for-tick with #Dogecoin may show the risks of reversion in highly speculative #digitalassets, with #deflationary implications underpinning the metal."

McGlone further emphasized Bitcoin's potential price decline, drawing a comparison to the Nasdaq 100 index's 2000 crash, where the index fell from 4,700 to 800 points after reaching its peak.  Source: X

Source: X

Earlier this month, McGlone predicted Bitcoin's potential drop to $10,000, attributing this prediction to similarities between current risk assets and the overvalued tech stocks of the dot-com era. He observed that the gold-to-Bitcoin price ratio currently mirrors Dogecoin's price movements, implying potential declines in both if investors shift towards safer havens like gold.

McGlone's analysis reflects his broader view that cryptocurrencies exhibit characteristics of market bubbles. He argues that investors may divest from Dogecoin and Bitcoin during periods of market uncertainty, favoring traditional safe-haven assets. This perspective is echoed, albeit indirectly, by Cathie Wood of Ark Invest, who recently reduced her firm's holdings in Meta shares, reflecting a broader trend of portfolio adjustments amid concerns about overvalued risk assets.

McGlone's warnings come as Bitcoin trades near $26,000, significantly down from its 2021 peak above $60,000. Dogecoin, currently priced near $0.06, also remains below its 2021 high of $0.74. Historical data consistently demonstrates that assets fueled by speculative fervor often undergo sharp corrections, as exemplified by the Nasdaq's 2000 collapse.

DogeHome

DogeHome DT News

DT News CoinsProbe

CoinsProbe U_Today

U_Today Crypto Daily™

Crypto Daily™ Times Tabloid

Times Tabloid Crypto Daily™

Crypto Daily™