| Before you reading, did you missed the PEPE? No worries, click here to 100x potential memes! |

- Bitcoin and other cryptocurrencies saw little change on Monday, holding steady near levels close to the recent peak of a rally.

- The price of Bitcoin dropped by less than 1% to below $36,950 in the last 24 hours, slipping further from its recent peak around $38,000.

- Tuesday’s Consumer Price Index (CPI) inflation reading and Wednesday’s retail sales data can both serve as catalysts for readjusting interest expectations.

Bitcoin price begins to move slowly ahead of US economic data; How will BTC progress this week? Is 38 thousand dollars possible?

Bitcoin Price Slows Ahead of Data

Bitcoin and other cryptocurrencies saw little change on Monday, holding steady near levels close to the recent peak of a rally. However, a technical indicator is flashing, suggesting that prices may be vulnerable to some losses.

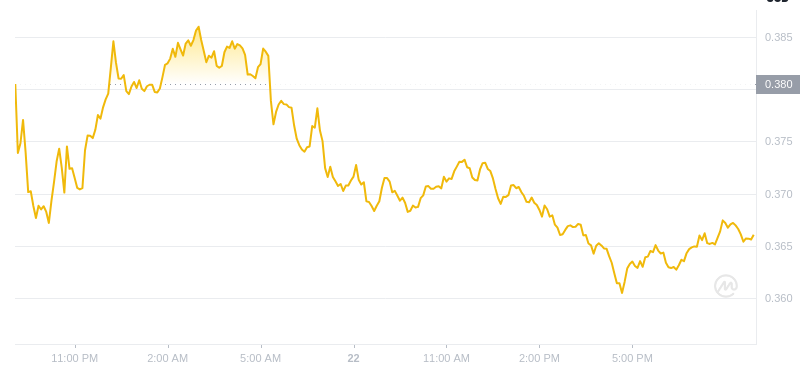

The price of Bitcoin dropped by less than 1% to below $36,950 in the last 24 hours, slipping further from its recent peak around $38,000 but still within a range that has persisted for about a week. The largest digital asset, after nearly a month-long rally with low volatility and trading volumes, has gained almost 40%, signaling a new bull market alongside calls.

Like the Dow Jones Industrial Average and the S&P 500, Bitcoin may react to macroeconomic data this week that could impact interest expectations, as borrowing costs play a significant role in demand for risky assets.

Traders have recently been optimistic that the Federal Reserve has completed its interest rate hikes, but Fed Chairman Jerome Powell said last week that hikes could still continue, making this week’s economic data crucial. Tuesday’s Consumer Price Index (CPI) inflation reading and Wednesday’s retail sales data can both serve as catalysts for readjusting interest expectations. Yuya Hasegawa, an analyst at Bitbank, said:

“The broad financial market looks optimistic that U.S. CPI and retail sales this week will show a slowdown in inflation and an increase in demand, and if so, Bitcoin can test $38,000.”

Negative Scenario for Bitcoin

However, in the short term, the technical market ground for Bitcoin may become decisive after weeks of gains, which could add pressure to crypto prices overall. Hasegawa stated:

“The relative strength index (RSI) for Bitcoin, which tends to show a deviation from the price trend, indicating a tendency for a trend reversal, has occurred twice this year and usually lasts about a month until the price trend changes… Bitcoin’s price trend could begin to reverse towards the end of this week.”

Beyond Bitcoin, Ether, the second-largest cryptocurrency, rose by less than 1% to $2,050 after the news of BlackRock applying for a spot Ether exchange-traded fund (ETF) following the advantage after the news. Smaller cryptocurrencies or altcoins were more mixed, with Cardano dropping 4%, while Polygon increased by 5%. Meme coins performed lower, with both Dogecoin and Shiba Inu dropping by more than 1%.

The post Bitcoin Price Stalls Ahead of Economic Data: What to Expect This Week? appeared first on COINOTAG NEWS.

| Did you missed the PEPE? No worries, click here to 100x potential memes! |

CoinDesk

CoinDesk Inside Bitcoins

Inside Bitcoins Crypto Daily™

Crypto Daily™ crypto.news

crypto.news Crypto Daily™

Crypto Daily™ DogeHome

DogeHome Optimisus

Optimisus Crypto Intelligence

Crypto Intelligence BlockchainReporter

BlockchainReporter