Entry Strategy

1. Identify Key Levels:**

1. Identify Key Levels:**

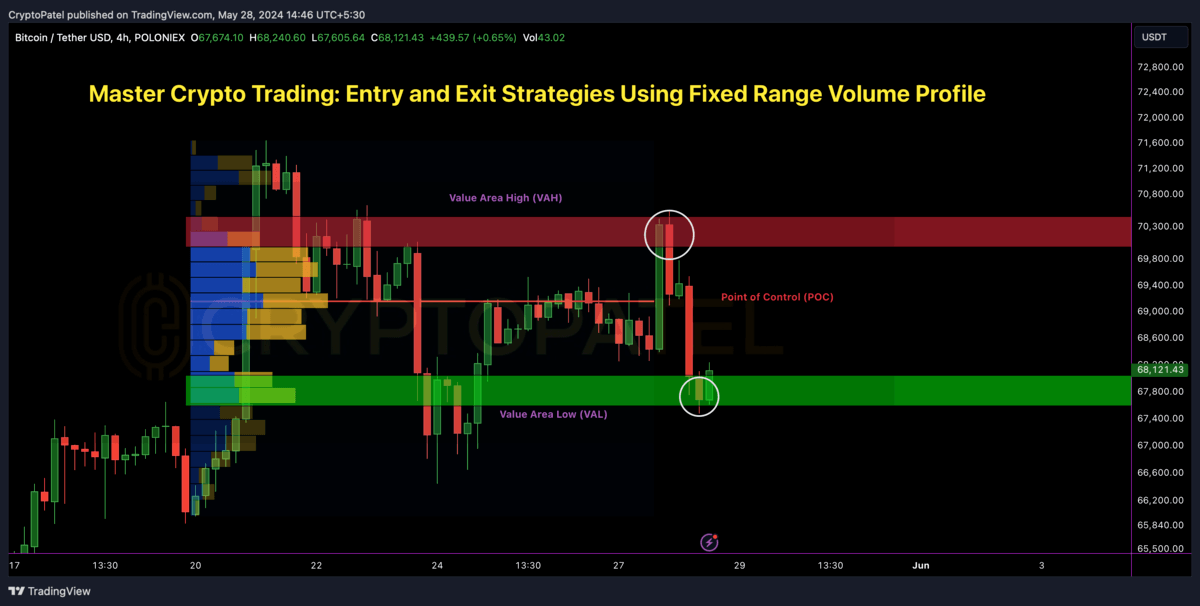

- Value Area High (VAH): Upper boundary with 70% volume concentration, often acting as resistance.

- Value Area Low (VAL): Lower boundary with 70% volume concentration, often acting as support.

- Point of Control (POC): Price level with highest traded volume, indicating significant interest.

2. Volume Shelves:**

- Identify areas with volume concentration, known as volume shelves. These indicate strong support or resistance zones.

3. Market Context:**

- Analyze overall market trend using higher time frames to determine trend direction (uptrend, downtrend, sideways).

4. Confirmation with Candlestick Patterns:**

- Use candlestick patterns around VAH, VAL, and POC for entry point confirmation. Look for patterns like pin bars, engulfing candles, and hammers.

5. Entry Trigger:**

- Long Positions: Enter near VAL with confirmation from bullish candlestick patterns.

- Short Positions: Enter near VAH with confirmation from bearish candlestick patterns.

- Consider entering at POC if there is strong price reaction (e.g., price bounces off POC with significant volume).

Exit Strategy

1. Target Levels:**

- Set initial targets at the next significant volume shelf.

- Use VAH and VAL as primary target levels, depending on entry direction.

- Consider POC as a mid-point target.

2. Trailing Stops:**

- Use trailing stops to lock in profits as price moves in your favor. For long positions, place stop-loss orders below VAL; for short positions, place above VAH.

3. Volume Analysis:**

- Monitor volume as price approaches target levels. Decreasing volume near targets could indicate a weakening trend, suggesting it's time to exit.

4. Price Action Signals:**

- Exit positions if you observe reversal candlestick patterns near your target levels, such as doji, shooting star, or hammer.

Example of Application

Scenario: Strong support level identified at VAL in an uptrend.

1. Entry: Place a buy order near VAL, with a stop loss just below the support level.

2. Target: Set first target at POC, second target at VAH.

3. Management: Use a trailing stop to follow the price, adjusting it below higher lows as the price moves up.

Crypto Daily™

Crypto Daily™ BlockchainReporter

BlockchainReporter Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™ crypto.news

crypto.news CoinPedia News

CoinPedia News Cryptopolitan_News

Cryptopolitan_News Crypto Daily™

Crypto Daily™ BSCN

BSCN