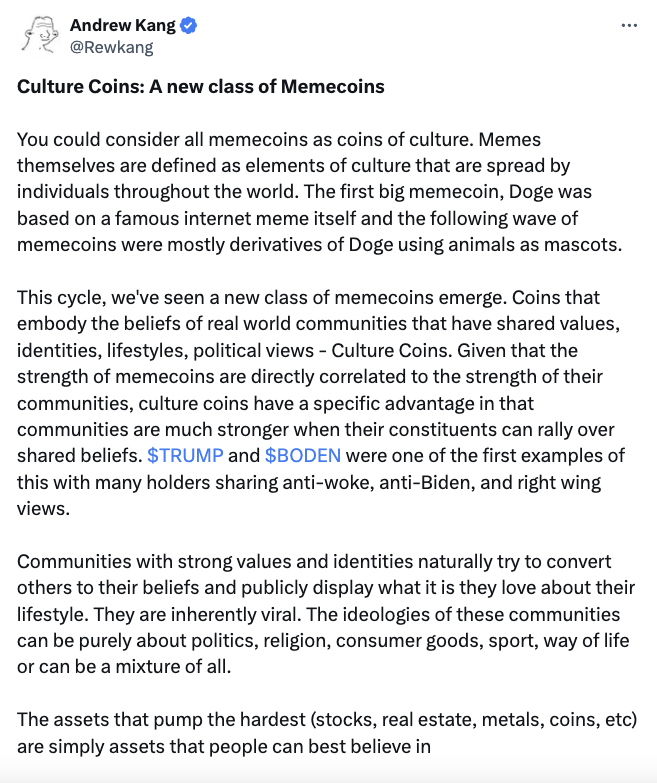

Memecoins that can capitalize on deeper “culture” this cycle could be far more profitable than standard meme tokens based on animals and simple jokes, according to Mechanism Capital co-founder Andrew Kang.

In an April 7 post to X, Kang said a new class of “culture coins” — memecoins centered around cultural values such as politics, brands, religion, and lifestyle — have the capacity to be far more “viral” than the popular memecoins of the last cycle such as Dogecoin (DOGE) or Shiba Inu (SHIB) coins

“Communities with strong values and identities naturally try to convert others to their beliefs and publicly display what it is they love about their lifestyle. They are inherently viral.”

“The ideologies of these communities can be purely about politics, religion, consumer goods, sport, way of life or can be a mixture of all,” added Kang.

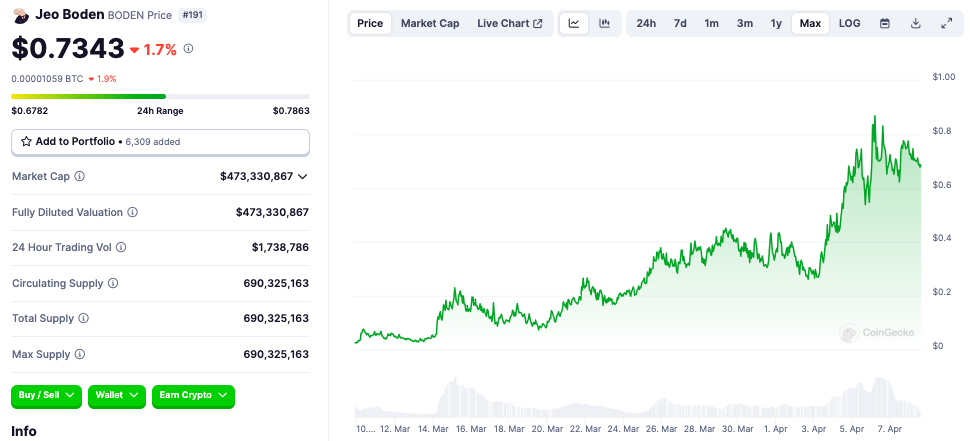

Kang noted two specific Solana-based memecoins — Jeo Boden (BODEN) and Doland Tremp (TREMP) as recent examples of culture coins that grew rapidly out of communities harboring “anti-woke, anti-Biden, and right-wing views.”

BODEN has grown massively since it’s launch on March 9, posting gains of well over 700,000% since inception. At time time of publication, Boden boasts a market capitalization of $473 million and stands as the 191st largest token by total value, per CoinGecko data.

The Donald Trump parody coin TREMP has also posted significant gains since its launch on Feb. 27 but didn’t gain as much traction as BODEN. It currently touts a market cap of $73 million, per Birdeye data.

Outside of politics, Kang suggested memecoins that draw their likeness from successful consumer brands — specifically naming ZYN and MOUTAI as his firm’s investments — could ride on the coattails of brands in a “circular economy” of gains.

“Compared to animal coins, coins that represent consumer brands can have the additional advantage of leveraging the associated lifestyle of that brand for added virality,” Kang added.

Related: ZachXBT won’t assist after memecoin devs throw tokenholders under the bus

Overall, Kang suggested that the decision to invest in memecoins wasn’t too far from investing in regular assets that achieve outsized returns.

“The assets that pump the hardest (stocks, real estate, metals, coins, etc) are simply assets that people can best believe in,” he said.

However, crypto industry pundits remain divided on the impact of memecoins on the sector.

BitMEX co-founder Arthur Hayes says memecoins are a “net positive” for their respective blockchain networks while others say they’re a dangerous, speculative mess that betrays the founding principles of blockchain technology.

Regardless of their effect on the ecosystem, memecoins have established themselves as the most profitable sector within crypto for the first quarter of this year.

According to a market report from CoinGecko, the top 10 largest memecoins recorded an average gain of 1,312.6% for holders in Q1, 2024.

“The memecoin narrative was 4.6 times more profitable than the next best-performing crypto narrative of tokenized real-world assets (RWA), and 33.3 times more profitable than the layer 2 narratives with the lowest returns in Q1 this year,” said CoinGecko analyst Lim Yu Qian.

Magazine: 5 dangers to beware when apeing into Solana memecoins

U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com DogeHome

DogeHome Optimisus

Optimisus Optimisus

Optimisus DeFi Planet

DeFi Planet Crypto Daily™

Crypto Daily™ BlockchainReporter

BlockchainReporter TheCoinrise Media

TheCoinrise Media