In an attention-grabbing chronicle witnessed within the cryptocurrency realm, Dogecoin, one of the most renowned meme-based cryptocurrencies, garnered significant investor attention today, April 3, as the token noted massive whale transactions. These transactions, emerging amid DOGE’s slip to the $0.18 level, birthed a tsunami of speculations surrounding DOGE’s price action ahead.

Following massive liquidations and market corrections, Dogecoin recorded a substantial plunge recently. Now, with on-chain whale activity burgeoning for the token, investors speculate over Dogecoin’s price as BTC halving approaches. Intriguingly, Bitcoin’s pre-halving correction adds up to the plunge witnessed by altcoins, as even DOGE reflected, mirroring a broader downtrend in the market.

DOGE Whale Activity Stirs Speculations Over Mixed Market Sentiments

According to the data spotlighted by the blockchain tracker Whale Alert, a staggering 583.75 million DOGE was noted to be on the move over the past 24 hours. Notably, these whale transactions showcased dumps to exchanges and accumulation by whales in hand, showcasing mixed sentiments in the market.

As per the data, 229 million DOGE, worth $42.95 million, was accumulated by an unknown wallet from Robinhood, whereas 60.26 million coins, worth $11.14 million, were dumped into the same CEX by another whale. Similarly, 58.81 million DOGE, worth $11.03 million, was accumulated from Coinbase, one of the leading CEXs, whereas 234.68 million DOGE, worth $43.61 million, was dumped to the same by another whale. This collectively hinted at a mixed sentiment among whales, in turn curating an uncertain scenario orbiting Dogecoin’s price action ahead.

Meanwhile, market dynamics for the meme coin further nabbed significant attention, illustrating a bearish trend win over the token.

Also Read: Shiba Inu Emerges As Top Traded Crypto On WazirX In India

Dogecoin Price Slips

As of writing, the Dogecoin token’s price noted a dip of 1.37% in the past 24 hours, currently resting at $0.184. This massive drop comes surfing the tide of recent market corrections, as mentioned above.

Simultaneously, Coinglass revealed a 4.47% drop in the token’s open interest, accompanied by a dip in the OI-weighted funding rate to 0.0197%. Hinting at reduced readiness among investors to invest more in long positions, escorted by a loss of investor interest in the asset, the token took a bearish stance as of press time.

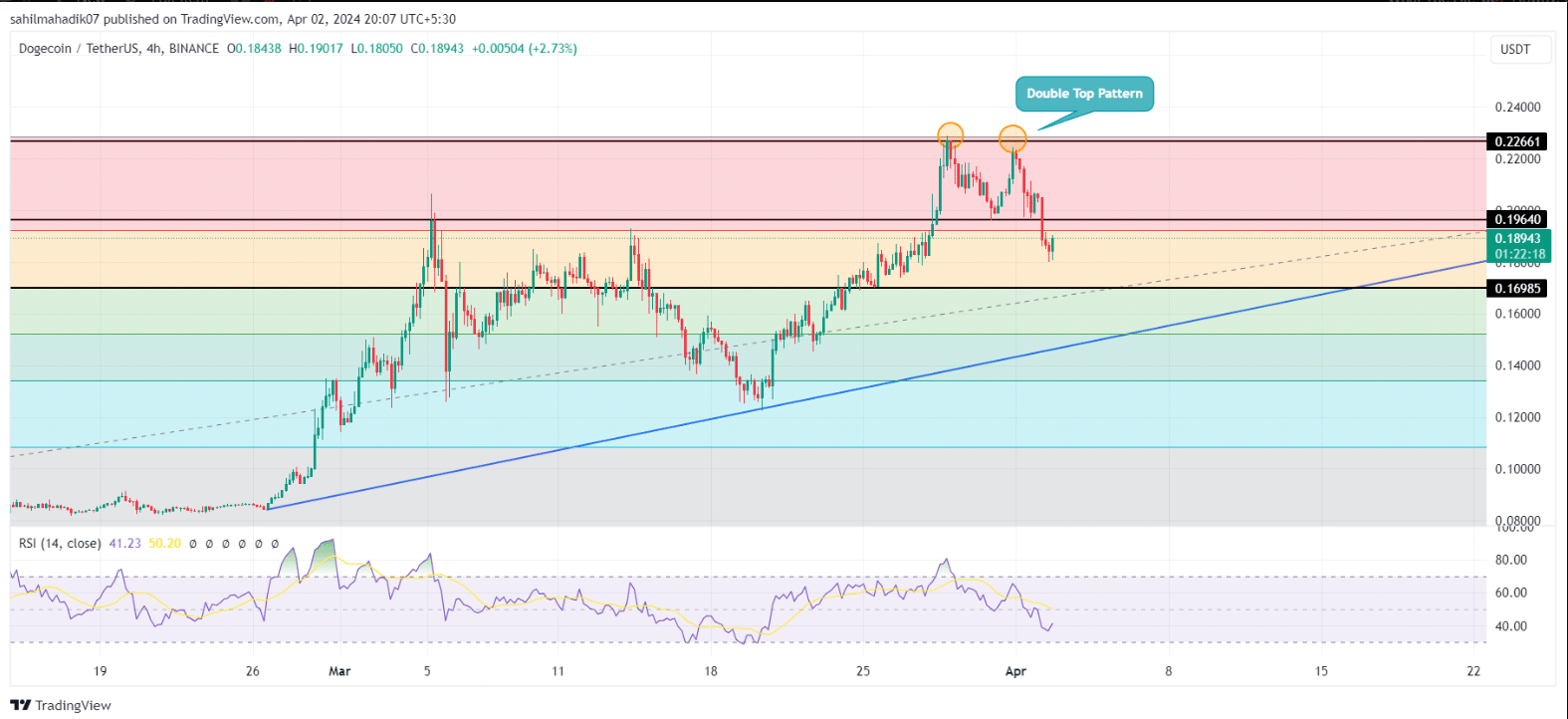

Moreover, analysis by CoinGape Media highlighted another intriguing phenomenon, wherein the dog-based meme token witnessed substantial selling pressure at the $0.22 mark, leading to a phenomenal price decrease to now trade at $0.18. In the analysis, aligning with the 4-hour chart, DOGE’s peak has formed a double-top pattern, amplifying the bearish sentiment among traders.

Should supply pressure persist moving ahead, the DOGE price may record another dip of nearly 8% to hit combined support of the ascending trendline and 38.2% Fibonacci retracement level at $0.17. Nonetheless, crypto market enthusiasts continue to extensively eye the token as BTC halving looms and historic data showcases altcoins mimicking BTC’s price movements.

Also Read: Solana Price Surge Secrets Revealed; What’s Solana Hiding From Us

DogeHome

DogeHome TheCoinrise Media

TheCoinrise Media Thecoinrepublic.com

Thecoinrepublic.com TheCoinrise Media

TheCoinrise Media TheCoinrise Media

TheCoinrise Media Cryptopolitan_News

Cryptopolitan_News Coin Edition

Coin Edition BlockchainReporter

BlockchainReporter