Cover image via U.Today

Dogecoin (DOGE) Exhibits a Surge in Large Holders Inflow

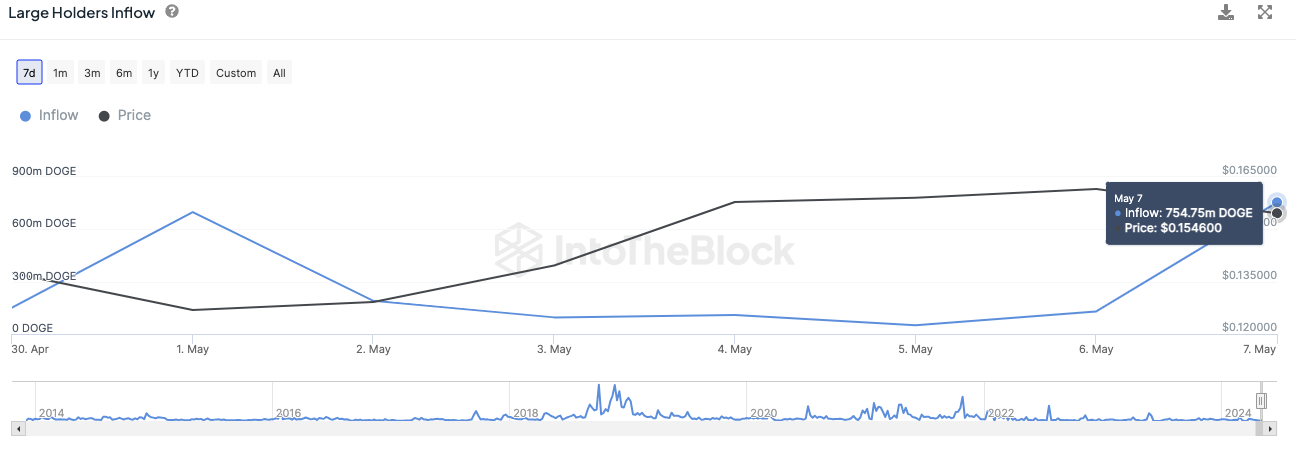

Over the past 24 hours, Dogecoin (DOGE) has experienced a remarkable 582% increase in a critical on-chain metric. According to data from IntoTheBlock, Large Holders Inflow has climbed significantly, from 129.63 million DOGE to an impressive 754.75 million DOGE, equivalent to approximately $116.98 million.

This surge in Large Holders Inflow indicates robust buying activity, primarily driven by influential entities such as whales and investors. These addresses typically acquire assets on centralized exchanges before transferring them to cold storage, which often signals a bullish sentiment.

Historical Significance of Large Holders Inflow

Historically, spikes in Large Holders Inflows have aligned with market bottoms, implying significant buying during corrections.  Source: IntoTheBlock

Source: IntoTheBlock

Outflows and Netflow Considerations

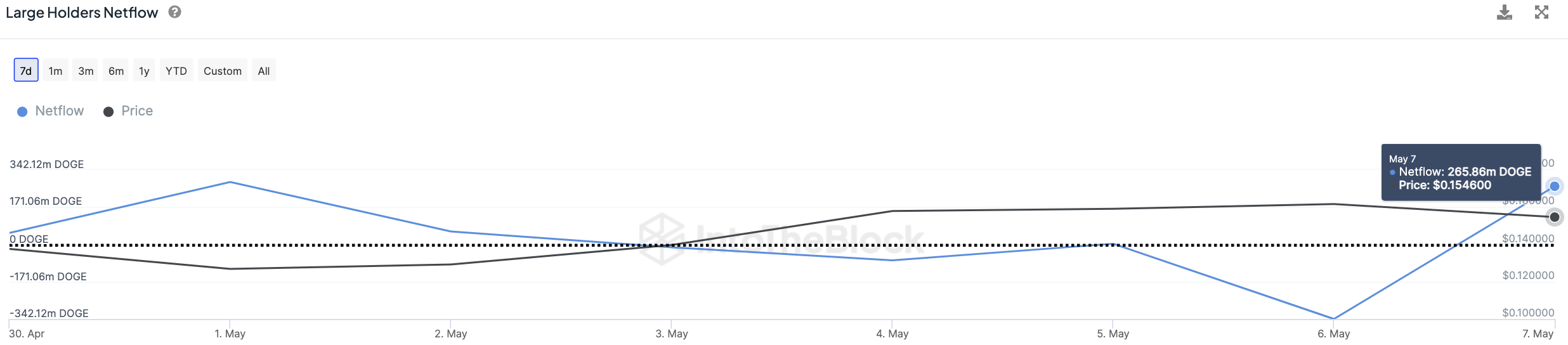

However, it is essential to consider the outflows from these addresses, as entities may conduct transfers for various operational reasons. Analysis of the Large Holders Outflow reveals a modest increase from 471.75 million DOGE to 488.89 million DOGE, translating to approximately $75.78 million over the same period. Consequently, the Large Holders Netflow stands at 265.86 million DOGE, approximately $41.2 million in the past day.  Source: IntoTheBlock

Source: IntoTheBlock

Significance of Large Holders Netflow

The concept of Large Holders Netflow serves as a gauge for monitoring the shifting positions of whales and investors holding over 0.1% of the circulating supply. Spikes in netflow imply accumulation by significant players, indicative of a bullish stance, while declines suggest reduced positions or selling activities.

Implications for Dogecoin's Trajectory

The surge in Dogecoin's on-chain metrics underscores the increasing involvement of influential players in the market, signaling a potentially optimistic trajectory for the cryptocurrency. As DOGE continues to attract attention from investors and traders, its performance in these key metrics serves as a significant indicator of market sentiment.

crypto.ro English

crypto.ro English DogeHome

DogeHome Crypto News Land

Crypto News Land ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com Optimisus

Optimisus