You can also read this news on COINTURK NEWS: Dogecoin Struggles to Build Its Ecosystem Despite Investor Interest

The largest meme coin by market value has failed to meet expectations in creating its own ecosystem. Weeks ago, announcements mentioned significant moves and new team members, but we have yet to see this materialize. However, DOGE, with its title as the biggest meme coin, still attracts investor interest. So, how many dollars will it be this week?

Dogecoin (DOGE) Commentary

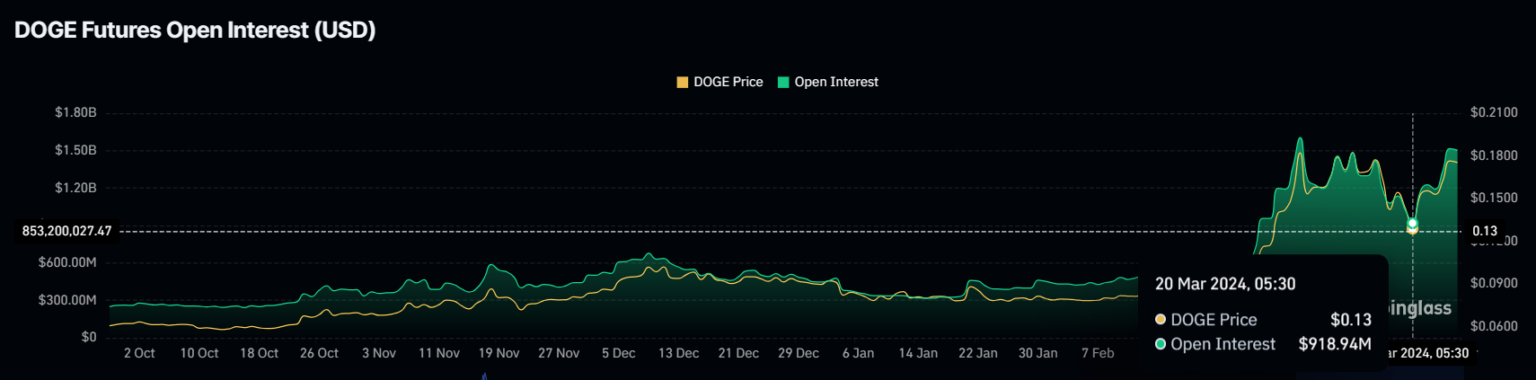

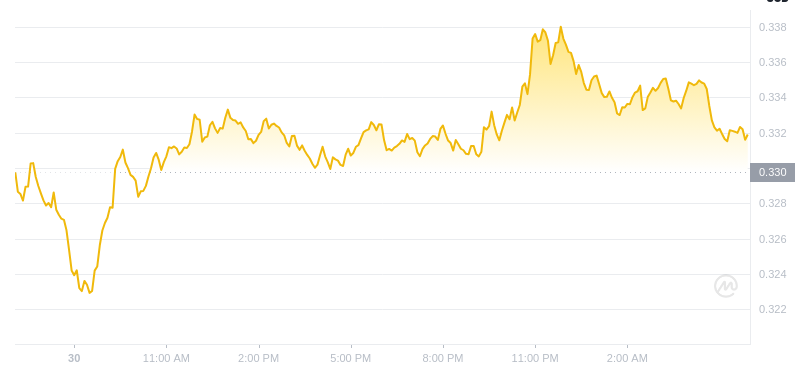

Recovering from this month’s losses, the price has risen sharply, achieving double-digit gains and targeting $0.2. Strong demand in futures trading also confirms investors’ strong bullish sentiment. A 66% increase in open interest now indicates expectations for a larger rally. DOGE is trading at $0.181 at the time of writing.

The RSI is in the neutral zone, and when combined with this bullish sentiment, it indicates there is room for higher peaks. Moreover, the MACD is the third key indicator supporting the possibility of a rise. Taking into account the optimism in the ETF channel, the possibility of DOGE reaching $0.2 is strengthening.

DOGE Price Prediction

For Dogecoin (DOGE), the conversion of $0.182 into support is crucial. At the time of writing, the price is just below this level, representing the downside of the situation. In the coming hours, if IBIT data does not meet expectations, it could trigger a sell-off.

However, the daily average address (DAA) difference is signaling a decline. This metric compares changes in the price of an asset with the number of new addresses interacting with it. It measures the imbalance between user adoption and network activity, where signals of decline or increase are formed.

In the past, when DAA signaled a sell-off, we often saw the price drop. Historical data does not predict the future, but indicators with a high success rate should rightfully raise doubts among investors expecting a rise. If the same happens again, DOGE’s price may need to head towards $0.16 this week instead of $0.2.

In a deeper correction, a drop to $0.15 could occur, and closes below this level would eliminate the possibility of a short-term recovery. The next bottom target would likely be the key area of $0.135.

ItsBitcoinWorld

ItsBitcoinWorld DogeHome

DogeHome Crypto Daily™

Crypto Daily™ Optimisus

Optimisus Optimisus

Optimisus Optimisus

Optimisus CFN

CFN Crypto Daily™

Crypto Daily™ DogeHome

DogeHome