- Dogecoin’s long liquidations totalled $16 million on 12 April

- Bearish sentiments continue to trail the memecoin

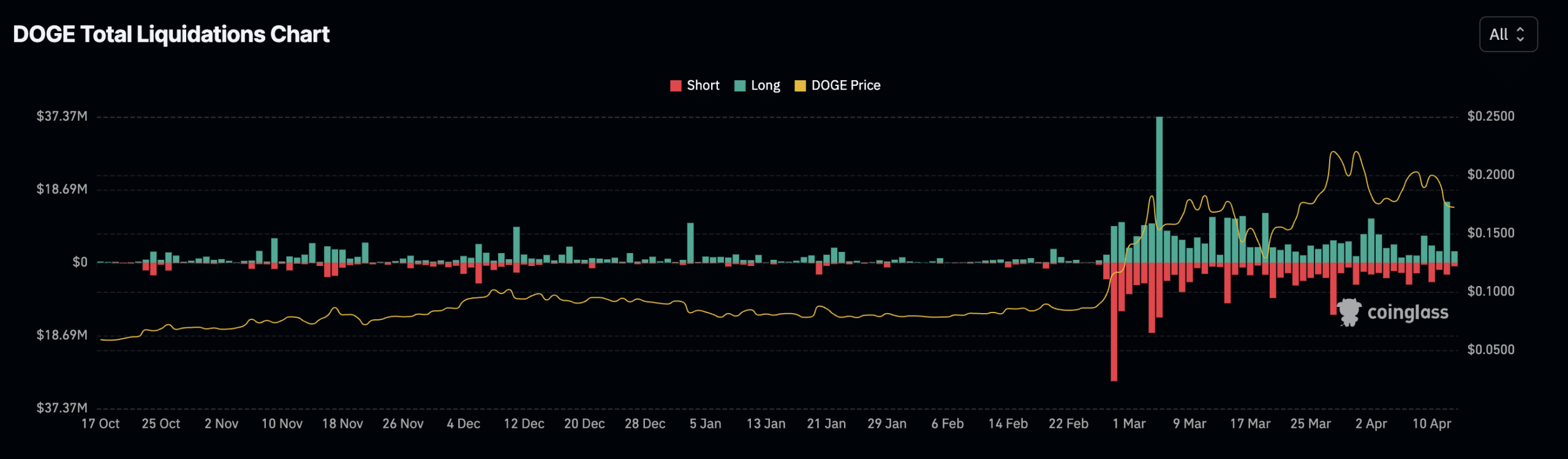

Dogecoin’s [DOGE] long liquidations climbed to a 30-day high over the last 24 hours, according to Coinglass. This, on the back of the larger market falling following Bitcoin’s own price depreciation on the charts. In fact, the entire cryptocurrency market saw trade positions worth over $860 million being liquidated among 270,993 traders.

On-chain data revealed that DOGE’s long liquidations totalled $16 million. The last time the crypto recorded such a high volume in long liquidations in its Futures market was on 6 March.

Liquidations occur in an asset’s Futures market when a trader’s position is forcefully closed due to insufficient funds to maintain the position. Long liquidations occur when there is an unexpected decline in an asset’s price, causing traders who have open positions in favor of a price rally to be forced to exit their positions.

In comparison, on the day in question, DOGE short liquidations totalled $3.08 million, as per Coinglass data.

Brace for further value decline

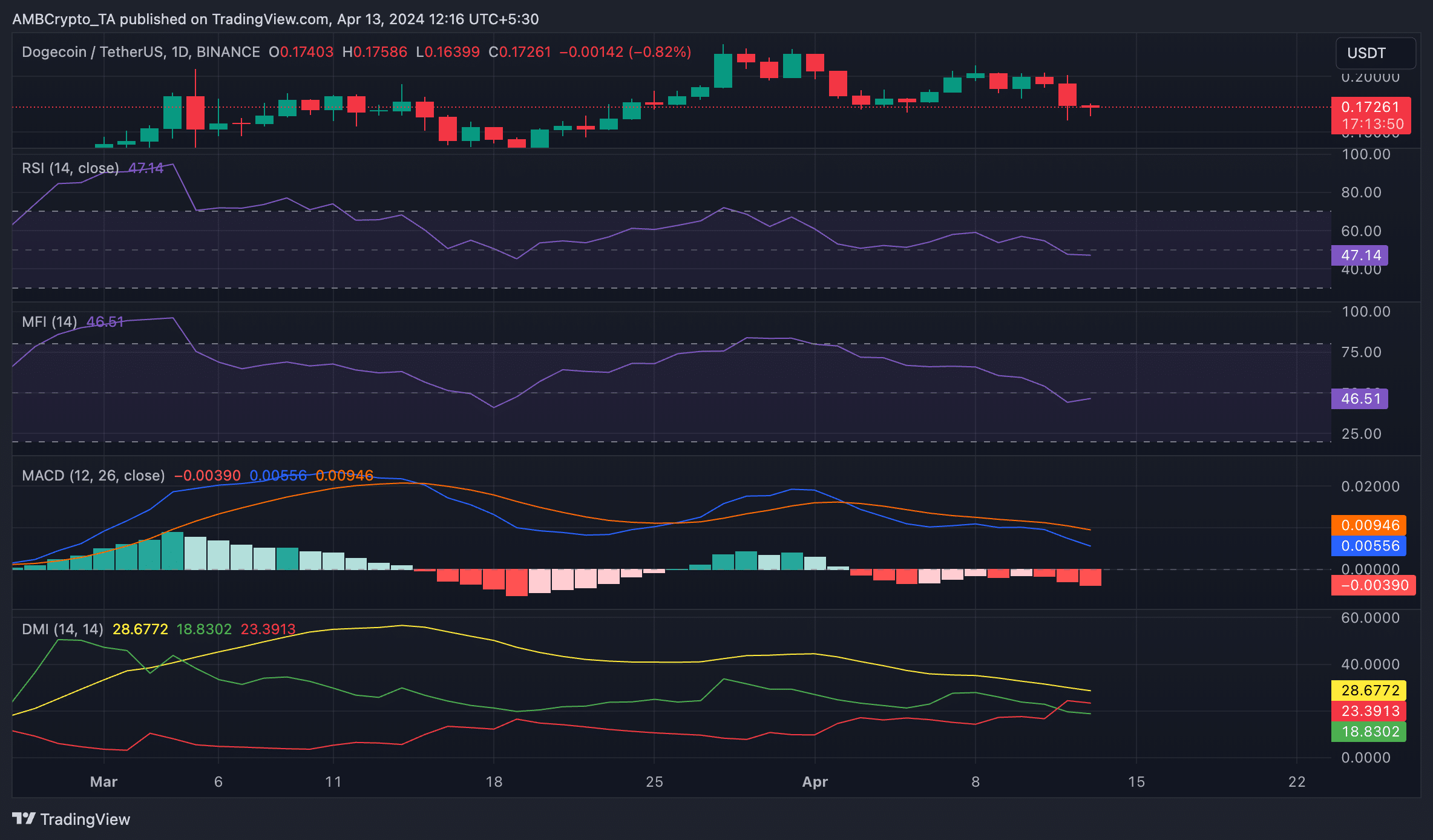

Extending its 6% weekly losses, DOGE’s price has plummeted by 13% in the last 24 hours, according to CoinMarketCap. At press time, the leading memecoin was valued at $0.1721 on the charts.

An assessment of the altcoin’s price movements on the 1-day chart showed that it might shed more gains this weekend. Key momentum indicators observed revealed a steady decline in demand for DOGE.

For instance, the values of its Relative Strength Index (RSI) and Money Flow Index (MFI) were 46.85 and 46.53, respectively. These indicators indicated a decline in demand for the altcoin among market participants and a spike in coin sell-offs.

Realistic or not, here’s DOGE’s market cap in BTC’s terms

Furthermore, readings from the coin’s Directional Movement Index (DMI) showed that its positive directional index (green) fell below its negative index (red) on 12 April. When these lines trend this way, it suggests a shift from bullish momentum to bearish. It signals the re-emergence of bears and an uptick in profit-taking activity.

Finally, DOGE’s MACD line rested above its Signal line at press time and confirmed this. This also indicated that DOGE’s short-term moving average was higher relative to its long-term moving average.

When these lines are arranged in this manner, it is seen as a sign to intensify coin sell-offs. Ergo, it’s going to be a tricky time being a Dogecoin holder.

CoinPedia News

CoinPedia News CoinPedia News

CoinPedia News Deythere

Deythere Cryptopolitan_News

Cryptopolitan_News Optimisus

Optimisus DogeHome

DogeHome Cryptos Newss

Cryptos Newss TheCoinrise Media

TheCoinrise Media BlockchainReporter

BlockchainReporter