The recent turmoil in the cryptocurrency market, particularly the significant dip in the Bitcoin price, has stirred a wave of speculation and discussion among investors and analysts alike. However, amid the chaos, there are signs of a potential recovery for Bitcoin, hinting at a renewed optimism in the digital asset realm.

So, let’s take a quick tour of the factors influencing Bitcoin’s resurgence and what the future might hold for this leading cryptocurrency.

Bitcoin Price Recovers After Recent Crash

The recent dip in Bitcoin’s price has left many investors apprehensive, but there’s a glimmer of hope on the horizon. Notably, several analysts have attributed this newfound optimism to the approaching Bitcoin Halving event, scheduled for later this month.

Meanwhile, such events have catalyzed significant price rallies for Bitcoin in the past, prompting anticipation of a similar outcome this time around. However, the market experts have also cautioned over potential corrections and volatility ahead of the Bitcoin Halving event.

For instance, prominent crypto market analyst Ali Martinez sees the pre-halving correction as a bullish indicator, suggesting potential for a substantial upward trajectory. He has recently said that even a 30% Bitcoin price correction would be a bullish indicator.

In addition, the price correction also provides a buying opportunity for the investors, and a similar situation was also noted recently. Despite the recent market turbulence, there’s evidence to suggest that institutional investors remain undeterred.

For context, whale activity has surged in response to the BTC price dip, with significant acquisitions observed. This trend, highlighted by analytics firm IntoTheBlock, underscores growing confidence among large-scale investors in Bitcoin’s long-term prospects.

Meanwhile, the allure of buying opportunities amid market downturns has historically attracted savvy investors, reinforcing the narrative of resilience within the crypto space. However, according to IntoTheBlock, significant Bitcoin holders are capitalizing on the market dip, acquiring approximately 33,000 BTC, valued at over $2 billion, amid the declining price.

Also Read: Ethena (ENA) Price Surges 53% After Airdrop, More Steam Left?

Anticipated Highs and Healthy Corrections

Looking ahead, market experts are cautiously optimistic about Bitcoin’s trajectory post-halving. While expectations of new price highs run high, analysts also anticipate intermittent corrections along the way.

Meanwhile, these smaller pullbacks, viewed as healthy adjustments, are considered integral to BTC’s overall stability and long-term growth prospects. As such, investors are advised to brace for potential volatility in the short term while maintaining a focus on the broader trends shaping Bitcoin’s journey.

It’s worth noting that the recent turmoil in the cryptocurrency market, particularly the dip in the BTC price, has spurred discussions about the future trajectory of the leading digital asset. However, despite the challenges, optimism persists, driven by factors such as the impending Bitcoin Halving and sustained institutional interest. While volatility may persist in the short term, the underlying sentiment points towards resilience and potential growth for Bitcoin in the long run.

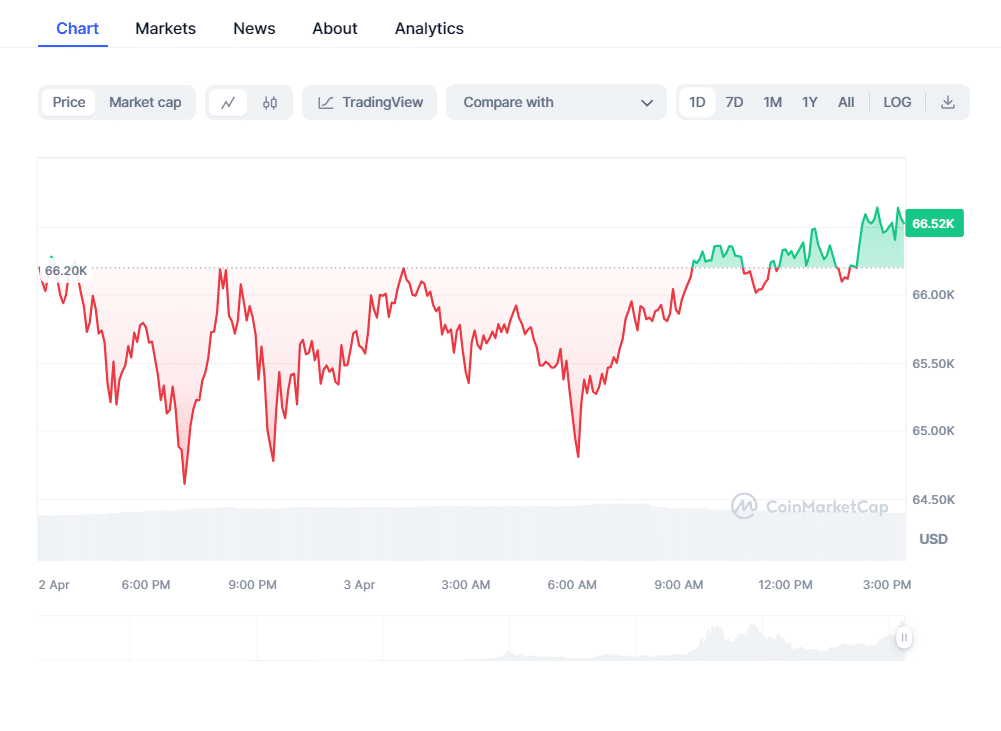

As of writing, the Bitcoin price was up 0.63% from yesterday and traded at $66,521.32, while its trading volume soared 5.17% to $44.38 billion. Over the last 24 hours, the Bitcoin price has noted a high of $66,664.09 and a low of $64,559.90.

Also Read: DOGE Whales Move Over 580 Mln Coins, Will Dogecoin Recover?

The post What To Expect From Bitcoin Recovery After The Crypto Market Crash? appeared first on CoinGape.

crypto.ro English

crypto.ro English DogeHome

DogeHome Crypto News Land

Crypto News Land ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com Optimisus

Optimisus