Memecoin Analysis: Price Predictions for Pepe, Bonk, and GME This Week

June has witnessed an impressive rally for meme coins, with several popular ones attracting significant buyer interest, leading to substantial price increases. A notable event was the return of Keith Gill, known as "Roaring Kitty," which sparked a surge in GME memecoin prices. Additionally, last week saw significant fluctuations in the prices of Pepe and Bonk coins, suggesting potential for further increases in the upcoming week.

Memecoins Gain Spotlight Amid Volatility

Last week, the GME memecoin, operating on the Solana blockchain, experienced an unexpected surge. This increase triggered a bullish outlook for both Pepe and Bonk prices, prompting analysts to revise their predictions for the meme coin market in the upcoming week.

Pepe Price Analysis

Pepe price experienced intense volatility in the last few days, facing strong rejection around the $0.000015 resistance mark. This pushed the price towards a low of $0.0000116. However, buyers defended this level, and the price currently hovers around $0.00001235, declining over 10% in the last 24 hours.

Buyers aim to maintain their momentum and push the price above the descending resistance line. The $0.000016 mark may pose a challenge, but it is expected to be surpassed. Following this, the PEPE/USDT pair could target a rally towards the strong resistance at $0.0000173.

Conversely, if bears aim to halt this upward movement, they must rapidly pull the price below the 50-day SMA at $0.0000112. Succeeding this, the pair could decline to $0.00000889 and further down to the crucial support level at $0.00000772.

Bonk Price Analysis

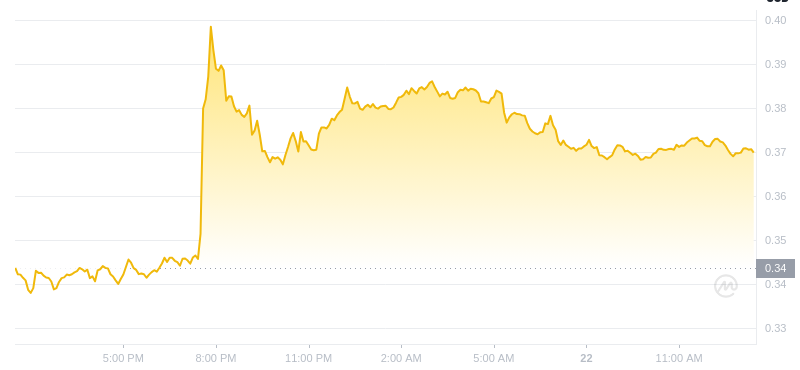

Bonk remains close to its moving averages, suggesting minimal aggressive activity from traders. Bonk rejected the $0.000033 level strongly and declined below the immediate Fib channels, resulting in a consolidation around $0.000028. As of writing, Bonk price trades at $0.0000284, surging over 3% in the last 24 hours.

The declining moving averages and a mid-level RSI hint at potentially continued bearish price movements. A break and close above the current consolidation could signal a bullish resurgence, potentially pushing the BONK/USDT pair towards the $0.0000369 resistance level. Further buying pressure might send the price towards $0.000048.

Conversely, a downturn below the support line of $0.000024 could invalidate the bullish pattern, potentially driving the pair down to the $0.000017 support level.

GME Price Analysis

The GME price has seen a remarkable recovery, surging from a low of $0.013 towards $0.018. However, bears continue to defend against a surge above resistance lines, slowing down the buying momentum. As of writing, GME price trades at $0.017, surging over 10% in the last 24 hours.

The 20-day exponential moving average (EMA) shows a slight surge at $0.016, and the relative strength index (RSI) is hovering above the midline, indicating dominant buying pressure. If the price manages to rebound from the current position, it could surge toward the $0.032 mark and possibly set a new all-time high.

However, if bears plunge the price below the support of $0.012, it might cause the GME/USDT pair to pull back to its crucial support of $0.008 to test buyer strength.

ItsBitcoinWorld

ItsBitcoinWorld Cryptopolitan_News

Cryptopolitan_News U_Today

U_Today Cryptopolitan_News

Cryptopolitan_News DT News

DT News Cryptopolitan_News

Cryptopolitan_News Thecryptoupdates

Thecryptoupdates DogeHome

DogeHome Coincu

Coincu