Pepe (PEPE) Rebounds After Encouraging US Inflation Data

Following the release of positive US Consumer Price Index (CPI) data, Pepe (PEPE) surged in value on Wednesday. It reached a high of $0.00014 amid significant trading volume, marking a 23% increase from its weekly low.

Buying the Dip

The Bureau of Labor Statistics (BLS) reported lower-than-expected inflation data. Headline CPI declined from 0.3% to 0.0%, missing estimates of 0.1%. The CPI decreased for the second consecutive month on an annualized basis, dropping to 3.3% from 3.4%. Excluding volatile food and energy prices, inflation fell to 0.2% month-over-month and 3.4% year-over-year.

These statistics preceded the Federal Reserve interest rate decision. Analysts anticipate that Fed officials will favorably receive the inflation figures and consider rate cuts in the coming months. Rate cuts typically stimulate economic activity since lower borrowing costs make speculative investments, including meme coins, more appealing.

Broader Market Uptrend

Pepe's price recovery was further supported by an overall upward trend in the cryptocurrency market. Investors who had been waiting for an entry point were encouraged to start buying. Bitcoin rose to $69,600, while Ethereum reached $3,645. Other meme coins like Bonk, Dogwifhat, and Book of Meme also experienced gains. A hawkish Fed decision could potentially reverse these trends.

Buying the Dip Momentum

Finally, Pepe's price surge can be attributed to a classic case of buying the dip. The coin had declined by approximately 35% from its weekly peak, creating an opportunity for investors to enter at a lower price point. The rebound was accompanied by heavy trading volume, with daily volume exceeding $1.28 billion, up from $714 million on Tuesday.

Pepe Price Prediction

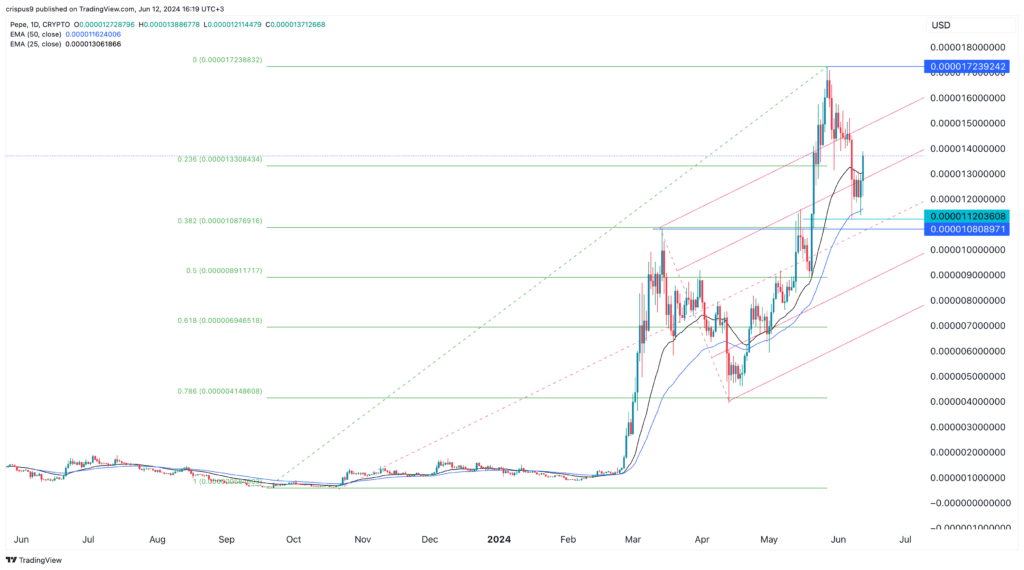

Technical analysis indicates that Pepe's rebound is backed by positive indicators. It has moved above the 23.6% Fibonacci Retracement level and the 50-day and 25-day moving averages. The first resistance level is now located at $0.00015, representing a 10% increase from its current value.

A breakout above this level could potentially drive Pepe towards $0.000172, its year-to-date high.

DogeHome

DogeHome Cryptopolitan_News

Cryptopolitan_News Coin Edition

Coin Edition BlockchainReporter

BlockchainReporter crypto.news

crypto.news Crypto Daily™

Crypto Daily™ BlockchainReporter

BlockchainReporter Optimisus

Optimisus