Terra Luna Classic (LUNC) has been accepted in a lower range as bulls bowed down to the intense sell-off and rising crypto market uncertainty. The hype for spot Bitcoin ETFs coupled with increased interest from the community in the token propelled LUNC to its highest peak in 2024 at $0.00028.

However, most market participants did not anticipate a sudden correction after the ETF approval. With many caught off guard, the next few days or weeks would be essential in determining where LUNC and the crypto market would be heading.

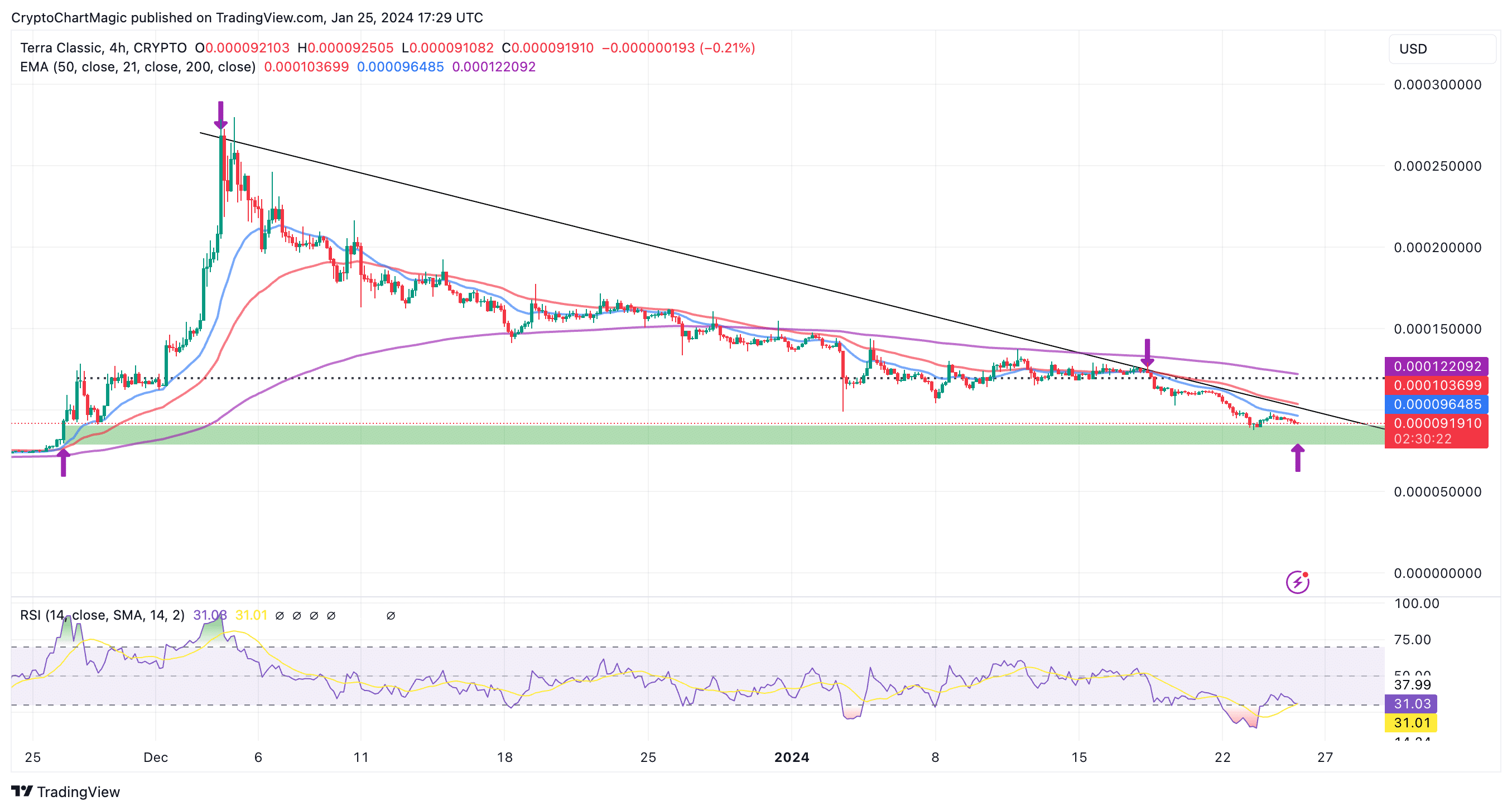

Terra Luna Classic price holds support at $0.00009

Currently, LUNC price exchanges hands at $0.000091. The green band starting from $0.00009 highlights the most important support area, which must be protected at all costs to help nurture a rebound in the short term.

With the Relative Strength Index (RSI) sliding from the neutral area into the oversold region, Terra Luna Classic is far from exhausting the downtrend. However, future losses are unlikely to be overarching, as oversold market conditions suggest that relief is nearby.

All three major applied moving averages, starting with the 20 Exponential Moving Average (EMA) (blue), the 50 EMA (red) and the 200 EMA (purple) sit above LUNC.

Due to this weak technical structure, it is not viable to start entering new buy orders until bulls assume full control of the trend.

Key milestones traders would be interested in going forward would be an initial bounce off the green support band or the area at $0.00009. Subsequently, Terra Luna Classic price must defeat the seller congestion at the 20 EMA and the confluence resistance created by the descending trendline and the 50-day EMA around $0.0001 to validate the potential for the anticipated rebound.

Therefore, long positions would start triggering above $0.0001 to avoid falling victim to sudden bull traps.

Market doldrums are also an excellent time to dollar cost average (DCA) into select altcoins like LUNC. The mundane price action following a massive sell-off encourages accumulation, in turn, creating the momentum to support the rally.

If Terra Luna Classic corrects further due to weakening support at $0.00009, investors may want to look toward $0.00008 and $0.00007 for liquidity-rich support areas.

Coincu

Coincu DogeHome

DogeHome BlockchainReporter

BlockchainReporter CoinPedia News

CoinPedia News TheNewsCrypto

TheNewsCrypto CFN

CFN Optimisus

Optimisus