Ethereum (ETH) has recently experienced notable volatility amid market price fluctuations. Despite this uncertain environment, Ethereum aims to maintain its price above the crucial $3,000 support zone.

以太坊(ETH)最近在市場價格波動中經歷了明顯的波動。儘管環境不確定,以太坊仍致力於將其價格維持在關鍵的 3,000 美元支撐區域之上。

Part of the volatility can be attributed to increased whale activity involving ETH, as significant amounts of the token are being transferred to exchanges. For instance, Whale Alert data on April 20 indicated that 10,911 ETH, valued at approximately $33.52 million, was transferred to Coinbase.

部分波動可歸因於涉及 ETH 的鯨魚活動增加,因為大量代幣被轉移到交易所。例如,4 月 20 日的 Whale Alert 數據顯示,價值約 3,352 萬美元的 10,911 ETH 轉移到 Coinbase。

Such large movements to major exchanges like Coinbase raise concerns about sustained volatility in Ethereum’s price, especially considering the decentralized finance (DeFi) asset’s susceptibility to overall market bearish sentiments.

Coinbase 等主要交易所的如此大的波動引發了人們對以太坊價格持續波動的擔憂,特別是考慮到去中心化金融(DeFi)資產對整體市場看跌情緒的敏感性。

Picks for you

為您精選

機會? 3 小時前,隨著比特幣費用飆升,這種 1 美元的加密貨幣可能會飆升

這就是為什麼你應該密切關注這 3 種加密貨幣 5 小時前

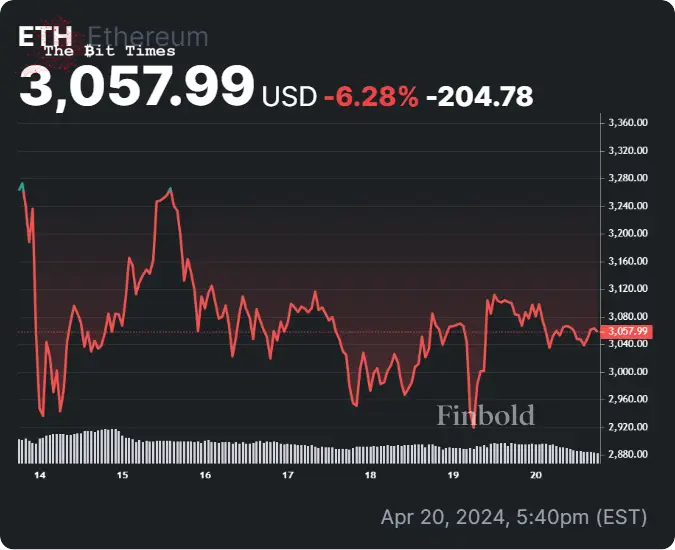

Currently, ETH is trading at $3,062.73, having corrected by nearly 1% in the last 24 hours. On the daily chart, Ethereum dipped to a low of $2,900 before experiencing a brief uptick.

目前,ETH 交易價格為 3,062.73 美元,在過去 24 小時內回檔了近 1%。日線圖上,以太坊跌至 2,900 美元低點,然後經歷短暫上漲。

Meanwhile, on the weekly chart, ETH is down over 6%. Amidst this volatility, the primary focus is on how Ethereum’s valuation will evolve in the coming days.

同時,在周線圖上,ETH 下跌超過 6%。在這種波動中,主要關注點是以太坊的估值在未來幾天將如何演變。

Ethereum price AI prediction

以太坊價格人工智慧預測

Ethereum is teetering just above the $3,000 zone, a critical juncture, as losing this level could trigger a further downward trajectory. Seeking insights into Ethereum’s potential future movements, Finbold turned to predictions from artificial intelligence (AI) machine algorithm models at CoinCodex.

以太坊目前在 3000 美元區域上方搖搖欲墜,這是一個關鍵時刻,因為失去這個水平可能會引發進一步的下行軌跡。為了深入了解以太坊未來的潛在趨勢,Finbold 求助於 CoinCodex 的人工智慧 (AI) 機器演算法模型的預測。

According to data retrieved on April 20, Ethereum is projected to trade at $3,117.08 on May 1, representing an increase of approximately 1.7% from its current valuation.

根據 4 月 20 日檢索的數據,預計 5 月 1 日以太坊交易價格為 3,117.08 美元,較目前估值上漲約 1.7%。

It’s worth noting that May has significant regulatory implications for Ethereum. The Securities and Exchange Commission (SEC) is likely to decide on approving a spot Ethereum exchange-traded fund (ETF).

值得注意的是,五月對以太坊有重大的監管影響。美國證券交易委員會(SEC)可能決定批准以太坊現貨交易所交易基金(ETF)。

Should this product receive approval, its potential impact on Ethereum’s market dynamics remains uncertain. It will be crucial to monitor whether it will echo the precedent set by similar ETFs for Bitcoin (BTC).

如果該產品獲得批准,其對以太坊市場動態的潛在影響仍不確定。至關重要的是要關注它是否會效仿類似的比特幣 ETF 所設定的先例。

ETH’s key support zone to watch

ETH 值得關注的關鍵支撐區域

Amid ongoing uncertainty surrounding Ethereum’s price, crypto analyst Ali Martinez cautioned on April 16 that should ETH continue a downward trend, investors should closely monitor the critical support zone between $2,000 and $2,430.

由於以太坊價格持續存在不確定性,加密貨幣分析師 Ali Martinez 於 4 月 16 日警告稱,如果 ETH 繼續下跌趨勢,投資者應密切關注 2,000 美元至 2,430 美元之間的關鍵支撐區域。

Within this range, approximately 9.37 million addresses hold nearly 53 million ETH. A breach of this support zone could potentially intensify selling pressure and exacerbate the downturn.

在此範圍內,大約有 937 萬個地址持有近 5300 萬個 ETH。突破該支撐區域可能會加劇拋售壓力並加劇經濟低迷。

Furthermore, Ethereum’s technical indicators remain predominantly bearish. A summary of the one-day gauges retrieved from TradingView indicates a ‘sell’ sentiment at 13, with similar sentiments reflected in moving averages and oscillators at 10 and 3, respectively.

此外,以太坊的技術指標仍主要看跌。從 TradingView 檢索到的一日指標摘要顯示,「賣出」情緒為 13,移動平均線和振盪指標分別為 10 和 3,反映了類似的情緒。

In conclusion, despite prevailing bearish sentiments surrounding Ethereum, the asset stands to benefit from any bullish resurgence in the broader market, likely driven by the aftermath of the Bitcoin halving event.

總之,儘管圍繞以太坊的看跌情緒普遍存在,但該資產仍將受益於更廣泛市場的看漲復甦,這可能是由比特幣減半事件的影響所推動的。

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

免責聲明:本網站上的內容不應被視為投資建議。投資是投機性的。投資時,您的資本面臨風險。

Source: https://thebittimes.com/ai-predicts-ethereum-price-for-may-1-2024-tbt85893.html

資料來源:https://thebittimes.com/ai-predicts-ethereum-price-for-may-1-2024-tbt85893.html

Crypto Front News

Crypto Front News Crypto News Flash

Crypto News Flash DogeHome

DogeHome Optimisus

Optimisus TheCoinrise Media

TheCoinrise Media Cryptopolitan_News

Cryptopolitan_News Cryptopolitan_News

Cryptopolitan_News Thecoinrepublic.com

Thecoinrepublic.com