Introduction

介紹

This comprehensive analysis presents an in-depth prediction for Amazon's stock price by 2030. By meticulously examining various factors influencing the company's performance, including financial indicators, market dynamics, technological advancements, consumer behavior, and competitive landscape, we aim to provide valuable insights into the potential trajectory of Amazon's stock price over the next decade.

這項全面的分析對亞馬遜到2030 年的股價進行了深入預測。價值的見解亞馬遜股價未來十年的潛在軌跡。

Financial Performance and Growth Potential

財務業績和成長潛力

Amazon's impressive financial performance establishes a solid foundation for future growth. The company has consistently demonstrated robust revenue growth, driven by its diverse product offerings, expanding customer base, and unwavering focus on customer satisfaction. With its well-established e-commerce platform, AWS dominance, and ventures into emerging sectors, Amazon is well-positioned to capitalize on evolving market trends, indicating significant growth potential for its stock price by 2030.

亞馬遜令人印象深刻的財務表現為未來的成長奠定了堅實的基礎。在多元化的產品供應、不斷擴大的客戶群以及對客戶滿意度的堅定關注的推動下,該公司始終表現出強勁的收入成長。憑藉其完善的電子商務平台、AWS 的主導地位以及對新興領域的投資,亞馬遜處於有利地位,可以利用不斷變化的市場趨勢,這表明到 2030 年其股價將具有巨大的成長潛力。

Market Dominance and Competitive Advantage

市場主導地位與競爭優勢

Amazon's market dominance in the e-commerce industry is unparalleled. The company's relentless pursuit of innovation and vast logistical infrastructure have granted it a substantial competitive advantage over its rivals. By continually expanding its product categories, enhancing its fulfillment network, and improving last-mile delivery efficiency, Amazon remains a leader in the rapidly growing e-commerce space. Such market dominance positions the company favorably to capture a larger market share and drive its stock price higher in the coming decade.

亞馬遜在電子商務產業的市場主導地位是無與倫比的。該公司對創新的不懈追求和龐大的物流基礎設施使其相對於競爭對手具有巨大的競爭優勢。透過不斷擴展其產品類別、增強其履行網路並提高最後一英里的交付效率,亞馬遜仍然是快速成長的電子商務領域的領導者。這種市場主導地位使該公司有利於在未來十年佔據更大的市場份額並推高其股價。

Technological Innovation and Disruption

技術創新與顛覆

Technological innovation lies at the core of Amazon's success. The company's investments in artificial intelligence, machine learning, and automation have resulted in operational efficiencies and improved customer experiences. Amazon's early adoption of voice assistants, smart home devices, and cloud computing services through AWS has revolutionized multiple industries. As Amazon continues to push the boundaries of technological advancements, it is poised to disrupt existing markets and tap into new growth opportunities, bolstering investor confidence and positively impacting the Amazon stock price in 2030.

技術創新是亞馬遜成功的核心。該公司在人工智慧、機器學習和自動化方面的投資提高了營運效率並改善了客戶體驗。亞馬遜早期透過 AWS 採用語音助理、智慧家居設備和雲端運算服務,徹底改變了多個產業。隨著亞馬遜不斷突破技術進步的界限,它將顛覆現有市場並挖掘新的成長機會,增強投資者信心並對 2030 年亞馬遜股價產生積極影響。

Expansion into New Markets and Revenue Streams

拓展新市場與收入來源

Amazon's expansion beyond e-commerce has been instrumental in diversifying its revenue streams. Amazon Web Services (AWS)'s cloud computing division has experienced remarkable growth and is expected to remain a significant revenue driver. Additionally, Amazon's foray into digital streaming with Prime Video, its investments in healthcare, and its smart home ecosystem powered by Alexa demonstrate the company's commitment to expanding its reach. This strategic expansion into new markets provides Amazon with additional revenue sources and enhances its overall market position, contributing to a positive outlook for the Amazon stock price prediction for 2030.

亞馬遜向電子商務以外的擴張有助於其收入來源多元化。亞馬遜網路服務 (AWS) 的雲端運算部門經歷了顯著的成長,預計仍將是重要的收入驅動力。此外,亞馬遜透過 Prime Video 進入數位串流媒體領域、在醫療保健領域的投資以及由 Alexa 提供支援的智慧家庭生態系統都表明了該公司致力於擴大其影響力。這次向新市場的策略擴張為亞馬遜提供了額外的收入來源,並增強了其整體市場地位,有助於對亞馬遜 2030 年股價的積極預測。

Consumer Behavior and Market Trends

消費者行為與市場趨勢

Understanding consumer behavior is vital in predicting Amazon's future performance. The continued shift towards online shopping, the increasing reliance on mobile devices, and the growing preference for convenience and personalized experiences favor Amazon's business model. By leveraging its vast consumer data, Amazon can deliver targeted advertising, personalized recommendations, and seamless shopping experiences, likely to drive customer loyalty and fuel revenue growth. Anticipating and capitalizing on changing consumer trends will drive Amazon's stock price upward in the next decade.

了解消費者行為對於預測亞馬遜未來的表現至關重要。線上購物的持續轉變、對行動裝置的日益依賴以及對便利和個人化體驗的日益偏好有利於亞馬遜的商業模式。透過利用其龐大的消費者數據,亞馬遜可以提供有針對性的廣告、個人化推薦和無縫購物體驗,從而可能提高客戶忠誠度並推動收入成長。預測並利用不斷變化的消費者趨勢將推動亞馬遜股價在未來十年內上漲。

Risk Assessment and Mitigation

風險評估和緩解

While Amazon's growth prospects are promising, it is essential to consider potential risks and uncertainties. Regulatory challenges, geopolitical factors, supply chain disruptions, and increasing competition are among the risks that could impact Amazon's stock price in the future. A comprehensive risk assessment and effective risk mitigation strategies will be crucial for Amazon's sustained growth and investor confidence.

雖然亞馬遜的成長前景充滿希望,但必須考慮潛在的風險和不確定性。監管挑戰、地緣政治因素、供應鏈中斷和競爭加劇都是未來可能影響亞馬遜股價的風險。全面的風險評估和有效的風險緩解策略對於亞馬遜的持續成長和投資者信心至關重要。

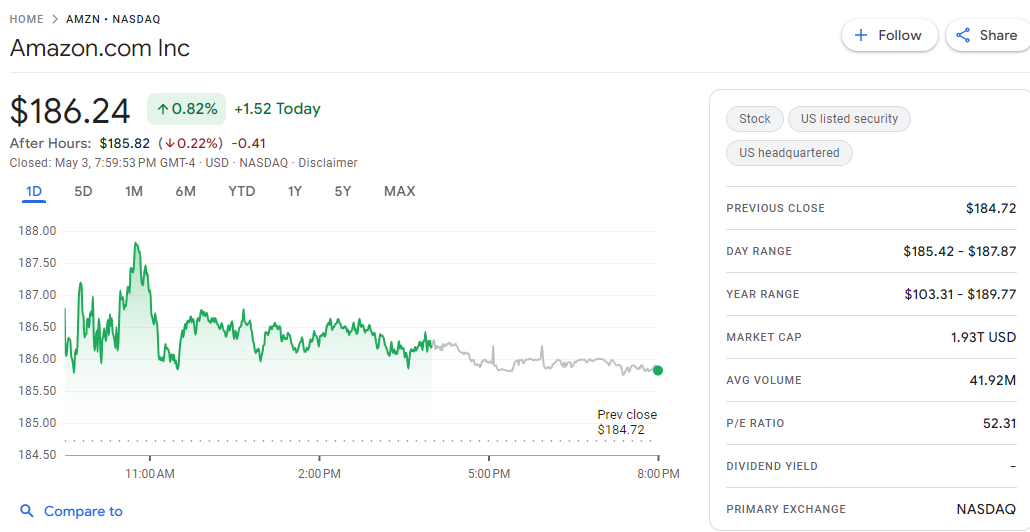

Amazon Stock Price Prediction 2024

2024 年亞馬遜股價預測

We project that the price of an item on Amazon will be $250 in 2024, representing an annual increase of 39%. We also anticipate a gain of 26% from now till the end of the year. We anticipate a price of $212 for 1 Amazon by mid-2024. The Amazon stock price is expected to increase by 75% in 2024, reaching $300 by year's end from its current $151. This is a +34% increase from the second half of 2025.

我們預計,2024 年亞馬遜上商品的價格將達到 250 美元,年增率為 39%。我們也預計從現在到今年年底將實現 26% 的成長。我們預計到 2024 年中期,1 個 Amazon 的價格將達到 212 美元。亞馬遜股價預計到 2024 年將上漲 75%,年底從目前的 151 美元漲至 300 美元。這比 2025 年下半年成長了 34%。

Amazon Stock Price Prediction 2025

2025 年亞馬遜股價預測

If Amazon shares continue to rise at the same average annual pace as they have over the last ten years, the current projection for Amazon stock in 2025 is $ 270. This is based on the assumption that Amazon shares will continue to grow in value. If this were to happen, the price of AMZN shares would climb by 60.35 percent.

如果亞馬遜股價繼續以與過去十年相同的年均速度上漲,那麼目前對 2025 年亞馬遜股票的預測為 270 美元。如果這種情況發生,AMZN 股價將上漲 60.35%。

Amazon Stock Forecast for the Year 2030

亞馬遜 2030 年股票預測

If Amazon's stock continues to rise at its current pace of growth during the last ten years, it will be worth $567.36 per share in the year 2030. If my forecast for Amazon stock in 2030 comes true, the value of AMZN stock will increase by 422.04% relative to where it is now trading.

如果亞馬遜的股票在過去十年中繼續按照目前的成長速度上漲,那麼到2030 年,每股價值將達到567.36 美元。美元。

Conclusion

結論

Based on the comprehensive financial performance analysis, market dominance, technological innovation, expansion into new markets, consumer behavior, and risk assessment, I predict that Amazon's stock price will experience significant growth by 2030.

基於綜合的財務績效分析、市場主導地位、技術創新、新市場擴張、消費者行為和風險評估,我預測亞馬遜的股價到2030年將會顯著成長。

FAQ

常問問題

What factors are considered in the prediction of Amazon's stock price for 2030?

亞馬遜2030年股價預測考慮了哪些因素?

The prediction considers Amazon's financial performance, market dominance, technological advancements, consumer behavior, competitive landscape, and potential risks. These elements help provide a well-rounded view of Amazon's potential growth trajectory.

該預測考慮了亞馬遜的財務表現、市場主導地位、技術進步、消費者行為、競爭格局和潛在風險。這些元素有助於全面了解亞馬遜的潛在成長軌跡。

How has Amazon's financial performance influenced its future stock price predictions?

亞馬遜的財務表現如何影響其未來股價預測?

Amazon's strong financial performance, characterized by steady revenue growth and diversified product offerings, sets a solid foundation for future growth. This financial robustness suggests significant potential for stock price appreciation by 2030.

亞馬遜強勁的財務業績,以穩定的收入成長和多元化的產品供應為特點,為未來的成長奠定了堅實的基礎。這種財務穩健性表明,到 2030 年,股價升值的潛力巨大。

What role does Amazon's market dominance play in its stock price forecast?

亞馬遜的市場主導對其股價預測有何影響?

Amazon's unparalleled market dominance, especially in e-commerce and logistics, positions it favorably for continued growth. This dominance is expected to drive its stock price higher as the company captures more market share over the next decade.

亞馬遜無與倫比的市場主導地位,尤其是在電子商務和物流領域,使其有利於持續成長。隨著該公司在未來十年佔據更多市場份額,這種主導地位預計將推高其股價。

How do technological innovations impact Amazon's stock price outlook?

科技創新如何影響亞馬遜的股價前景?

Amazon's commitment to technological innovation, such as AI, machine learning, and automation, has not only improved operational efficiencies but also customer experiences. These advancements are crucial for market disruption and could significantly boost Amazon's stock price by 2030.

亞馬遜致力於人工智慧、機器學習和自動化等技術創新,不僅提高了營運效率,也提高了客戶體驗。這些進步對於顛覆市場至關重要,並可能在 2030 年大幅提升亞馬遜的股價。

In what ways does Amazon's expansion into new markets affect its stock price?

亞馬遜向新市場的擴張如何影響其股價?

By venturing into new sectors like cloud computing, digital streaming, and smart home technologies, Amazon diversifies its revenue streams. This strategic expansion enhances its market position and is a positive indicator for its future stock price.

透過進軍雲端運算、數位串流媒體和智慧家居技術等新領域,亞馬遜實現了收入來源多元化。此次策略擴張增強了其市場地位,對其未來股價而言是一個正面的指標。

How does consumer behavior influence Amazon's stock price projection?

消費者行為如何影響亞馬遜的股價預測?

The shift towards online shopping and the demand for personalized experiences align well with Amazon's business model. Leveraging vast consumer data allows Amazon to enhance customer engagement and loyalty, likely driving up its stock price.

向線上購物的轉變和對個人化體驗的需求與亞馬遜的商業模式非常吻合。利用大量消費者數據,亞馬遜可以提高客戶參與度和忠誠度,可能推高其股價。

What are the potential risks that could affect Amazon's future stock price?

可能影響亞馬遜未來股價的潛在風險有哪些?

Risks include regulatory challenges, geopolitical factors, supply chain disruptions, and increased competition. Effective risk mitigation strategies are essential to maintain growth momentum and investor confidence.

風險包括監管挑戰、地緣政治因素、供應鏈中斷和競爭加劇。有效的風險緩解策略對於維持成長動能和投資者信心至關重要。

What is the predicted stock price of Amazon for the years 2024, 2025, and 2030?

亞馬遜2024年、2025年和2030年的預測股價是多少?

The predicted stock price for Amazon is $300 by the end of 2024, $270 in 2025, and $567.36 by 2030. These predictions assume that Amazon will continue growing at a similar rate as in the past decade, with significant annual increases.

亞馬遜的預測股價到 2024 年底為 300 美元,2025 年為 270 美元,到 2030 年為 567.36 美元。

MORE:

更多的:

- [Rivian Stock Price Prediction](https://www.investingcube.com/rivian-stock-price-prediction/)

- [Coinbase Stock Price Prediction](https://www.investingcube.com/coinbase-stock-price-prediction/)

- [LUNC Price Prediction](https://www.investingcube.com/lunc-price-prediction/)

- [Shiba Inu Price Prediction 2040](https://www.investingcube.com/shiba-inu-price-prediction-2040/)

[Rivian 股價預測](https://www.investingcube.com/rivian-stock-price-prediction/)[Coinbase 股價預測](https://www.investingcube.com/coinbase-stock-price-prediction)/ )[LUNC 價格預測](https://www.investingcube.com/lunc-price-prediction/)[2040 年柴犬價格預測](https://www.investingcube.com/shiba-inu-price-prediction) -2040/)

CoinPedia News

CoinPedia News CoinPedia News

CoinPedia News CoinPedia News

CoinPedia News suncrypto.in

suncrypto.in TheCoinrise Media

TheCoinrise Media CoinPedia News

CoinPedia News BH NEWS

BH NEWS Optimisus

Optimisus DogeHome

DogeHome