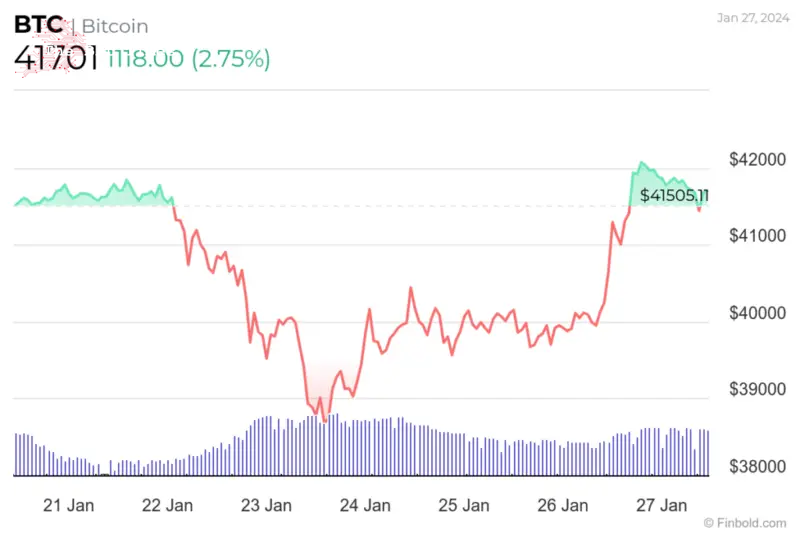

After days of correcting that saw Bitcoin’s (BTC) valuation face the possibility of extended sell-off below the $40,000 mark, the maiden cryptocurrency has made short-term gains as it seeks to establish a sustained rally.

經過幾天的調整,比特幣 (BTC) 的估值面臨著進一步跌破 40,000 美元大關的可能性,但這種首次出現的加密貨幣在尋求持續反彈的過程中已經取得了短期收益。

As the market anticipates the next Bitcoin move, a crypto analyst by the pseudonym IamZeroIka, in an X (formerly Twitter) post on January 27, identified a critical price level that could determine the fate of Bitcoin’s bullish momentum.

隨著市場預期比特幣的下一步走勢,一位化名IamZeroIka 的加密貨幣分析師在1 月27 日的X(前Twitter)帖子中指出了一個關鍵的價格水平,該水平可能決定比特幣看漲勢頭的命運。

According to the expert, Bitcoin’s recent bounce, which saw it touch above $38,000 for the first time in weeks, could be a temporary uptick if it fails to surpass the $42,000 mark. He noted that breaking through this resistance level would open the door for further gains, potentially pushing Bitcoin toward $44,000 or even $46,000.

這位專家表示,比特幣最近的反彈是幾週來首次觸及 38,000 美元以上,如果未能突破 42,000 美元大關,可能只是暫時的上漲。他指出,突破這一阻力位將為進一步上漲打開大門,有可能將比特幣推向 44,000 美元甚至 46,000 美元。

“Unless Bitcoin reclaims the 42K (HTF), this is nothing more than a lower high, in my opinion. <…> Everything below 48K can be used as fuel to recharge short positions,” he said.

「在我看來,除非比特幣奪回 42K (HTF),否則這只不過是一個較低的高點。低於 48K 的一切都可以作為補充空頭部位的燃料,」他說。

However, failure to reclaim $42,000 could have significant consequences, suggesting that bears could regain control and drive the price further if Bitcoin remains below this key level.

然而,未能收回 42,000 美元可能會產生嚴重後果,這表明如果比特幣仍低於這一關鍵水平,空頭可能會重新獲得控制權並進一步推高價格。

Further emphasizing his point, IamZeroIka provided a simplified overview of the daily chart technical Analysis, highlighting three key bearish signals. Firstly, he pointed out the break of the three-month uptrend trendline, indicating a potential shift in momentum from bullish to bearish.

IamZeroIka 進一步強調了他的觀點,提供了日線圖技術分析的簡化概述,強調了三個關鍵的看跌訊號。首先,他指出三個月上升趨勢線的突破,顯示動能可能從看漲轉向看跌。

At the same time, he observed a break in the structure, suggesting that falling below these levels could potentially set the stage for further decline. Lastly, he drew attention to the liquidity in the $32,000 and $36,000 zone. In this regard, the zone appears to have a high concentration of buy orders, which could act as a magnet for the price if it falls, potentially accelerating the downtrend.

同時,他觀察到結構的突破,這表明跌破這些水平可能會為進一步下跌奠定基礎。最後,他提請注意 32,000 美元和 36,000 美元區域的流動性。在這方面,該區域的買盤似乎高度集中,如果價格下跌,這可能會吸引價格,從而可能加速下跌趨勢。

Bitcoin turns bullish as GBTC sell-offs slow

隨著 GBTC 拋售放緩,比特幣轉為看漲

It’s worth noting that the recent Bitcoin sell-off came against the wider market expectations following the approval of the spot exchange-traded fund (ETF). Indeed, part of Bitcoin’s volatility was mainly attributed to outflows from the Grayscale Bitcoin Trust (GBTC).

值得注意的是,近期比特幣的拋售與現貨交易所交易基金(ETF)獲得批准後更廣泛的市場預期背道而馳。事實上,比特幣波動的部分原因主要歸因於灰階比特幣信託基金(GBTC)的資金流出。

Notably, the recent surge in the asset’s valuation has coincided with an increasing slowdown in outflows from GBTC. The consistent slowdown could suggest the start of a deceleration in redemptions.

值得注意的是,近期該資產估值的飆升與 GBTC 資金流出的日益放緩同時發生。持續放緩可能表示贖回開始放緩。

In this context, JPMorgan (NYSE: JPM) strategist Nikolaos Panigirtzoglou suggested that the Bitcoin sell-off might be nearing an end, stating that the “GBTC profit-taking has largely happened.”

在此背景下,摩根大通(NYSE:JPM)策略師 Nikolaos Panigirtzoglou 表示,比特幣拋售可能已接近尾聲,並表示「GBTC 獲利回吐已基本發生」。

Meanwhile, BlackRock’s (NYSE: BLK) Bitcoin ETF is poised to achieve a noteworthy milestone by surpassing $2 billion in assets under management. The firm’s latest product is maintaining its dominance in the emerging category of ETFs, which is viewed as a positive sentiment for the market, considering BlackRock’s status as the world’s largest investment firm.

同時,貝萊德 (BlackRock)(NYSE:BLK)的比特幣 ETF 管理資產規模將超過 20 億美元,預計將實現一個值得注意的里程碑。該公司的最新產品保持了其在新興 ETF 類別中的主導地位,考慮到貝萊德作為全球最大投資公司的地位,這被視為對市場的積極情緒。

Notably, at the start of the week, Bitcoin experienced a significant decline, dropping below $39,000 for the first time since early December. Interestingly, several analysts had projected that the sell-off might extend further to the $30,000 level, and therefore, the ongoing rebound could be welcomed news for the market.

值得注意的是,本周初,比特幣經歷了大幅下跌,自 12 月初以來首次跌破 39,000 美元。有趣的是,一些分析師預計拋售可能會進一步擴大至 30,000 美元的水平,因此,持續的反彈可能對市場來說是個好消息。

Bitcoin price analysis

比特幣價格分析

By press time, Bitcoin was trading at $41,701, having recorded gains of almost 3% on the daily chart. On the weekly chart, BTC is up less than 1%.

截至發稿時,比特幣交易價格為 41,701 美元,日線圖上漲幅接近 3%。週線圖上,BTC漲幅不到1%。

Amid the current bullish sentiments, Bitcoin technical analysis is dominated by neutrality. The summary of the one-day gauges retrieved from TradingView recommends ‘neutral’ at 9. The same sentiment is replicated for moving averages and oscillators at 1 and 8, respectively.

在當前的看漲情緒中,比特幣技術分析以中性為主。從 TradingView 檢索到的一日指標摘要建議「中性」為 9。移動平均線和振盪指標分別為 1 和 8,也出現了相同的情緒。

In conclusion, although Bitcoin shows bullish sentiments in the short term, the asset needs more convincing to break past the $42,000 mark, which remains a key resistance zone for further gains.

總而言之,儘管比特幣在短期內表現出看漲情緒,但該資產需要更有說服力才能突破 42,000 美元大關,這仍然是進一步上漲的關鍵阻力區域。

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

免責聲明:本網站上的內容不應被視為投資建議。投資是投機性的。投資時,您的資本面臨風險。

資料來源:https://thebittimes.com/analyst-identizes-key-price-level-to-validate-bitcoin-s-bullish-scenario-tbt77946.html

U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com DogeHome

DogeHome Optimisus

Optimisus Optimisus

Optimisus DeFi Planet

DeFi Planet Crypto Daily™

Crypto Daily™ BlockchainReporter

BlockchainReporter TheCoinrise Media

TheCoinrise Media