Cover image via U.Today

通過U.Today掩護圖像

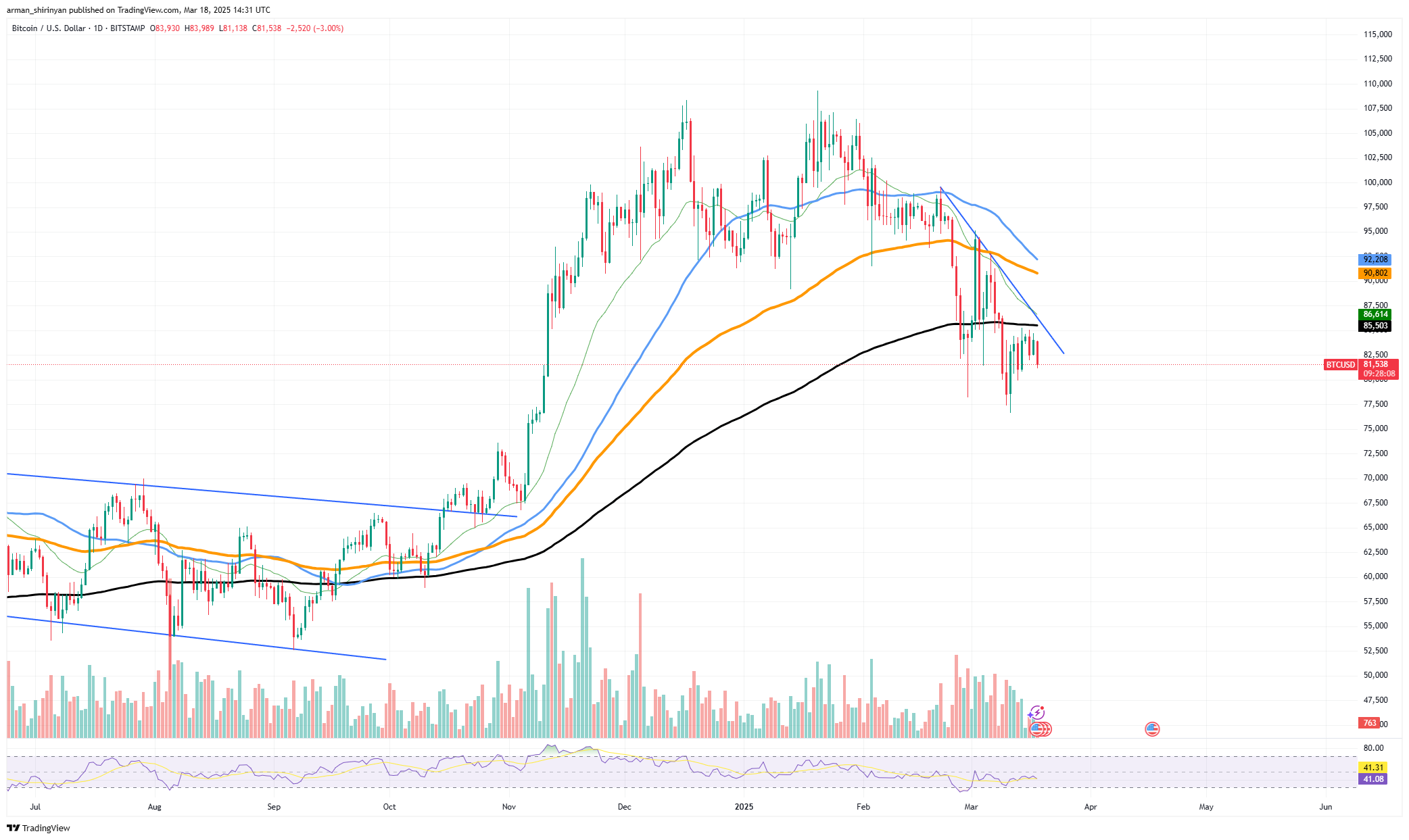

Bitcoin's price continues to struggle, facing significant technical resistance. The 200-day Exponential Moving Average (EMA), a key indicator of trend reversals, has repeatedly rejected Bitcoin's attempts at recovery. This inability to overcome resistance raises concerns about further downward movement in the coming weeks.

比特幣的價格繼續掙扎,面臨著巨大的技術抵抗。 200天的指數移動平均線(EMA)是趨勢逆轉的關鍵指標,已反复拒絕比特幣恢復的嘗試。這種無法克服的抵抗會引起人們對未來幾週進一步下降運動的擔憂。

Bitcoin is currently trading around $82,000, continuing a downward trend from recent highs. Rejection at the 200 EMA highlights persistent bearish sentiment. Declining trading volume further underscores weak buying pressure, increasing the risk of another sell-off.

比特幣目前的交易約為82,000美元,延續了最近的高點。 200 EMA的拒絕重點介紹了持續的看跌情緒。 交易量的下降進一步強調了購買壓力較小,增加了另一種拋售的風險。

The market's weakening is evident in Bitcoin's difficulty establishing strong support. Recent lower highs indicate sellers regaining control, potentially pushing Bitcoin back towards previous support levels. Failure to hold the $80,000 mark could see Bitcoin drop to the next significant support around $75,000, signaling a deeper correction.

在比特幣難以建立大力支持的困難中,市場的削弱顯而易見。 最近的低點表明賣方重新獲得控制,可能將比特幣恢復到以前的支持水平。如果不持有80,000美元的大關可能會使比特幣降至下一個重大支撐,左右$ 75,000左右,這表明更深層次的更正。

The broader cryptocurrency market remains turbulent, with major altcoins mirroring Bitcoin's struggles. Regulatory concerns and macroeconomic uncertainties contribute to cautious investor sentiment. The Relative Strength Index (RSI), while in neutral territory, shows weakening momentum, supporting the notion of a short-term recovery being unlikely.

更廣泛的加密貨幣市場仍然是動蕩的,主要的山寨幣反映了比特幣的掙扎。 監管問題和宏觀經濟的不確定性導致了謹慎的投資者情緒。 相對強度指數(RSI)在中性區域中顯示出弱勢勢頭,支持短期恢復的概念不太可能。

Bitcoin's failure to reclaim key resistance levels suggests a continuation of the bearish cycle. Without a significant market shift or surge in buying volume, further downward pressure is likely. Traders should closely monitor the $80,000 support level, as a breach could trigger a more substantial decline.

比特幣未能恢復關鍵阻力水平,這表明持續看跌週期。 沒有明顯的市場轉移或購買量的激增,可能會進一步向下壓力。 交易者應密切監視80,000美元的支持水平,因為違規行為可能會引發更大的下降。

Dogecoin's Struggle

多黴素的掙扎

Dogecoin remains under pressure as it attempts to break through the crucial $0.18 resistance level. Repeated failures to surpass this barrier indicate weak market strength. This persistent rejection suggests further declines are possible.

Dogecoin試圖突破至關重要的0.18電阻水平,因此仍處於壓力下。 重複失敗以超過這一障礙表明市場實力較弱。這種持續的拒絕表明進一步下降是可能的。

The $0.18 resistance has consistently thwarted Dogecoin's attempts to reach previous highs, leading to price drops with increased selling pressure near this level. The inability to overcome this resistance reflects overall market weakness and a lack of substantial buying support.

$ 0.18的阻力一直阻止Dogecoin企圖達到以前的高價,導致價格下跌,而銷售壓力增加了此水平。無法克服這種抵抗的能力反映了整體市場弱點和缺乏大量購買支持。

Exacerbating Dogecoin's woes is the emergence of a death cross—a bearish technical pattern where the short-term moving average crosses below the long-term moving average. This pattern diminishes the likelihood of a short-term recovery, suggesting a prolonged downward trend. As long as this bearish formation persists, DOGE may experience continued sell-offs and weak reversal attempts.

加劇狗狗幣的困境是死亡十字架的出現,這是一種看跌的技術模式,短期移動平均平均線橫向長期移動平均線。 這種模式減少了短期恢復的可能性,表明向下趨勢延長。 只要這種看跌的形成仍然存在,Doge可能會持續拋售和逆轉嘗試較弱。

If DOGE fails to recover, the next significant support lies around $0.16. A break below this level could trigger further drops, potentially testing the lower support zone near $0.14. The market's inability to sustain bullish momentum remains a significant concern for Dogecoin investors.

如果Doge無法恢復,那麼下一個重大支持就在0.16美元左右。 低於此水平的突破可能會觸發進一步的下降,可能會在$ 0.14的較低支撐區域測試。 市場無法維持看漲的勢頭仍然是Dogecoin投資者的重要關注點。

Solana's Ascending Triangle

索拉納的上升三角形

Solana, after a prolonged decline, continues to face significant downward pressure and struggles to regain momentum. Despite the challenges, a subtle, potentially positive sign has emerged: the formation of higher lows. This technical pattern often indicates a potential reversal, suggesting buyers are entering at slightly higher levels, potentially paving the way for a more stable recovery.

索拉納(Solana)長期下降了,繼續面臨著巨大的下降壓力和努力恢復動力的努力。 儘管面臨挑戰,但出現了微妙的,潛在的積極跡象:高低的形成。 這種技術模式通常表明潛在的逆轉,這表明買家的水平略高,可能為更穩定的恢復鋪平了道路。

However, Solana's overall market outlook remains challenging. A death cross on the charts—where short-term moving averages fall below long-term averages—has trapped the asset in a persistent downtrend. Such patterns typically indicate extended bearish conditions, making it difficult for SOL to break out of its current range.

但是,Solana的整體市場前景仍然具有挑戰性。 圖表上的死亡十字架(短期移動平均值低於長期平均值)將資產困在持續的下降趨勢中。這些模式通常表明延長的看跌條件,使SOL難以脫離其當前範圍。

Technically, resistance levels at $143 and $169 would significantly hinder any potential recovery. A clear break above these levels is necessary for Solana to establish long-term bullish momentum. Furthermore, lower highs during previous recovery attempts highlight the ongoing battle against selling pressure. The overall market sentiment must also be considered.

從技術上講,電阻水平為143美元和169美元將極大地阻礙任何潛在的恢復。 索拉納(Solana)建立長期看漲勢頭是必不可少的。 此外,先前恢復期間的較低高點突出了與銷售壓力的持續戰鬥。 還必須考慮整體市場情緒。

In a volatile cryptocurrency market, weaker assets like Solana may find a comeback more difficult. If Bitcoin and other major assets fail to recover, SOL could face further downside risks. Despite these concerns, the higher lows suggest some buyer resilience. Maintaining above $125 and gaining momentum could lead to a test of immediate resistance levels.

在一個動蕩的加密貨幣市場中,像Solana這樣的資產較弱可能會發現復出更加困難。 如果比特幣和其他主要資產無法恢復,SOL可能會面臨進一步的下行風險。 儘管有這些擔憂,但較高的低點表明一些買家的韌性。 保持超過125美元的速度並獲得勢頭,可能會導致立即阻力水平的測試。

Conversely, failure to hold support could prolong the downtrend, leaving the asset vulnerable to further losses. Given Solana's critical juncture, traders and investors should closely monitor price action in the coming days. Ultimately, investor confidence and overall market conditions will determine whether this potential price signal represents a genuine recovery or merely a temporary respite in the bearish trend. Read original article on U.Today

相反,如果不舉行支持可能會延長下降趨勢,從而使資產容易遭受進一步的損失。 鑑於索拉納(Solana)的關鍵關頭,交易者和投資者應在未來幾天內密切監視價格行動。 最終,投資者的信心和整體市場條件將決定這種潛在的價格信號是真正的恢復還是看跌趨勢中的臨時喘息。 閱讀有關U.Today的原始文章

CoinPedia News

CoinPedia News DogeHome

DogeHome BH NEWS

BH NEWS U.Today

U.Today COINTURK NEWS

COINTURK NEWS Coin Edition

Coin Edition CFN

CFN