Highly capitalized investors have been accumulating Bitcoin (BTC) since the year started, driving the asset’s price to an all-time high. These investment activities are observable through Bitcoin wallet addresses holding large amounts of the coin, also known as whales.

自今年年初以來,資本雄厚的投資者一直在累積比特幣(BTC),推動該資產的價格創下歷史新高。這些投資活動可以透過持有大量比特幣(也稱為鯨魚)的比特幣錢包地址來觀察。

In particular, a Bitcoin whale has stacked 1,308 BTC, worth nearly $90 million since March 6. The address ‘bc1qag725vjxxpkkl5gshfkye9xn4p5vklrlhgkw5w’ currently holds this amount at a dollar-cost average of $68,617 per coin, according to Lookonchain’s post.

特別是,自 3 月 6 日以來,比特幣鯨魚已經累積了 1,308 BTC,價值近 9,000 萬美元。根據 Lookonchain 的帖子,地址「bc1qag725vjxxpkkl5gshfkye9xn4p5vklrlhgkw5w」目前持有這筆金額,每枚比特幣 68,68,68,168,000 美元。

Notably, its last purchase was on April 7, for a 113.735 BTC Binance withdrawal, worth over $7.85 million. This was the Bitcoin whale’s second-largest transaction during this month of accumulation. The largest single purchase was 123.128 BTC, with a value superior to $8 million on April 3.

值得注意的是,其最後一次購買是在 4 月 7 日,幣安提款了 113.735 BTC,價值超過 785 萬美元。這是比特幣鯨魚在本月累積過程中的第二大交易。 4 月 3 日,最大單筆購買量為 123.128 BTC,價值超過 800 萬美元。

Picks for you

為您精選

狗狗幣價格預測; DOGE 能否扭轉 XRP 的市值? 45 分鐘前

BTC 的隱藏歷史:《劫持比特幣》一書在 3 小時前成為暢銷書

R. Kiyosaki 列出了 3 項資產,可將您從「一切泡沫」中拯救出來 3 小時前

5 小時前交易失敗時需要考慮的 10 大 Solana 競爭對手

BTC price analysis

比特幣價格分析

As of writing, the leading cryptocurrency is trading at $70,117, back inside a price range lost on April 2. Essentially, the range’s highs and lows are now key resistance and support levels, of $71,500 and $68,500, respectively.

截至撰寫本文時,領先的加密貨幣交易價格為70,117 美元,回到4 月2 日失去的價格區間內。從本質上講,該區間的高點和低點現在是關鍵阻力位和支撐位,分別為71,500 美元和68,500 美元。

From a technical Analysis perspective, Bitcoin displays a short-term uptrend targeting $71,500 and further deciding from there. Moreover, the Relative Strength Index (RSI) in the 4-hour time frame suggests strong momentum and a bullish signal for Bitcoin whales to invest in.

從技術分析的角度來看,比特幣顯示出短期上漲趨勢,目標為 71,500 美元,並在此基礎上進一步決定。此外,4小時時間範圍內的相對強弱指數(RSI)顯示強勁的勢頭和比特幣鯨魚投資的看漲訊號。

More bullish signals for Bitcoin whales and investors

比特幣鯨魚和投資者面臨更多看漲訊號

In the meantime, Finbold has been reporting multiple bullish signals for Bitcoin whales and investors throughout the week. For example, a market cycle analysis that calls for the “most aggressive bull cycle” in BTC history, with new highs.

與此同時,芬博爾德本週一直向比特幣鯨魚和投資者報告多個看漲訊號。例如,市場週期分析呼籲比特幣歷史上“最激進的牛市週期”,並創下新高。

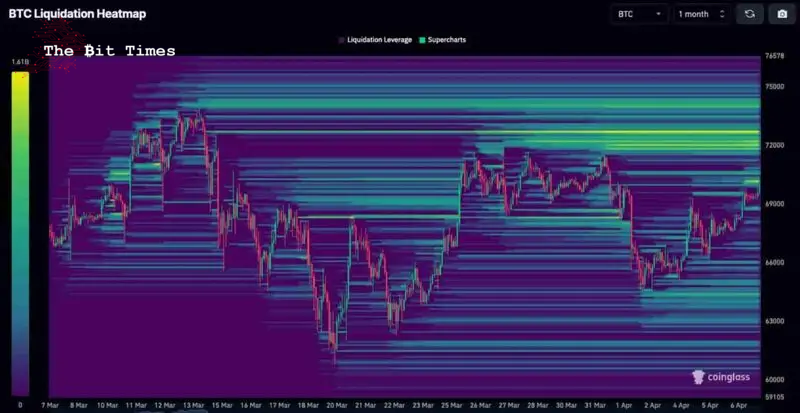

Interestingly, data retrieved from CoinGlass by press time hints at a potential BTC short squeeze above $72,000. This is due to the large amount of leveraged liquidations accumulated in this zone, which Bitcoin whales could make a target for increased profits in a possible resistance-breaking surge.

有趣的是,截至發稿時從 CoinGlass 檢索到的數據暗示 BTC 空頭擠壓可能會超過 72,000 美元。這是由於該區域積累了大量槓桿清算,比特幣鯨魚可以將其作為可能突破阻力的飆升中增加利潤的目標。

Nevertheless, the Bitcoin community faces fundamental uncertainties despite all the positive whale activity and technical bullish signals. This is due to the launch of Roger Ver’s new book ‘Hijacking Bitcoin: The Hidden History of BTC.’ The book was launched on April 5 and became a best-seller on Amazon within just two days, shaking historical beliefs.

然而,儘管有積極的鯨魚活動和技術看漲訊號,但比特幣社群仍面臨基本的不確定性。這得歸功於 Roger Ver 的新書《劫持比特幣:BTC 隱藏的歷史》的推出。該書於 4 月 5 日上市,短短兩天就成為亞馬遜暢銷書,動搖了歷史信念。

Yet, the upcoming Bitcoin halving expected to April 20 could drive the investor’s attention to bullish economic fundamentals.

然而,預計 4 月 20 日到來的比特幣減半可能會促使投資者關注看漲的經濟基本面。

All things considered, Bitcoin’s future price action remains uncertain, while mostly favoring a bullish bias. Investors must do their due diligence and understand the underlying risks and opportunities of investing in BTC.

考慮到所有因素,比特幣未來的價格走勢仍然不確定,同時大多傾向於看漲偏見。投資者必須盡職調查並了解投資比特幣的潛在風險和機會。

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

免責聲明:本網站的內容不應被視為投資建議。投資是投機性的。投資時,您的資本面臨風險。

Source: https://thebittimes.com/bullish-signal-bitcoin-whale-accumulates-90-million-in-a-month-tbt84740.html

資料來源:https://thebittimes.com/bullish-signal-bitcoin-whale-accumulates-90-million-in-a-month-tbt84740.html

DogeHome

DogeHome Crypto News Land

Crypto News Land ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com Optimisus

Optimisus Optimisus

Optimisus