The cryptocurrency market has witnessed a massive wave of short liquidations, erasing approximately $87 million in bearish bets from the market. The shakeout is a powerful move by bulls, leaving many in the bear camp facing significant losses and potentially building the foundation for a longer-term rally continuation.

加密貨幣市場見證了大規模的空頭清算浪潮,消除了市場上約 8,700 萬美元的看跌押注。這次洗牌是多頭的一次強有力的舉動,使許多空頭陣營面臨重大損失,並可能為長期反彈的延續奠定基礎。

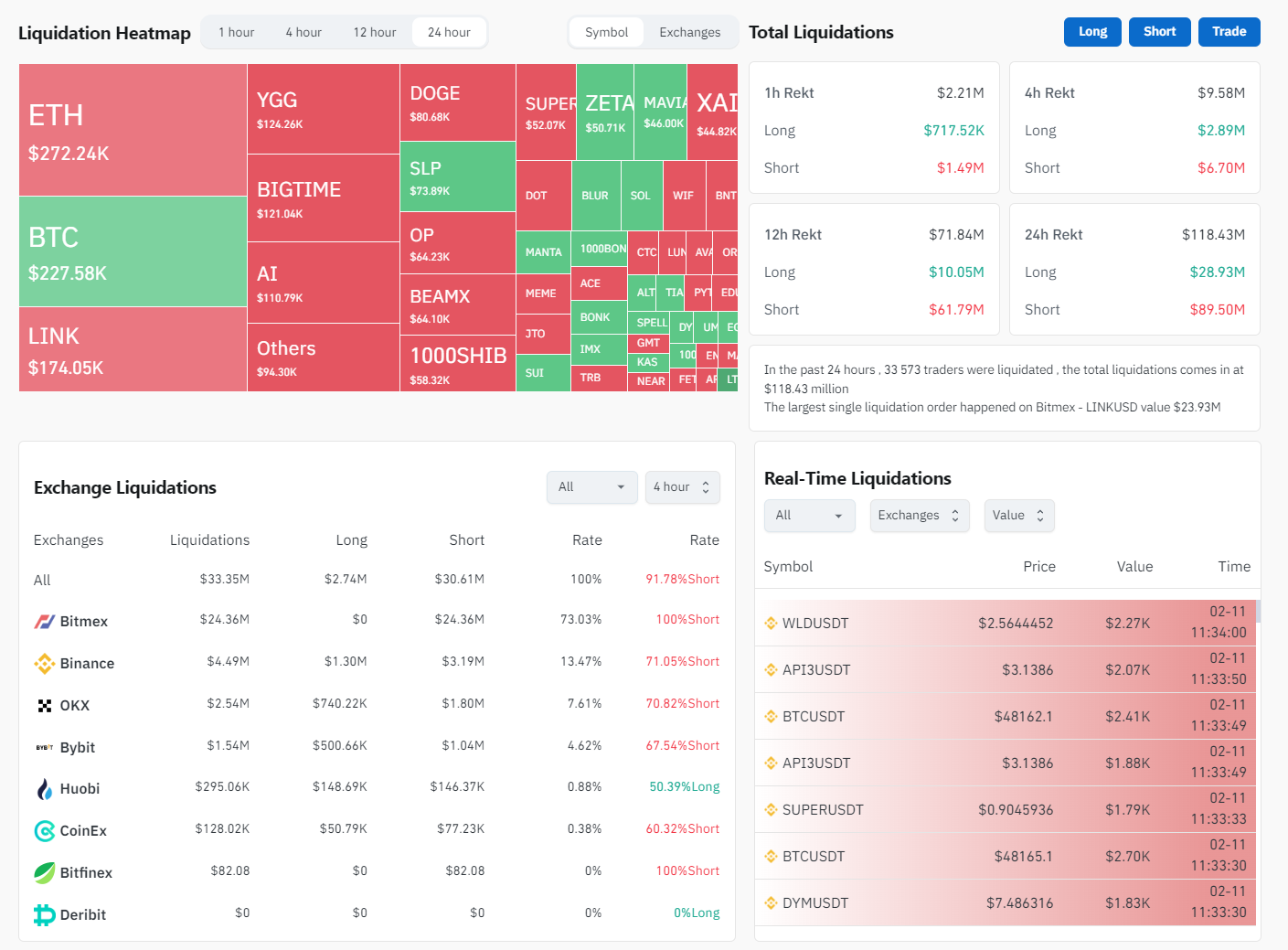

The liquidation data reveals that Ethereum, Bitcoin and Dogecoin are among the most affected assets, with liquidations amounting to $272,000, $227,000 and $80,000 respectively. Rapid price movements can trigger cascading liquidations due to the extensive use of leverage by traders and not the greatest liquidity on some trading pairs.

清算數據顯示,以太幣、比特幣和狗狗幣是受影響最嚴重的資產,清算金額分別為 27.2 萬美元、22.7 萬美元和 8 萬美元。由於交易者廣泛使用槓桿而不是某些交易對的最大流動性,快速的價格變動可能會引發連鎖清算。

Source: CoinGlass

Source: CoinGlass來源:CoinGlass

The effect of these liquidations on market performance is multifaceted. On the one hand, the elimination of short positions can alleviate downward pressure on prices, potentially leading to short-term rallies as the market adjusts to the reduced number of bets against the assets. On the other hand, these events can inject uncertainty into the market, as traders may become cautious in the wake of such significant liquidations.

這些清算對市場表現的影響是多方面的。一方面,空頭部位的消除可以緩解價格的下行壓力,隨著市場適應資產押注數量的減少,可能會導致短期反彈。另一方面,這些事件可能會給市場帶來不確定性,因為交易者在如此重大的清算之後可能會變得謹慎。

Specifically examining Bitcoin's price activity, the leading cryptocurrency has shown resilience. Bitcoin's recent price trajectory saw it reclaim the $46.3K level, a price not seen since early January, reflecting a robust recovery and a renewed confidence among investors. This rebound is a testament to the underlying bullish sentiment that persists despite potential headwinds.

特別檢查比特幣的價格活動,領先的加密貨幣表現出了彈性。比特幣最近的價格軌跡重新回到了 4.63 萬美元的水平,這是自 1 月初以來的最高水平,反映出強勁的復甦和投資者信心的恢復。這種反彈證明了儘管存在潛在阻力,但潛在的看漲情緒仍然持續存在。

However, traders and investors must remain vigilant. While the current liquidations have favored those with long positions, the markets are known for their unpredictability. The key price levels to watch for Bitcoin in the near term include the support level at around $43.5K and the psychological barrier at $50K, which, if breached, could signal a new phase of bullish momentum.

然而,交易者和投資者必須保持警惕。雖然目前的清算有利於那些持有多頭部位的人,但市場以其不可預測性而聞名。近期需要關注的比特幣關鍵價格水平包括 4.35 萬美元左右的支撐位和 5 萬美元的心理障礙,如果突破該水平,可能預示著看漲勢頭進入新階段。

Cryptopolitan

Cryptopolitan DogeHome

DogeHome crypto.ro English

crypto.ro English Crypto News Land

Crypto News Land ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com