Data shows that cryptocurrency long holders have seen liquidations of $365 million in the past day as Bitcoin’s price has crashed below $66,000.

數據顯示,隨著比特幣價格跌破 66,000 美元,加密貨幣多頭持有者在過去一天遭遇了 3.65 億美元的清算。

Cryptocurrency Derivative Market Has Registered High Liquidations Today

According to data from CoinGlass, the derivative side of the cryptocurrency market has suffered some major liquidations in the past day following the volatility that assets like Bitcoin have gone through.

加密貨幣衍生性商品市場今天出現大量清算 根據CoinGlass的數據,隨著比特幣等資產的波動,加密貨幣市場的衍生性商品市場在過去一天遭遇了一些重大清算。

The “liquidation” of a contract takes place when it amasses losses of a certain degree, leading to the derivative exchange with which it’s open to forcibly close it off.

當合約虧損達到一定程度時,合約就會被“清算”,導致衍生性商品交易所強行將其關閉。

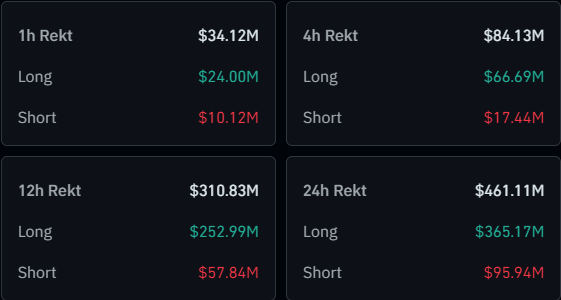

Below is a table that shows the information about the liquidation event that has occurred in the cryptocurrency sector over the last day:

相關閱讀:比特幣再次出現重大 Coinbase 流出:這次 12 億美元 下面的表格顯示了過去一天加密貨幣領域發生的清算事件的資訊:

Looks like a large amount of liquidations have occurred during the past 24 hours | Source: CoinGlass

As is visible above, the market has observed total liquidations of more than $461 million in the past 24 hours. 144,049 traders were involved in this flush, with the largest single liquidation standing at over $7 million.

看來過去24小時內發生了大量爆倉 |資料來源:CoinGlass 如上圖所示,過去 24 小時內市場清算總額超過 4.61 億美元。 144,049 名交易者參與了此次沖倉,最大單筆清算金額超過 700 萬美元。

It would appear that the long investors have taken the brunt of this liquidation event, with $365 million contracts of this type seeing forceful closure. This would mean that almost 80% of the total liquidations involved these traders betting on a bullish outcome.

看起來,多頭投資者在這次清算事件中首當其衝,價值 3.65 億美元的此類合約被強制平倉。這意味著近 80% 的清算總額涉及這些交易者押注看漲結果。

The price action in the sector as a whole has been negative in the past day, with Bitcoin witnessing a drawdown of almost 6%. As such, it’s not surprising to see the liquidations being long-heavy.

過去一天,整個產業的價格走勢一直是負面,比特幣下跌了近 6%。因此,看到長期大量清算也就不足為奇了。

Mass liquidation events are popularly known as “squeezes.” Since the event from the past day has been dominated by the long side of the sector, the squeeze would be categorized as a “long squeeze.”

大規模清算事件通常被稱為「擠壓」。由於過去一天的事件主要由該行業的多頭主導,因此擠壓將被歸類為「多頭擠壓」。

During a squeeze, a sharp swing in the price can result in a large amount of liquidations that only fuel the price move further. This amplified move then causes even more liquidations, and in this way, a cascade of them gets unleashed.

在擠壓期間,價格的急劇波動可能會導致大量清算,這只會加劇價格的進一步波動。這種放大的舉動會導致更多的清算,這樣就會釋放出一連串的清算。

A majority of the latest flushes have come in the past 12 hours alone, as liquidations stand at $310 million for the window. This once again corresponds with the price action, as Bitcoin and others have been the most volatile in this period.

僅在過去 12 小時內,大多數最新的沖水都發生了,該窗口的清算金額為 3.1 億美元。這再次與價格走勢相對應,因為比特幣和其他貨幣在這段時期是波動性最大的。

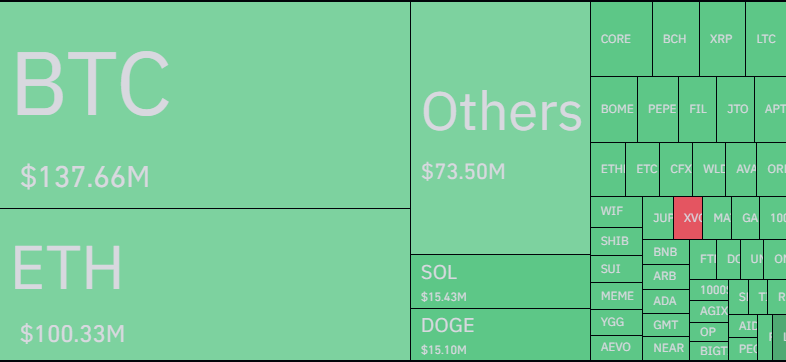

As for how the various individual symbols are responsible for the squeeze, the table below breaks it down:

至於各個符號如何造成擠壓,下表進行了細分:

The breakdown of the liquidations according to symbol | Source: CoinGlass

Bitcoin was responsible for the greatest share of liquidations at $137 million, while Ethereum (ETH) came second at $100 million. Out of the altcoins, Solana (SOL) and Dogecoin (DOGE) have topped the list with about $15 million liquidations each.

按符號劃分的清算明細 |來源:CoinGlassBitcoin 的清算份額最大,為 1.37 億美元,而以太坊(ETH)則位居第二,為 1 億美元。在山寨幣中,Solana (SOL) 和 Dogecoin (DOGE) 分別以約 1500 萬美元的清算量位居榜首。

In the cryptocurrency sector, mass liquidation events like today’s aren’t exactly an uncommon sight, due to the fact that the coins are in general quite volatile and many platforms offer easy access to extreme amounts of leverage.

相關閱讀:比特幣何時見頂?這種歷史模式可能會提供提示在加密貨幣領域,像今天這樣的大規模清算事件並不罕見,因為加密貨幣總體上波動性很大,而且許多平台可以輕鬆獲得極高的槓桿率。

Because of these factors, uninformed trading in the derivative side of the cryptocurrency market can prove to be quite risky.

由於這些因素,加密貨幣市場衍生性商品方面的不知情交易可能會被證明風險很大。

Bitcoin Price

Bitcoin has plunged all the way towards the $65,200 level with its latest drawdown.

比特幣價格隨著最新的回撤,比特幣一路暴跌至 65,200 美元的水平。

The price of the asset appears to have gone through some significant decline in the past day | Source: BTCUSD on TradingView

該資產的價格在過去一天似乎經歷了一些大幅下跌 |資料來源:TradingView 上的 BTCUSD 精選圖片來自 Shutterstock.com、CoinGlass.com,圖表來自 TradingView.com

Optimisus

Optimisus Crypto News Land

Crypto News Land Optimisus

Optimisus Cryptopolitan_News

Cryptopolitan_News DogeHome

DogeHome Cryptopolitan

Cryptopolitan crypto.ro English

crypto.ro English