Several major U.S. exchanges have filed applications to list exchange-traded funds (ETFs) tracking digital assets like Hedera (HBAR) and Dogecoin (DOGE), signaling the growing integration of cryptocurrencies into traditional finance. These ETFs offer investors regulated access to these digital assets, eliminating the complexities of directly owning and managing large quantities of cryptocurrency.

美國的幾項主要交易所提出了申請,以列出交易所交易基金(ETF)跟踪數字資產(例如Hedera(HBAR)和Dogecoin(Doge)),這表明了加密貨幣融入傳統融資的融合日益增長。 這些ETF為投資者提供了對這些數字資產的訪問權限,從而消除了直接擁有和管理大量加密貨幣的複雜性。

Nasdaq's Initiative: Grayscale Hedera ETF

納斯達克的倡議:格雷斯卡·赫德拉ETF

On March 3, 2025, Nasdaq filed a 19b-4 form with the U.S. Securities and Exchange Commission (SEC) to list the Grayscale Hedera Trust. This marks Grayscale's sixth attempt to launch an altcoin-focused ETF, highlighting their commitment to expanding cryptocurrency investment options. The Grayscale Hedera ETF will track the performance of HBAR, the native token of the Hedera network, providing investors with exposure to this innovative platform.

2025年3月3日,納斯達克向美國證券交易委員會(SEC)提交了19b-4表格,以列出灰刻級Hedera Trust。這標誌著Grayscale的第六次嘗試推出以Altcoin為中心的ETF,強調了他們致力於擴大加密貨幣投資選擇的承諾。 Hedera ETF灰度Hedera ETF將跟踪Hedera網絡本地代幣HBAR的性能,從而為投資者提供了這種創新平台的影響。

Hedera distinguishes itself through its use of the Hashgraph consensus algorithm, offering faster and cheaper transactions compared to traditional blockchain technology. This efficiency attracts businesses seeking effective decentralized solutions. The SEC has acknowledged the filing and initiated a review process, typically lasting around 45 days, to assess the ETF's compliance with regulatory standards.

Hedera通過使用標籤共識算法來區分自己,與傳統的區塊鏈技術相比,提供更快,更便宜的交易。這種效率吸引了尋求有效分散解決方案的企業。 SEC已承認該文件,並啟動了審查程序,通常持續約45天,以評估ETF遵守監管標準。

NYSE Arca's Proposal: Bitwise Dogecoin ETF

NYSE ARCA的提議:位狗狗ETF

Similarly, NYSE Arca submitted a proposed rule change to list the Bitwise Dogecoin ETF. This ETF aims to provide direct exposure to Dogecoin, reflecting its evolution from a meme coin to a significant cryptocurrency. If approved, the Bitwise Dogecoin ETF would allow investors to gain exposure to DOGE without the need to manage private keys or interact directly with cryptocurrency exchanges.

同樣,紐約證券交易所ARCA提交了擬議的規則更改,以列出位狗狗ETF。 該ETF旨在直接接觸Dogecoin,反映其從模因硬幣到明顯的加密貨幣的演變。 如果獲得批准,dogecoin ETF將允許投資者無需管理私鑰或直接與加密貨幣交易所互動而獲得Doge的曝光率。

Dogecoin's transformation from a satirical cryptocurrency to a major player in the market underscores the dynamic nature of the crypto space. Its inclusion in a proposed ETF further demonstrates increasing institutional interest and the mainstream adoption of previously niche digital assets.

Dogecoin從諷刺的加密貨幣轉變為市場上的主要參與者強調了加密貨幣空間的動態性質。它的包含在擬議的ETF中進一步表明,機構的利益不斷提高,並主流採用了以前的數字資產。

Market Reactions and Price Movements

市場反應和價格變動

The announcements of these ETF filings significantly impacted the prices of HBAR and DOGE. Hedera's price surged following the news, reflecting investor enthusiasm. Dogecoin also experienced a price increase, although subsequent volatility, typical of the cryptocurrency market, followed.

這些ETF文件的公告極大地影響了HBAR和DOGE的價格。 赫德拉(Hedera)的價格在新聞之後飆升,反映了投資者的熱情。隨後,Dogecoin隨後發生了典型的加密貨幣市場的波動性,儘管隨後發生了上漲。

Hedera and Dogecoin's Current Price Overview

Hedera和Dogecoin的當前價格概述

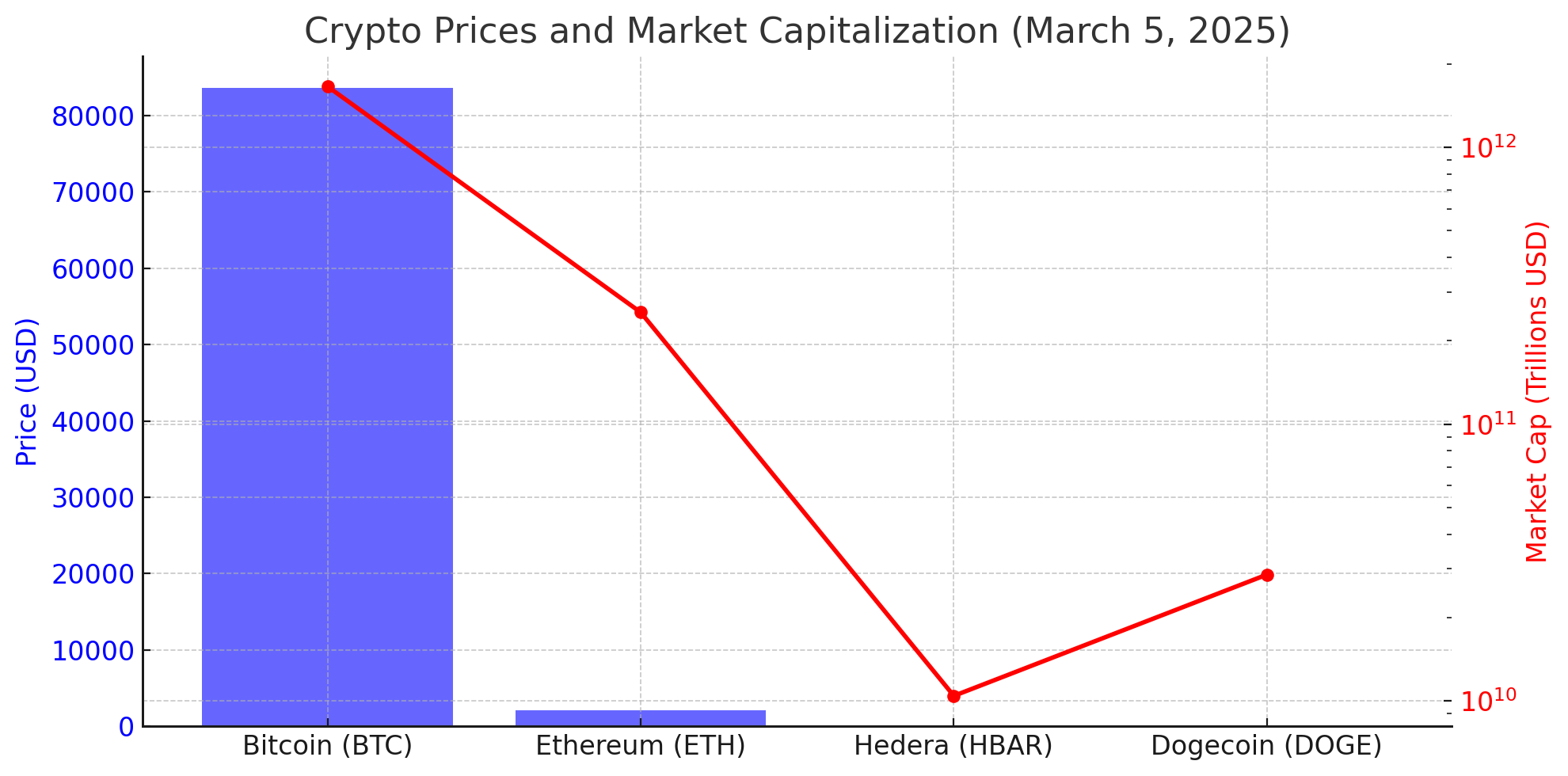

As of March 5, 2025, the cryptocurrency market showed significant movement. The table below summarizes the current prices and market capitalizations of selected cryptocurrencies:

截至2025年3月5日,加密貨幣市場表現出重大運動。 下表總結了選定加密貨幣的當前價格和市值:

| Cryptocurrency | Price (USD) | Market Capitalization (USD) |

|---|---|---|

| Bitcoin (BTC) | $83,609.00 | $1,659,803,929,597 |

| Ethereum (ETH) | $2,099.55 | $253,486,591,781 |

| Hedera (HBAR) | $0.248851 | $10,428,950,179 |

| Dogecoin (DOGE) | $0.198161 | $28,602,621,709 |

Data sourced from CoinMarketCap and GoldPrice.org as of March 5, 2025.

CryptocurrencyPrice(USD)市值(USD)比特幣(BTC)$ 83,609.00 $ 1,659,803,929,597 ethereum(ETH)$ 2,099.55 $ 253,486,486,591,781HEDERA(HBAR) 161 $ 28,602,621,709DATA截至2025年3月5日,來自CoinMarketCap和Goldprice.org。

Implications for the Crypto ETF Landscape

對加密ETF景觀的影響

The ETF applications for Hedera and Dogecoin are part of a broader trend among asset managers to offer regulated investment products linked to various cryptocurrencies. This reflects growing demand for regulated crypto investment vehicles from both retail and institutional investors.

Hedera和Dogecoin的ETF應用程序是資產經理中更廣泛的趨勢的一部分,即提供與各種加密貨幣相關的受監管的投資產品。這反映了零售和機構投資者對受監管的加密投資工具的需求不斷增長。

The SEC's decision on these applications will be crucial. Approval could trigger a wave of new crypto ETFs, expanding beyond altcoins to encompass other digital assets within traditional financial markets. Conversely, delays or rejections could fuel further discussions about crypto investment regulations.

SEC對這些申請的決定至關重要。批准可能會觸發一波新的加密ETF,擴大了山寨幣以外的地方,以涵蓋傳統金融市場中的其他數字資產。相反,延誤或拒絕可能會激發有關加密投資法規的進一步討論。

Conclusion

結論

Nasdaq and NYSE Arca's efforts to list ETFs for Hedera and Dogecoin represent a significant step toward integrating cryptocurrencies into traditional finance. These developments provide investors with valuable new tools and highlight the evolving financial landscape's adaptation to new digital assets. The SEC's decision on these proposals will be instrumental in shaping the future of crypto adoption and regulation.

納斯達克(NASDAQ)和紐約證券交易所(NYSE ARCA)為HEDERA和DOGECOIN列出ETF的努力是將加密貨幣整合到傳統金融中的重要一步。 這些發展為投資者提供了寶貴的新工具,並突出了不斷發展的金融格局對新數字資產的改編。 SEC對這些建議的決定將有助於塑造加密採用和監管的未來。

FAQs

常見問題解答

- What is an ETF? An Exchange-Traded Fund (ETF) is an investment fund traded on a stock exchange, typically tracking a specific index, commodity, or asset.

- How does a cryptocurrency ETF work? A cryptocurrency ETF provides exposure to digital assets without directly purchasing them. Investors invest in a fund that holds the cryptocurrency, simplifying the process and often providing regulatory oversight.

- Why invest in a Crypto ETF? A crypto ETF combines the benefits of regulatory oversight and a traditional brokerage account, eliminating the need for digital wallets and private key management.

- What are the risks of crypto ETFs? Risks include the inherent volatility of cryptocurrencies, potential regulatory changes, and the performance of the underlying assets, which can cause significant ETF value fluctuations.

Glossary of Key Terms

什麼是ETF?交易所交易基金(ETF)是一家以證券交易所交易的投資基金,通常跟踪特定指數,商品或資產。加密貨幣ETF如何工作?加密貨幣ETF無需直接購買數字資產就可以接觸數字資產。投資者投資於擁有加密貨幣,簡化流程並經常提供監管監督的基金。為什麼投資加密ETF? Crypto ETF結合了監管監督的好處和傳統的經紀帳戶,消除了對數字錢包和私人密鑰管理的需求。加密ETF的風險是什麼?風險包括加密貨幣的固有波動性,潛在的監管變化以及基礎資產的性能,這可能會引起重大的ETF價值波動。

- Cryptocurrency: A digital or virtual currency using cryptography for security and operating independently of a central authority.

- Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, tracking the performance of a specific asset or group of assets.

- Hedera (HBAR): The native cryptocurrency of the Hedera network, known for its Hashgraph consensus algorithm, enabling fast and secure transactions.

- Dogecoin (DOGE): A cryptocurrency that originated as a meme but has become a significant digital asset with a substantial market capitalization.

- SEC (Securities and Exchange Commission): The U.S. federal agency responsible for enforcing federal securities laws and regulating the securities industry.

Sources

加密貨幣:使用加密貨幣進行安全性和獨立於中央權威運行的數字或虛擬貨幣。交換交易基金(ETF):投資基金在證券交易所進行交易,跟踪特定資產或一組資產的績效。 :起源於模因,但已成為具有實質性市值的重要數字資產。SEC(證券交易委員會):美國聯邦機構負責執行聯邦證券法和規範證券行業。

- etf.com

- coinmarketcap.com

- cointelegraph.com

etf.comcoinmarketcap.comcointelegraph.com

The Coin Republic

The Coin Republic BlockchainReporter

BlockchainReporter TheCoinrise Media

TheCoinrise Media BlockchainReporter

BlockchainReporter DogeHome

DogeHome CFN

CFN Cointelegraph

Cointelegraph CFN

CFN