The immediate impact of Bitcoin halving was not as impressive as has been the norm with other cycles. However, the long-term outlook of the halving is what the ardent crypto investors will be focusing on. The anticipated supply crunch could be a force to be reckoned with in the bull run not only for Bitcoin but also for key altcoins to hold like Ethereum (ETH) and Dogecoin (DOGE).

比特幣減半的直接影響並不像其他週期的常態那樣令人印象深刻。然而,減半的長期前景才是熱心的加密貨幣投資者將關注的焦點。預期的供應緊縮可能是牛市中不可忽視的一股力量,不僅對比特幣而言,對以太坊(ETH)和狗狗幣(DOGE)等關鍵山寨幣也是如此。

Amidst the hope for a major breakout later in the year, the crypto market depicts increasing uncertainty due to investor unrest. While the red color worries participants, some see the precarious situation as a time to DCA and buy altcoins to hold eyeing above 100X profit potential.

儘管人們希望今年稍後會出現重大突破,但由於投資者的不安,加密貨幣市場的不確定性不斷增加。雖然紅色讓參與者感到擔憂,但有些人認為這種不穩定的局勢是 DCA 和購買山寨幣以維持 100 倍以上利潤潛力的最佳時機。

Bitcoin price hovers at $64,542 after correcting from a weekly peak above $67,000 while Ethereum sits below $3,200. Altcoins are the most affected by the headwinds, with some tokens recording double-digit losses.

比特幣價格從 67,000 美元以上的周高點修正後徘徊在 64,542 美元,而以太坊價格則低於 3,200 美元。山寨幣受逆風影響最大,一些代幣出現了兩位數的損失。

Identifying the altcoins to hold during this uncertain moment, could work for investors in the long-term.

從長遠來看,確定在這個不確定的時刻持有的山寨幣可能對投資者有利。

- Ethereum (ETH) Tops The List Of Altcoins To Hold

The optimism for a spot Ethereum Exchange-traded fund (ETF) gained momentum in Q1 after the Securities and Exchange Commission (SEC) approved a bunch of Bitcoin ETFs.

以太坊(ETH) 在持有的山寨幣名單中名列前茅在美國證券交易委員會(SEC) 批准了一系列比特幣ETF 後,對現貨以太坊交易所交易基金(ETF) 的樂觀情緒在第一季度獲得了動力。

Several potential ETH ETF issuers moved to file with the agency for approval to operate the products in the United States. Market sentiment on Ethereum improved significantly, with experts projecting a similar impact to the BTC ETF on the price of Bitcoin which hit a new all-time high of $73,837 in March, CoinGecko data shows.

幾家潛在的 ETH ETF 發行人已向該機構提交申請,請求批准在美國營運這些產品。 CoinGecko 數據顯示,以太坊的市場情緒顯著改善,專家預計比特幣價格將受到與 BTC ETF 類似的影響,比特幣價格在 3 月創下 73,837 美元的歷史新高。

However, according to the latest report, the SEC could move to deny Ethereum ETFs. The report published by Reuters cited issuers of the ETF and other companies who said that the regulator is not eager to meet with them.

然而,根據最新報告,美國證券交易委員會可能會拒絕以太坊 ETF。路透社發表的報告引述ETF發行人和其他公司的話說,監管機構並不急於與他們會面。

So far nine firms have filed proposals with the SEC to list Ethereum ETFs including VanEck, and ARK Investment Management. Spot ETFs track the price of Ethereum in real-time.

到目前為止,已有九家公司向 SEC 提交了以太坊 ETF 上市提案,其中包括 VanEck 和 ARK Investment Management。現貨 ETF 即時追蹤以太坊的價格。

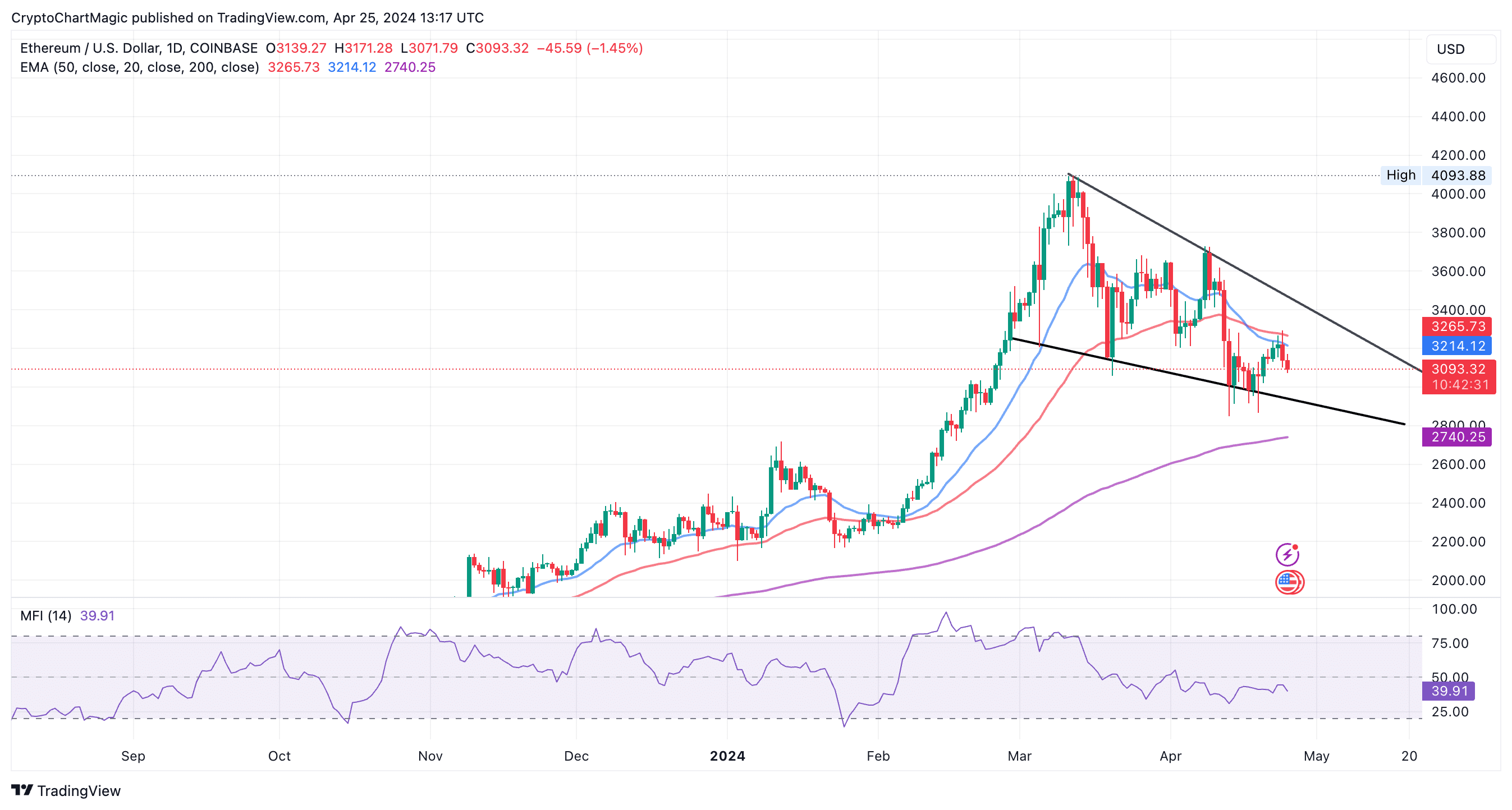

The Money Flow Index (MFI) below the 40 mark reinforces the bearish grip on Ether. In other words, there’s more money flowing out than into Ethereum markets, exerting more pressure on the price which is currently 24% below the 2024 peak of $4,089. The token also sits below two bull market indicators, the 20-day Exponential Moving Average (EMA) and the 50-day EMA (the blue and red lines on the chart).

資金流量指數(MFI)低於 40 關卡強化了對以太坊的看跌控制。換句話說,流出的資金多於流入以太坊市場的資金,這對價格造成了更大的壓力,目前價格比 2024 年高峰 4,089 美元低了 24%。該代幣也位於兩個牛市指標下方,即 20 天指數移動平均線 (EMA) 和 50 天 EMA(圖表上的藍線和紅線)。

Ethereum price analysis chart | Tradingview

以太坊價格分析圖|交易視圖

The correction could flip profitable if Ethereum price gains momentum from the forming falling wedge pattern. A break above the upper trend line could encourage traders to buy ETH betting on a trend reversal toward the $4,000 mark.

如果以太坊價格從形成的下降楔形形態中獲得動力,那麼修正可能會帶來獲利。突破上趨勢線可能會鼓勵交易者買入 ETH,押注趨勢反轉至 4,000 美元大關。

- Dogecoin (DOGE)

Dogecoin’s trading activity surged significantly, witnessing a 10% uptick in volume, totaling a whopping $1.38 billion, despite a dip in its price. As the 8th largest cryptocurrency by market capitalization, Dogecoin now boasts a market value of around $21.53 billion.

狗狗幣 (DOGE) 狗狗幣的交易活動顯著激增,儘管價格下跌,但交易量增加了 10%,總額高達 13.8 億美元。作為市值第八大加密貨幣,狗狗幣目前市值約為 215.3 億美元。

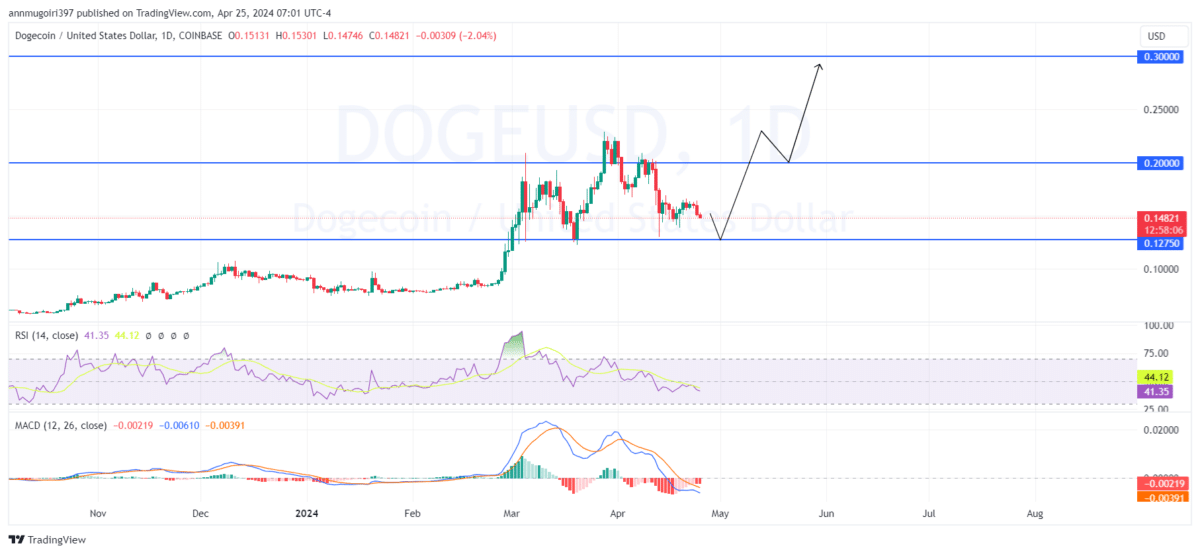

Over the previous week, Dogecoin value displayed considerable volatility, fluctuating between $0.14 and $0.16, ultimately resulting in a nearly 2% increase.

上週,狗狗幣價格出現了相當大的波動,在 0.14 美元至 0.16 美元之間波動,最終上漲了近 2%。

If Dogecoin’s value remains above $0.14, there’s growing anticipation that this could fuel further gains. This steadiness might pave the way for an upward move toward the $0.8 mark, which could open the door to the $1.00 level in the foreseeable future.

如果狗狗幣的價值保持在 0.14 美元以上,人們越來越預期這可能會推動進一步上漲。這種穩定性可能為上漲至 0.8 美元大關鋪平道路,從而可能在可預見的未來打開通往 1.00 美元水平的大門。

On the other hand, increasing bearish trends could push Dogecoin back to its support level of $0.14. Continued downward trends could further depress its value, reaching a low of $0.11 in the ensuing weeks.

另一方面,看跌趨勢的加劇可能會將狗狗幣推回到 0.14 美元的支撐位。持續的下跌趨勢可能會進一步壓低其價值,在接下來的幾週內跌至 0.11 美元的低點。

Dogecoin Price Forecast price chart

狗狗幣價格預測價格圖表

The daily technical indicators for Dogecoin show a sustained period of volatility as the cryptocurrency continues to fluctuate within a tight trading range. The upper Bollinger Band stands at $0.2054, while the lower band indicates a level of support at $0.132, suggesting that Dogecoin is experiencing a significant level of price movement. Additionally, the Relative Strength Index (RSI) is currently at 41.98, indicating that the asset is neutral.

狗狗幣的每日技術指標顯示出持續的波動期,因為加密貨幣繼續在狹窄的交易區間內波動。布林線上限為 0.2054 美元,下線則表示支撐位為 0.132 美元,表示狗狗幣正在經歷大幅的價格波動。此外,相對強弱指數(RSI)目前為 41.98,表示該資產處於中性。

The post 2 Trending Altcoins To Hold Targeting 100X Profit Post Bitcoin Halving appeared first on CoinGape.

比特幣減半後 2 個趨勢山寨幣將持有目標 100 倍利潤的貼文首先出現在 CoinGape 上。

ETHNews

ETHNews Crypto Daily™

Crypto Daily™ crypto.ro English

crypto.ro English Thecoinrepublic.com

Thecoinrepublic.com Crypto Daily™

Crypto Daily™ DogeHome

DogeHome U.Today

U.Today Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™