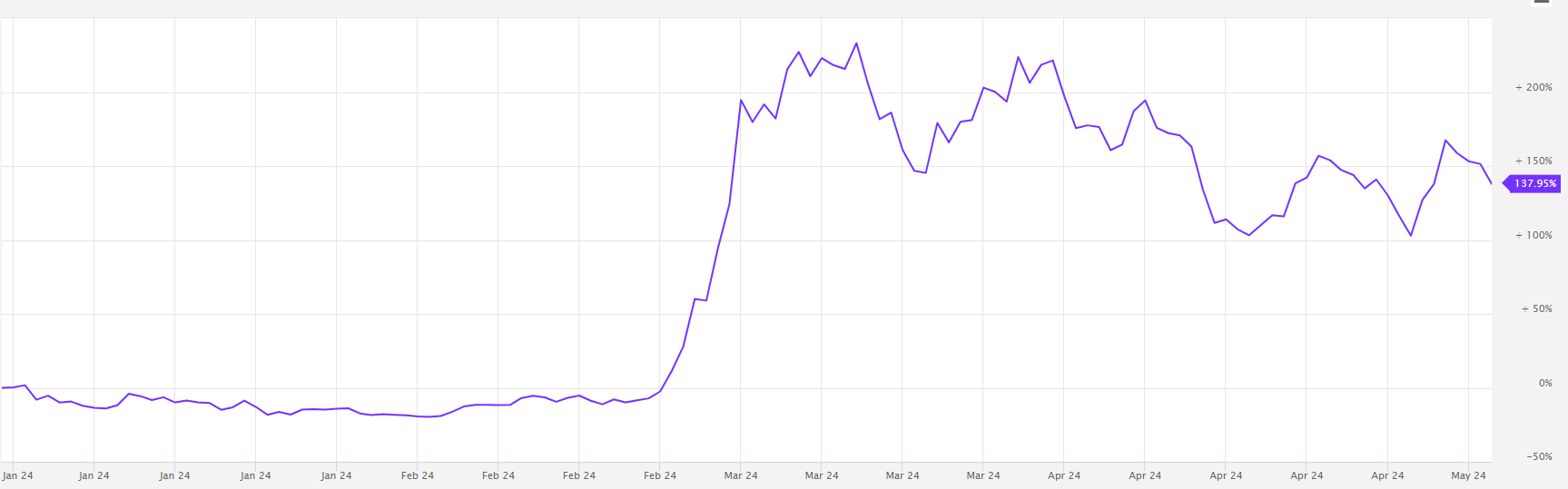

The MarketVector Meme Coin Index (MEMECOIN) has surged by over 137% since the beginning of 2024, continuing the upward trend of top memecoins.

自 2024 年初以來,MarketVector Meme 幣指數(MEMECOIN)已飆升超過 137%,延續了頂級 meme 幣的上升趨勢。

MarketVector's memecoin index has outperformed the S&P 500 index by over 15 times this year. In contrast, the S&P has only experienced a 9.3% price appreciation year-to-date (YTD), according to TradingView data.

MarketVector 的 memecoin 指數今年的表現超過標準普爾 500 指數 15 倍以上。相較之下,根據 TradingView 的數據,標準普爾指數今年迄今 (YTD) 的價格僅上漲了 9.3%。

The memecoin index is up over 137% YTD and 186% over the past year, trading at $76.60 as of 8:52 am UTC.

Memecoin 指數年初至今上漲 137%,去年上漲 186%,截至 UTC 上午 8:52 交易價格為 76.60 美元。

MEMECOIN, year-to-date. Source: MarketVector

MEMECOIN,今年迄今。來源:MarketVector

MarketVector, a subsidiary of the United States asset management giant VanEck, launched its memecoin index on October 31, 2021. It includes the six largest memecoins: Dogecoin (DOGE) with a 30.7% allocation rate, Shiba Inu (SHIB) with a 28.3% allocation, 14.5% Pepe (PEPE), 12.5% Dogwifhat (WIF), 7.14% Floki Inu (FLOKI), and 6.7% Bonk (BONK) tokens.

美國資產管理巨頭VanEck 旗下的MarketVector 於2021 年10 月31 日推出了memecoin 指數。 28.3%分配,14.5% Pepe (PEPE)、12.5% Dogwifhat (WIF)、7.14% Floki Inu (FLOKI) 和 6.7% Bonk (BONK) 代幣。

The "high risk, high return strategy" makes memecoins appealing to investors with a speculative nature and will likely maintain the relevance of top coins, according to Anndy Lian, intergovernmental blockchain expert and author of NFT: From Zero to Hero. Lian told Cointelegraph:

政府間區塊鏈專家、《NFT:從零到英雄》一書的作者Anndy Lian 表示,「高風險、高回報策略」使memecoin 吸引了具有投機性質的投資者,並可能保持頂級貨幣的相關性。 Lian 告訴 Cointelegraph:

"This creates a viral effect that can lead to rapid price increases. Many investors are drawn to the potential for quick, high returns. Memecoins are known for their volatility, which can result in substantial gains for traders who time their investments correctly."

“這會產生病毒效應,導致價格快速上漲。許多投資者被快速、高回報的潛力所吸引。Memecoin 以其波動性而聞名,這可以為正確投資時機的交易者帶來可觀的收益。”

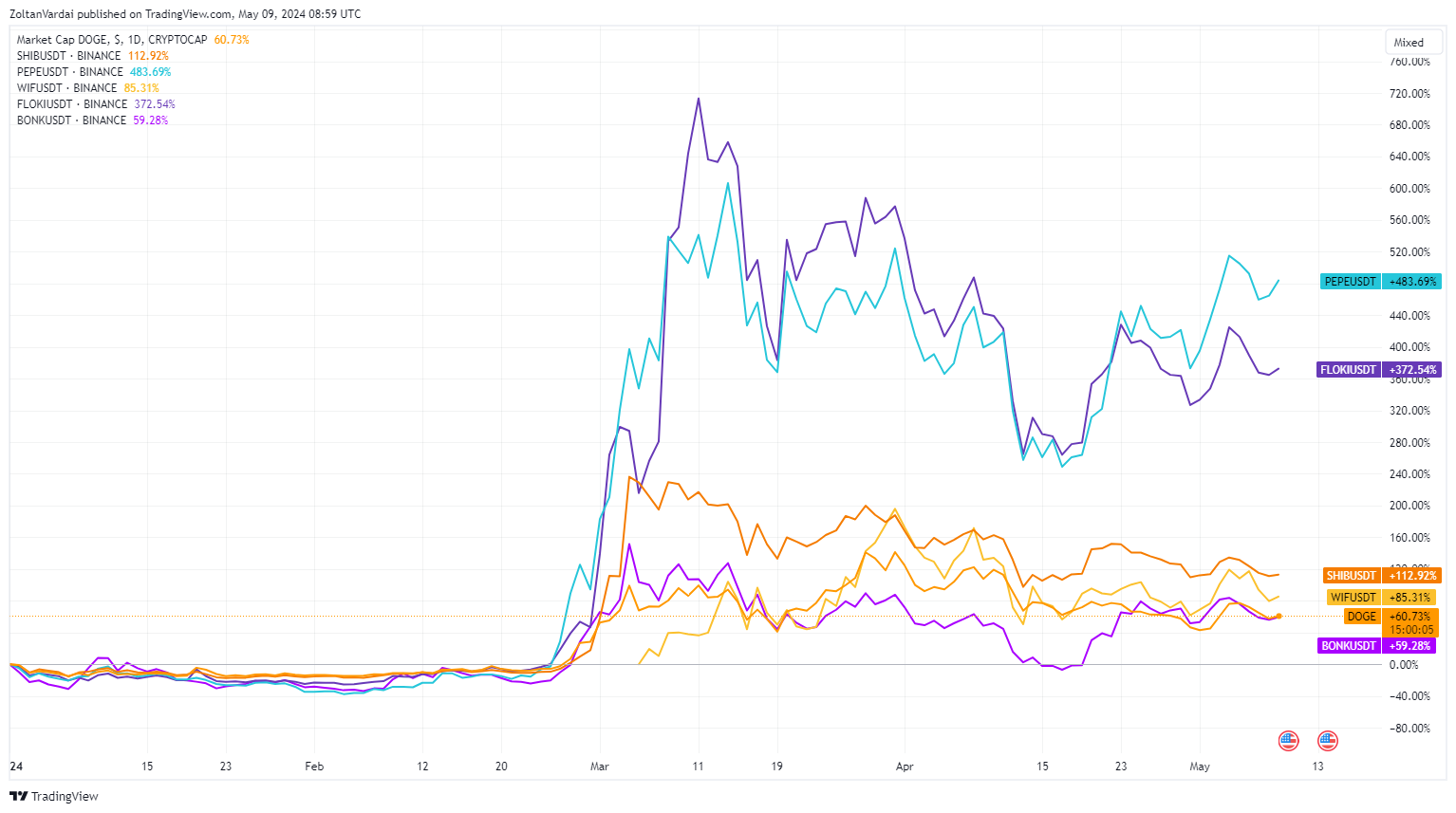

Examining the memecoin fund's individual components, Pepe has been the biggest gainer, rising 482% YTD, followed by Floki with a 372% increase and Shiba Inu with a 112% YTD gain, taking the third spot. Bonk has been the weakest performer, rising over 59% YTD, but still outperforming the S&P 500 by over sixfold.

從 memecoin 基金的各個組成部分來看,Pepe 漲幅最大,年初至今上漲 482%,其次是 Floki,今年迄今上漲 372%,Shiba Inu 年初至今上漲 112%,排名第三。 Bonk 是表現最差的股票,年初至今上漲了 59% 以上,但仍比標準普爾 500 指數高出六倍多。

Top 6 Memecoins, YTD, Source: TradingView

年初至今 6 大 Memecoin,來源:TradingView

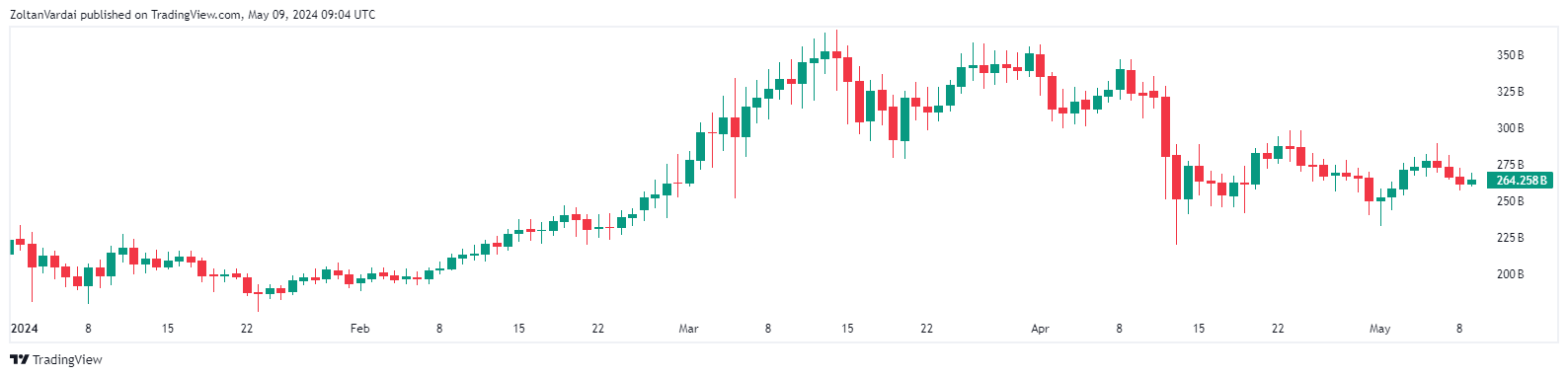

Memecoins often provide exponential returns, even compared to some of the leading cryptocurrencies. In comparison to the memecoin index's 137% appreciation, the top altcoins excluding the 10 largest cryptocurrencies have only seen their market cap increase by 24% YTD.

即使與一些領先的加密貨幣相比,Memecoin 通常也會提供指數回報。與 memecoin 指數 137% 的升值相比,除 10 種最大的加密貨幣外,頂級山寨幣的市值今年迄今僅增長了 24%。

Altcoin market cap excluding top 10. Source: TradingView

山寨幣市值不包括前 10 名。

Top altcoins experience weekly sell-off

頂級山寨幣每周遭遇拋售

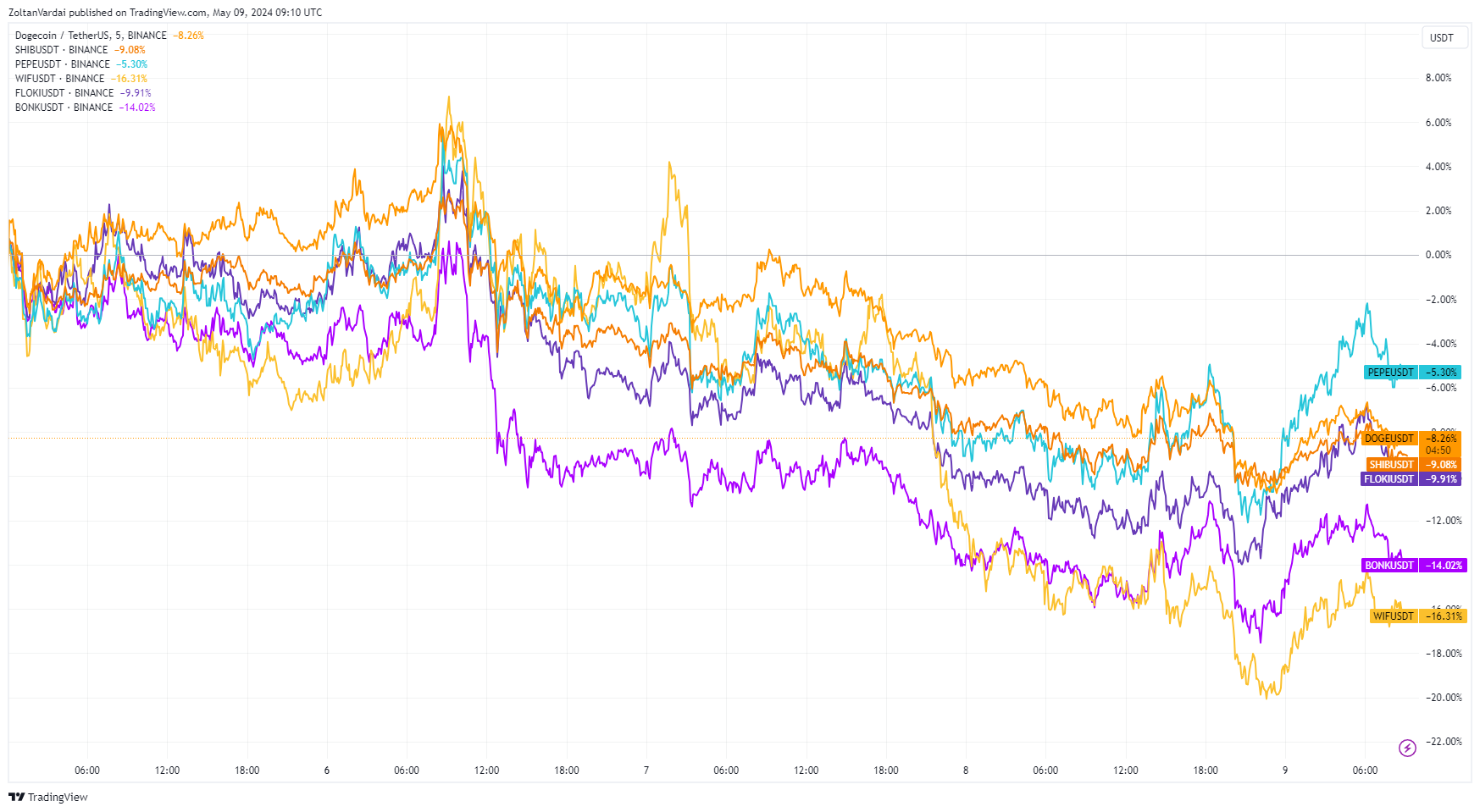

Despite the profitable yearly returns, the six largest memecoins have experienced a sell-off this week, raising concerns about a potential end to the memecoin season. Over the past five days, Dogwifhat has fallen over 15% as the biggest loser, while Pepe has declined by over 5% - the smallest decline among the top memecoins.

儘管年度回報豐厚,但六種最大的模因幣本週經歷了拋售,引發了人們對模因幣季節可能結束的擔憂。在過去五天裡,Dogwifhat 下跌超過 15%,成為最大跌幅,而 Pepe 下跌超過 5%,是頂級 memecoin 中跌幅最小的。

Top Memecoins, 5-day chart. Source: TradingView

頂級 Memecoin,5 天圖表。來源:TradingView

As memecoins lack inherent utility, it is challenging for traders and technical analysts to predict their price action, which is primarily driven by social media hype cycles for each memecoin.

由於模因幣缺乏固有的實用性,交易者和技術分析師很難預測其價格走勢,這主要是由每種模因幣的社交媒體炒作週期所驅動的。

Trading volume is often used to gauge sentiment around memecoins. Weekly memecoin trading volume has been declining since early March across all blockchains, as reported by Cointelegraph.

交易量通常用於衡量模因幣的情緒。根據 Cointelegraph 報導,自 3 月初以來,所有區塊鏈的每週 memecoin 交易量一直在下降。

Related: Trader loses 7-figure sum due to 0L Network hard fork

相關:由於 0L 網路硬分叉,交易者損失了 7 位數

DogeHome

DogeHome BlockchainReporter

BlockchainReporter Cryptopolitan_News

Cryptopolitan_News U_Today

U_Today crypto.news

crypto.news DogeHome

DogeHome crypto.news

crypto.news Crypto News Land

Crypto News Land