Volatility rocked crypto markets less than two days before Bitcoin’s halving, with the asset bouncing between $61,000 and $64,000.

在比特币减半前不到两天,波动性震撼了加密货币市场,资产价格在 61,000 美元至 64,000 美元之间波动。

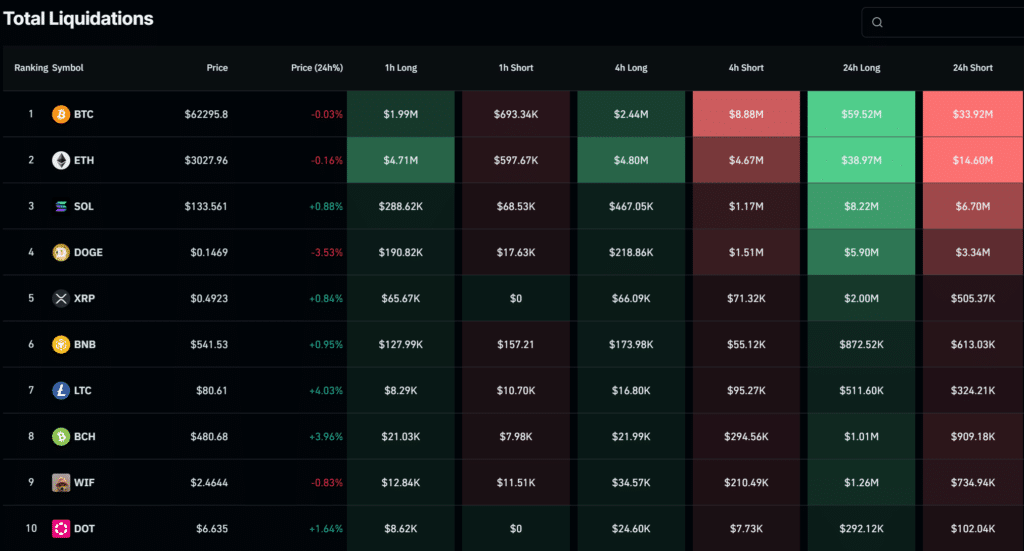

According to CoinGlass, this market fluctuation triggered more liquidations in Bitcoin (BTC) positions and across the broader digital asset ecosystem. Long BTC positions suffered the biggest hit on April 18 due to the token’s brief drop under $62,000.

据 CoinGlass 称,这种市场波动引发了比特币(BTC)头寸和更广泛的数字资产生态系统的更多清算。由于 BTC 短暂跌破 62,000 美元,4 月 18 日,BTC 多头头寸遭受最大打击。

Traders betting on higher Bitcoin prices logged over $57 million in liquidations across several trading venues. Short positions, investors predicting price declines, lost north of $36 million in 24 hours.

押注比特币价格上涨的交易员在多个交易场所的清算金额超过 5700 万美元。投资者预测价格下跌,空头头寸在 24 小时内损失了 3600 万美元以上。

Data also ranked a $5.3 million BTC/USDT pair trader on crypto exchange OKX as the single-larget liquidation order at press time, as more than 74,571 traders saw positions wiped out from the market.

截至发稿时,数据还将加密货币交易所 OKX 上的 530 万美元 BTC/USDT 货币对交易者列为单笔最大清算订单,超过 74,571 名交易者的头寸从市场上消失。

Ethereum (ETH), the second-largest cryptocurrency, trailed BTC with over $53 million in liquidations comprised of long and short traders. Major altcoin Solana (SOL) boasted considerably less at $14 million, followed by veteran meme token Dogecoin (DOGE) with around $9 million.

第二大加密货币以太坊 (ETH) 的多头和空头交易者清算额超过 5300 万美元,落后于 BTC。主要山寨币 Solana (SOL) 的价格要低得多,为 1400 万美元,其次是老牌模因代币 Dogecoin (DOGE),价格约为 900 万美元。

You might also like: The winners and losers from Bitcoin’s halving

您可能还喜欢:比特币减半的赢家和输家

Bitcoin pre-halving swings

比特币减半前的波动

Bitcoin’s corrections and subsequent price swings seem to have initiated a market cooldown after racing to a new all-time high last month and buoying the entire crypto market near its 2021 peak.

比特币上个月创下历史新高并提振整个加密货币市场接近 2021 年峰值后,其调整和随后的价格波动似乎引发了市场降温。

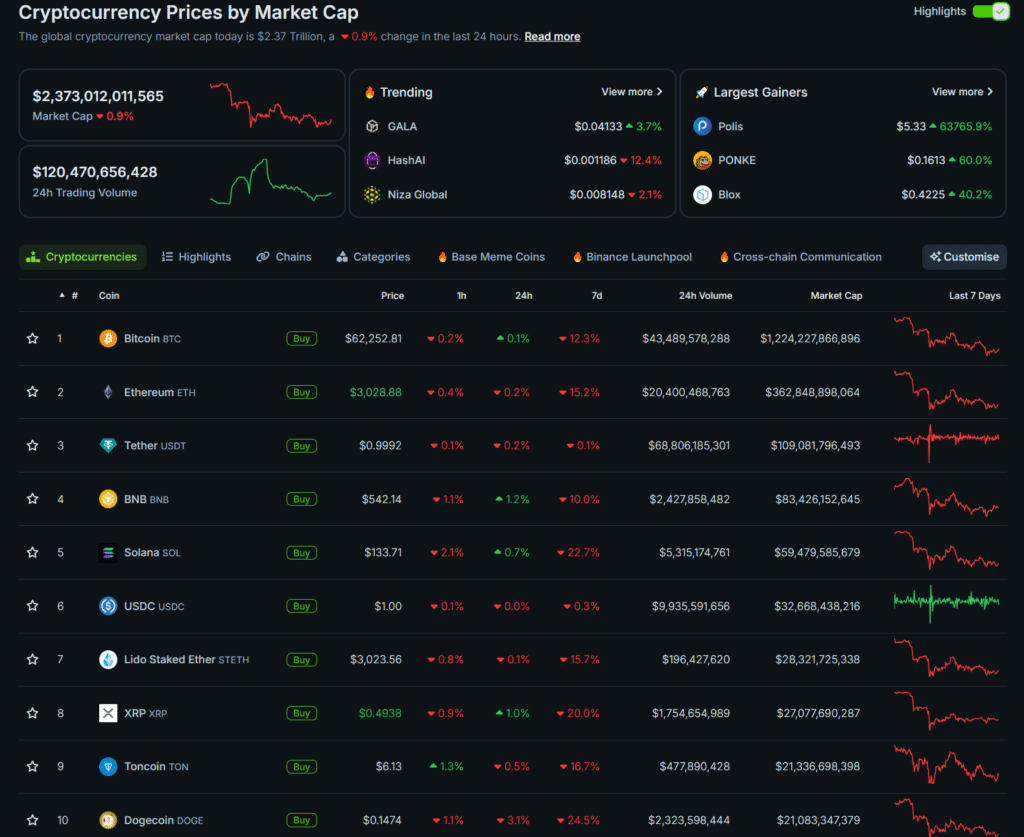

As of writing, the total crypto market traded flat, down 0.9% at a $2.3 trillion valuation per CoinGecko. The sector surpassed $3 trillion during the previous bull run and came close to this height following BTC’s boom earlier this year.

截至撰写本文时,整个加密货币市场交易持平,下跌 0.9%,CoinGecko 估值为 2.3 万亿美元。在上一次牛市期间,该行业的价值超过了 3 万亿美元,并在今年早些时候 BTC 繁荣后接近这一高度。

However, pre-halving volatility is not a novel pattern in crypto, and markets historically retrace up to 50% before BTC automatically deploys its code change. As the name suggests, the halving will cut block reward by half, potentially stifling mining companies’ revenue.

然而,减半前的波动性在加密货币中并不是一种新颖的模式,历史上,在 BTC 自动部署其代码更改之前,市场会回撤高达 50%。顾名思义,减半将使区块奖励减少一半,可能会抑制矿业公司的收入。

As a cautionary measure, miners reportedly turned on more machines before the halving to extract as much value as possible from the blockchain and stockpile cash reserves to cushion operational costs.

据报道,作为一项谨慎措施,矿商在减半之前开启了更多机器,以从区块链中提取尽可能多的价值,并储备现金储备以缓冲运营成本。

Read more: Bitcoin mining difficulty marks new high before halving

阅读更多:比特币挖矿难度在减半前创下新高

Optimisus

Optimisus Optimisus

Optimisus BlockchainReporter

BlockchainReporter BlockchainReporter

BlockchainReporter DogeHome

DogeHome Optimisus

Optimisus Optimisus

Optimisus Optimisus

Optimisus Thecryptoupdates

Thecryptoupdates