The cryptocurrency market has seen immense growth and adoption over the past few years. With over 10,000 cryptocurrencies in existence today, it can be challenging to make sense of the market landscape and identify promising investment opportunities.

过去几年,加密货币市场出现了巨大的增长和采用。目前存在超过 10,000 种加密货币,了解市场格局并识别有前景的投资机会可能具有挑战性。

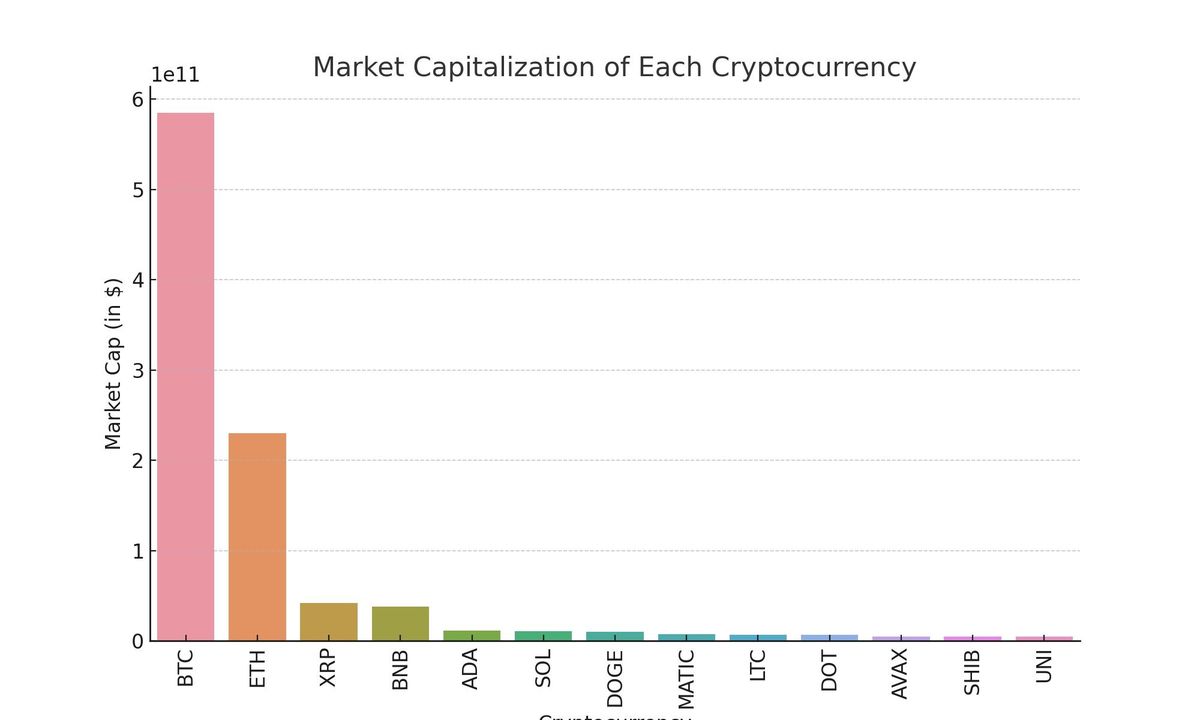

In this extensive technical analysis, we will delve into the key data points of 10 major cryptocurrencies: Bitcoin (BTC), Ethereum (ETH), XRP, Binance Coin (BNB), Cardano (ADA), Solana (SOL), Dogecoin (DOGE), Polygon (MATIC), Litecoin (LTC), and Polkadot (DOT).

在这篇广泛的技术分析中,我们将深入研究 10 种主要加密货币的关键数据点:比特币 (BTC)、以太坊 (ETH)、XRP、币安币 (BNB)、卡尔达诺 (ADA)、Solana (SOL)、狗狗币 (DOGE) )、Polygon (MATIC)、莱特币 (LTC) 和 Polkadot (DOT)。

By closely examining their price statistics, volatility, market dominance, all-time highs and lows, we aim to decipher the numbers and uncover insights into the potential value of each crypto asset.

通过仔细检查其价格统计数据、波动性、市场主导地位、历史高点和低点,我们的目标是破译这些数字并揭示每种加密资产的潜在价值。

Join us in showcasing the cryptocurrency revolution, one newsletter at a time. Subscribe now to get daily news and market updates right to your inbox, along with our millions of other subscribers (that’s right, millions love us!) — what are you waiting for?

Scrutinizing the Metrics of the Top Cryptocurrency, Bitcoin

订阅与我们一起展示加密货币革命,一次一份时事通讯。立即订阅,将每日新闻和市场更新直接发送到您的收件箱,以及我们数百万其他订阅者(没错,数以百万计的人爱我们!) - 您还在等什么?仔细研究顶级加密货币比特币的指标

As the first and largest cryptocurrency, Bitcoin dominates the market in many respects. With a current price hovering around $30,100, Bitcoin has a gargantuan market capitalization of nearly $585 billion. This gives it a 46.7% market dominance, meaning nearly half the total crypto market value is tied to Bitcoin.

作为第一个也是最大的加密货币,比特币在许多方面占据着市场主导地位。目前比特币价格徘徊在 30,100 美元左右,其市值接近 5850 亿美元。这使其占据了 46.7% 的市场主导地位,这意味着近一半的加密市场总价值与比特币相关。

Despite its market leader position, Bitcoin has struggled to regain the astronomical highs of November 2021 when prices peaked at $69,000. As of July 2022, Bitcoin remains down 56% from its all-time high. However, zooming out on the long-term chart reveals Bitcoin has seen jaw-dropping growth of over 44,000% from its early years.

尽管比特币处于市场领导者地位,但它仍难以重拾 2021 年 11 月价格达到 69,000 美元峰值的天文高点。截至 2022 年 7 月,比特币仍较历史高点下跌 56%。然而,缩小长期图表显示,比特币较早年增长了 44,000% 以上,令人瞠目结舌。

In terms of trading volume, Bitcoin sees significant activity totaling over $12 billion in daily volume. However, compared to its market cap, Bitcoin's volume to market cap ratio sits at just 0.0193, pointing to comparatively low liquidity.

就交易量而言,比特币的日交易量总计超过 120 亿美元。然而,与其市值相比,比特币的成交量与市值之比仅为 0.0193,表明其流动性相对较低。

Over the past month, Bitcoin has seen a respectable rally of 14%. However, its performance over the past quarter has been lackluster, with 30-day and 90-day returns of just 14% and 37.3% respectively. This points to slowing momentum and waning investor interest.

过去一个月,比特币上涨了 14%。然而,其过去一个季度的表现却乏善可陈,30天和90天回报率分别仅为14%和37.3%。这表明势头放缓,投资者兴趣减弱。

Overall, while Bitcoin remains the crypto leader, its muted price action signals it may be losing steam. As investors seek higher returns, they could rotate holdings into alternative cryptocurrencies.

总体而言,虽然比特币仍然是加密货币的领导者,但其温和的价格走势表明它可能正在失去动力。随着投资者寻求更高的回报,他们可以将持有的资产转向其他加密货币。

Ethereum Flashes Strength with Solid Returns

以太坊闪耀实力并带来丰厚回报

As the second largest cryptocurrency, Ethereum has firmly established itself as a leading blockchain protocol for decentralized apps and NFTs. With a market cap exceeding $229 billion, Ethereum dominates nearly 20% of the crypto market value.

作为第二大加密货币,以太坊已牢牢确立了自己作为去中心化应用程序和 NFT 领先区块链协议的地位。以太坊市值超过 2290 亿美元,占据加密货币市场近 20% 的份额。

Despite suffering major losses of 60% from its all-time high, Ethereum has delivered consistent positive returns across short and mid-term timeframes. Over the past month, Ethereum has surged 11.1% compared to Bitcoin’s 14% gain. The mid-term picture looks brighter still, with 3-month and 1-year returns of 25.7% and 37.3% respectively.

尽管以太坊较历史高点遭受了 60% 的重大损失,但在短期和中期时间范围内仍实现了持续的正回报。过去一个月,以太坊飙升 11.1%,而比特币则上涨 14%。中期前景看起来更加光明,3 个月和 1 年回报率分别为 25.7% 和 37.3%。

Ethereum’s trading volume comes in at a healthy $9.8 billion. However, its volume to market cap ratio stands at just 0.0428, indicating relatively thin liquidity similar to Bitcoin.

以太坊的交易量达到 98 亿美元。然而,其成交量与市值之比仅为 0.0428,表明与比特币类似的流动性相对较弱。

Overall, Ethereum's strong multi-month returns and dominance in decentralized finance paint an optimistic picture of its investment potential. As blockchain adoption accelerates, Ethereum looks poised to capitalize on its first-mover advantage in smart contract capabilities.

总体而言,以太坊强劲的多月回报和在去中心化金融领域的主导地位描绘了对其投资潜力的乐观前景。随着区块链采用的加速,以太坊似乎准备利用其在智能合约功能方面的先发优势。

Surging XRP Attempts to Reclaim Former Glory

飙升的 XRP 试图重拾昔日辉煌

The XRP token from the Ripple ecosystem suffered heavy losses after reaching peak prices above $3 in early 2018. However, after bottoming out below 30 cents in July 2022, XRP has undergone a dazzling rally of over 60% in the past two weeks. This momentum surge has propelled XRP’s returns over the past 30 days to a staggering 62.5%.

来自 Ripple 生态系统的 XRP 代币在 2018 年初价格达到 3 美元以上的峰值后遭受重创。然而,在 2022 年 7 月触底至 30 美分以下后,XRP 在过去两周内经历了超过 60% 的耀眼涨幅。这种势头的飙升推动 XRP 在过去 30 天的回报率达到惊人的 62.5%。

With strong volume surpassing $2.8 billion daily, XRP liquidity appears high. Its volume to market cap ratio stands at a healthy 0.0682. This implies strong trading interest behind the recent XRP price uptrend.

由于每日交易量超过 28 亿美元,XRP 的流动性似乎很高。其成交量与市值之比保持在 0.0682 的健康水平。这意味着近期 XRP 价格上涨趋势背后有强劲的交易兴趣。

While XRP maintains a solid market cap of $42 billion, its share of the total crypto market cap comes in at just 3.4%. Thus, despite being a top 10 cryptocurrency, XRP is dwarfed by the likes of Bitcoin and Ethereum in terms of influence and dominance.

尽管 XRP 保持着 420 亿美元的稳定市值,但其在加密货币总市值中的份额仅为 3.4%。因此,尽管 XRP 是排名前 10 位的加密货币,但其影响力和主导地位与比特币和以太坊等加密货币相比还是相形见绌。

After being pummeled from all-time highs above $3, XRP trades at heavy discounts to past peaks. Its current price around $0.80 marks a discount of 76% from highs. This indicates traders see considerable unrealized upside potential if XRP can revisit past highs.

在从 3 美元以上的历史高点遭受重创后,XRP 的交易价格较过去的峰值大幅折扣。目前其价格约为 0.80 美元,较高点折价 76%。这表明,如果 XRP 能够重新回到过去的高点,交易者就会看到巨大的未实现的上涨潜力。

Binance Coin Stable but Lacking Impetus

币安币稳定但缺乏动力

As the native token of the Binance cryptocurrency exchange, Binance Coin (BNB) plays a pivotal role in cheaply settling trades on the platform. However, despite its utility value and ninth-ranked market cap of $38 billion, BNB has struggled to gain upward momentum.

作为币安加密货币交易所的原生代币,币安币(BNB)在平台上廉价的交易结算中发挥着关键作用。然而,尽管 BNB 具有实用价值且市值排名第九,达到 380 亿美元,但它仍难以获得上涨动力。

Over the past month, BNB scraped out a lackluster 0.5% gain. And across the past three months, BNB remains stuck in a rut with negligible price movement. Failing to participate in broader market rallies, BNB's year-to-date returns sit at -6.1%.

过去一个月,BNB 勉强上涨了 0.5%。在过去的三个月里,BNB 仍然停滞不前,价格波动微乎其微。由于未能参与更广泛的市场反弹,BNB 年初至今的回报率为-6.1%。

With lackluster trading activity compared to market cap, BNB suffers from weaker liquidity metrics. Its volume to market cap ratio resides at just 0.0238, which could explain its tighter price ranges.

与市值相比,交易活动乏善可陈,BNB 的流动性指标也较弱。其成交量与市值之比仅为 0.0238,这可以解释其价格区间收窄的原因。

Unless Binance Coin can find renewed trading interest and break out of its ranging behavior, its price outlook appears muted. However, as the crucial native asset of the world’s largest cryptocurrency exchange, BNB cannot be discounted over the long-run.

除非币安币能够找到新的交易兴趣并突破区间波动行为,否则其价格前景似乎黯淡。然而,BNB作为全球最大加密货币交易所的重要原生资产,长期来看不能打折扣。

Cardano Builds Momentum after Capitulation

卡尔达诺在投降后积聚动力

The native ADA token of the Cardano blockchain has suffered brutal declines over the past year, with losses near 90% from all-time highs. However, after capitulating to around 30 cents in June, ADA appears to have posted a durable bottom.

卡尔达诺区块链的原生 ADA 代币在过去一年中遭受了残酷的下跌,较历史最高点损失了近 90%。然而,在 6 月份跌至 30 美分左右之后,ADA 似乎已经形成了持久的底部。

With a parabolic surge of 22% over the past month, ADA now trades around $0.32 - nearly double its June lows. Zooming out further, ADA has gained 9% and 23% over the past 14 days and 30 days respectively. With accelerating momentum, ADA could have legs for further upside, likely aided by its decent liquidity profile.

ADA 过去一个月抛物线飙升 22%,目前交易价格约为 0.32 美元,几乎是 6 月低点的两倍。进一步缩小范围,ADA 在过去 14 天和 30 天分别上涨了 9% 和 23%。随着势头加速,ADA 可能会进一步上涨,这可能得益于其良好的流动性状况。

With a volume to market cap ratio of 0.0282, ADA sees stronger trading activity relative to market cap compared to alternatives like BNB. If buying interest continues climbing, ADA could attempt to revisit the $1.00 level and recoup some of its crushing losses from the past year.

ADA 的成交量与市值之比为 0.0282,与 BNB 等替代品相比,相对于市值而言,ADA 的交易活动更为强劲。如果购买兴趣继续攀升,ADA 可能会尝试重新回到 1.00 美元的水平,并弥补去年的部分惨重损失。

Solana Regains its Footing above $25

Solana 重新站稳 25 美元上方

Solana (SOL) has endured a catastrophic collapse over the past 8 months, plummeting 90% from a peak of $260 last November. The devastation in SOL price reflects loss of investor confidence in the network after suffering extended outages and reliability issues.

Solana (SOL) 在过去 8 个月里经历了灾难性的崩溃,从去年 11 月的峰值 260 美元暴跌了 90%。 SOL 价格的大幅下跌反映出投资者在遭受长期停电和可靠性问题后对网络信心的丧失。

However, after finding a bottom around $21 in June, Solana has regained its footing above the $25 level. The cryptocurrency gained 20% over the past week, powered by strong momentum. In the past month alone, SOL has surged 71% off its lows.

然而,在 6 月份触底 21 美元附近后,Solana 又重新站稳了 25 美元上方。在强劲势头的推动下,加密货币在过去一周上涨了 20%。仅在过去一个月,SOL 就已较低点飙升 71%。

With volumes exceeding $700 million and a healthy volume to market cap ratio of 0.0678, Solana sports decent liquidity metrics. As developers continue building decentralized apps on Solana, the network activity could help resuscitate Solana prices. The deep discounts from all-time highs offer speculative upside potential.

Solana 的交易量超过 7 亿美元,交易量与市值之比为 0.0678,具有良好的流动性指标。随着开发人员继续在 Solana 上构建去中心化应用程序,网络活动可能有助于恢复 Solana 价格。与历史高点相比的大幅折扣提供了投机性上行潜力。

Dogecoin Consolidates After Speculative Mania

狗狗币在投机狂热后巩固

Dogecoin captured investor spotlight in 2021 after skyrocketing over 15,000% on pure speculative mania. However, the hyper-volatile rally was unsustainable. After peaking at $0.73 in May 2021, DOGE has bled out over 90% to current levels around $0.07.

狗狗币在 2021 年因纯粹的投机狂热而飙升超过 15,000% 后,引起了投资者的关注。然而,极度波动的反弹是不可持续的。在 2021 年 5 月达到 0.73 美元的峰值后,DOGE 已下跌超过 90%,目前水平约为 0.07 美元。

With Dogecoin trading firmly below its 2021 highs, the highly-speculative rally appears to have largely unwound. In recent months, Dogecoin has traded range-bound between $0.06 and $0.08, lacking a clear directional bias.

由于狗狗币的交易价格远低于 2021 年的高点,高度投机性的涨势似乎已基本平息。近几个月来,狗狗币的交易价格在 0.06 美元至 0.08 美元之间波动,缺乏明确的方向性偏差。

Compared to the glittery promises of Dogecoin proponents last year, its price action has proven rather unremarkable recently. Unless DOGE can recapture investor imagination and break out of its ranges, significant volatility or price spikes seem unlikely.

与去年狗狗币支持者的光鲜亮丽的承诺相比,最近它的价格走势却显得平淡无奇。除非 DOGE 能够重新吸引投资者的想象力并突破其区间,否则大幅波动或价格飙升似乎不太可能。

Still, with the power of memes, anything is possible in crypto. Dogecoin cannot be ruled out as a potential speculative rocket ship if mass interest reignites.

尽管如此,凭借模因的力量,加密货币中一切皆有可能。如果大众兴趣重新燃起,狗狗币就不能被排除为潜在的投机火箭飞船。

Polygon Exhibits Strength after Deep Correction

多边形在深度修正后展现力量

As a scaling solution for Ethereum, Polygon (MATIC) enjoys bullish fundamentals with Ethereum ecosystem activity expanding rapidly. However, MATIC tokens faced immense pressure over the past 7 months alongside the broader crypto downturn.

作为以太坊的扩容解决方案,Polygon (MATIC) 的基本面看涨,以太坊生态系统活动迅速扩张。然而,在过去 7 个月里,随着更广泛的加密货币低迷,MATIC 代币面临着巨大的压力。

After peaking near $3 in late 2021, MATIC plunged as low as $0.71 in June 2022 - a gut-wrenching decline of 75% from highs. However, MATIC has since rallied sharply after finding its bottom. Over the past month, MATIC has surged 26% as the crypto market regained its footing.

在 2021 年底达到接近 3 美元的峰值后,MATIC 在 2022 年 6 月跌至 0.71 美元,较高点下跌了 75%。然而,MATIC 在触底后大幅反弹。过去一个月,随着加密货币市场重新站稳脚跟,MATIC 飙升了 26%。

With a reasonably strong liquidity profile, MATIC appears well-positioned to capitalize on renewed investor appetite for risk. As Layer-2 scaling solutions grab attention amidst Ethereum's high fees, MATIC could target a retest of $1.00 resistance. Its current price around $0.75 offers attractive potential upside.

凭借相当强劲的流动性,MATIC 似乎处于有利地位,可以利用投资者新的风险偏好。随着 Layer-2 扩容解决方案在以太坊的高额费用中引起关注,MATIC 可能会重新测试 1.00 美元的阻力位。目前其价格约为 0.75 美元,具有诱人的潜在上涨空间。

Litecoin Rebound Gains Steam

莱特币反弹势头增强

Litecoin has cemented itself as one of the most popular and recognized cryptocurrency alternatives to Bitcoin. However, LTC has faced no shortage of volatility over its history. After peaking at a record $410 in May 2021, Litecoin collapsed along with the broader crypto sphere to below $100.

莱特币已经巩固了自己作为比特币最受欢迎和最受认可的加密货币替代品之一的地位。然而,LTC 在其历史上并不缺乏波动性。在 2021 年 5 月达到创纪录的 410 美元峰值后,莱特币与更广泛的加密货币领域一起暴跌至 100 美元以下。

However, Litecoin now appears to be back on the recovery trail. With a sizable 21% gain over the past month, Litecoin is building notable upside momentum. If the rally continues, Litecoin could retest overhead resistance around the $150 mark. With strong on-chain activity and liquidity, LTC has fuel in the tank for extended gains.

然而,莱特币现在似乎又回到了复苏之路。莱特币在过去一个月上涨了 21%,正在形成显着的上涨势头。如果反弹继续下去,莱特币可能会重新测试 150 美元关口附近的上方阻力位。凭借强劲的链上活动和流动性,LTC 拥有扩大收益的动力。

Still down over 75% from its all-time high, Litecoin has enormous room for appreciation if it can revisit last year's peaks. With strong utility value for fast and cheap transactions, Litecoin appears underpriced at current levels around $94.

莱特币仍较历史高点下跌超过 75%,如果能重回去年的峰值,则还有巨大的升值空间。由于快速且廉价的交易具有强大的实用价值,莱特币目前的价格似乎被低估在 94 美元左右。

Polkadot Trades Range-Bound but Promising Platform Potential

Polkadot 交易范围有限,但平台潜力巨大

As a novel multichain network protocol, Polkadot (DOT) offers an intriguing vision for a unified decentralized web. However, over the past 8 months, DOT has failed to gain traction amidst the crypto rout. After topping out at $55 in November 2021, DOT has plunged over 90%.

作为一种新颖的多链网络协议,Polkadot(DOT)为统一的去中心化网络提供了一个有趣的愿景。然而,在过去 8 个月里,DOT 未能在加密货币溃败中获得牵引力。在 2021 年 11 月达到 55 美元的最高点后,DOT 已暴跌超过 90%。

Despite a sharp 15% rally over the past month, DOT remains stuck trading in a range between $5 and $6. Unless DOT can thrust higher and break out of its trading range, significant near-term upside appears limited.

尽管过去一个月大幅上涨 15%,但 DOT 仍徘徊在 5 美元至 6 美元之间的区间内交易。除非 DOT 能够走高并突破其交易区间,否则近期的大幅上涨空间似乎有限。

However, with Polkadot’s thesis around interconnected blockchains gaining attention, the project seems well-positioned for long-term adoption. As developers build parachains on Polkadot, real-world usage could strengthen the fundamental investment case for DOT tokens.

然而,随着 Polkadot 关于互连区块链的论文受到关注,该项目似乎已经做好了长期采用的准备。随着开发人员在 Polkadot 上构建平行链,现实世界的使用可以加强 DOT 代币的基本投资案例。

Avalanche Attempts to Carve Out Support

雪崩试图争取支持

As a speedy smart contracts platform, Avalanche (AVAX) looked highly promising in late 2021 on the back of its blazing 3-second transaction finality. Investor enthusiasm catapulted AVAX to a record high of $145 in November 2021. However, the price action quickly soured, with AVAX entering a vicious bear market.

作为一个快速的智能合约平台,Avalanche (AVAX) 凭借其惊人的 3 秒交易终结性,在 2021 年底看起来非常有前途。投资者的热情使 AVAX 在 2021 年 11 月创下了 145 美元的历史新高。然而,价格走势很快就恶化了,AVAX 进入了恶性熊市。

Over the past 8 months, Avalanche has shed over 90% of its value. However, since bottoming out around $13 in June, the cryptocurrency has shown signs of basing and recovering. AVAX has surged 24% in the past 30 days as bullish momentum returns.

过去 8 个月,Avalanche 的价值缩水了 90% 以上。然而,自 6 月份触底 13 美元左右以来,加密货币已显示出筑底和复苏的迹象。随着看涨势头回归,AVAX 在过去 30 天内飙升了 24%。

With a decent liquidity profile, Avalanche appears well-positioned to continue regaining ground. Moreover, with extremely low fees and fast transaction speeds, the AVAX ecosystem could be poised for growth as developers build DeFi and Web3 applications.

凭借良好的流动性状况,雪崩似乎处于有利地位,可以继续收复失地。此外,凭借极低的费用和快速的交易速度,随着开发人员构建 DeFi 和 Web3 应用程序,AVAX 生态系统可能会不断增长。

After its parabolic rally and subsequent comedown, AVAX prices seem attractive for accumulation at current levels around $14. But with crypto sentiment still fragile, the road to recovery may prove bumpy.

在经历了抛物线式上涨和随后的下跌之后,AVAX 价格似乎对目前 14 美元左右的水平具有吸引力。但由于加密货币市场情绪仍然脆弱,复苏之路可能会崎岖不平。

Shiba Inu Consolidates After Astronomical Rally

柴犬在天价上涨后巩固

The Dogecoin spinoff, Shiba Inu (SHIB), captivated the crypto world in 2021 after delivering mind-blowing returns of over 75,000,000% in a year. However, the vertical price action was patently unsustainable. SHIB has since retraced 90% from its peak, now trading for a fraction of a penny.

狗狗币衍生品 Shiba Inu (SHIB) 在一年内实现了超过 75,000,000% 的令人惊叹的回报,并在 2021 年吸引了加密世界。然而,垂直价格走势显然是不可持续的。此后,SHIB 已从峰值回落 90%,目前交易价格仅为一美分。

In recent months, Shiba Inu has remained relatively calm, lacking any clear price trend. Range-bound action points to consolidation and a potential bottoming formation. However, with purely speculative appeal and no real utility, SHIB lacks catalysts to drive significant renewed upside.

近几个月来,柴犬表现相对平静,缺乏明显的价格走势。区间波动表明盘整和潜在的触底形态。然而,由于纯粹的投机吸引力且没有实际效用,SHIB缺乏推动大幅上涨的催化剂。

Barring another massive influx of retail traders, Shiba Inu prices seem likely to remain comparatively muted. The days of exponential 1,000% price spikes are likely behind. With most short-term speculators flushed out, those still holding seem inclined to hodl their SHIB tokens.

除非零售贸易商再次大量涌入,否则柴犬价格可能会保持相对平静。价格指数 1,000% 飙升的日子可能已经过去了。随着大多数短期投机者被淘汰,那些仍然持有的人似乎倾向于持有他们的 SHIB 代币。

Uniswap v3 Aims to Recapture Key Levels

Uniswap v3 旨在重新夺回关键水平

As the largest decentralized exchange in the crypto market, Uniswap and its UNI token play a pivotal role in automated crypto trading. However, UNI has plunged severely from its euphoric highs in early 2021 above $45.

作为加密货币市场最大的去中心化交易所,Uniswap 及其 UNI 代币在自动化加密货币交易中发挥着举足轻重的作用。然而,UNI 已从 2021 年初 45 美元以上的高点大幅下跌。

After bottoming out around $5.50 in June, Uniswap has rebounded sharply with a 34% gain over the past 30 days. This momentum could propel a retest of the $10 level if the rally continues. UNI appears to have recommitted buyers, which should support prices as long as broader crypto sentiment improves.

在 6 月份触底 5.50 美元左右后,Uniswap 大幅反弹,过去 30 天涨幅达 34%。如果反弹继续下去,这种势头可能会推动重新测试 10 美元水平。 UNI 似乎已经重新承诺了买家,只要更广泛的加密情绪改善,这应该会支撑价格。

With strong protocol usage and volumes, Uniswap seems fundamentally solid despite its 90% drawdown. As decentralized exchanges siphon activity from centralized counterparts, Uniswap looks positioned to capture significant growth in Web3 trading activity.

凭借强劲的协议使用率和交易量,尽管 Uniswap 缩水了 90%,但它似乎基本稳固。随着去中心化交易所从中心化交易所吸收活动,Uniswap 有望抓住 Web3 交易活动的显着增长。

Key Takeaways from The Analysis

分析的主要要点

- Bitcoin Dominates but Faces Slowing Momentum - Despite being synonymous with crypto, Bitcoin has lagged alternative cryptocurrencies in recent months. Its returns appear muted and investor interest is pivotin

- Ethereum Leads The Pack - With Ethereum dominating DeFi and NFT activity, its thriving ecosystem could propel its valuation higher as real-world utility continues growing.

- Solana and Cardano Poised To Recover - After facing extreme bearish pressure, Solana and Cardano seem oversold at current levels. Their strong capabilities and discounted prices offer upside potential.

- XRP and Litecoin Rally Picks Up Steam - After deep declines to multi-year lows, XRP and Litecoin appear to be bottoming out. Their impressive rebounds point to renewed bullishness.

- Polkadot and Avalanche Build Promising Ecosystems - Despite muted price action, Polkadot and Avalanche have built impressive decentralized web visions that could drive adoption.

- Meme Coins Consolidate After Mania Deflates - Dogecoin and Shiba Inu have stabilized after their massive rallies in 2021. Lacking catalysts, more subdued action likely lies ahead.

- Decentralized Exchanges Face Growth Potential - With their integral role in Web3, Uniswap and other DEXs seem primed to disrupt traditional exchanges in the years ahead.

比特币占据主导地位,但势头放缓——尽管比特币是加密货币的代名词,但近几个月来,比特币已经落后于其他加密货币。它的回报似乎很低,投资者的兴趣正在转向

以太坊领先——随着以太坊主导 DeFi 和 NFT 活动,随着现实世界效用的持续增长,其蓬勃发展的生态系统可能会推高其估值。

Solana 和 Cardano 准备复苏 - 在面临极端看跌压力后,Solana 和 Cardano 在目前的水平上似乎超卖。他们强大的能力和折扣价格提供了上升潜力。

XRP 和莱特币反弹势头强劲 - 在大幅下跌至多年低点后,XRP 和莱特币似乎正在触底反弹。他们令人印象深刻的反弹表明了新的看涨情绪。

Polkadot 和 Avalanche 构建了有前景的生态系统 - 尽管价格走势平淡,Polkadot 和 Avalanche 已经建立了令人印象深刻的去中心化网络愿景,可以推动采用。

Meme 币在狂热消退后整合——狗狗币和柴犬币在 2021 年大幅上涨后已趋于稳定。由于缺乏催化剂,未来的走势可能会更加温和。

去中心化交易所面临增长潜力——凭借其在 Web3 中不可或缺的作用,Uniswap 和其他 DEX 似乎准备在未来几年颠覆传统交易所。

Conclusion

结论

Has Bitcoin's Time Passed or Will It Reclaim Dominance?

比特币的时代已经过去还是会夺回主导地位?

While Bitcoin was the pioneering cryptocurrency, its first-mover advantage may be fading as investors embrace alternative networks with greater capabilities and speed. However, Bitcoin still maintains its digital gold narrative and role as a reserve store of value in crypto portfolios.

虽然比特币是开创性的加密货币,但随着投资者接受功能更强大、速度更快的替代网络,其先发优势可能正在减弱。然而,比特币仍然保持其数字黄金的叙述和作为加密货币投资组合中的储备价值存储的角色。

On one hand, Bitcoin’s muted price action signals fading leadership and momentum in the space. But on the other hand, its recognition and liquidity ensure it remains the gateway into cryptocurrency investing. Ultimately, Bitcoin will likely stay influential but see its dominance slowly diluted rather than completely collapsed.

一方面,比特币价格走势平淡表明该领域的领导地位和势头正在减弱。但另一方面,它的认可度和流动性确保它仍然是加密货币投资的门户。最终,比特币可能会保持影响力,但其主导地位会慢慢被稀释,而不是完全崩溃。

Are Centralized Exchanges at Risk of Disruption from Decentralized Rivals?

中心化交易所是否面临去中心化竞争对手干扰的风险?

The rise of decentralized exchanges like Uniswap offers greater security, transparency, and accessibility compared to centralized exchanges. With no central operator in control, decentralized exchanges align better with crypto ideals and Web3 philosophy.

与中心化交易所相比,Uniswap 等去中心化交易所的兴起提供了更高的安全性、透明度和可访问性。由于没有中央运营商控制,去中心化交易所更符合加密理想和 Web3 理念。

However, centralized exchanges like Binance still dominate trading volumes because they offer more coins, stability, and a more familiar user experience. While decentralized exchanges seem well-positioned for steady adoption, completely displacing incumbent centralized exchanges seems unlikely.

然而,像币安这样的中心化交易所仍然主导着交易量,因为它们提供更多的代币、稳定性和更熟悉的用户体验。虽然去中心化交易所似乎处于稳定采用的有利地位,但完全取代现有的中心化交易所似乎不太可能。

The cryptocurrency ecosystem will likely support both models serving different needs. But decentralized exchanges have room to continuously capture greater market share through organic Web3 growth in the coming years.

加密货币生态系统可能会支持满足不同需求的两种模型。但去中心化交易所有空间在未来几年通过 Web3 的有机增长来持续占领更大的市场份额。

crypto.news

crypto.news The Bit Journal

The Bit Journal Crypto Daily™

Crypto Daily™ DogeHome

DogeHome Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™ crypto.ro English

crypto.ro English Optimisus

Optimisus Crypto Daily™

Crypto Daily™