The memecoin frenzy has been the buzz of the crypto community this bull season. Pepe and WIF have surged into the top 20 cryptocurrencies by market capitalization within a year of their public launch.

模因币的狂热一直是这个牛市季节加密货币社区的热门话题。 Pepe 和 WIF 在公开发行后的一年内就跃升为市值排名前 20 的加密货币。

These memecoins have gained significant traction in the crypto leverage market, where traders either go short or long on their prices.

这些模因币在加密货币杠杆市场中获得了巨大的吸引力,交易者要么做空要么做多其价格。

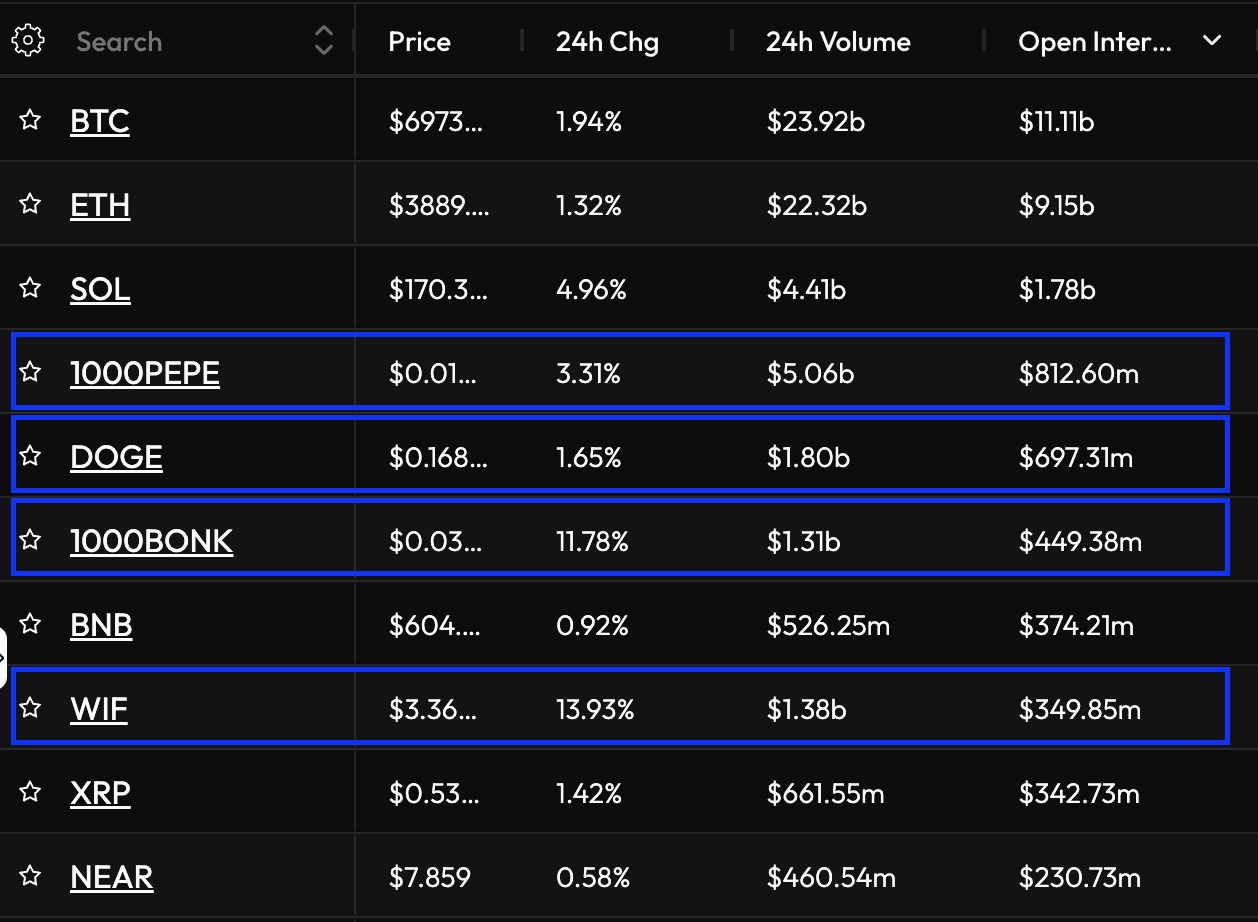

Four out of the top 10 cryptocurrencies by open interest (OI) are memecoins, with Pepe (PEPE) leading the charge with $812.6 million in OI and nearly half of Solana’s (SOL) $1.7 billion in OI.

按持仓量 (OI) 计算的前 10 名加密货币中,有 4 种是 memecoin,其中 Pepe (PEPE) 以 8.126 亿美元的 OI 领先,占 Solana (SOL) 17 亿美元 OI 的近一半。

Apart from Pepe, Dogecoin (DOGE), Bonk (BONK), and Dogwifhat (WIF) also made it to the top 10. Bitcoin (BTC) is leading the chart with $11.1 billion in OI, followed by Ethereum (ETH) with $9.15 billion.

除了 Pepe 之外,Dogecoin (DOGE)、Bonk (BONK) 和 Dogwifhat (WIF) 也进入了前十名。比特币 (BTC) 以 111 亿美元的 OI 领先,其次是以太坊 (ETH),为 91.5 亿美元。

Open interest chart. Source: CoinGlass

未平仓合约图表。来源:CoinGlass

Another thing to note is the significant difference in OI from top to bottom. Bitcoin's OI is $11 billion, while the tenth-placed Near Protocol (NEAR) has only $230 million in OI, indicating the major difference in traders’ interest.

另一个需要注意的是OI从上到下的显着差异。比特币的 OI 为 110 亿美元,而排名第十的近协议(NEAR)的 OI 仅为 2.3 亿美元,这表明交易者的兴趣存在重大差异。

The recent rise in OI for memecoins comes from its bullish momentum over the past couple of weeks when Pepe hit a new all-time high while WIF reached a new multi-week high above $3.30.

最近 Memecoin 的 OI 上涨源于过去几周的看涨势头,当时 Pepe 创下了历史新高,而 WIF 则创下了 3.30 美元以上的多周新高。

Open Interest refers to the total amount of pending derivative contracts that have not yet been settled. In a futures contract, for every seller, a buyer is required to settle the contract.

未平仓合约是指尚未结算的未决衍生品合约总额。在期货合约中,对于每个卖方,买方都需要结算合约。

A contract is deemed “open” from the moment it is opened by the buyer or seller until it is closed by the counterparty. OI increases when new contracts are added and decreases when contracts are settled. In contrast to the trading volume, OI is continuous data.

合同从买方或卖方打开合同之日起直至交易对手关闭合同为止,均被视为“未平仓”。当新合同增加时,持仓量增加;当合同结算时,持仓量减少。与交易量相反,持仓量是连续数据。

Related: 3 tips for protecting Bitcoin profits amid Ethereum ETF mania

相关:在以太坊 ETF 狂热中保护比特币利润的 3 个技巧

A growing OI indicates bullish momentum in the market as leverage traders open more contracts in anticipation of price momentum.

持仓量不断增长表明市场看涨势头,杠杆交易者因预期价格走势而开立更多合约。

Despite the surge in the prices of memecoins and the rise in OI, the funding rates remained negative for the memecoins across crypto exchanges.

尽管 memecoin 的价格飙升且 OI 上升,但整个加密货币交易所的 memecoin 的融资利率仍然为负。

Funding rates represent the cost of holding a position in a perpetual swap or futures contract relative to the asset’s spot price. Positive funding rates indicate a bullish market sentiment while a negative funding rate indicates a bearish sentiment.

资金费率代表相对于资产现货价格持有永续掉期或期货合约头寸的成本。正的资金利率表明看涨的市场情绪,而负的资金利率则表明看跌的市场情绪。

Magazine: Blockchain detectives: Mt. Gox collapse saw birth of Chainalysis

杂志:区块链侦探:Mt. Gox 崩溃见证了 Chainaanalysis 的诞生

Optimisus

Optimisus BH NEWS

BH NEWS The Blockopedia

The Blockopedia COINTURK NEWS

COINTURK NEWS Crypto News Land

Crypto News Land DogeHome

DogeHome Coincu

Coincu Coin Edition

Coin Edition