Dogecoin's Monthly Chart Shows a Recurring Pattern

On a monthly timeframe, Dogecoin is exhibiting recurring patterns near previous cycle highs. Price movements during the 2017 breakout mirrored a similar pattern, forming rounded bases before surpassing resistance levels. This pattern is repeating; Dogecoin has formed multiple rounded bottoms and experienced resistance rejection. A breakout above resistance could mirror the 2017 surge. The 2017 breakout included periods of consolidation and rapid price growth. Confirmation of a breakout above the red resistance line could trigger price discovery and a potential return to previous highs.

DOGE/USD monthly chart | Source: X

However, this pattern also suggests the possibility of extended sideways movement or further resistance unless past conditions are replicated. The resistance area poses a significant barrier, potentially leading to renewed support testing before another breakout attempt. Accumulation behavior observed just before resistance became insurmountable might invalidate the breakout prediction. A decisive break with strong momentum will confirm a rally; otherwise, extended sideways trading is likely.

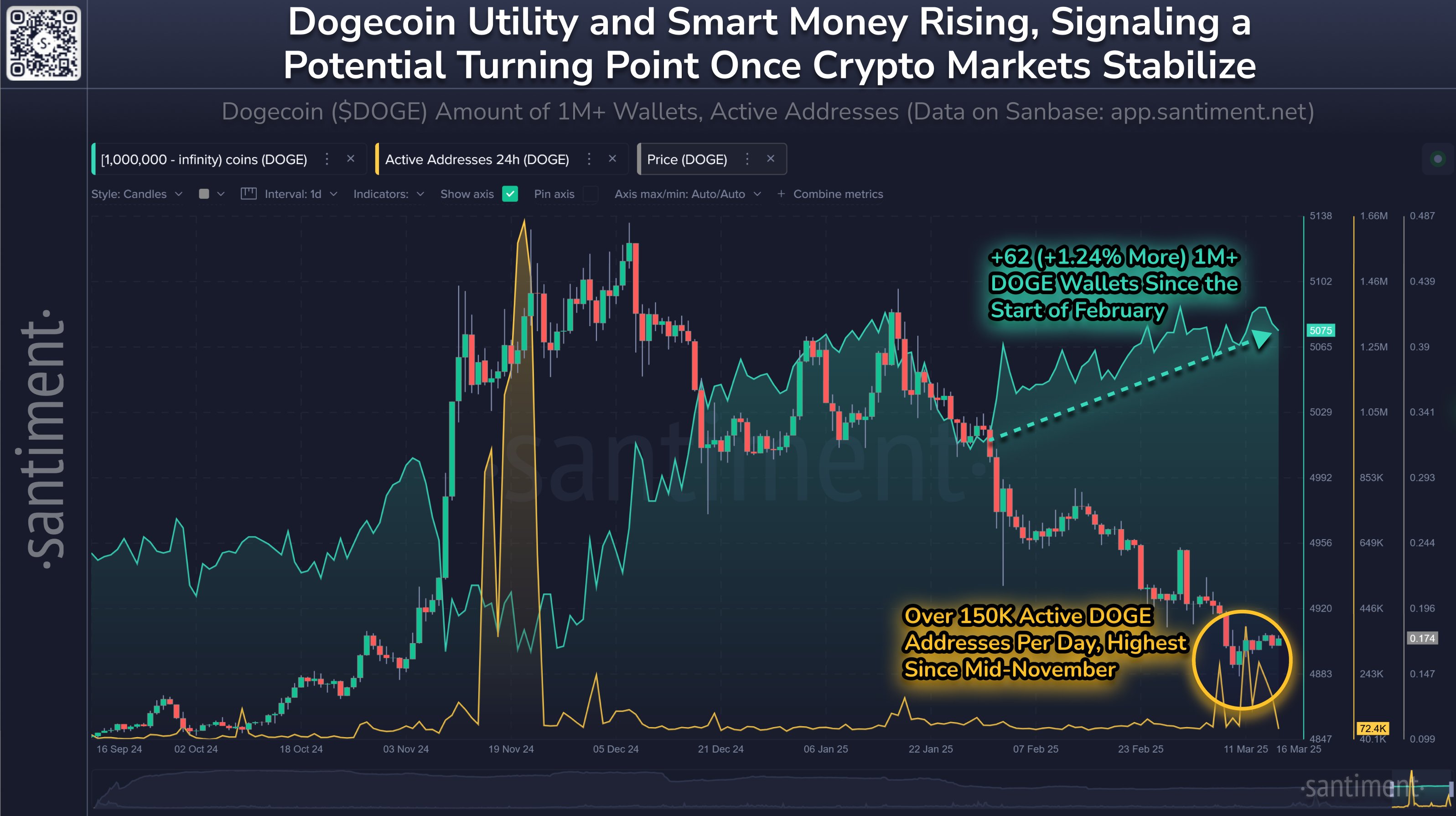

Dogecoin's On-Chain Activity Remains Strong Despite Price Drops

Despite two months of cryptocurrency market depreciation resulting in significant Dogecoin losses, on-chain activity has increased. Data shows a rise in Dogecoin wallets holding over 1 million tokens since early February (approximately 1.24%). Large financial institutions also continue to increase their holdings, indicating sustained interest. Since mid-November, daily active addresses have reached a four-month high of 150,000, even amidst declining prices.

DOGE on-chain activity | Source: Santimentfeed

Increased network activity points to a high level of ongoing engagement. While Dogecoin's price peaked in late 2024 before declining, recent data suggests potential stabilization. The crypto market's growing stability could signal a fundamental shift. The increased ownership by "smart money" and intensified utility signals suggest a potential price increase.

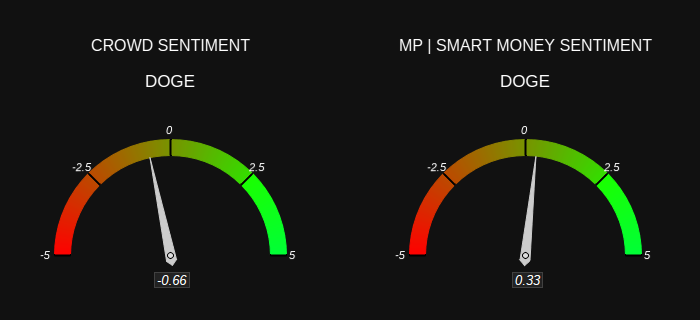

Dogecoin Market Sentiment: Diverging Views

Sentiment analysis reveals a divergence in investor opinions. Retail investors express negative sentiment (-0.66), described as bearish by Market Prophit on X (formerly Twitter). Conversely, sophisticated investors show bullish sentiment (0.33). This disparity reflects differing perspectives.

Market sentiment | Source: Market Prophit

Retail investors' negative outlook stems from Dogecoin's price decline; they often follow short-term trends. Conversely, "smart money" investors identify value opportunities, anticipating future price recovery. This divergence suggests a potential turning point for Dogecoin.

The post Dogecoin Repeats Pattern, What’s Next As Accumulation Resumes? appeared first on The Coin Republic.

TheNewsCrypto

TheNewsCrypto TheCoinrise Media

TheCoinrise Media Cryptopolitan_News

Cryptopolitan_News CoinsProbe

CoinsProbe DogeHome

DogeHome U_Today

U_Today Crypto News Land

Crypto News Land Optimisus

Optimisus Crypto Daily™

Crypto Daily™