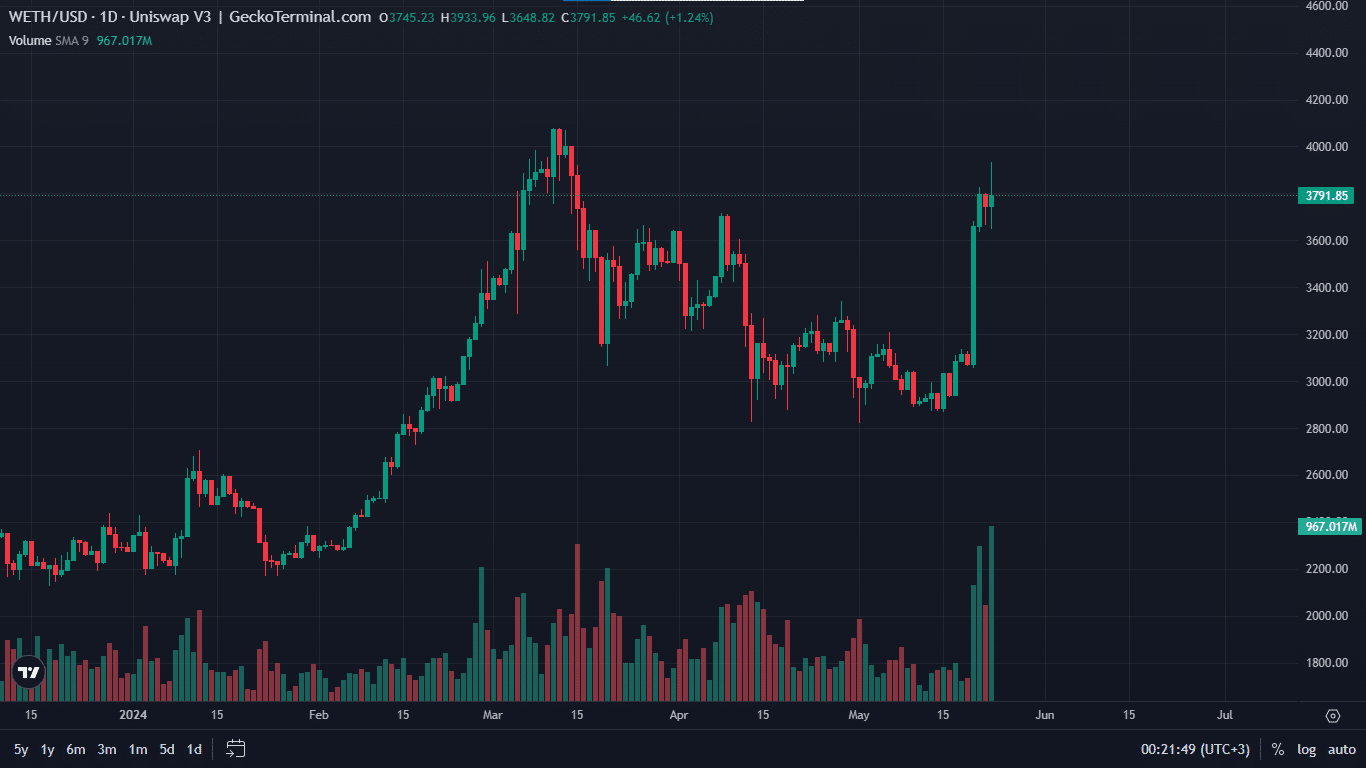

The US Securities and Exchange Commission (SEC) approved spot Ethereum ETFs (exchange-traded funds) in another landmark regulatory breakthrough for crypto, sending the Ethereum price soaring nearly 2% to $3,792.

美國證券交易委員會 (SEC) 批准了現貨以太坊 ETF(交易所交易基金),這是加密貨幣監管的另一個里程碑式突破,導致以太坊價格飆升近 2% 至 3,792 美元。

The decision comes nearly five months after the landmark approval of multiple Bitcoin spot ETFs, and despite the fact that until early this week most analysts had believed such a decision was highly unlikely.

這項決定是在多個比特幣現貨 ETF 獲得里程碑式批准近五個月後作出的,儘管直到本周初大多數分析師還認為這樣的決定極不可能發生。

The announcement came only hours after the SEC initiated talks with Ethereum ETF issuers for final adjustments to their S-1 forms, causing markets to speculate that approval was a done deal. Ahead of the announcement, SEC chair Gary Gensler had told investors to “stay tuned.”

就在這一消息發布的幾個小時前,SEC 開始與以太坊 ETF 發行人就其 S-1 表格進行最終調整進行談判,導致市場猜測批准已成定局。在宣布這一消息之前,美國證券交易委員會主席加里詹斯勒 (Gary Gensler) 告訴投資者「敬請關注」。

JUST IN: The SEC initiates talks with Ethereum ETF issuers for final adjustments to the S-1 form.

Looks like the $ETH ETF is a done deal. 🚀

— Lark Davis (@TheCryptoLark) May 23, 2024

剛剛:美國證券交易委員會開始與以太坊 ETF 發行人進行談判,以對 S-1 表格進行最終調整。 🚀— Lark Davis (@TheCryptoLark) 2024 年 5 月 23 日

Ethereum ETFS Fast-Tracked By SEC

以太坊 ETFS 獲 SEC 快速跟踪

The securities watchdog began fast-tracking the approvals process early this week, when it asked applicants to update their filings. That prompted analysts Eric Balchunas and James Seyffart at Bloomberg Intelligence to up the odds of approval to 75%, from ”slim to none” previously.

證券監管機構於本周初開始加快審批流程,要求申請人更新其文件。這促使彭博資訊 (Bloomberg Intelligence) 的分析師 Eric Balchunas 和 James Seyffart 將批准的可能性從之前的「微乎其微」提高到了 75%。

In anticipation of an imminent approval, investors purchased more than 100,000 ETH in spot markets on May 22, the highest for a day since last September, according to on-chain analytics firm CryptoQuant

根據鏈上分析公司 CryptoQuant 的數據,由於預計即將獲得批准,投資者於 5 月 22 日在現貨市場購買了超過 10 萬枚 ETH,這是自去年 9 月以來的單日最高紀錄

Early ETH holders buy over 100K ETH yesterday

Julio Moreno, Head of Research at CryptoQuant, reported on X that "Permanent Holders" of Ethereum bought a massive amount of ETH yesterday amid the increasing speculation of spot ETH ETF approval. They purchased over 100,000 ETH, the…

— CoinNess Global (@CoinnessGL) May 21, 2024

昨天,早期ETH 持有者購買了超過10 萬個ETH CryptoQuant 研究主管Julio Moreno 在X 上報道稱,隨著現貨ETH ETF 批准的猜測不斷增加,以太坊的「永久持有者」昨天購買了大量ETH 。他們買了超過 10 萬個 ETH,...——CoinNess Global (@CoinnessGL) 2024 年 5 月 21 日

A bipartisan group of House lawmakers, including Majority Whip Tom Emmer and NJ Democrat Josh Gottheimer, had sent a letter to the SEC chair yesterday, May 22, urging the SEC “to approve spot Ether ETFs and ‘`other’ digital assets.” The letter said that the investment products would offer investors access to crypto in a regulated, transparent, and safe format.

包括多數黨黨鞭 Tom Emmer 和新澤西州民主黨人 Josh Gottheimer 在內的兩黨眾議院議員昨天(即 5 月 22 日)致信 SEC 主席,敦促 SEC「批准現貨以太坊 ETF 和『其他』數位資產」。信中表示,這些投資產品將為投資者提供受監管、透明和安全的加密貨幣形式。

We urge SEC Chair @GaryGensler to approve the pending Ether ETP applications. @GOPMajorityWhip @RepJoshG @USRepMikeFlood @WileyNickel

Check out our letter to @GaryGensler below: pic.twitter.com/uv8Sp8lqUx

— French Hill (@RepFrenchHill) May 23, 2024

我們敦促 SEC 主席 @GaryGensler 批准待決的 Ether ETP 申請。 @GOPMajorityWhip @RepJoshG @USRepMikeFlood @WileyNickel查看下面我們給@GaryGensler的信:pic.twitter.com/uv8Sp8lqUx— French Hill (@RepFrenchHill) 2024年5月23日

Singapore-based QCP Capital said earlier that approval of ETH ETFs could trigger a 60% increase in the price of Ethereum.

總部位於新加坡的 QCP Capital 早些時候表示,ETH ETF 的批准可能會引發以太幣價格上漲 60%。

The Ethereum price has soared by almost 45% in the past two weeks, mirroring the surge seen in the Bitcoin price in the run up to the approval of spot Bitcoin ETFs in January. ETH is trading at $3,792 as of 17:19 p.m. EST.

過去兩週,以太坊價格飆升了近 45%,與 1 月現貨比特幣 ETF 獲得批准之前比特幣價格的飆升相呼應。截至下午 17:19,ETH 交易價格為 3,792 美元。美東時間。

GeckoTerminal: ETH/USD 1-day chart

GeckoTerminal:ETH/美元 1 日圖表

Also Read:

另請閱讀:

Meme Coins Explode On Ethereum ETF Optimism As Pepe Hits ATH

Ethereum Price Prediction: ETH Climbs 2% As 5 ETF Bidders Amend Their Filings And This Green AI Crypto Presale Races Towards $4 Million

Ethereum Name Service, Ethena, And ETH Meme Coins PEPE And FLOKI Among Big Winners As ETH ETF Odds Improve

Meme 幣在以太坊ETF 樂觀情緒中爆發,Pepe 觸及ATHEthereum 價格預測:隨著5 個ETF 投標人修改其文件,ETH 上漲2%,這次綠色AI 加密貨幣預售將達到400 萬美元以太坊名稱服務、Ethena 和ETH Meme 幣PEPE 和FLOKI 成為大贏家隨著 ETH ETF 賠率的提高

DogeHome

DogeHome BlockchainReporter

BlockchainReporter CoinPedia News

CoinPedia News TheNewsCrypto

TheNewsCrypto CFN

CFN Optimisus

Optimisus Crypto News Land

Crypto News Land