The period of BTC inactivity appears to have come to an end, at least momentarily, with the cryptocurrency marking significant increases twice within the last 48 hours. Bitcoin has surged by over three thousand dollars during this period, while daily liquidations have rocketed to over $125 million. This surge comes after a significant drop following the U.S. SEC’s approval of nearly a dozen spot Exchange-Traded Funds (ETFs) on January 10, and particularly after these ETFs became available for trading the following day. The recent recovery in the market hints at a pre-halving bullish rally and BTC price might aim for $50K in the coming days, significantly plunging market interest on altcoins.

BTC 的不活躍期似乎已經結束,至少暫時結束,該加密貨幣在過去 48 小時內兩次大幅上漲。在此期間,比特幣已飆升超過 3000 美元,而每日清算額已飆升至超過 1.25 億美元。在美國證券交易委員會於 1 月 10 日批准近 12 檔現貨交易所交易基金 (ETF) 後,特別是在這些 ETF 於第二天開始交易後,股價大幅下跌。最近市場的復甦暗示著減半前的看漲反彈,比特幣價格可能在未來幾天達到 5 萬美元,從而大幅降低市場對山寨幣的興趣。

Bitcoin’s Market Dominance Skyrockets

Bitcoin began its surge yesterday, reaching $45,000 for the first time in a month since the ETF approvals. The next 12 hours have also shown a promising trend, with the cryptocurrency soaring to another monthly peak of over $46,000.

比特幣的市場主導地位飆升比特幣昨天開始飆升,自 ETF 獲批以來一個月內首次達到 45,000 美元。接下來的 12 小時也顯示出令人鼓舞的趨勢,加密貨幣飆升至超過 46,000 美元的另一個月度高峰。

The sharp rise in Bitcoin’s value led to an abrupt and widespread liquidation of positions, totaling nearly $125 million. These liquidations primarily affected leveraged traders who were betting on different market movements, triggering an intense volatility in the market. Coinglass data reveals that the total crypto market liquidation surpassed $123 million, with short-positions worth of $90 million were closed. This has resulted in a surging buying confidence, with BTC price triggering nearly $50 million in total liquidation.

比特幣價值的大幅上漲導致部位突然大規模清算,總計近 1.25 億美元。這些清算主要影響了押注不同市場趨勢的槓桿交易者,引發了市場的劇烈波動。 Coinglass 數據顯示,加密貨幣市場清算總額超過 1.23 億美元,其中價值 9,000 萬美元的空頭部位被平倉。這導致購買信心高漲,BTC 價格引發了近 5,000 萬美元的總清算。

— Santiment (@santimentfeed) February 9, 2024📈 #Crypto markets are recovering well after the post-#ETF drop 4 weeks ago. #Bitcoin, in particular, has completed its comeback, reaching $46.3K for the first time since January 11th. $BTC social volume is rising, while the crowd shows less interest in $ETH, $DOGE, and $XMR. pic.twitter.com/rcaxdBwCfX

Significantly, Bitcoin’s increasing market dominance has eclipsed that of top altcoins such as ETH , DOGE, and XMR, as reported by Santiment. With Bitcoin’s market share climbing to over 53.5% accompanied by a spike in social media discussions, there’s been a noticeable decline in altcoin dominance, leading to a declined interest in the altcoin sector.

- Santiment (@santimentfeed) 2024 年 2 月 9 日📈 #Crypto 市場在 4 週前#ETF 下跌後正在恢復良好。尤其是#Bitcoin,已經完成了捲土重來,自 1 月 11 日以來首次達到 4.63 萬美元。 $BTC 的社交量正在上升,而人群對 $ETH、$DOGE 和 $XMR 的興趣卻在減少。 pic.twitter.com/rcaxdBwCfX 值得注意的是,根據 Santiment 報導,比特幣日益增長的市場主導地位已經超過了 ETH、DOGE 和 XMR 等頂級山寨幣。隨著比特幣的市場份額攀升至 53.5% 以上,伴隨著社交媒體討論的激增,山寨幣的主導地位明顯下降,導致山寨幣行業的興趣下降。

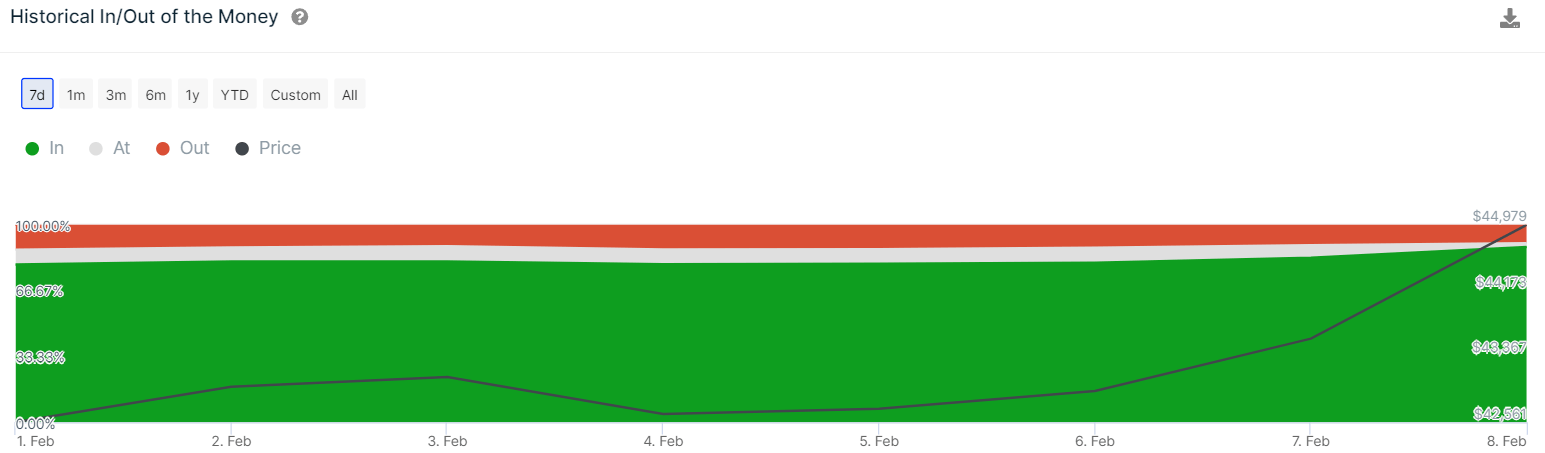

The recent rally in Bitcoin has elevated the proportion of profitable addresses to 88.7%, which translates to approximately 46 million addresses. This development is likely to boost investor confidence, prompting more individuals to acquire Bitcoin at its current price levels and thereby softening the resistance levels it faces. Notably, with the uptick in Bitcoin’s value, there’s been a trend of investors pulling their funds from exchanges.

最近比特幣的上漲將獲利地址的比例提升至 88.7%,相當於約 4,600 萬個地址。這一發展可能會提振投資者信心,促使更多人以當前價格水平購買比特幣,從而軟化其面臨的阻力水平。值得注意的是,隨著比特幣價值的上漲,投資者出現了從交易所撤資的趨勢。

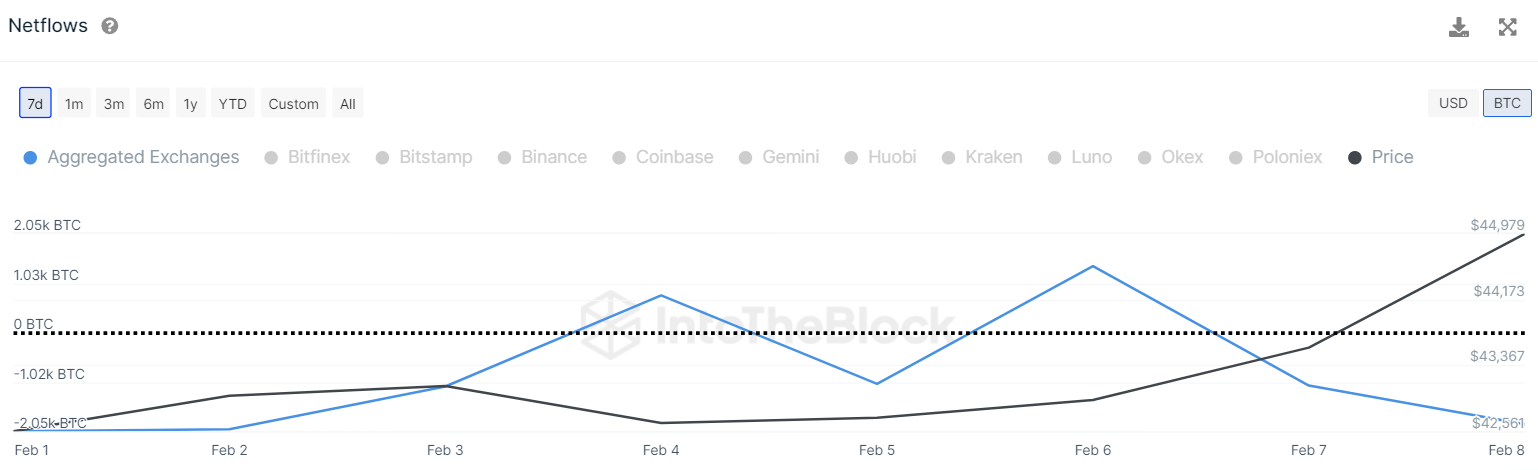

Data from IntoTheBlock indicates that Bitcoin’s Netflow has seen a decrease over the past 48 hours, hitting its lowest negative point at -1.91K BTC. This trend of net outflows exceeding inflows, even amidst rising prices, suggests that investors are increasingly inclined to hold onto their Bitcoin rather than sell it for immediate gains. Such behavior is reinforcing Bitcoin’s momentum, setting the stage for a potential surge beyond the $50K threshold.

IntoTheBlock 的數據顯示,比特幣的淨流量在過去 48 小時內有所下降,觸及最低負點 -1.91K BTC。即使在價格上漲的情況下,這種淨流出超過流入的趨勢表明,投資者越來越傾向於持有比特幣,而不是為了立即獲利而出售它。這種行為正在增強比特幣的勢頭,為突破 5 萬美元的潛在飆升奠定基礎。

Bitcoin’s Short-Term Target Of $48K

Bitcoin (BTC) is on its way to reaching $48,000 in the near term, triggered by a consistent pattern of gains observed around the Chinese New Year, as per Markus Thielen, head of research at Matrixport and founder of 10x Research.

Matrixport 研究主管兼創辦人 Markus Thielen 表示,比特幣的短期目標為 48K 美元,受中國農曆新年前後觀察到的持續上漲模式的影響,比特幣 (BTC) 近期將達到 48,000 美元。10 倍研究。

Thielen highlighted in a report published on Thursday the critical statistical significance of the upcoming days, noting that Bitcoin typically experiences an 11% rally around the Chinese New Year, which begins on February 10 (Saturday). “Over the past nine years, Bitcoin has consistently seen an uptick whenever traders purchased it three days before and sold it ten days after the commencement of the Chinese New Year,” Thielen explained.

Thielen 在周四發布的報告中強調了未來幾天的關鍵統計意義,並指出比特幣通常會在 2 月 10 日(週六)開始的農曆新年前後經歷 11% 的上漲。 「在過去的九年裡,每當交易者在農曆新年開始前三天購買比特幣並在農曆新年開始十天后出售比特幣時,比特幣就會持續上漲,」蒂倫解釋道。

Peering into the future, Thielen predicts more gains for Bitcoin, drawing on the Elliott Wave theory—a technical analysis method that suggests price movements follow predictable wave patterns. According to this theory, price trends unfold in five phases, with waves 1, 3, and 5 categorized as “impulse waves” that denote the primary trend direction.

展望未來,蒂倫利用艾略特波浪理論(技術分析方法,顯示價格走勢遵循可預測的波浪模式)預測比特幣將獲得更多收益。根據該理論,價格趨勢分為五個階段,其中波 1、波 3 和波 5 被歸類為“脈衝波”,表示主要趨勢方向。

Conversely, waves 2 and 4 act as retracements or minor pullbacks within the broader impulsive movement. Thielen points out that Bitcoin has navigated through its wave 4 retracement, dropping to $38,500, and is now on its fifth and final impulse wave of the current uptrend, aiming for a target of $52,000 by mid-March.

相反,第 2 浪和第 4 浪在更廣泛的脈衝運動中充當回調或小幅回調。 Thielen 指出,比特幣已經度過了第 4 波回撤,跌至 38,500 美元,目前正處於當前上升趨勢的第五波也是最後一波衝擊波,目標是到 3 月中旬達到 52,000 美元的目標。

Optimisus

Optimisus Optimisus

Optimisus Optimisus

Optimisus Thecryptoupdates

Thecryptoupdates DogeHome

DogeHome The Crypto Times

The Crypto Times Coincu

Coincu Optimisus

Optimisus Coin_Gabbar

Coin_Gabbar