Crypto Markets Mixed Before US Inflation Data, Fed Decision.

在美國通膨數據和聯準會決定公佈之前,加密貨幣市場漲跌互現。

Asian markets showed divergence as investors awaited crucial US data and the Federal Reserve's policy decision.

由於投資者等待重要的美國數據和聯準會的政策決定,亞洲市場出現分歧。

Anticipated data includes a +0.1% Y/Y increase in headline CPI for November, with core CPI expected to rise +0.2% M/M.

預期數據包括 11 月整體 CPI 年比上漲 0.1%,核心 CPI 預計將較上季上漲 0.2%。

Non-farm payrolls for November surpassed expectations at 199k, with a lower unemployment rate of 3.7%.

11 月非農就業人數超出預期,為 19.9 萬,失業率較低至 3.7%。

Average hourly earnings rose by 0.4% MoM, exceeding the expected 0.3%, and the participation rate increased to 62.8%.

平均時薪較上月上漲0.4%,超出預期0.3%,參與率升至62.8%。

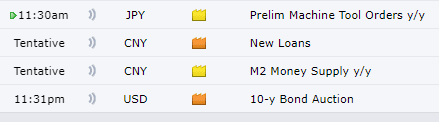

Major Events To Watch:

值得關注的重大事件:

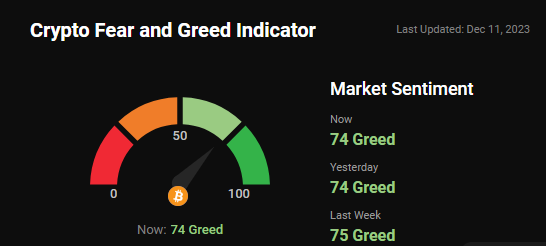

Crypto Fear and Greed:

加密恐懼與貪婪:

Over the past day, the cryptocurrency market underwent a phase of consolidation, resulting in price stabilization and a neutral stance on the "Greed and Fear Index." Presently registering at 74 on a scale ranging from 0 to 100, the index indicates a moderate degree of investor sentiment.

過去一天,加密貨幣市場經歷了一個盤整階段,導致價格穩定,「貪婪與恐懼指數」保持中性立場。該指數目前在 0 到 100 的範圍內為 74,顯示投資者情緒處於中等程度。

Latest Market Update:

最新市場動態:

Bitcoin, the world's oldest and most esteemed cryptocurrency, maintained its position below the $43,500 mark on early Monday.

比特幣是世界上最古老、最受尊敬的加密貨幣,週一早些時候維持在 43,500 美元大關下方。

Despite minor losses in other leading cryptocurrencies, popular altcoins such as Ethereum, Solana, Ripple, Litecoin, and Dogecoin experienced slight declines across the board.

儘管其他主要加密貨幣出現小幅下跌,但以太坊、Solana、Ripple、萊特幣和狗狗幣等熱門山寨幣卻全面小幅下跌。

BitTorrent (New) has surged to the forefront with an impressive 25.00% gain in the past 24 hours.

BitTorrent(新)在過去 24 小時內以令人印象深刻的 25.00% 漲幅躍居前列。

Apecoin, on the other hand, suffered the most substantial loss, declining by 11.36% over the last 24 hours.

另一方面,Apecoin 損失最為慘重,在過去 24 小時內下跌了 11.36%。

Total crypto market volume in the last 24 hours: $84 billion, marking a 16% decrease.

過去 24 小時加密貨幣市場總成交量:840 億美元,下降 16%。

DeFi (Decentralized Finance) volume: $7.95 billion, constituting 10.70% of the total crypto market 24-hour volume.

DeFi(去中心化金融)交易量:79.5億美元,佔加密貨幣市場24小時交易量的10.70%。

Volume of all stable coins: $65.8 billion, representing 88.52% of the total crypto market 24-hour volume.

所有穩定幣交易量:658億美元,佔加密貨幣市場24小時總交易量的88.52%。

Bitcoin dominance: 53.42%, experiencing a 0.33% decrease over the day.

比特幣主導:53.42%,日內下降 0.33%。

Major Worldwide News Update:

全球主要新聞更新:

In November, nonfarm payrolls recorded a growth of 199,000, exceeding the anticipated 190,000. The unemployment rate saw a decline to 3.7%, surpassing the predicted 3.9%. The positive figures were influenced by increased government hiring and the return of workers from strikes. These results underscore the job market's robustness, alleviating worries about recent upticks in the unemployment rate.

11月份非農業就業人數增加19.9萬人,超過預期的19萬人。失業率下降至3.7%,超過預期的3.9%。這些積極的數字受到政府招聘增加和工人從罷工中返回的影響。這些結果凸顯了就業市場的穩健性,並緩解了人們對近期失業率上升的擔憂。

The FOMC is expected to maintain rates at 5.25-5.50% in December. Despite Chair Powell's readiness to tighten policy further, the market anticipates a shift towards rate cuts in 2024. Economists project rates to stay until July 2024, but markets price in a potential cut as early as March. Concerns linger about the market's dovish pricing and the Fed's communication strategy amid persistent inflation.

預計 FOMC 12 月利率將維持在 5.25-5.50%。儘管鮑威爾主席準備進一步收緊政策,但市場預計 2024 年將轉向降息。經濟學家預計利率將維持到 2024 年 7 月,但市場預計最早可能在 3 月降息。人們對市場鴿派定價和聯準會在持續通膨背景下的溝通策略的擔憂仍然存在。

The upcoming Consumer Price Index data for November 2023, scheduled for release on December 12 at 8:30 am ET, is expected to show a slowdown in inflation. This is attributed to the decline in energy prices. Market forecasts indicate a steady monthly and 3% yearly rise in headline CPI. Core CPI, excluding food and energy, is anticipated to increase by 0.3% on a monthly basis and 4% annually—exceeding the Federal Reserve's 2% target. These projections contribute to the growing belief in the market that a potential Federal Reserve rate cut may occur by spring.

即將發布的 2023 年 11 月消費者物價指數數據預計將於美國東部時間 12 月 12 日上午 8:30 發布,預計將顯示通膨放緩。這歸因於能源價格的下跌。市場預測顯示整體 CPI 月穩定上漲,年率上漲 3%。不包括食品和能源的核心消費者物價指數預計將按月上漲 0.3%,全年上漲 4%,超過聯準會 2% 的目標。這些預測使市場越來越相信聯準會可能會在春季降息。

MicroStrategy's (MSTR) shares have soared since adopting a Bitcoin strategy in August 2020, outperforming S&P 500, Nasdaq, Gold, Silver, bonds, and even Bitcoin. With a 385% growth compared to Bitcoin's 274%, MicroStrategy's steadfast Bitcoin holdings and recent market events contribute to its impressive surge.

自 2020 年 8 月採用比特幣策略以來,MicroStrategy (MSTR) 股價飆升,表現優於標準普爾 500 指數、納斯達克指數、黃金、白銀、債券,甚至比特幣。與比特幣 274% 的成長相比,MicroStrategy 穩定的比特幣持有量和最近的市場事件促成了其令人印象深刻的飆升,成長了 385%。

Venus Protocol addresses rumors of an exploit, attributing concerns to a short-term pricing issue from the Binance Oracle affecting a specific pool. The incident underscores the importance of transparency in the decentralized finance space, amid recent security challenges, including KyberSwap's $46 million exploit.

Venus Protocol 解決了有關漏洞利用的謠言,將人們的擔憂歸因於幣安預言機影響特定池的短期定價問題。該事件強調了在最近的安全挑戰(包括 KyberSwap 的 4,600 萬美元漏洞)中,去中心化金融領域透明度的重要性。

Comedian Owen Benjamin ignites debate by labeling Bitcoin a "decentralized Ponzi scheme." Ripple CTO David Schwartz questions spending behavior amid a declining dollar, while author Saifedean Ammous defends Bitcoin's scarcity. The ongoing discourse reflects the evolving nature of the crypto space and regulatory scrutiny.

喜劇演員歐文·本傑明將比特幣標記為“去中心化的龐氏騙局”,引發了爭論。 Ripple 技術長 David Schwartz 質疑美元貶值期間的消費行為,而作家 Saifedean Ammous 則為比特幣的稀缺性辯護。正在進行的討論反映了加密貨幣空間和監管審查不斷發展的性質。

Google is updating its crypto ads policy, requiring advertisers offering Cryptocurrency Coin Trusts in the US to obtain certification. Effective January 29, 2024, the certification process ensures adherence to Google's standards, promoting trustworthy cryptocurrency-related ads. Global compliance with local laws is emphasized, extending the policy to NFT advertisements.

谷歌正在更新其加密貨幣廣告政策,要求在美國提供加密貨幣信託的廣告商獲得認證。此認證流程於 2024 年 1 月 29 日生效,可確保遵守 Google 標準,推廣值得信賴的加密貨幣相關廣告。強調在全球範圍內遵守當地法律,並將政策擴展到 NFT 廣告。

Bitcoin and Ether led a crypto rally, with Bitcoin resilient at $43,700 after a minor dip. Ether sustained monthly gains of almost 25% and a year-to-date rise of about 95%. Optimism around the April 2024 Bitcoin halving and potential ETF approvals contributed to a 56% gain since October 2023. The debut of JTO governance token and Solana's 11% increase indicated broader market trends. Analysts foresee a cycle where Bitcoin takes the lead, followed by Ethereum, Solana, and other altcoins.

比特幣和以太幣引領加密貨幣反彈,比特幣在小幅下跌後反彈至 43,700 美元。以太幣月漲幅接近 25%,今年迄今漲幅約 95%。圍繞2024 年4 月比特幣減半和潛在ETF 批准的樂觀情緒推動了自2023 年10 月以來比特幣價格上漲56%。JTO 治理代幣的首次亮相和Solana 的上漲11% 表明了更廣泛的市場趨勢。分析人士預計,比特幣將處於領先地位,隨後是以太坊、Solana 和其他山寨幣。

COIN GABBAR Views: Will Bitcoin overcome resistance, or is a correction looming below $40,000? Could $50,000 be the next target, and will the Santa Claus rally endure? In light of these dynamics, is it prudent to invest now, or should one weigh the option of liquidating their position? To get latest news Stay tuned us at coingabbar

COIN GABBAR 觀點:比特幣會克服阻力,還是回檔即將跌破 4 萬美元? 5 萬美元會成為下一個目標嗎?聖誕老人的漲勢會持續下去嗎?鑑於這些動態,現在投資是否謹慎,還是應該權衡平倉的選擇?獲取最新消息請關注我們 coingabbar

Disclaimer: Crypto is not regulated and can offer considerable risks. There may be no regulatory remedies available in the event of any losses resulting from price analysis. As a result, before engaging in any transactions involving crypto products, each investor must perform in-depth examination or seek independent advice.

免責聲明:加密貨幣不受監管,可能會帶來相當大的風險。如果價格分析造成任何損失,可能沒有可用的監管補救措施。因此,在進行任何涉及加密產品的交易之前,每個投資者都必須進行深入檢查或尋求獨立建議。

For More News: Crypto Daily Roundup, 8 Dec: Altcoins Sparkle, Bitcoin Takes a Siesta

更多新聞:《加密貨幣每日綜述》,12 月 8 日:山寨幣閃閃發光,比特幣午睡

ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com DogeHome

DogeHome Optimisus

Optimisus Optimisus

Optimisus DeFi Planet

DeFi Planet Crypto Daily™

Crypto Daily™