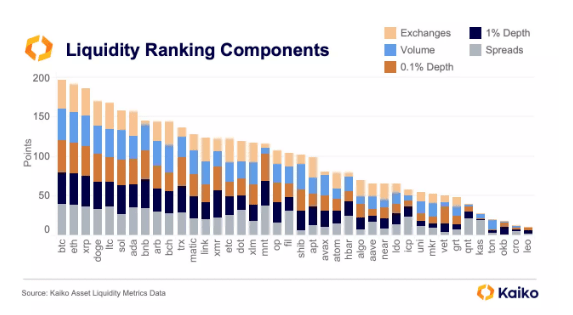

Kaiko, a blockchain analytics platform, conducted an investigation that revealed the complexities of liquidity across the biggest crypto assets, with some lower market cap assets beating higher ones. According to its Q3 liquidity rankings, XRP and Dogecoin (DOGE) managed to beat out Solana and Cardano in liquidity rankings, coming in behind only Bitcoin and Ethereum. There were also some surprise numbers on the rankings, like BNB coming in 8th in terms of liquidity, and Litecoin also outperforming.

區塊鏈分析平台 Kaiko 進行了一項調查,揭示了最大的加密資產的流動性的複雜性,一些市值較低的資產擊敗了市值較高的資產。根據其第三季流動性排名,XRP 和狗狗幣 (DOGE) 在流動性排名中擊敗了 Solana 和 Cardano,僅次於比特幣和以太坊。排名中也有一些令人驚訝的數字,例如 BNB 在流動性方面排名第八,而萊特幣也表現出色。

Kaiko Analysis Highlights Liquidity For Crypto Assets

Kaiko 分析強調加密資產的流動性

The vast number of crypto assets has always brought out the idea among investors to rank their valuation on a scale of some sort, with the most adopted being the market cap. However, according to Kaiko, liquidity, along with other metrics like volume and market depth is a better way to measure a token’s real value apart from its market cap. This was best demonstrated by FTX’s token FTT, whose market was bloated to reach a peak of nearly $10 billion without having enough liquidity on exchanges to back this up.

大量的加密資產總是讓投資者產生一種想法,以某種程度對它們的估值進行排名,其中最常用的是市值。然而,根據 Kaiko 的說法,流動性以及交易量和市場深度等其他指標是衡量代幣除市值之外的實際價值的更好方法。 FTX 的代幣 FTT 最好地證明了這一點,其市場膨脹到接近 100 億美元的峰值,而交易所卻沒有足夠的流動性來支持這一點。

According to its latest rankings, Bitcoin took up the first spot in liquidity. This wasn’t surprising, as Bitcoin has always held a tight reign over the crypto industry since its inception. Ethereum followed in second place in terms of liquidity to reiterate its position as the king of altcoins. However, Kaiko’s liquidity rankings started to digress from the market cap at the third position, with BNB underperforming massively to come in at 8th place.

根據最新排名,比特幣在流動性方面佔據第一名。這並不奇怪,因為比特幣自誕生以來一直牢牢控制著加密產業。以太坊在流動性方面緊隨其後,重申其山寨幣之王的地位。然而,Kaiko 的流動性排名開始偏離第三位的市值,BNB 表現大幅不佳,排在第八位。

Instead, XRP came in at 4th place, beating out the likes of Solana and Cardano (the Ethereum killers) on exchanges among traders. XRP’s liquidity boost in the quarter was thanks to the asset receiving regulatory clarity in the US. Dogecoin came in at 5th place, despite being 10th on market cap rankings, to solidify its position as the leader among meme coins. Litecoin came in at 5th place to complete the top five, despite being 18th in market cap rankings.

相反,XRP 在交易者之間的交易中擊敗了 Solana 和 Cardano(以太坊殺手)等,排名第四。 XRP 在本季的流動性增加得益於該資產在美國獲得了監管明確。儘管狗狗幣在市值排名中排名第十,但仍排名第五,鞏固了其作為迷因幣領導者的地位。儘管萊特幣的市值排名第 18 位,但它在前五名中排名第 5。

On the other hand, AVAX’s liquidity ranking dropped 11 places when compared to its market cap, while TON came in at 37th place despite being 9th by market cap during the quarter. Also, ATOM, UNI, APT, TON, SHIB, OKB, LEO, and CRO all fell more than five spots.

另一方面,AVAX 的流動性排名與其市值相比下降了 11 位,而 TON 儘管本季市值排名第 9 位,但排名第 37 位。此外,ATOM、UNI、APT、TON、SHIB、OKB、LEO 和 CRO 均下降了 5 位以上。

What Does Liquidity Say About Dogecoin And Crypto Assets?

流動性對狗狗幣和加密資產有何影響?

Kaiko’s measure of liquidity included the spread and the average daily trading volume on different exchanges. The analytics platform also included two different market depth levels; 0.1% for higher frequency traders and 1% for longer-term holders.

Kaiko衡量流動性的指標包括不同交易所的點差和平均每日交易量。該分析平台還包括兩個不同的市場深度等級:高頻交易者為 0.1%,長期持有者為 1%。

In terms of trading volume, BTC came in first place while ETH and XRP followed suit. However, SOL beat DOGE in this metric with around $2 billion in the quarter.

從交易量來看,BTC位居第一,ETH和XRP緊追在後。然而,SOL 在這一指標上擊敗了 DOGE,該季度銷售額約為 20 億美元。

The bottom line is that greater liquidity often precedes greater success over the longer term for cryptocurrencies. Q4 2023 should tell a strong tale in terms of crypto liquidity, as most cryptocurrencies registered new yearly highs in terms of market cap.

最重要的是,從長遠來看,更大的流動性往往會帶來加密貨幣更大的成功。 2023 年第四季在加密貨幣流動性方面應該會講述一個強勁的故事,因為大多數加密貨幣的市值都創下了年度新高。

Featured image from Shutterstock

來自 Shutterstock 的精選圖片

ETHNews

ETHNews Bitop Exchange

Bitop Exchange CoinPedia News

CoinPedia News DogeHome

DogeHome ItsBitcoinWorld

ItsBitcoinWorld Cryptopolitan_News

Cryptopolitan_News U_Today

U_Today Cryptopolitan_News

Cryptopolitan_News DT News

DT News