You can also read this news on COINTURK NEWS: Ethereum Price Surge: Analyzing the Underlying Factors

您也可以在 COINTURK NEWS 上閱讀此新聞:以太坊價格飆升:分析潛在因素

Ethereum‘s price began to climb today, surpassing $3,630 with a 3.5% increase since March 31. The price of Ethereum has risen by 18.75% from the local low of around $3,050 set just over a week ago. So, what are the factors supporting Ethereum’s price increase in recent days? Let’s take a look.

以太坊的價格今天開始攀升,自 3 月 31 日以來上漲了 3.5%,突破了 3,630 美元。以太坊的價格較一周前創下的 3,050 美元左右的局部低點上漲了 18.75%。那麼,支撐以太幣近幾日價格上漲的因素有哪些呢?讓我們來看看。

Why Is Ethereum Rising?

以太坊為何上漲?

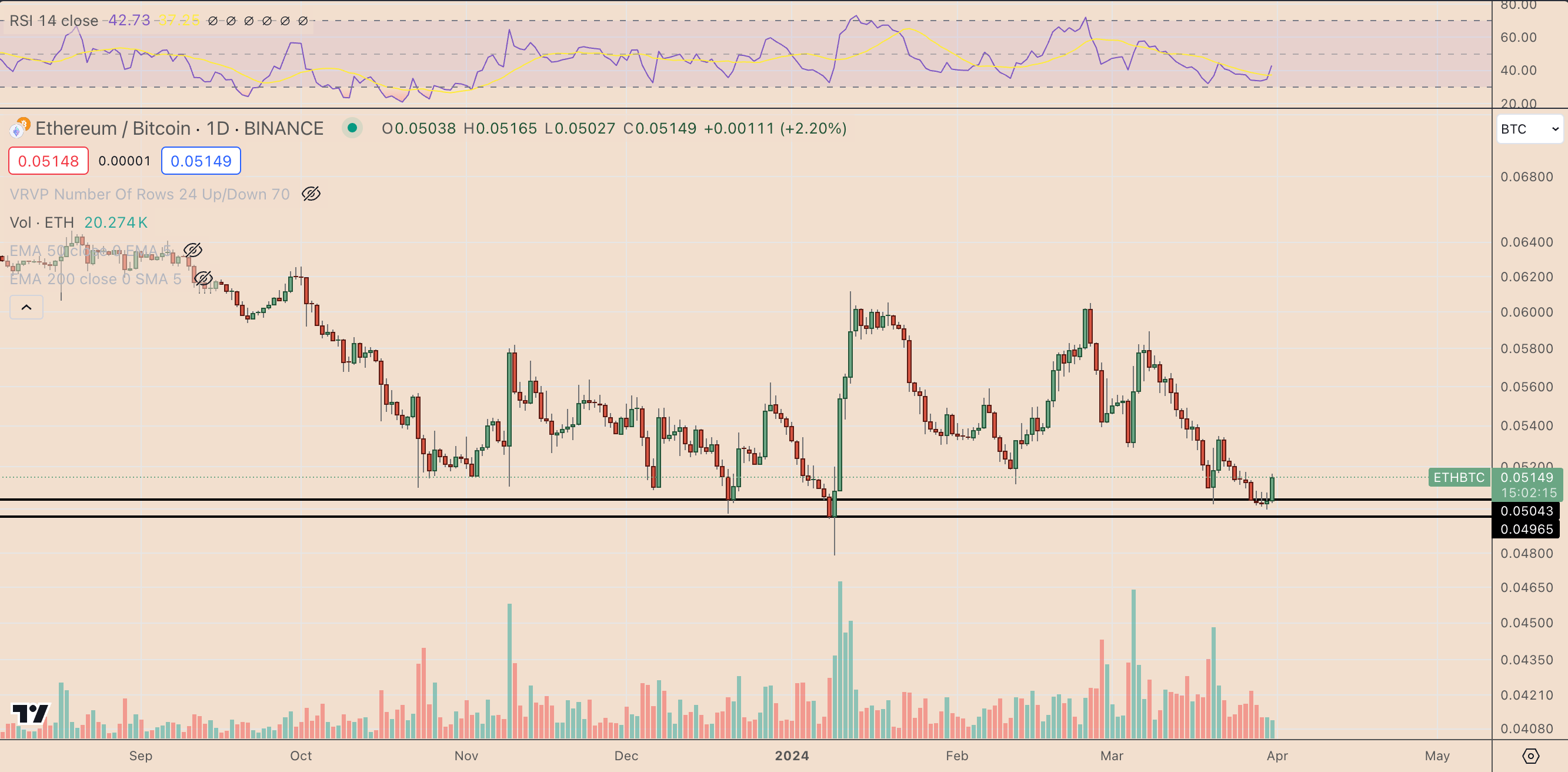

Ethereum’s ongoing rise against the US dollar coincides with equally strong gains against Bitcoin. The widely followed ETH/BTC pair gained approximately 2.5% in value on March 31, reaching 0.051 BTC, indicating a possible short-term capital rotation.

以太坊兌美元的持續上漲與比特幣同樣強勁的上漲同時發生。廣受關注的 ETH/BTC 貨幣對在 3 月 31 日上漲約 2.5%,達到 0.051 BTC,顯示可能存在短期資金輪動。

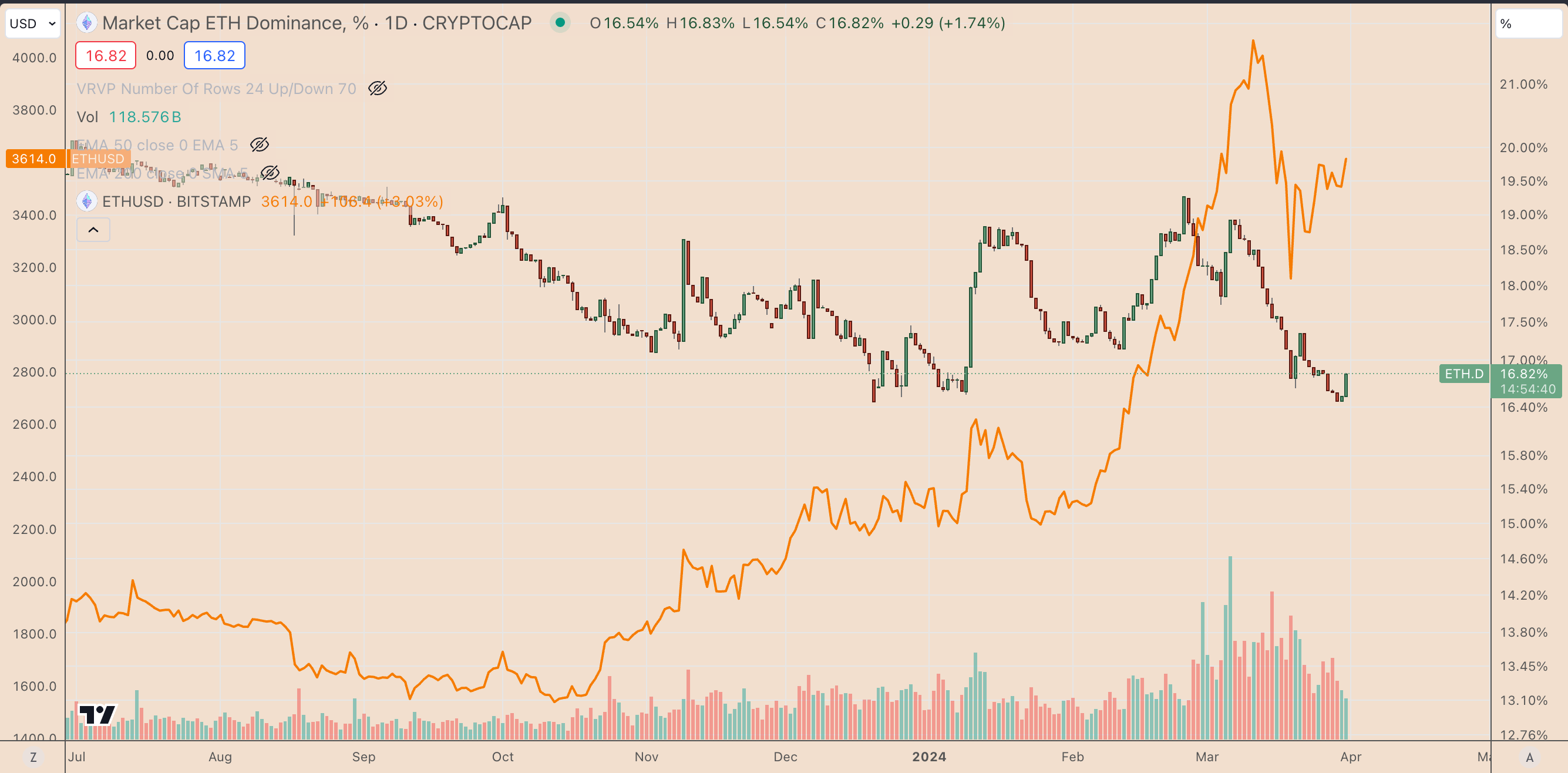

Moreover, Ethereum’s performance against the broader cryptocurrency market has significantly improved in the last 48 hours, as highlighted by a 2.16% increase in the Ethereum Dominance Index (ETH.D) from its lowest level on March 29.

此外,以太坊相對於更廣泛的加密貨幣市場的表現在過去 48 小時內顯著改善,以太坊優勢指數 (ETH.D) 從 3 月 29 日的最低水平上漲 2.16% 就凸顯了這一點。

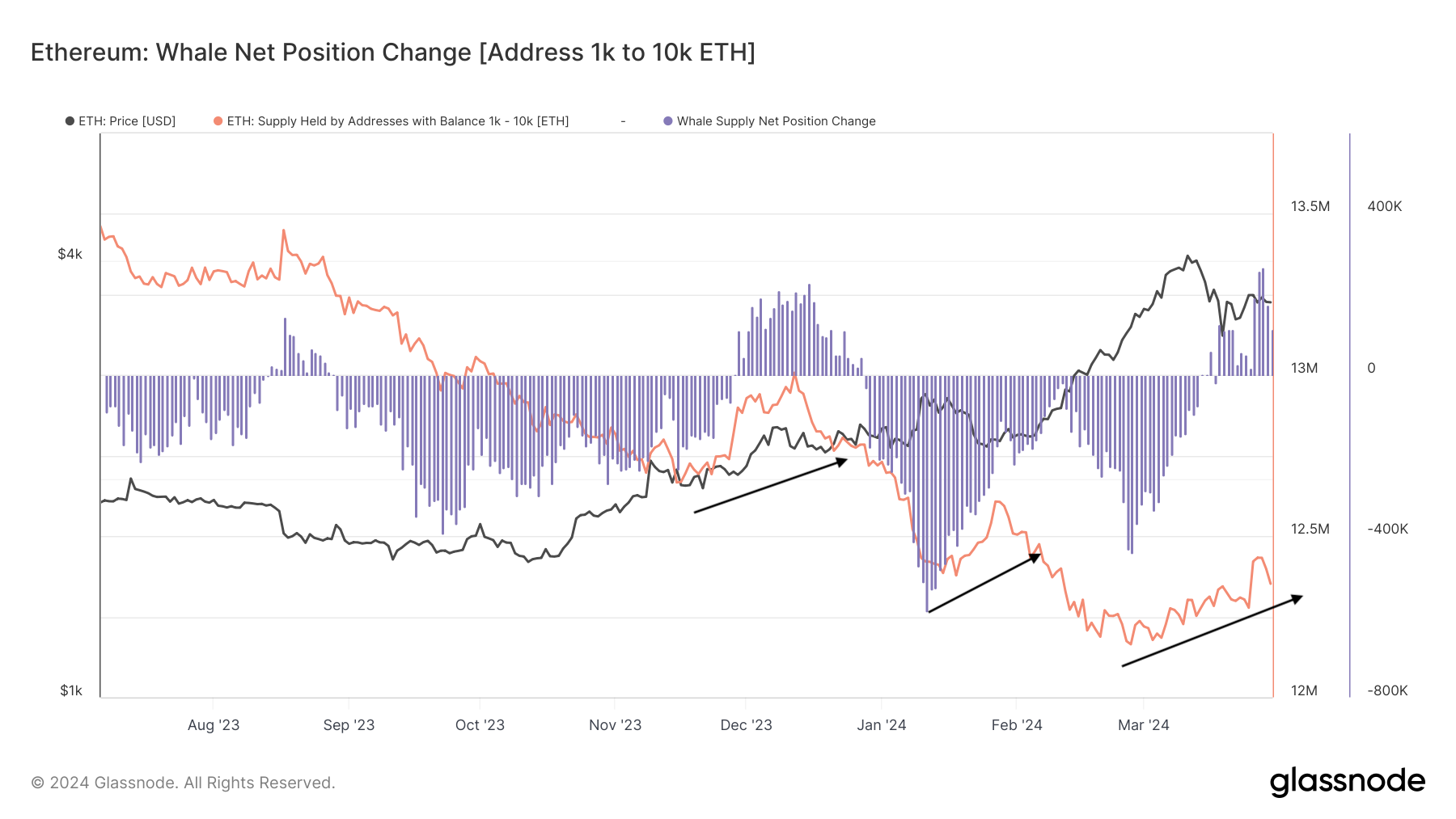

This trend underscores a growing capital inflow from rival altcoin projects into the Ethereum market, bolstering Ethereum’s value in dollars. The recent gains in Ethereum occurred prior to an accumulation period among the wealthiest investors, also known as whales.

這一趨勢突顯出越來越多的資金從競爭對手的山寨幣項目流入以太坊市場,從而支撐了以太坊的美元價值。以太坊最近的上漲發生在最富有的投資者(也稱為鯨魚)的累積期之前。

According to blockchain data analytics platform Glassnode, organizations holding between 1,000 and 10,000 Ethereum increased their reserves by approximately 1.15% in March. Interestingly, this accumulation pattern often precedes significant price increases in the ETH/USD pair, as witnessed today.

根據區塊鏈數據分析平台 Glassnode 的數據,持有 1,000 至 10,000 個以太坊的組織在 3 月增加了約 1.15% 的儲備。有趣的是,如今天所見,這種累積模式通常先於 ETH/USD 貨幣對價格大幅上漲。

Ethereum in the Futures Market

期貨市場中的以太坊

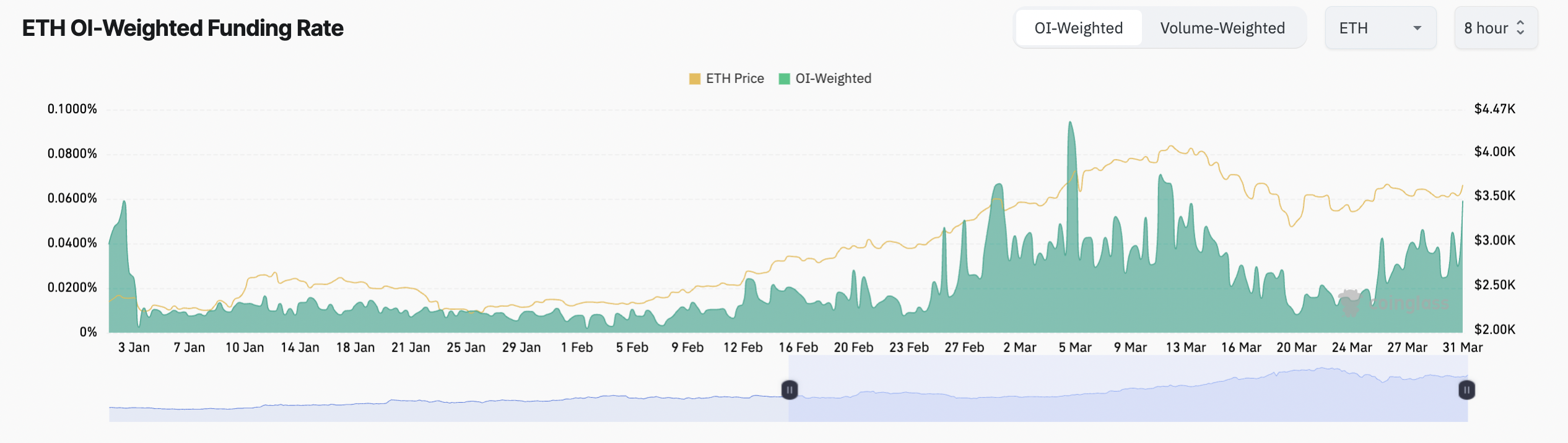

Ethereum’s price increase today coincided with a sharp rise in funding rates in the futures market. Notably, as of March 31, the funding rate for Dogecoin futures contracts reached its highest level since March 12, at 0.0591% every eight hours or 1.24% weekly, indicating an increased cost of holding long positions.

以太坊今日價格上漲恰逢期貨市場融資利率大幅上漲。值得注意的是,截至3月31日,狗狗幣期貨合約的資金費率達到3月12日以來的最高水平,每八小時0.0591%,每週1.24%,顯示持有多頭頭寸的成本增加。

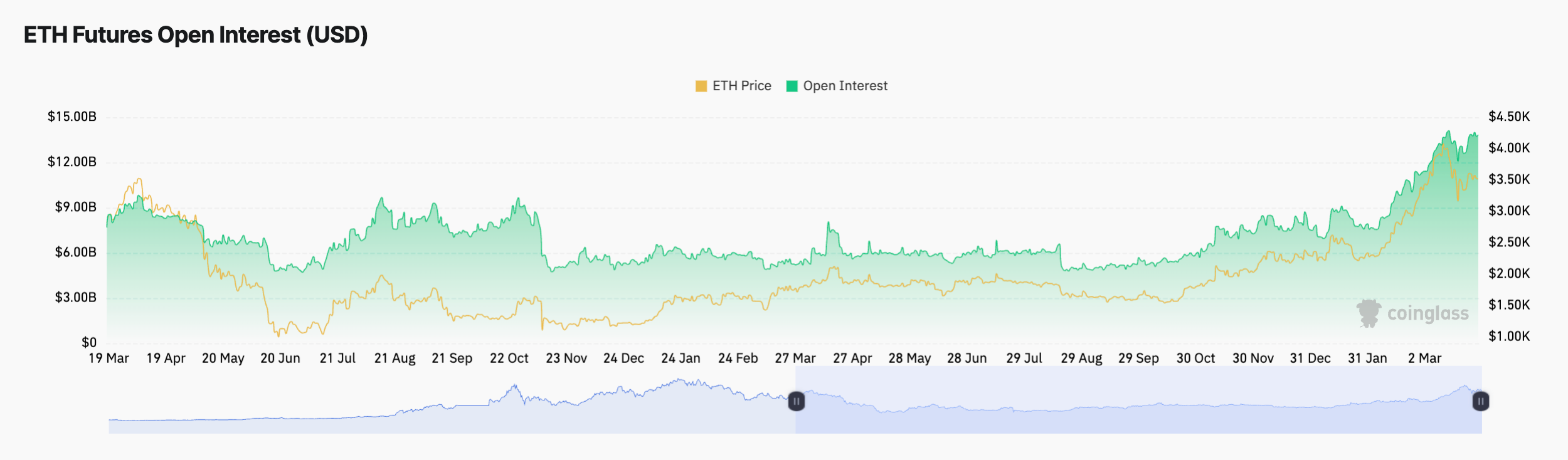

At the same time, Ethereum’s open interest, or the total number of outstanding futures contracts, stabilized around $14 billion after reaching an all-time high three days prior.

與此同時,以太坊的未平倉合約(即未平倉期貨合約總數)在三天前達到歷史新高後穩定在 140 億美元左右。

The rising funding rates, along with the stabilized open interest, suggest that investors are borrowing more to finance their long positions, expecting the asset’s price to rise and hoping to increase their returns.

融資利率上升以及未平倉合約穩定表明,投資者正在藉入更多資金來為其多頭頭寸融資,預期資產價格上漲並希望增加回報。

The post first appeared on COINTURK NEWS: Ethereum Price Surge: Analyzing the Underlying Factors

該貼文首次出現在 COINTURK 新聞上:以太坊價格飆升:分析潛在因素

Crypto Intelligence

Crypto Intelligence Bitcoin Sistemi EN

Bitcoin Sistemi EN CoinsProbe

CoinsProbe CryptoPotato_News

CryptoPotato_News CoinsProbe

CoinsProbe DogeHome

DogeHome Coin_Gabbar

Coin_Gabbar Crypto News Flash

Crypto News Flash Optimisus

Optimisus