Institutional investors apparently have no interest in altcoins as data from Bybit Research show half of institutional’s portfolio is allocated to Bitcoin.

机构投资者显然对山寨币不感兴趣,因为 Bybit Research 的数据显示,机构投资者投资组合的一半分配给了比特币。

Institutions are more interested in Bitcoin (BTC), than Ethereum (ETH) or altcoins, according to a new data from Bybit Research.

Bybit Research 的最新数据显示,机构对比特币 (BTC) 比以太坊 (ETH) 或山寨币更感兴趣。

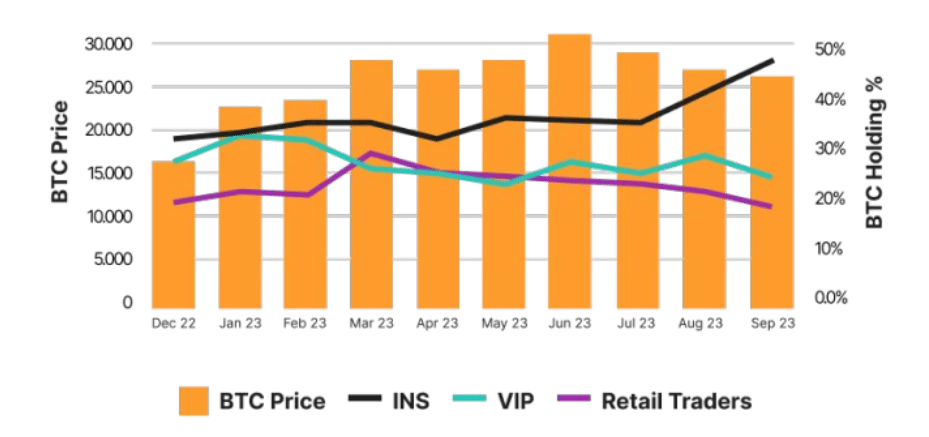

As crypto markets have experienced extreme volatility in 2022, institutional investors increased their Bitcoin holdings during the initial three quarters of 2023, a pattern “distinct from that of other users,” the report says.

报告称,由于加密市场在 2022 年经历了极度波动,机构投资者在 2023 年前三个季度增加了比特币持有量,这种模式“与其他用户不同”。

“Of particular interest is the fact that, in September, half of INS’s asset portfolio was allocated to BTC.”

“特别有趣的是,9 月份 INS 资产组合的一半被分配给了 BTC。”

Bybit Research

拜比特研究

You might also like: Crypto investors are falling into a trap: analyst

您可能还喜欢:分析师:加密货币投资者正在陷入陷阱

As per analysts, the prevailing positive market sentiment toward Bitcoin can be attributed to “favorable lawsuit outcomes,” as the market anticipates good outcome for spot Bitcoin exchange-traded funds (ETFs). However, retail traders in the meantime “exhibit the lowest holding percentage in BTC” compared to institutions, which might be due to their “comparatively higher leverage levels,” Bybit suggests.

分析师认为,市场对比特币普遍的积极情绪可以归因于“有利的诉讼结果”,因为市场预计现货比特币交易所交易基金(ETF)会取得良好的结果。然而,Bybit 表示,与机构相比,零售交易者同时“表现出最低的 BTC 持有比例”,这可能是由于他们“杠杆水平相对较高”。

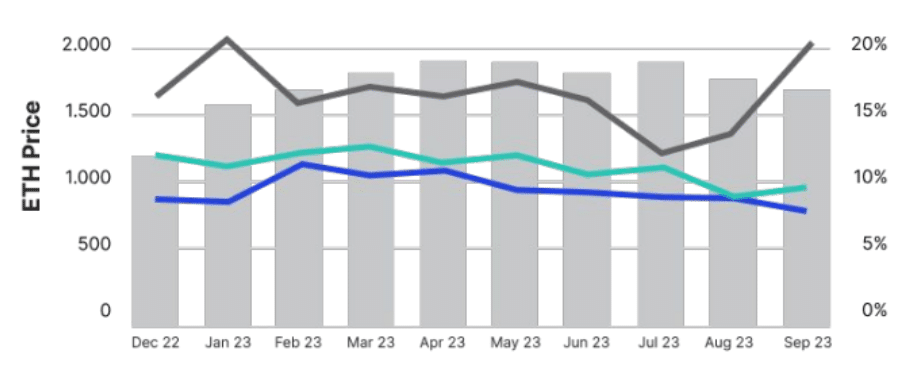

It appears institutions have also started slowly allocating their funds to Ethereum since Sept. 2023, but analysts think this surge of activity may have to do with institutions’ “general upbeat sentiment toward crypto” as VIP and retail traders are demonstrating lack of interest in Ethereum since the Shanghai upgrade (also known as “Shapella”).

自 2023 年 9 月以来,机构似乎也开始缓慢地将资金分配给以太坊,但分析师认为,这种活动激增可能与机构“对加密货币的普遍乐观情绪”有关,因为 VIP 和零售交易者表现出对以太坊缺乏兴趣自上海升级(也称为“Shapella”)以来。

For the research report, Bybit generated data based on its active users base from Dec. 2022 – Sept. 2023. VIP traders are said to be investors with holding portfolio worth more than $50,000.

在该研究报告中,Bybit 根据 2022 年 12 月至 2023 年 9 月的活跃用户群生成了数据。据说 VIP 交易者是持有投资组合价值超过 50,000 美元的投资者。

Meanwhile, crypto industry executives have declared the start of a new bull run, with more voices calling for new all-time highs for Bitcoin above $100,000 in 2024. For instance, Pascal Gauthier, CEO of Ledger, noted in an interview with CNBC that 2023 was a year of preparation for the growth ahead, adding that the sentiment for 2024 and 2025 is “very encouraging.”

与此同时,加密行业高管宣布新一轮牛市即将开始,越来越多的声音呼吁比特币在 2024 年突破 10 万美元的历史新高。例如,Ledger 首席执行官 Pascal Gauthier 在接受 CNBC 采访时指出,2023 年比特币价格将达到 10 万美元以上。今年是为未来增长做准备的一年,并补充说 2024 年和 2025 年的市场情绪“非常令人鼓舞”。

Read more: Investors scramble for Dogecoin rival’s presale, anticipating price surge

阅读更多:投资者争相抢购狗狗币竞争对手的预售,预计价格飙升

Coin Edition

Coin Edition DogeHome

DogeHome Coin_Gabbar

Coin_Gabbar Coincu

Coincu BlockchainReporter

BlockchainReporter CoinPedia News

CoinPedia News TheNewsCrypto

TheNewsCrypto CFN

CFN