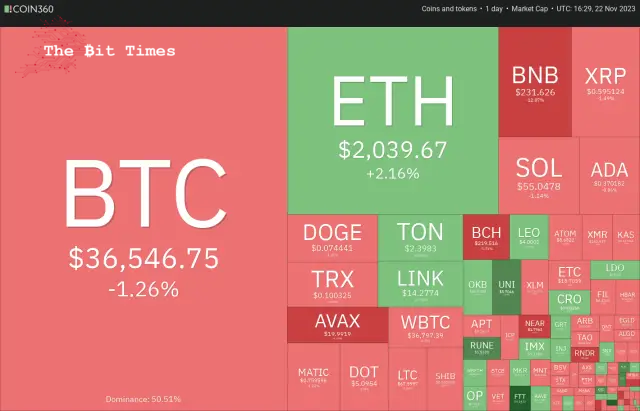

The significant resurgence in Bitcoin (BTC) and specific alternative cryptocurrencies indicates that bullish sentiment continues to prevail, with investors consistently showing interest in purchasing these assets at reduced prices.

比特币(BTC)和特定替代加密货币的大幅复苏表明看涨情绪继续盛行,投资者始终表现出以较低价格购买这些资产的兴趣。

Traders generally have a solid aversion to uncertainty, so the recent resolution between Binance, Changpeng “CZ” Zhao, and the United States Department of Justice will likely foster a positive outlook for the cryptocurrency market. Most analysts have expressed optimism regarding this development, although a minority have voiced caution, citing the ongoing lawsuit by the Securities and Exchange Commission against Binance.

交易者普遍厌恶不确定性,因此币安、赵长鹏和美国司法部最近达成的决议可能会促进加密货币市场的积极前景。大多数分析师对这一发展表示乐观,但也有少数分析师表示谨慎,理由是美国证券交易委员会正在对币安提起诉讼。

On November 21st, Bitcoin and various major alternative cryptocurrencies experienced a substantial decline in value following the Binance-related news. However, it appears traders swiftly intervened after the initial knee-jerk reaction, taking advantage of the lower prices. Following this initial rebound, the bullish momentum is anticipated to encounter significant resistance from bearish forces.

11 月 21 日,币安相关消息传出后,比特币和各种主要替代加密货币的价值大幅下跌。然而,在最初的本能反应之后,交易商似乎利用较低的价格迅速进行了干预。在最初的反弹之后,看涨势头预计将遇到看跌力量的重大阻力。

Buying on dips and selling on rallies results in a range-bound action as both the bulls and the bears battle it for supremacy. Generally, a consolidation near the 52-week high is considered a bullish sign, but traders should wait for an upside confirmation before jumping in to buy.

逢低买入和逢高卖出会导致区间波动,因为多头和空头都在争夺霸主地位。一般来说,在 52 周高点附近盘整被认为是看涨信号,但交易者应等待上行确认后再买入。

Will Bitcoin and select altcoins remain stuck inside a range for the next few days? What are the critical levels to watch out for?

在接下来的几天里,比特币和部分山寨币是否会继续停留在区间内?需要注意的关键水平是什么?

Let’s analyse the charts of the top 10 cryptocurrencies to find out.

让我们分析一下前 10 名加密货币的图表来找出答案。

Bitcoin (BTC) price analysis

比特币(BTC)价格分析

The bears pulled Bitcoin below the 20-day exponential moving average ($35,948) on Nov 21st but could not sustain the lower levels. Strong buying by the bulls pushed the price back above the 20-day EMA on Nov 22nd.

11 月 21 日,空头将比特币拉低至 20 天指数移动平均线(35,948 美元)以下,但无法维持较低水平。 11 月 22 日,多头的强劲买盘将价格推回 20 日均线上方。

The BTC/USDT pair has been consolidating between $34,800 and $38,000 for several days. This indicates a balance between supply and demand. A minor positive in favour of the bulls is that the 20-day EMA slows up, and the relative strength index (RSI) remains in the positive zone.

BTC/USDT 货币对连续几天在 34,800 美元至 38,000 美元之间盘整。这表明供需之间达到平衡。有利于多头的一个小利好是 20 日均线放缓,相对强弱指数 (RSI) 仍处于正值区域。

If bulls propel the price above $38,000, the pair could start the next leg of the uptrend to $40,000. This level may act as a formidable resistance, but the team may soar to $48,000 if cleared.

如果多头将价格推高至 38,000 美元以上,则该货币对可能会开始下一阶段的上升趋势至 40,000 美元。该水平可能会成为一个强大的阻力位,但如果清除,该团队的股价可能会飙升至 48,000 美元。

On the contrary, if the price turns down and breaks below $34,800, it will suggest that the traders are rushing to the exit. That may open the doors for a further decline to $32,400.

相反,如果价格下跌并跌破34,800美元,则表明交易者正在急于退出。这可能为进一步下跌至 32,400 美元打开大门。

Ether (ETH) price analysis

以太币(ETH)价格分析

Ether turned down from the resistance line on Nov 20th and slipped below the 20-day EMA ($1,957) on Nov 21st.

以太坊于 11 月 20 日从阻力线下跌,并于 11 月 21 日跌破 20 日均线(1,957 美元)。

However, the bulls had other plans. They aggressively purchased the drop below the 20-day EMA and are again trying to overcome the barrier at the resistance line. This remains a pivotal level to watch because a break above it could start a rally to $2,137 and then to $2,200.

然而,公牛队还有其他计划。他们在 20 日均线下方积极买入,并再次试图克服阻力线的障碍。这仍然是一个值得关注的关键水平,因为突破该水平可能会开始反弹至 2,137 美元,然后升至 2,200 美元。

On the downside, $1,880 is a necessary support to watch out for. If this level fails, the ETH/USDT pair may start a deeper correction to the 50-day simple moving average ($1,791). That could delay the start of the next leg of the up-move.

下行方面,1,880 美元是值得关注的必要支撑位。如果这个水平失败,ETH/USDT 货币对可能会开始对 50 日简单移动平均线(1,791 美元)进行更深层次的修正。这可能会推迟下一阶段上涨的开始。

BNB price analysis

BNB价格分析

BNB 于 11 月 21 日经历了疯狂上涨,盘中最高价为 272 美元,最低价为 224 美元。这表明多头和空头之间的下一步走势存在不确定性。

A minor positive is that the bulls did not allow the price to break below the significant support at $223. That started a recovery on Nov 22nd, and the bulls are trying to push the price back above the 20-day EMA ($240). If they succeed, it will signal that the BNB/USDT pair may consolidate between $223 and $265 for some time.

一个小的积极因素是,多头不允许价格跌破 223 美元的重要支撑位。 11 月 22 日开始复苏,多头正试图将价格推回到 20 日均线(240 美元)上方。如果成功,这将表明 BNB/USDT 货币对可能会在一段时间内在 223 美元至 265 美元之间盘整。

Conversely, if the price fails to sustain above the 20-day EMA, it will suggest that bears are selling on rallies. That could again pull the price toward $223. A break below this support could extend the fall to $203.

相反,如果价格未能维持在 20 日均线之上,则表明空头正在逢高抛售。这可能会再次将价格推向 223 美元。跌破该支撑位可能会导致跌幅扩大至 203 美元。

XRP price analysis

瑞波币价格分析

XRP turned down from the 20-day EMA ($0.61) on Nov 20th and fell to the 50-day SMA ($0.57) on Nov 21st.

XRP 从 11 月 20 日的 20 日均线(0.61 美元)下跌,并于 11 月 21 日跌至 50 日均线(0.57 美元)。

The bulls are expected to defend the support at $0.56 because a failure to do so may result in a drop toward $0.46. The slightly downsloping 20-day EMA and the RSI just below the midpoint indicate a minor advantage to the bears.

预计多头将守住 0.56 美元的支撑位,因为如果未能做到这一点,可能会导致跌向 0.46 美元。略微向下倾斜的 20 日均线和略低于中点的 RSI 表明空头有较小的优势。

If the price breaks above the 20-day EMA, it will suggest strong buying at lower levels. That will signal a possible range-bound action between $0.56 and $0.74 for a few days. The bulls will return to the driver’s seat after the XRP/USDT pair rises above $0.74.

如果价格突破 20 日均线,则表明较低水平的强劲买盘。这将预示着几天内可能在 0.56 美元至 0.74 美元之间波动。在 XRP/USDT 货币对升至 0.74 美元以上后,多头将重新占据主导地位。

Solana (SOL) price analysis

Solana (SOL) 价格分析

Solana climbed above the critical overhead resistance of $0.59 on Nov 19th, but the bulls could not build upon this strength. The bears pulled the price back below $0.59 on Nov 20th.

Solana 于 11 月 19 日攀升至 0.59 美元的关键上方阻力位,但多头无法利用这一强势。 11 月 20 日,空头将价格拉回至 0.59 美元以下。

The SOL/USDT pair snapped back from the 20-day EMA ($51) on Nov 22nd, indicating that the bulls vigorously protect the level. Buyers will again try to overcome the obstacle at $59 and challenge the local high at $68.

SOL/USDT 货币对于 11 月 22 日从 20 日均线(51 美元)反弹,表明多头大力保护该水平。买家将再次尝试克服 59 美元的障碍,并挑战 68 美元的局部高点。

On the contrary, if the price again turns down from $59, it will suggest that bears remain active at higher levels. Sellers will again attempt to sink the price below the vital support at $48. If this level allows, the pair may nosedive to the 50-day SMA ($37).

相反,如果价格再次从 59 美元下跌,则表明空头在更高水平上仍然活跃。卖家将再次试图将价格压低至 48 美元的重要支撑位以下。如果该水平允许,该货币对可能会暴跌至 50 日移动平均线(37 美元)。

Cardano (ADA) price analysis

卡尔达诺(ADA)价格分析

Repeated failures of the bulls to maintain Cardano above the breakout level of $0.38 started a correction on Nov 21st.

多头多次未能将卡尔达诺维持在 0.38 美元的突破水平上方,并于 11 月 21 日开始调整。

The price reached the 20-day EMA ($0.35), a strong support. The sharp rebound off this level suggests robust buying by the bulls. It also increases the likelihood of a break above $0.39. If this level is scaled, the ADA/USDT pair could rise to $0.46.

价格触及 20 日均线(0.35 美元),这是一个强有力的支撑。从该水平大幅反弹表明多头强劲买盘。它还增加了突破 0.39 美元的可能性。如果扩大这一水平,ADA/USDT 货币对可能会上涨至 0.46 美元。

Bears must quickly drag the price below the 20-day EMA if they want to prevent the rally. There is minor support at $0.34, but if it cracks, the pair may slide to the 50-day SMA ($0.30).

如果空头想阻止反弹,就必须迅速将价格拖至 20 日均线下方。 0.34 美元有小支撑,但如果突破,该货币对可能会滑向 50 日移动平均线(0.30 美元)。

Dogecoin (DOGE) price analysis

狗狗币 (DOGE) 价格分析

Dogecoin plunged below the 20-day EMA ($0.07) on Nov 21st, but the bears struggle to sustain the lower levels.

狗狗币于 11 月 21 日跌破 20 日均线(0.07 美元),但空头难以维持较低水平。

The bulls are trying to push the DOGE/USDT pair back above the 20-day EMA. It will suggest aggressive buying on dips if they can pull it off. The bulls will then make one more attempt to clear the overhead hurdle at $0.08 and start the march toward $0.10.

多头正试图将 DOGE/USDT 货币对推回到 20 日均线上方。如果他们能成功的话,这将建议逢低积极买入。然后,多头将再次尝试清除 0.08 美元的上方障碍,并开始向 0.10 美元进军。

Alternatively, the bears will try to sell the rallies and keep the price pinned below the 20-day EMA. That could open the doors for a potential drop to the 50-day SMA ($0.07) and eventually to the crucial support at $0.06.

或者,空头将尝试逢高卖出并将价格保持在 20 日均线下方。这可能为跌至 50 日移动平均线(0.07 美元)并最终跌至 0.06 美元的关键支撑位打开大门。

Toncoin (TON) price analysis

Toncoin has been finding support at the 50-day SMA ($2.19), indicating that the sentiment remains positive and traders buy on dips.

Toncoin (TON) 价格分析 Toncoin 一直在 50 日移动平均线(2.19 美元)处找到支撑,表明市场情绪依然乐观,交易者逢低买入。

Both moving averages remain flattish, and the RSI is just above the midpoint, indicating a range-bound action in the short term. If the price is above $2.40, the TON/USDT pair may rise to $2.59.

两条移动平均线均保持平稳,RSI 略高于中点,表明短期内将出现区间波动。如果价格高于 2.40 美元,TON/USDT 货币对可能会上涨至 2.59 美元。

Contrary to this assumption, if the price breaks below the 20-day EMA, the pair could test the support at the 50-day SMA. The pair may move downward to $2 and $1.89 if this support cracks.

与这一假设相反,如果价格跌破 20 日均线,该货币对可能会测试 50 日均线的支撑。如果该支撑位破裂,该货币对可能会下跌至 2 美元和 1.89 美元。

Chainlink (LINK) price analysis

Chainlink turned down from the immediate resistance of $15.39 on Nov 20th and fell below the 20-day EMA ($13.63) on Nov 21st.

Chainlink (LINK) 价格分析 Chainlink 从 11 月 20 日的直接阻力位 15.39 美元回落,并于 11 月 21 日跌破 20 日均线(13.63 美元)。

The LINK/USDT pair rebounded above the 20-day EMA on Nov 22nd, indicating demand at lower levels. Buyers will again try to propel the price above $15.39 and retest the overhead resistance at $16.60.

LINK/USDT 货币对于 11 月 22 日反弹至 20 日均线上方,表明需求处于较低水平。买家将再次尝试将价格推高至 15.39 美元上方,并重新测试上方阻力位 16.60 美元。

Meanwhile, the bears are likely to have other plans. They will try to defend the $15.39 level and pull the price below the 61.8% Fibonacci retracement level of $12.83. The pair may plummet to the 50-day SMA ($10.94) if they do that.

与此同时,空头可能还有其他计划。他们将努力守住 15.39 美元的水平,并将价格拉至 61.8% 斐波那契回撤位 12.83 美元以下。如果这样做,该货币对可能会暴跌至 50 日移动平均线(10.94 美元)。

Avalanche (AVAX) price analysis

雪崩 (AVAX) 价格分析

Avalanche closed above the $10.52 to $22 range on Nov 19th, but the bulls could not maintain the higher levels. The bears pulled the price back below the breakout level on Nov 20th.

11 月 19 日,Avalanche 收盘于 10.52 美元至 22 美元区间之上,但多头无法维持较高水平。空头将价格拉回到 11 月 20 日的突破水平以下。

The 20-day EMA ($17.71) slows up, and the RSI is in positive territory, indicating that the bulls have the upper hand. Buyers will again try to propel the price above $22, and if they are successful, it will suggest the start of a new up-move. The AVAX/USDT pair could then start its journey toward $30.

20 日均线(17.71 美元)放缓,RSI 处于正值区域,表明多头占据上风。买家将再次尝试将价格推高至 22 美元以上,如果成功,则意味着新一轮上涨的开始。然后 AVAX/USDT 货币对可能会开始走向 30 美元。

Contrarily, if the price turns down from $22, it will indicate that the bears vigorously protect the level. That will increase the possibility of a break below the 20-day EMA. If that happens, the pair may remain stuck inside the extensive range longer.

相反,如果价格从 22 美元下跌,则表明空头正在大力保护该水平。这将增加跌破20日均线的可能性。如果发生这种情况,该货币对可能会在广泛的区间内停留更长时间。

Source – Rakesh Upadhyay

来源——Rakesh Upadhyay

Source: https://thebittimes.com/latest-market-overview-22nd-nov-btc-eth-bnb-xrp-sol-ada-doge-ton-link-avax-tbt71288.html

资料来源:https://thebittimes.com/latest-market-overview-22nd-nov-btc-eth-bnb-xrp-sol-ada-doge-ton-link-avax-tbt71288.html

Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™ DogeHome

DogeHome TheCoinrise Media

TheCoinrise Media Thecoinrepublic.com

Thecoinrepublic.com TheCoinrise Media

TheCoinrise Media TheCoinrise Media

TheCoinrise Media Cryptopolitan_News

Cryptopolitan_News