The flagship crypto asset could surge depending on what one major macro indicator does next, according to analytics platform Santiment.

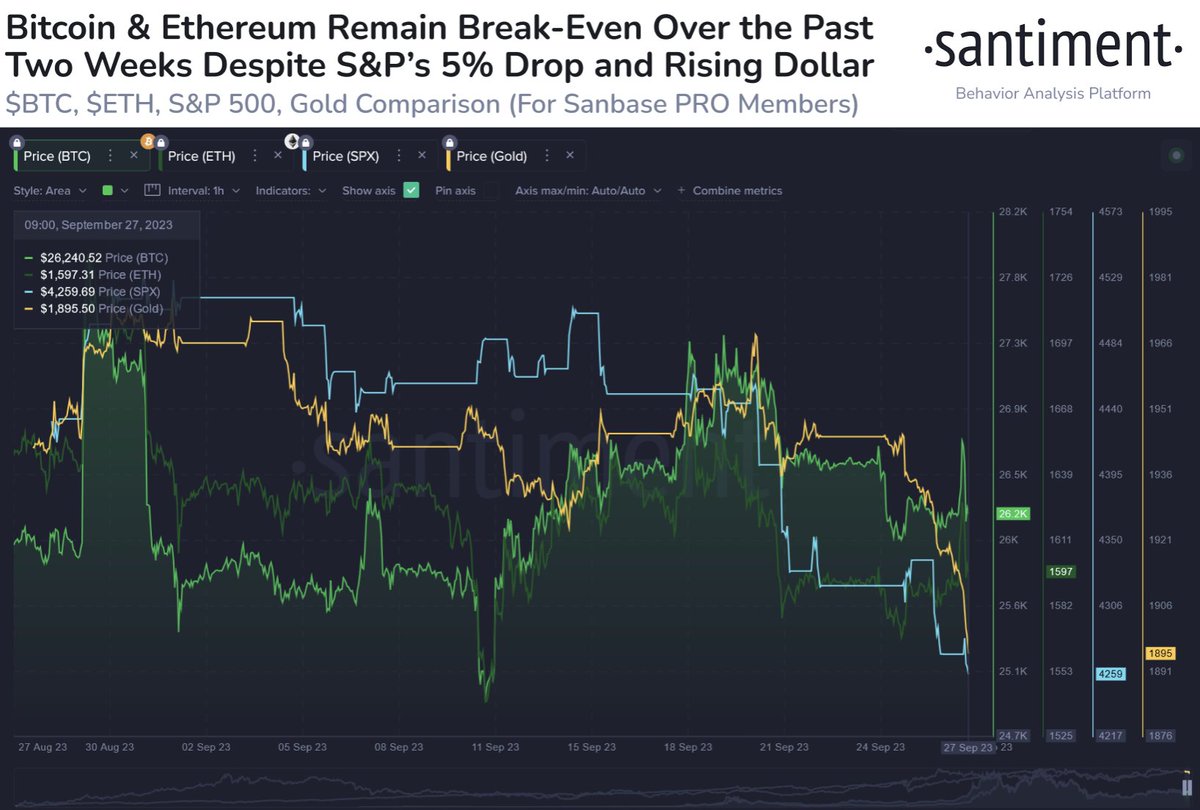

The analytics firm reports that the US dollar index (DXY) has reached a ten-month high, causing a decline in crypto assets and the S&P 500 stocks index.

According to Santiment, Bitcoin (BTC) has remained at a break-even point during the past two weeks, unlike the S&P 500 index which has fallen by 5% over the same period, despite the strong dollar. This may “indicate a breakout could come once the DXY settles down.”

Bitcoin is trading at $26,459 at time of writing.

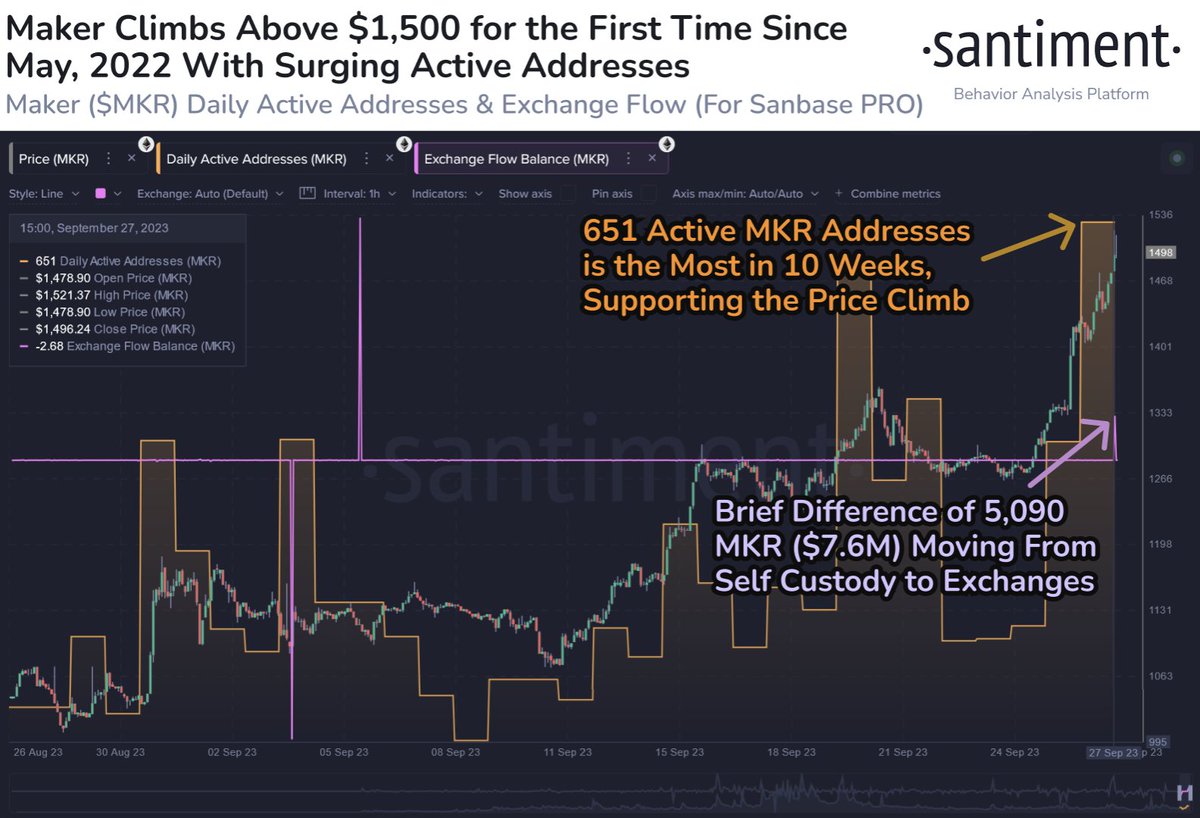

Turning to altcoins, Santiment says that caution is warranted on Maker (MKR) amid the native token of decentralized finance project Maker Protocol rallying by over 40% in slightly over a fortnight to hit a 16-month high.

“An inflow of MKR moving to exchanges is something to be cautious of for at least a temporary local top.”

Maker is trading at $1,520 at time of writing.

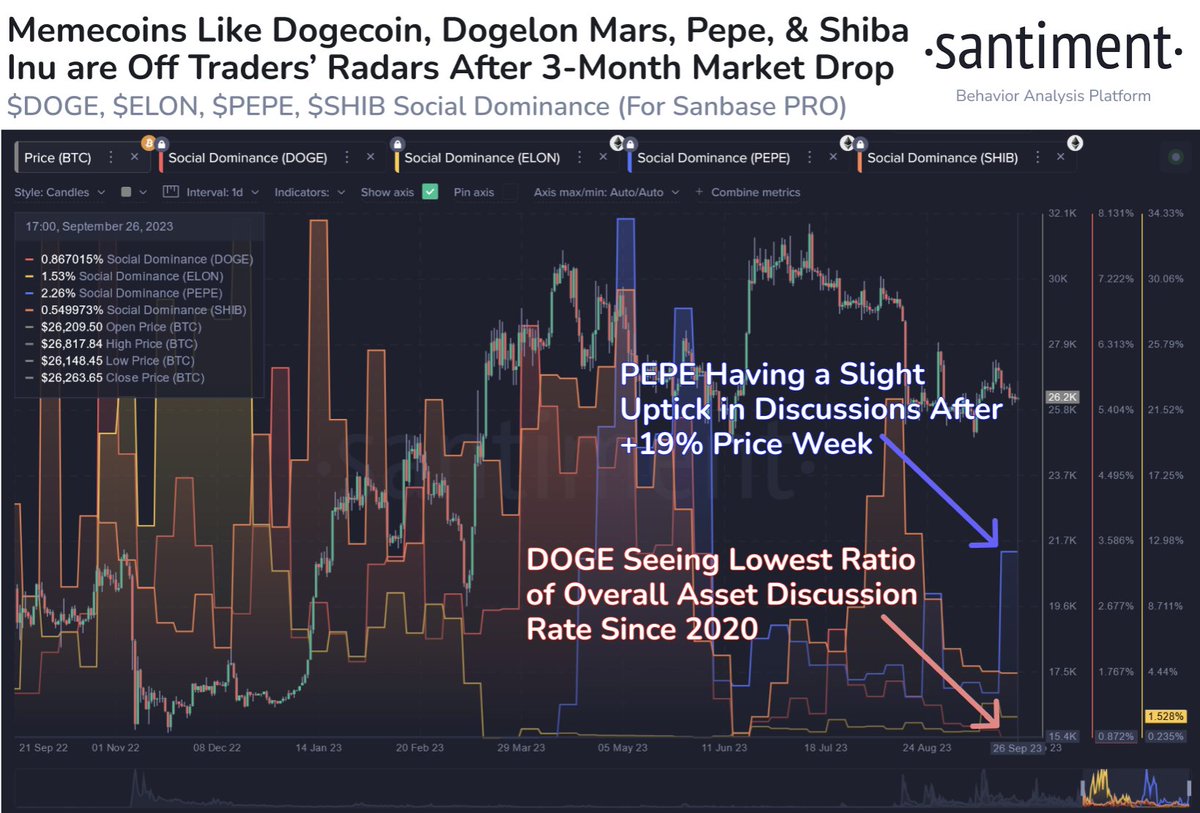

On memecoins such as Dogecoin (DOGE), Santiment says,

“As altcoins have seen more declines than gains since the mid-July crypto market local top, memecoins are showing a smaller ratio of overall trader interest than they have in some time. Particularly, DOGE has the lowest discussion rate since 2020.”

Dogecoin is trading at $0.0609 at time of writing, down by around 27% from the five-month high of $0.0838 reached in July.

DogeHome

DogeHome TheCoinrise Media

TheCoinrise Media Thecoinrepublic.com

Thecoinrepublic.com Optimisus

Optimisus CryptoPotato_News

CryptoPotato_News BlockchainReporter

BlockchainReporter Optimisus

Optimisus