The Impact of the U.S. Presidential Election on Bitcoin (BTC)

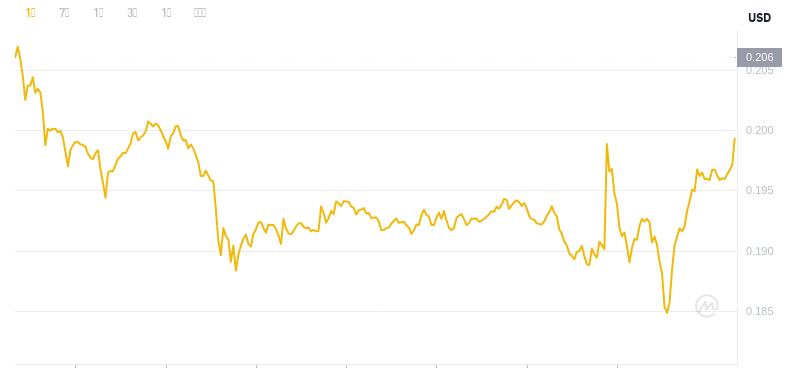

As the November 5th presidential election approaches, Bitcoin's value is experiencing significant volatility, oscillating around $69,000 with expectations of extreme price fluctuations. Both traders and analysts anticipate substantial swings of up to 10%, depending on the outcome of the race between former President Donald Trump and Vice President Kamala Harris.

Trump vs. Harris: Potential Election Impacts on Bitcoin

Trump has historically been perceived as supportive of cryptocurrencies, advocating for the U.S. to become a global leader in the space. He has promised to reshape crypto regulations, address policies implemented by Securities and Exchange Commission (SEC) Chair Gary Gensler, and establish the U.S. as a "world capital of crypto." Harris, on the other hand, endorses a cautious regulatory framework designed to foster innovation while safeguarding consumer interests.

According to Polymarket, a crypto-based betting platform, Trump's election odds have fluctuated recently. After reaching 67% in late October, his odds have dipped to 56% as Harris has gained support. This shift coincided with a brief decline in BTC's value below $69,000, resulting in liquidations of approximately $350 million. These swings highlight the market's heightened sensitivity to election outcomes.

Potential for Bitcoin to Reach $80,000 Post-Election

With Bitcoin currently trading at around $69,000, analysts predict that a Trump victory could serve as a bullish catalyst, potentially driving BTC to record highs of $80,000 or more. BTC's near-record price of $73,300 on October 29th suggests bullish sentiment. Investors are speculating on election-driven momentum and increased interest in Bitcoin ETFs. Data indicates significant capital inflows into Bitcoin ETFs, such as BlackRock's iShares Bitcoin Trust (IBIT) reporting $642.9 million in inflows, bolstering confidence in Bitcoin's trajectory.

Tony Sycamore, an IG Markets analyst, believes a clear breakout above $74,000 could solidify an uptrend, propelling BTC to new highs. However, caution remains; a drop below $65,000 could disrupt the uptrend.

Volatility and Liquidations Signal Market Jitters

Following the decline in Trump's odds on Polymarket, Bitcoin briefly fell below $69,000, resulting in $349.8 million in liquidations, primarily from long positions. This marked the highest liquidation day since October 25th, indicating the fragile sentiment surrounding the election.

According to crypto analyst Daan Crypto Trades, Bitcoin could experience "at least a 10% move in either direction" depending on the outcome, suggesting that November 5th could be a turning point. BTC's current weekly close is "not the cleanest," indicating susceptibility to short-term events.

Beyond the Election: Interest Rate Cuts and Regulatory Changes

Regardless of the election outcome, market participants anticipate continued interest rate cuts by the Federal Reserve, which could further fuel Bitcoin's bullish momentum. Expectations are high for additional easing measures that would increase the attractiveness of alternative investments, potentially benefiting the crypto market.

Analysts are optimistic, predicting that BTC could surge to $100,000 if conditions remain favorable, especially if a Trump win leads to more lenient crypto regulations. Conversely, a Harris win may result in conservative measures that could slow Bitcoin's upward trajectory.

Conclusion

With the election approaching, Bitcoin stands at a critical juncture. The potential for a surge to $80,000 or a dip below $65,000 has the crypto market on high alert, mirroring political shifts. As uncertainty persists, traders are preparing for significant post-election volatility, recognizing that the results could shape Bitcoin's direction for the remainder of 2024.

Disclaimer: This article provides informational content and should not be interpreted as legal, tax, investment, or financial advice.

Cryptopolitan_News

Cryptopolitan_News Cryptopolitan_News

Cryptopolitan_News Thecoinrepublic.com

Thecoinrepublic.com DogeHome

DogeHome Optimisus

Optimisus U_Today

U_Today Optimisus

Optimisus DogeHome

DogeHome Optimisus

Optimisus