After many trials and tribulations – and even a string of bankruptcies – Bitcoin (BTC) miners have been able to catch a break in late 2023 with a significant rally in the price of the world’s foremost cryptocurrency.

經過多次考驗和磨難,甚至一連串破產,比特幣 (BTC) 礦商終於在 2023 年底迎來了喘息之機,世界上最重要的加密貨幣的價格大幅上漲。

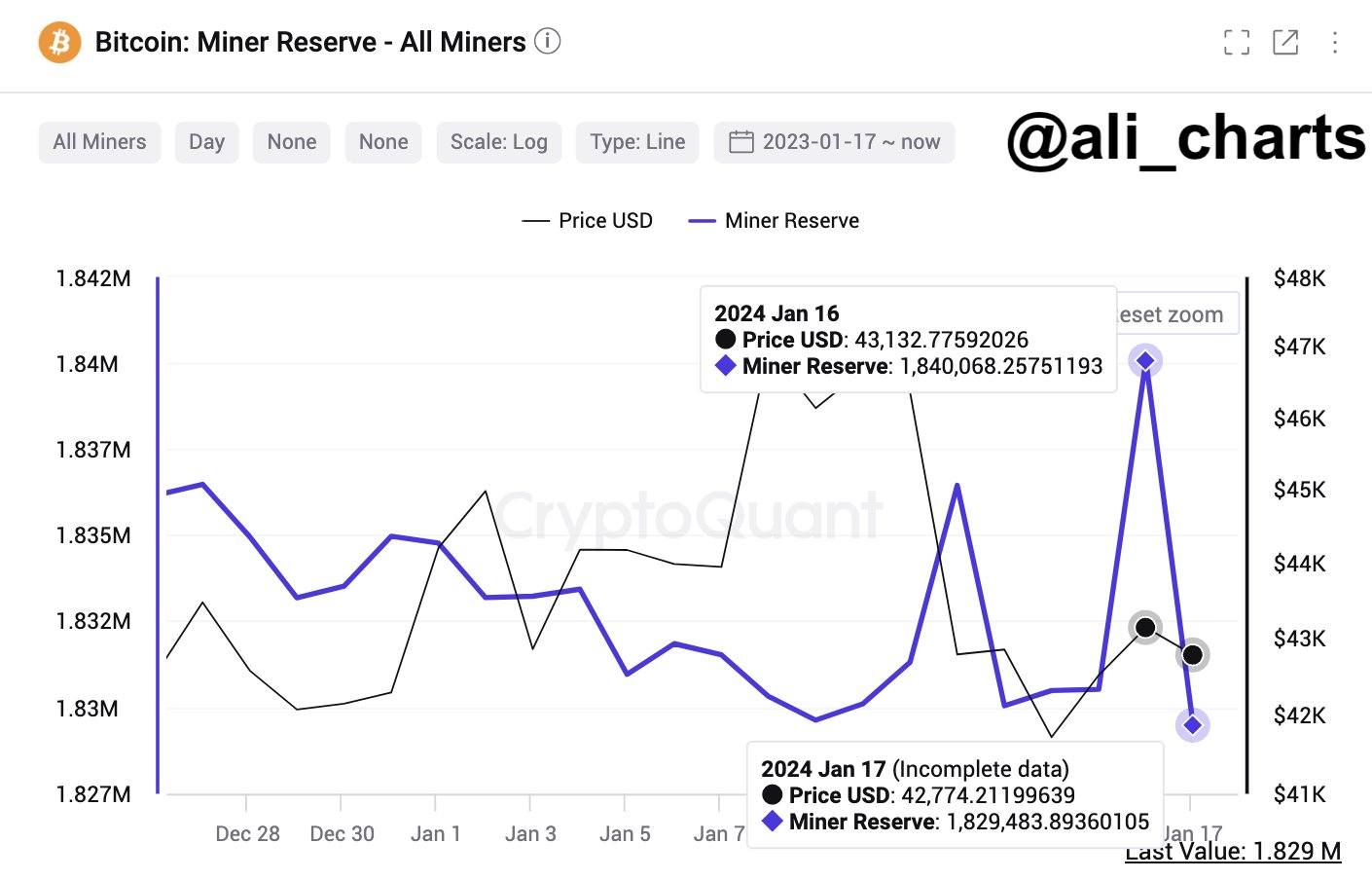

The New Year saw a new trend with these companies as they started selling their cryptocurrency en masse. As of January 17, miners have sold a total of 10,600 BTC worth approximately $452 million, per an X post shared by Ali Martinez, a prominent crypto expert.

新年以來,這些公司出現了新趨勢,他們開始大規模出售加密貨幣。根據加密貨幣專家 Ali Martinez 分享的 X 帖子,截至 1 月 17 日,礦工總共出售了 10,600 個 BTC,價值約 4.52 億美元。

In fact, Bitcoin miners are currently engaged in active selling, and on-chain data indicates that significant selling pressure persists across the major cryptocurrency exchanges, according to the analytics platform Crypto Quant.

事實上,根據分析平台 Crypto Quant 的數據,比特幣礦商目前正在積極拋售,鏈上數據顯示主要加密貨幣交易所仍存在巨大的拋售壓力。

This trend comes as the crypto industry is undergoing several important shifts. Exactly one week ago, on January 10. the SEC announced it had approved a long list of spot Bitcoin exchange-traded funds (ETFs) – the first of their kind in the U.S.

這一趨勢出現之際,加密產業正經歷幾個重要的轉變。就在一週前,也就是 1 月 10 日,美國證券交易委員會 (SEC) 宣布已批准一長串現貨比特幣交易所交易基金 (ETF),這是美國同類基金中的首個。

The historic decision, while driving volume and boosting investor enthusiasm, also caused a major retracement that saw Bitcoin erase $80 billion from its market cap and the entire crypto market approximately $100 billion in just under a week.

這項歷史性決定在推動交易量並提高投資者熱情的同時,也引發了重大回調,比特幣市值在不到一周的時間內蒸發了 800 億美元,整個加密貨幣市場蒸發了約 1000 億美元。

The selloffs also come 11 days after Bitcoin mining difficulty and expenses rose by an estimated 1.78% and less than a hundred days before the halving – an event that will significantly decrease BTC supply and is expected to have a major impact on prices across the board.

這次拋售發生在比特幣挖礦難度和費用預計上漲 1.78% 後 11 天,距離減半還有不到一百天,這一事件將大幅減少 BTC 供應,預計將對全面價格產生重大影響。

Institutions increasingly interested in Bitcoin miners

機構對比特幣礦工越來越感興趣

As it turns out, mining companies have also benefited from significant investments from multiple financial behemoths – including those traditionally critical of, if not even opposed to, Bitcoin – which have been pumping millions into the sector throughout 2023.

事實證明,礦業公司也受益於多個金融巨頭的巨額投資,其中包括那些傳統上批評甚至反對比特幣的金融巨頭,這些巨頭在 2023 年向該行業注入了數百萬美元。

BlackRock (NYSE: BLK), the world’s largest asset manager with $9.42 trillion in assets under management (AUM), has been a major shareholder of 4 out of 5 biggest mining firms since at least August 2023 and has only ramped up its involvement with these firms throughout the second half of the year.

貝萊德(NYSE:BLK)是全球最大的資產管理公司,管理資產達9.42 兆美元,至少自2023 年8 月以來一直是5 家最大礦業公司中4 家的主要股東,並且只是加強了對這些公司的參與。整個下半年的公司。

Additionally, Vanguard – an investment firm with $7.7 trillion in AUM – has also been pumping money into Bitcoin miners and was, as of January 13, the largest shareholder of both Marathon Digital (NASDAQ: MARA) and Riot Platforms Inc. (NASDAQ: RIOT), despite also reportedly blocking its clients from buying the newly-approved BTC ETFs.

此外,資產管理規模達7.7 兆美元的投資公司Vanguard 也一直在向比特幣礦商注入資金,截至1 月13 日,Vanguard 是Marathon Digital(納斯達克股票代碼:MARA)和Riot Platforms Inc. (納斯達克股票代碼:RIOT)的最大股東),儘管據報道還阻止其客戶購買新批准的 BTC ETF。

BTC price analysis

比特幣價格分析

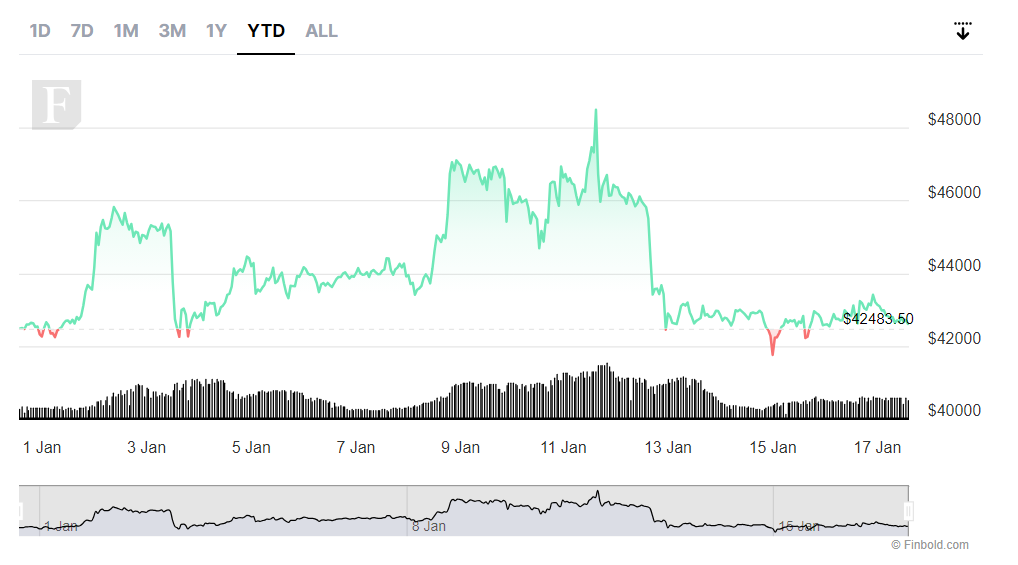

Bitcoin itself has been undergoing a price correction since the start of 2024 and has already faced two sharp and significant price declines. The first came on January 3, when it erased $60 billion in a day, and the second shortly after the EFT approval when it – after briefly retesting $49,000 – quickly crashed to approximately $42,000.

自 2024 年初以來,比特幣本身就一直在經歷價格調整,並已面臨兩次價格大幅下跌。第一次發生在 1 月 3 日,當時一天之內蒸發了 600 億美元,第二次發生在 EFT 批准後不久,在短暫重新測試 49,000 美元後,迅速跌至約 42,000 美元。

Since January 1, Bitcoin is down 3.61%, and the world’s foremost cryptocurrency fell another 0.56% in the last 24 hours, reaching the press-time price of $42,584.

自 1 月 1 日以來,比特幣已下跌 3.61%,全球最重要的加密貨幣在過去 24 小時內又下跌 0.56%,截至發稿時價格為 42,584 美元。

Despite this, Bitcoin has shown some growth in the last 30 days – 2.82% – and a remarkable 52-week price increase of 101.28%. At the time of publication, it decisively retains its top position among cryptocurrencies with a market cap of $834 billion.

儘管如此,比特幣在過去 30 天中還是出現了一些增長——2.82%——並且 52 週價格漲幅高達 101.28%。截至發稿時,它以 8,340 億美元的市值堅定地保持著加密貨幣中的領先地位。

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

免責聲明:本網站的內容不應被視為投資建議。投資是投機性的。投資時,您的資本面臨風險。

Source: https://thebittimes.com/bitcoin-miners-dump-over-450-million-in-a-day-tbt76868.html

資料來源:https://thebittimes.com/bitcoin-miners-dump-over-450-million-in-a-day-tbt76868.html

DogeHome

DogeHome Thecryptoupdates

Thecryptoupdates The Bit Journal

The Bit Journal Times Tabloid

Times Tabloid CoinoMedia

CoinoMedia U_Today

U_Today ETHNews

ETHNews crypto.news

crypto.news CoinPedia News

CoinPedia News