Ethereum (ETH) climbed above $2,000 and tested resistance at $2,130 for the first since April last week amid renewed euphoria around the filing of the first Ether spot exchange-traded fund by global leading asset manager BlackRock.

由于全球领先的资产管理公司贝莱德 (BlackRock) 提交首只以太坊现货交易所交易基金的申请,以太坊 (ETH) 攀升至 2,000 美元上方,并自上周 4 月以来首次测试 2,130 美元的阻力位。

Investors are also looking forward to the potential approval of Bitcoin spot ETFs by the US Securities and Exchange Commission (SEC) later this week, which could also be bullish for Ethereum and other altcoins.

投资者还期待本周晚些时候美国证券交易委员会 (SEC) 可能批准比特币现货 ETF,这也可能对以太坊和其他山寨币有利。

However, the approval of the spot ETFs is not guaranteed since the SEC can decide to postpone its decision.

然而,现货 ETF 的批准并不能得到保证,因为 SEC 可以决定推迟其决定。

Nevertheless, investors turned their attention back to Ethereum price the moment news broke that BlackRock had made the first step toward applying for a spot ETH ETF.

尽管如此,当贝莱德迈出申请现货 ETH ETF 的第一步的消息传出后,投资者将注意力重新转向了以太坊价格。

Can Ethereum Price Uphold Support Above $2,000

以太坊价格能否守住2000美元上方的支撑

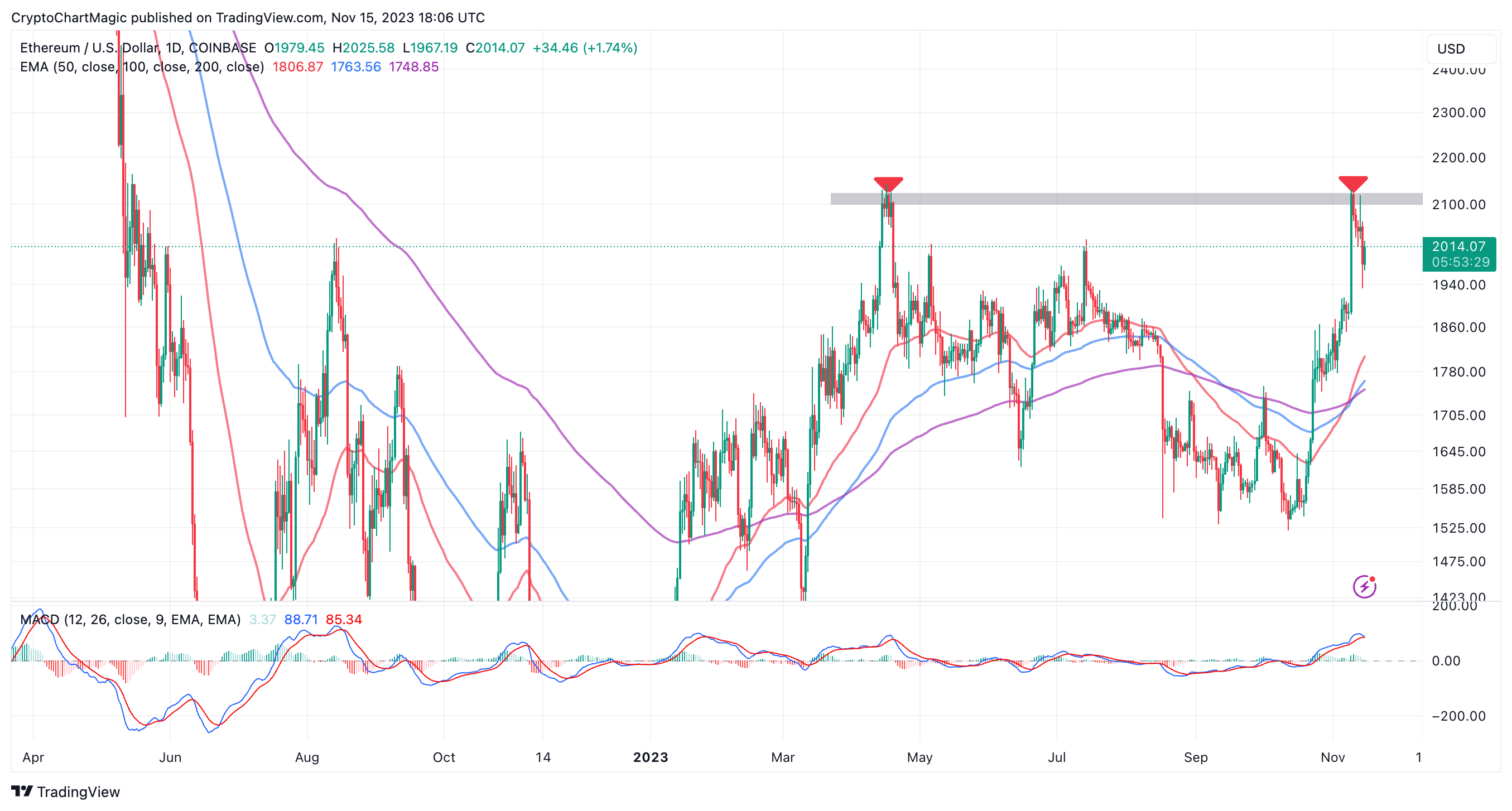

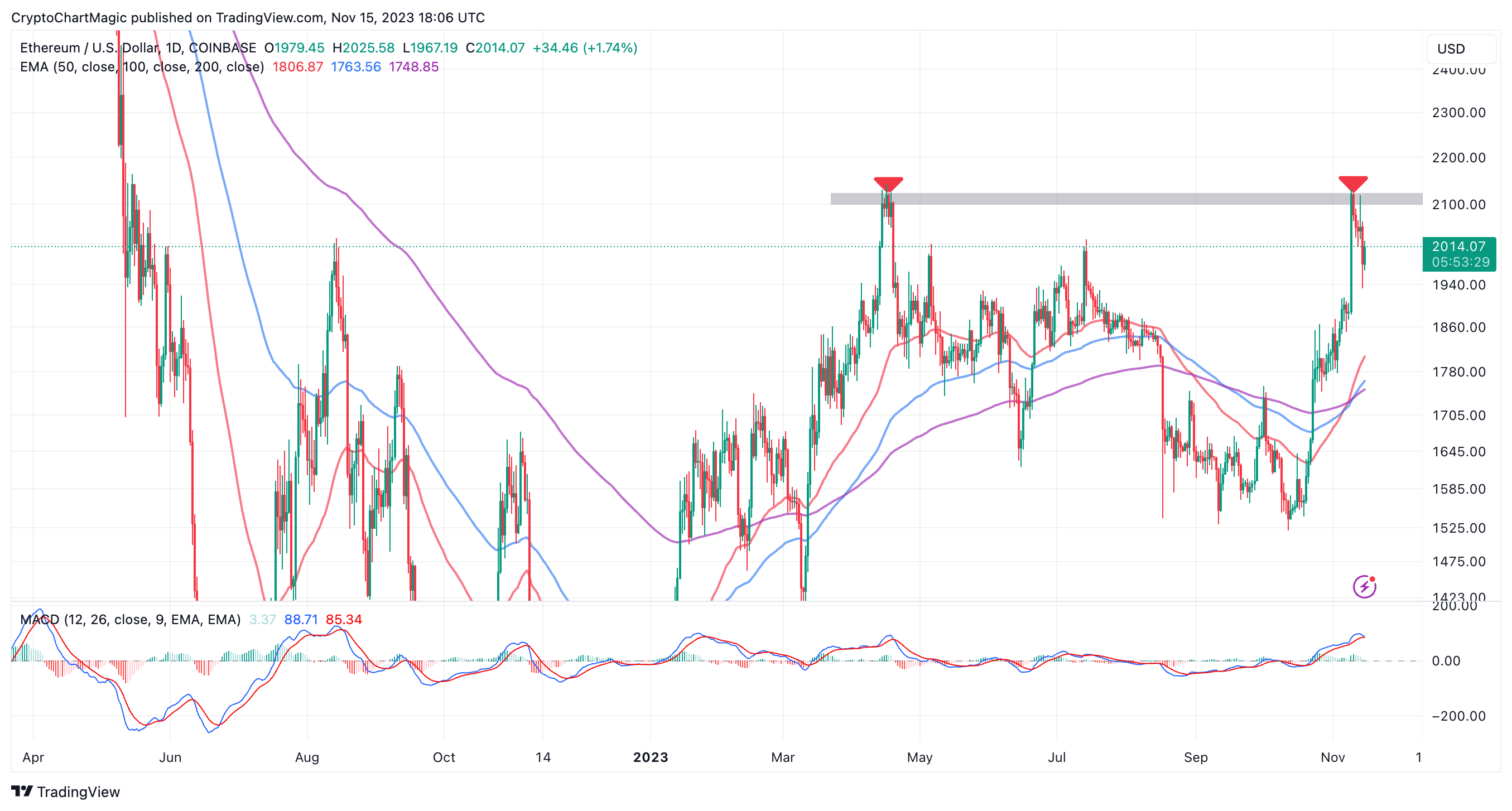

Ether is trading at $2,010 at the time of writing on Wednesday during US business hours. Holding support above $2,000 seems critical for the continuation of the uptrend, especially with bulls having lost the support briefly after the US Consumer Price Index (CPI) data was released on Tuesday.

截至周三美国营业时间撰写本文时,以太币交易价格为 2,010 美元。保持 2,000 美元上方的支撑似乎对于持续上涨趋势至关重要,尤其是在周二美国消费者价格指数 (CPI) 数据发布后多头短暂失去支撑的情况下。

However, with inflation easing in the country, investors are expected to gain confidence in risk assets like Bitcoin and Ethereum. Moreover, geopolitical tensions occasioned by the Israel-Hamas war may continue to drive investors to crypto with ETH and BTC being the biggest contenders.

然而,随着该国通货膨胀的缓解,预计投资者将对比特币和以太坊等风险资产产生信心。此外,以色列与哈马斯战争引发的地缘政治紧张局势可能会继续推动投资者转向加密货币,其中 ETH 和 BTC 是最大的竞争者。

Meanwhile, support above $2,000 would mean that Ethereum has the momentum to keep the uptrend intact. It could also help support the bullish outlook from the Moving Average Convergence Divergence (MACD) indicator.

与此同时,高于 2,000 美元的支撑位意味着以太坊有动力保持上升趋势不变。它还可能有助于支持移动平均线收敛分歧(MACD)指标的看涨前景。

If Ethereum slides below $2,000, it could create instability and possibly lead to a sell-off as traders may want to protect their wallets to avoid liquidations. Investors who bought after the breakout above the seller congestion at $1,900 may want to sell, thus increasing the overhead pressure.

如果以太坊跌破 2,000 美元,可能会造成不稳定,并可能导致抛售,因为交易者可能希望保护自己的钱包以避免清算。在突破 1,900 美元的卖方聚集点之后买入的投资者可能想要卖出,从而增加了间接压力。

The presence of a double-top pattern around $2,130 could further complicate the technical situation for the bulls. Another rejection may lead to a spike in selling pressure.

2,130 美元附近双顶形态的存在可能会使多头的技术形势进一步复杂化。另一次拒绝可能会导致抛售压力激增。

For that reason, market participants are likely to be concerned about Ethereum’s decline below $2,000 which might trigger a sell-off to $1,900 and the local support at $1,800.

因此,市场参与者可能会担心以太坊跌破 2,000 美元,这可能会引发抛售至 1,900 美元和 1,800 美元的本地支撑位。

Traders interested in shorting ETH may want to ensure that the blue MACD line crosses below the red signal line. The momentum indicator will have to persistently drop toward the neutral area to affirm the new bearish thesis.

有兴趣做空 ETH 的交易者可能希望确保蓝色 MACD 线穿过红色信号线下方。动量指标必须持续下降至中性区域才能证实新的看跌论点。

However, there is a very narrow chance that declines will intensify, especially with Ethereum forming double bullish crosses on the daily chart. The first pattern occurred with the 50-day Exponential Moving Average (EMA) (red) moving above the 100-day EMA (blue) followed by the second cross where the same 50-day EMA flipped above the 200-day EMA (purple).

然而,下跌加剧的可能性非常小,尤其是以太坊在日线图上形成双看涨交叉时。第一种形态出现在 50 日指数移动平均线 (EMA)(红色)移至 100 日均线(蓝色)上方,随后出现第二个交叉,其中相同的 50 日指数移动平均线翻转至 200 日均线(紫色)上方。

Combined, these bull market indicators affirm the bullish outlook in the market, propping Ethereum price rally towards $3,000.

这些牛市指标综合起来证实了市场的看涨前景,支撑以太坊价格上涨至 3,000 美元。

Ethereum Network Fees Hit 4-Month Highs

以太坊网络费用创 4 个月新高

According to blockchain data company Santiment, the Ethereum network fees have in the recent past increased to their highest level in four months. This increase also coincided with the token’s climb above $2,000 suggesting that investors were transacting more on-chain.

根据区块链数据公司 Santiment 的数据,以太坊网络费用最近已升至四个月来的最高水平。这一增长也与代币攀升至 2,000 美元以上同时发生,这表明投资者正在更多地进行链上交易。

#Ethereum's fees have unsurprisingly risen as $ETH rose back above $2K last week & network utility surged. Relatively, though, transactions are still cheap compared to $14 May average fee levels we saw. Watch how other ERC-20's are impacted, as well. https://t.co/yuzXALw53z pic.twitter.com/ndw1PYeVEF

#Ethereum 的费用不出所料地上涨,因为上周 ETH 价格回升至 2K 美元以上且网络效用飙升。不过,相对而言,与我们看到的 5 月平均费用水平 14 美元相比,交易仍然便宜。还请关注其他 ERC-20 如何受到影响。 https://t.co/yuzXALw53z pic.twitter.com/ndw1PYeVEF

— Santiment (@santimentfeed) November 14, 2023

- Santiment (@santimentfeed) 2023 年 11 月 14 日

There is always a positive correlation between Ethereum price and the transaction fees. As the price of Ether rallies, investors tend to move more of the token on-chain, which contributes to the volatility and the subsequent uptrend.

以太坊价格与交易费用之间始终存在正相关关系。随着以太币价格上涨,投资者往往会在链上转移更多代币,这会导致波动性和随后的上涨趋势。

Related Articles

相关文章

- CFTC Chair Warns of Potential Repeat of FTX Crisis in Crypto Market

- Dogecoin Co-Founder Reveals His Networth, Prepare for a Shocker

- Avalanche Price Explodes Hitting $20 As Citi Taps AvaCloud For Blockchain FX Solution

CFTC 主席警告加密市场可能重演 FTX 危机

狗狗币联合创始人透露他的净资产,为震惊做好准备

随着花旗利用 AvaCloud 提供区块链外汇解决方案,Avalanche 价格暴涨至 20 美元

The post Ethereum Price Prediction As Double-Top Pattern Threatens ETH Rally, How To Stay Profitable appeared first on CoinGape.

《以太坊价格预测:双顶形态威胁 ETH 反弹,如何保持盈利》首先出现在 CoinGape 上。

DeFi Planet

DeFi Planet Crypto Daily™

Crypto Daily™ BlockchainReporter

BlockchainReporter TheCoinrise Media

TheCoinrise Media DogeHome

DogeHome Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™ TheCoinrise Media

TheCoinrise Media