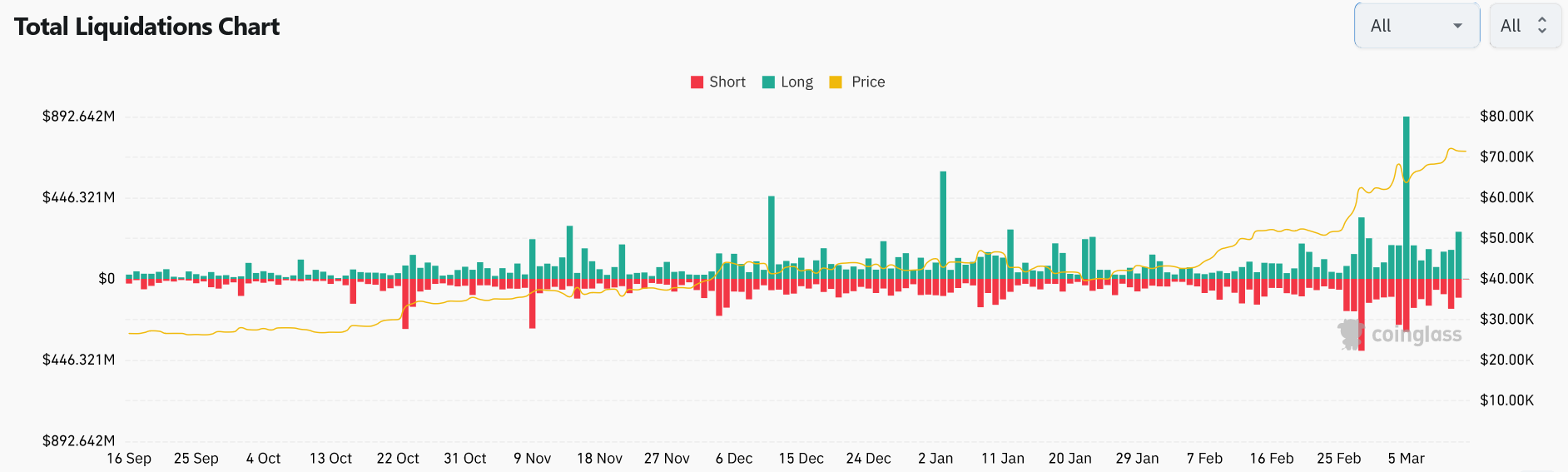

Over $361 million worth of leveraged trades have been liquidated over the last 24 hours as Bitcoin (BTC) hit a new all-time high of $73,050 before falling back down below $70,000 on March 12.

The price swing mostly liquidated long positions — those betting it would rise — with $258 million erased, while short sellers were ousted a little over $103 million, according to data from crypto trading and information platform Coinglass.

It’s the largest long flush-out since March 5, when Bitcoin fell to $60,800 after notching its previous all-time high of around $69,000.

Volatility wasn’t as severe this time around, with Bitcoin’s price only swinging 4.85% between its March 12 low of $69,365 and a high of $72,733, according to CoinGecko.

Bitcoin has since leveled out to $71,400 at the time of publication.

A 10x Research spokesperson told Cointelegraph the uptick in volatility is likely stemming from traders anticipating a price correction.

“Traders are becoming more nervous that we could see a price correction as Bitcoin has failed to rally during [United States] trading hours when the ETFs start trading.”

“At the same time there is big FOMO going on,” which may mean the rally will continue, the spokesperson added.

10x Research also noted that futures open interest increased 5% over the weekend — March 9 and 10 — which it suspects were put on with tight stops.

Related: Bitcoin short sellers are out $161M as Bitcoin surprises with 11% rally

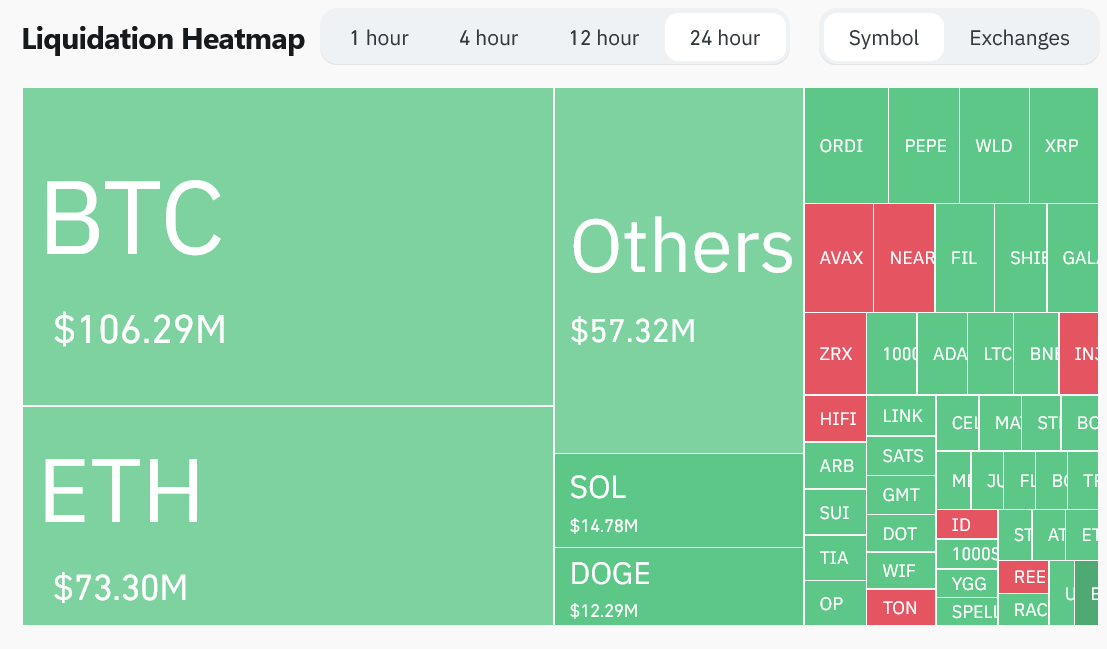

Bitcoin and Ether (ETH) trades accounted for the most liquidations over the last 24 hours at $106.3 million and $73.3 million, respectively.

Solana (SOL), Dogecoin (DOGE) and the Bitcoin-based memecoin Ordi (ORDI) also saw significant liquidations.

The most short and long liquidations occurred on crypto exchange OKX, totaling $152 million, while Binance traders saw combined losses of $128.4 million.

Short sellers lost more than $6 billion trying to bet against publicly traded crypto firms over the first 11 months of 2023 as Bitcoin rallied 130% to $37,800 over the same time, according to research firm S3 Partners.

Magazine: ‘Crypto is inevitable’ so we went ‘all in’ — Meet Vance Spencer, permabull

Coincu

Coincu Coin Edition

Coin Edition DogeHome

DogeHome Coin_Gabbar

Coin_Gabbar Coincu

Coincu BlockchainReporter

BlockchainReporter CoinPedia News

CoinPedia News TheNewsCrypto

TheNewsCrypto