Over $361 million worth of leveraged trades have been liquidated over the last 24 hours as Bitcoin (BTC) hit a new all-time high of $73,050 before falling back down below $70,000 on March 12.

在過去 24 小時內,價值超過 3.61 億美元的槓桿交易被清算,比特幣 (BTC) 創下 73,050 美元的歷史新高,但在 3 月 12 日回落至 70,000 美元以下。

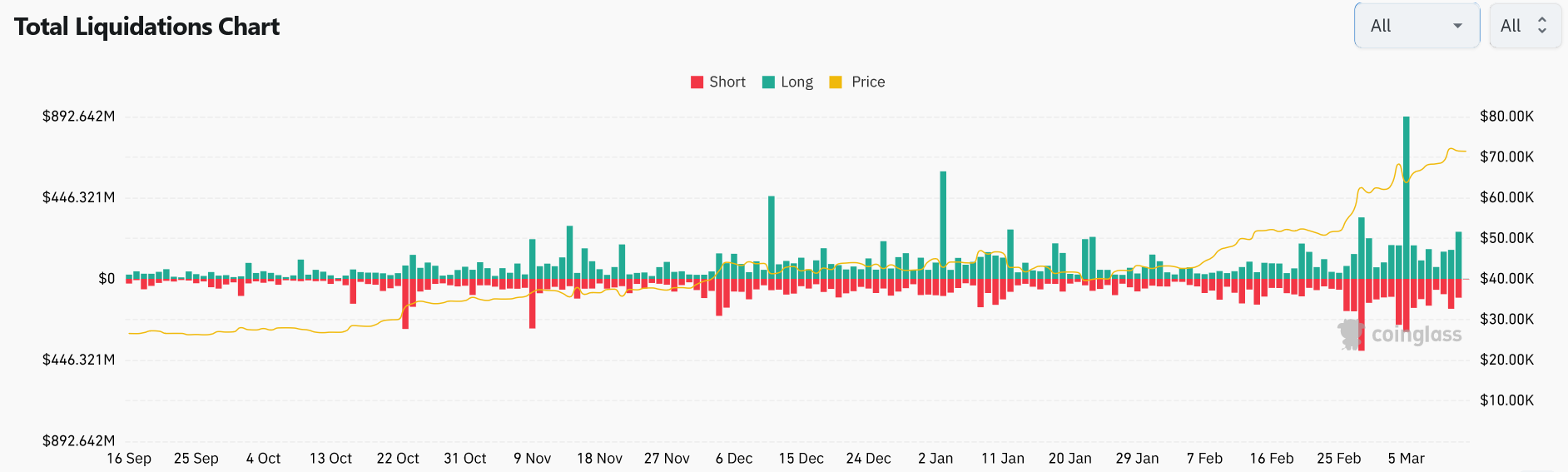

The price swing mostly liquidated long positions — those betting it would rise — with $258 million erased, while short sellers were ousted a little over $103 million, according to data from crypto trading and information platform Coinglass.

根據加密貨幣交易和資訊平台 Coinglass 的數據,價格波動主要清算了多頭頭寸(那些押注價格會上漲的人),損失了 2.58 億美元,而空頭則被驅逐了略多於 1.03 億美元。

It’s the largest long flush-out since March 5, when Bitcoin fell to $60,800 after notching its previous all-time high of around $69,000.

這是自 3 月 5 日以來最大的多頭衝出,當時比特幣在創下 69,000 美元左右的歷史高點後跌至 60,800 美元。

Volatility wasn’t as severe this time around, with Bitcoin’s price only swinging 4.85% between its March 12 low of $69,365 and a high of $72,733, according to CoinGecko.

根據 CoinGecko 的數據,這次波動沒有那麼嚴重,比特幣的價格在 3 月 12 日的低點 69,365 美元和高點 72,733 美元之間僅波動了 4.85%。

Bitcoin has since leveled out to $71,400 at the time of publication.

截至本文發佈時,比特幣價格已穩定至 71,400 美元。

A 10x Research spokesperson told Cointelegraph the uptick in volatility is likely stemming from traders anticipating a price correction.

10x Research 發言人告訴 Cointelegraph,波動性上升可能源自於交易員預期價格調整。

“Traders are becoming more nervous that we could see a price correction as Bitcoin has failed to rally during [United States] trading hours when the ETFs start trading.”“交易員變得更加緊張,因為比特幣在 ETF 開始交易的[美國]交易時間內未能上漲,因此我們可能會看到價格調整。”

“At the same time there is big FOMO going on,” which may mean the rally will continue, the spokesperson added.

發言人補充說,“與此同時,人們也存在嚴重的‘錯失恐懼症’”,這可能意味著漲勢將繼續下去。

10x Research also noted that futures open interest increased 5% over the weekend — March 9 and 10 — which it suspects were put on with tight stops.

10x Research 也指出,週末(3 月 9 日和 10 日)期貨未平倉合約增加了 5%,懷疑是因為設置了嚴格的停損。

Related: Bitcoin short sellers are out $161M as Bitcoin surprises with 11% rally

相關:比特幣意外上漲 11%,比特幣賣空者損失 1.61 億美元

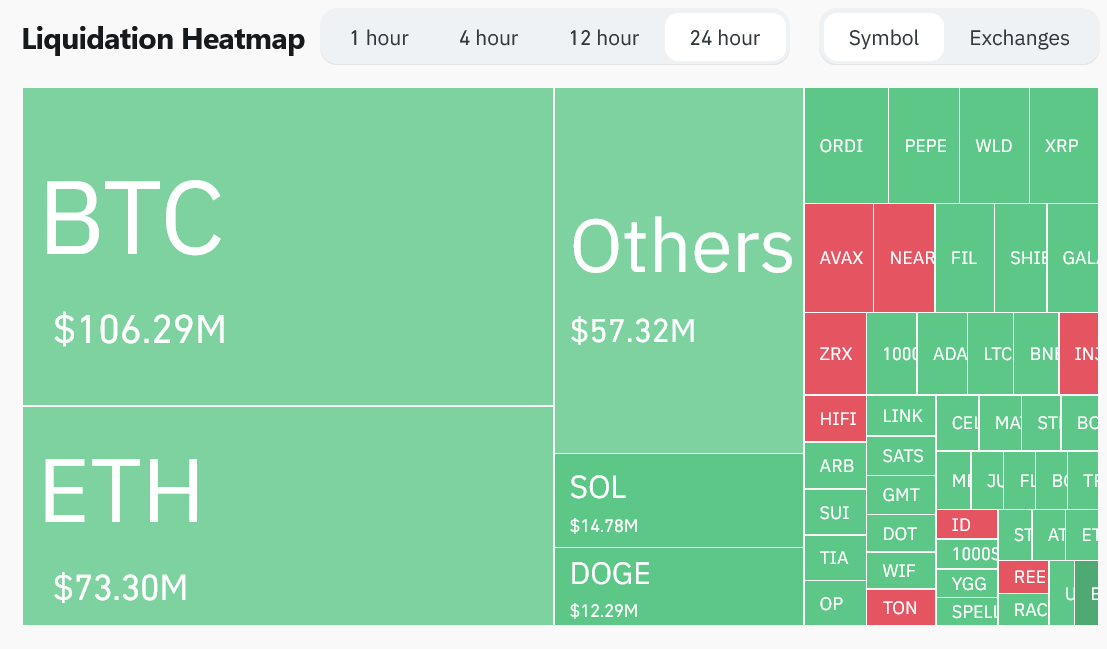

Bitcoin and Ether (ETH) trades accounted for the most liquidations over the last 24 hours at $106.3 million and $73.3 million, respectively.

在過去 24 小時內,比特幣和以太坊 (ETH) 交易的清算量最多,分別為 1.063 億美元和 7,330 萬美元。

Solana (SOL), Dogecoin (DOGE) and the Bitcoin-based memecoin Ordi (ORDI) also saw significant liquidations.

Solana (SOL)、Dogecoin (DOGE) 和基於比特幣的 memecoin Ordi (ORDI) 也出現了大幅清算。

The most short and long liquidations occurred on crypto exchange OKX, totaling $152 million, while Binance traders saw combined losses of $128.4 million.

最多的空頭和多頭清算發生在加密貨幣交易所 OKX,總計 1.52 億美元,而幣安交易者的總損失為 1.284 億美元。

Short sellers lost more than $6 billion trying to bet against publicly traded crypto firms over the first 11 months of 2023 as Bitcoin rallied 130% to $37,800 over the same time, according to research firm S3 Partners.

研究公司S3 Partners 的數據顯示,2023 年前11 個月,隨著比特幣上漲130% 至37,800 美元,賣空者在2023 年前11 個月試圖做空公開交易的加密貨幣公司,損失超過60 億美元。

Magazine: ‘Crypto is inevitable’ so we went ‘all in’ — Meet Vance Spencer, permabull

雜誌:“加密貨幣是不可避免的”,所以我們“全力以赴”——認識萬斯·斯賓塞,permabull

Optimisus

Optimisus Thecoinrepublic.com

Thecoinrepublic.com TheCoinrise Media

TheCoinrise Media Optimisus

Optimisus Optimisus

Optimisus DogeHome

DogeHome TheCoinrise Media

TheCoinrise Media TheCoinrise Media

TheCoinrise Media DogeHome

DogeHome