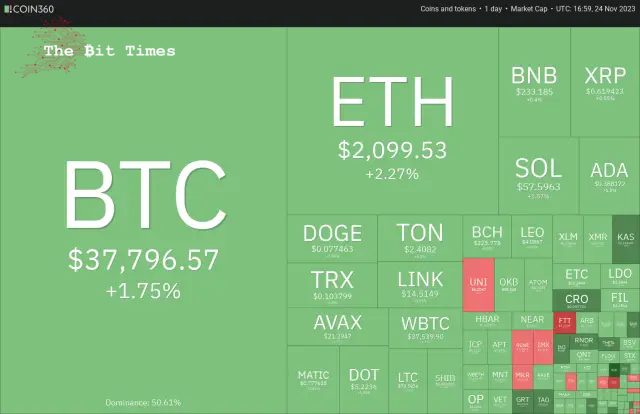

Bitcoin’s (BTC) price has surged past the $38,000 mark, suggesting the potential for an upward rally. The positive sentiment and sustained bullish pressure were evident as Bitcoin breached the critical resistance level on November 24th. Adrian Przelozny, CEO of Independent Reserve, expressed optimism, foreseeing a promising outlook for the next two years. He anticipates increased market activity in early 2024.

Two significant factors driving the cryptocurrency market in the coming year include the Bitcoin halving scheduled for April and pending applications for a spot exchange-traded fund. Some of these ETF applications face a decision deadline in January. With these significant events on the horizon, Bitcoin will likely attract buyers even during price corrections.

Analysts expect a retracement from $40,000 in the near term. That could be one of the reasons why Cathie Wood’s investment firm, ARK Invest, has been gradually selling into strength. The firm sold about 700,000 shares of the Grayscale Bitcoin Trust (GBTC) over the past month, but it is worth noting that ARK still holds more than 4.3 million GBTC shares.

Could crypto traders bulldoze their way through the overhead resistance levels in Bitcoin and major altcoins? What are the critical levels to watch out for?

Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin (BTC) price analysis

Bitcoin pierced the stiff resistance of $37,980 on November 24th, but the bulls are struggling to sustain the breakout. This suggests that the bears are vigorously guarding the level.

Both moving averages are sloping up, and the relative strength index (RSI) is above 61, indicating that the path of least resistance is to the upside. If buyers maintain the price above $37,980, the BTC/USDT pair could reach $40,000.

This level may again witness a tough battle between the bulls and the bears, but if the buyers prevail, the pair could skyrocket to $48,000. Time is running out for the bears. They must sink the price below the 20-day EMA if they want to weaken the momentum. The short-term trend will turn negative below $34,800.

Ether (ETH) price analysis

The bulls pushed Ether above the resistance line on November 22nd, suggesting the start of the next leg of the up-move.

The bears tried to pull the price back below the resistance line on November 23rd, but the bulls held their ground. This suggests that the bulls try to flip the resistance line into support. The ETH/USDT pair could start a northward march toward $2,200 if they succeed.

This level may act as a formidable resistance again, but if bulls overcome it, the pair will complete a large ascending triangle pattern. That could open the gates for a potential rally to the pattern target of $3,400.

This bullish view will be invalidated soon if the price turns down and plummets below the vital support at $1,900.

BNB price analysis

The 20-day EMA has started to turn down, and the RSI is just below the midpoint, indicating a minor advantage to the bears. The short-term trend will turn negative on a break and close below the crucial support at $223. That could clear the path for a fall to $203.

Bulls must push and sustain the price above the 20-day EMA if they want to prevent the downside. The BNB/USDT pair may spend more time between $223 and $265.

XRP price analysis

The bulls are trying to shove XRP above the 20-day EMA ($0.62), which suggests strong buying at lower levels.

The 20-day EMA has flattened out, and the RSI is near the midpoint, indicating range-bound action in the short term. The XRP/USDT pair may swing between $0.56 and $0.74 for a few days.

If the price rises and sustains above the 20-day EMA, the pair could gradually climb to $0.67 and then to $0.74. Buyers must overcome this hurdle to indicate the start of a new up-move.

Conversely, if the price turns down from the current level and breaks below $0.56, it will signal the start of a sharper correction to $0.46.

Solana (SOL) price analysis

Solana has been trying to break above the $59 resistance for the past two days, but the bears have held their ground. A minor positive in favour of the bulls is that they have not ceded ground to the bears.

The rising 20-day EMA ($52.80) and the RSI in the positive territory suggest that bulls have the upper hand. That enhances the prospects of a rally above the overhead resistance. If that happens, the SOL/USDT pair could ascend to $68.

Contrary to this assumption, the bears will strive to tug the pair below the 20-day EMA if the price turns down from the current level. If they can pull it off, the pair may drop to $48, where buyers will likely step in.

Cardano (ADA) price analysis

Cardano has been swinging above and below the $0.38 level for the past few days. This shows uncertainty about the next directional move between the bulls and the bears.

The upsloping moving averages and the RSI in the positive territory indicate that the bulls have a slight edge. If the price rises above $0.40, it will signal the start of a new up-move to $0.42 and later to $0.46.

Bears must yank the price below $0.34 if they want to trap the aggressive bulls. That may result in a fall to the 50-day SMA ($0.31). The ADA/USDT pair may oscillate between $0.24 and $0.38 for longer.

Dogecoin (DOGE) price analysis

Dogecoin has maintained above the 20-day EMA ($0.08) for the past two days, but the rise lacks momentum. This indicates that bulls are cautious at higher levels.

Buyers will have to propel the price above $0.08 to signal strength. The DOGE/USDT pair could surge toward the target objective of $0.10. This level may again witness a tough battle between the bulls and the bears.

If the price turns down from $0.08, it will suggest that bears remain active at higher levels. The pair may then drop to the immediate support at $0.07. The flattish 20-day EMA and the RSI just above the midpoint do not give a clear advantage to the bulls or the bears.

Toncoin (TON) price analysis

Buyers are trying to push Toncoin to the overhead resistance of $2.59. The repeated retest of a resistance level tends to weaken it.

If bulls drive and sustain the price above the $2.59 to $2.77 resistance zone, it will complete a cup-and-handle pattern. That could start a new uptrend to $3.28 and, after that, to the pattern target of $4.03.

Alternatively, if the TON/USDT pair turns down from the overhead resistance, it will suggest that bears fiercely protect the level. That could result in a move down to the 50-day SMA ($2.20). A slide below this level will open the doors for a fall to $2 and $1.89.

Chainlink (LINK) price analysis

Chainlink is facing selling at the downtrend line, as seen from the long wick on the November 23rd candlestick.

However, the bulls have not given up and have again pushed the price to the downtrend line. The cost is stuck between the downtrend line and the 61.8% Fibonacci retracement level of $12.83. This has resulted in a squeeze, likely resolving with a sharp move on either side.

If the price surges above the downtrend line, the LINK/USDT pair may climb to $16.60 and $18.30. Instead, if the price turns down and plunges below $12.83, the decline could extend to the 50-day SMA ($11.21).

Avalanche (AVAX) price analysis

Avalanche has reached the overhead resistance at $22, a critical level to watch out for. The bears are expected to defend this level with vigour.

However, if bulls do not give up much ground from the current level, it will increase the likelihood of a break above $22. The pair may climb to $25, where the bears will likely mount a strong defence.

On the downside, the 20-day EMA ($18.40) remains critical to watch. If the price turns down and slips below this level, it will suggest the start of a deeper correction to $16. Such a move will indicate that the AVAX/USDT pair may spend more time between $10.50 and $22.

Source – Rakesh Upadhyay

Source: https://thebittimes.com/latest-market-overview-24th-nov-btc-eth-bnb-xrp-sol-ada-doge-ton-link-avax-tbt71575.html

Crypto News Land

Crypto News Land DogeHome

DogeHome Coincu

Coincu Coin Edition

Coin Edition Coin_Gabbar

Coin_Gabbar Coincu

Coincu BlockchainReporter

BlockchainReporter