Dogecoin (DOGE) price dipped below $0.08 mark in the early hours of Jan. 10, while market data trends suggest a positive Bitcoin Spot ETF verdict could trigger further downside.

狗狗幣 (DOGE) 價格在 1 月 10 日凌晨跌破 0.08 美元大關,而市場數據趨勢表明,積極的比特幣現貨 ETF 判決可能會引發進一步的下跌。

Market analysts and speculators are leaning heavily towards an imminent ETF approval verdict from the US Securities and Exchange Commission (SEC). Recent market data trends show that price correlation between Dogecoin (DOGE) and Bitcoin (BTC) have flipped negative over the past month. This alignment signals a potential DOGE price downswing if BTC reacts positively to an ETF approval verdict.

市場分析師和投機者嚴重傾向美國證券交易委員會 (SEC) 即將批准 ETF。最近的市場數據趨勢顯示,狗狗幣(DOGE)和比特幣(BTC)之間的價格相關性在過去一個月中轉為負值。如果 BTC 對 ETF 批准判決做出積極反應,這種一致性表明 DOGE 價格可能會下跌。

DOGE price correlation to BTC has dipped to 5-month low

DOGE 與 BTC 的價格相關性已降至 5 個月低點

Dogecoin, the pioneer memecoin, was created in 2013 as a light fork of the Bitcoin blockchain. Over the years, the fortunes of both Proof of Work (PoW) networks have been closely intertwined.

狗狗幣是迷因幣的先驅,創建於 2013 年,是比特幣區塊鏈的輕量級分叉。多年來,兩個工作量證明(PoW)網路的命運緊密相連。

In recent weeks, however, DOGE and BTC prices have been trending in opposite directions. Dogecoin price has tumbled 26% from its local top record on Dec 11 to hit $0.078 on Jan. 10. But interestingly, BTC price has climbed 5% from $43,700 to peak at $47,972 during that period.

然而,最近幾週,DOGE 和 BTC 的價格走勢卻相反。狗狗幣價格從 12 月 11 日的當地最高紀錄下跌 26%,至 1 月 10 日觸及 0.078 美元。但有趣的是,比特幣價格在此期間從 43,700 美元上漲了 5%,達到高峰 47,972 美元。

The correlation coefficient is a vital technical indicator that quantifies the correlation between the price movements of different assets. The chart below shows that the DOGE/BTC price correlation has declined to -0.52 as of Jan 10, its lowest in 5-months.

相關係數是量化不同資產價格變動之間相關性的重要技術指標。下圖顯示,截至 1 月 10 日,DOGE/BTC 價格相關性已降至 -0.52,為 5 個月以來的最低水準。

As things stand, Bitcoin and Dogecoin are now inversely correlated. A negative correlation coefficient of -0.53 means that a 10% increase in the price of Bitcoin is likely to be followed by a 5.3% decline in DOGE price.

就目前情況而言,比特幣和狗狗幣現在呈現負相關。負相關係數為-0.53,意味著比特幣價格上漲 10% 後,DOGE 價格可能會下跌 5.3%。

With a Bitcoin ETF approval verdict looming, this trend could have a far reaching impact in the days ahead. An overwhelming majority of speculators and market analysts are leaning towards a positive verdict, which could potentially send BTC price into a parabolic rally toward $50,000.

隨著比特幣 ETF 批准判決的臨近,這一趨勢可能會在未來幾天產生深遠的影響。絕大多數投機者和市場分析師都傾向於積極的裁決,這可能會導致 BTC 價格拋物線上漲至 5 萬美元。

Considering the negative price correlation, DOGE price could suffer significant downsizing, if this bullish scenario plays out for BTC.

考慮到價格的負相關性,如果這種看漲情況對 BTC 有利,DOGE 價格可能會大幅下跌。

You might also like: Bitcoin ETF applicants ramp up BTC purchases ahead of SEC verdict

您可能也喜歡:比特幣 ETF 申請人在 SEC 裁決前增加 BTC 購買量

Furthermore, on-chain data shows that Dogecoin miners and node validators have recently intensified their selling pressure in the past month. This reflects further confirmation that DOGE is at risk of a major price downtrend.

此外,鏈上數據顯示,狗狗幣礦工和節點驗證者最近一個月的拋售壓力加大。這進一步證實了 DOGE 面臨價格大幅下跌的風險。

IntoTheBlock’s Miners’ Reserve metric, tracks real-time changes in balances of coins held in wallets controlled by recognized miners and mining pools. Dogecoin miners held a cumulative balance of 4.49 Billion DOGE as of Dec. 10. But, as depicted by the blue trendline in the chart below, that figure has rapidly dropped to 4.35 billion DOGE at the close of Jan. 9.

IntoTheBlock 的礦工儲備指標追蹤由認可礦工和礦池控制的錢包中持有的代幣餘額的即時變化。截至 12 月 10 日,狗狗幣礦工的累積餘額為 44.9 億 DOGE。但是,如下圖藍色趨勢線所示,截至 1 月 9 日收盤,這一數字已迅速降至 43.5 億 DOGE。

This shows that miners have offloaded 140 million DOGE from their cumulative holdings between Dec. 10 and Jan. 10. Valued at the current Dogecoin prices of $0.078, the recently-traded coins are worth approximately $11.13 million.

這表明礦工在12 月10 日至1 月10 日期間已從其累積持有量中拋售了1.4 億枚DOGE。以當前狗狗幣價格0.078 美元計算,最近交易的代幣價值約為1113 萬美元。

Strategic investors interpret a rapid decline in miners’ reserves as a significant bearish signal for 140 million newly-minted DOGE coins into the spot market that dilutes market supply. And when it is not met by a commensurate boost in demand, price decline often follows. Unsurprisingly, DOGE price has dropped 27% during the miners’ latest selling spree in the past month.

策略投資者將礦商儲備的快速下降解讀為1.4億枚新鑄造的DOGE幣進入現貨市場的重大利空訊號,從而稀釋了市場供應。當需求沒有相應增加時,價格往往會下跌。不出所料,在過去一個月礦工的最新拋售熱潮中,DOGE 價格下跌了 27%。

More importantly, a prolonged selling trend among miners suggests they are pessimistic about the coins’ short-term price prospects. Hence, a growing penchant to sell rather than stack up their reserves has emerged among investors.

更重要的是,礦商的長期拋售趨勢顯示他們對代幣的短期價格前景感到悲觀。因此,投資者越來越傾向於出售而不是累積儲備。

Given how influential miners are on a proof of stake network, this could influence other strategic stakeholders within the Dogecoin ecosystem to take on bearish positions as well.

考慮到礦工在權益證明網路上的影響力,這可能會影響狗狗幣生態系統內的其他策略性利害關係人也採取看跌立場。

In summary, the negative correlation with Bitcoin means that Dogecoin price could drop significantly if the SEC issues an approval verdict on Spot BTC ETFs. Also, if the miners selling frenzy continues, it could further accelerate a DOGE price downswing.

綜上所述,與比特幣的負相關性意味著,如果 SEC 對現貨 BTC ETF 做出批准裁決,狗狗幣價格可能會大幅下跌。此外,如果礦商拋售狂潮持續下去,可能會進一步加速 DOGE 價格下跌。

Forecast: can Dogecoin price stay above $0.07?

預測:狗狗幣價格能否維持在 0.07 美元以上?

Based on the market data trends analyzed above, DOGE price appears to be at risk of a major price correction. But for the bears to validate this price, they must flip the initial support buy-wall around $0.070.

根據上述市場數據趨勢分析,DOGE價格似乎面臨大幅調整的風險。但空頭要驗證這個價格,他們必須翻轉 0.070 美元左右的初始支撐買入牆。

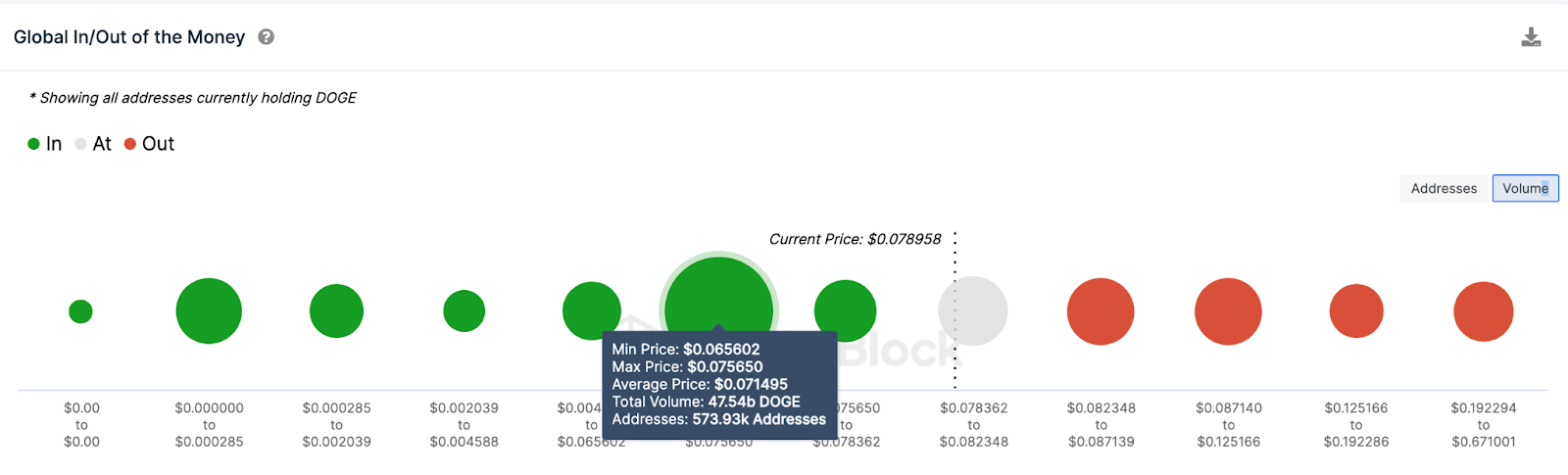

IntoTheBlock’s Global In/Out of the Money (GIOM) data groups the current Dogecoin holders by their historical entry prices. It currently depicts that 573,930 addresses had acquired 47.5 billion DOGE at the average price of $0.071.

IntoTheBlock 的全球資金進出 (GIOM) 數據按歷史入場價格將當前狗狗幣持有者分組。目前顯示,573,930 個地址以 0.071 美元的平均價格購買了 475 億個 DOGE。

Given that this is the largest cluster of current Dogecoin holders, the bears could have a hard time breaking down the $0.070 support.

鑑於這是當前狗狗幣持有者的最大群體,空頭可能很難突破 0.070 美元的支撐位。

However, there’s a risk that a positive BTC ETF verdict could set off a wave of margin calls and stop-loss triggers in the Dogecoin markets. If this bearish scenario plays out, it could open the doors to $0.06 retest.

然而,BTC ETF 的積極裁決可能會在狗狗幣市場引發一波追加保證金和停損觸發的風險。如果這種看跌情況發生,可能會為重新測試 0.06 美元打開大門。

On the upside, if Dogecoin price rebounds above $0.10, the bulls could effectively negate this pessimistic forecast. But in this case, the 338,590 addresses that acquired 14.97 billion DOGE at the average price of $0.084 could mount a major resistance.

從好的方面來說,如果狗狗幣價格反彈至 0.10 美元以上,多頭可能會有效否定這一悲觀預測。但在這種情況下,以 0.084 美元的平均價格購買 149.7 億 DOGE 的 338,590 個地址可能會構成重大阻力。

Failure to breakout of that sell-wall could see DOGE price retrace again.

如果未能突破賣出牆,狗狗幣價格可能會再次回檔。

Read more: BTC and DOGE sent to Moon, Dogecoin’s price sinks

了解更多:BTC 和 DOGE 被送到月球,狗狗幣的價格下跌

Optimisus

Optimisus DogeHome

DogeHome Crypto News Land

Crypto News Land Optimisus

Optimisus Crypto News Land

Crypto News Land Crypto News Land

Crypto News Land Optimisus

Optimisus Cryptopolitan_News

Cryptopolitan_News