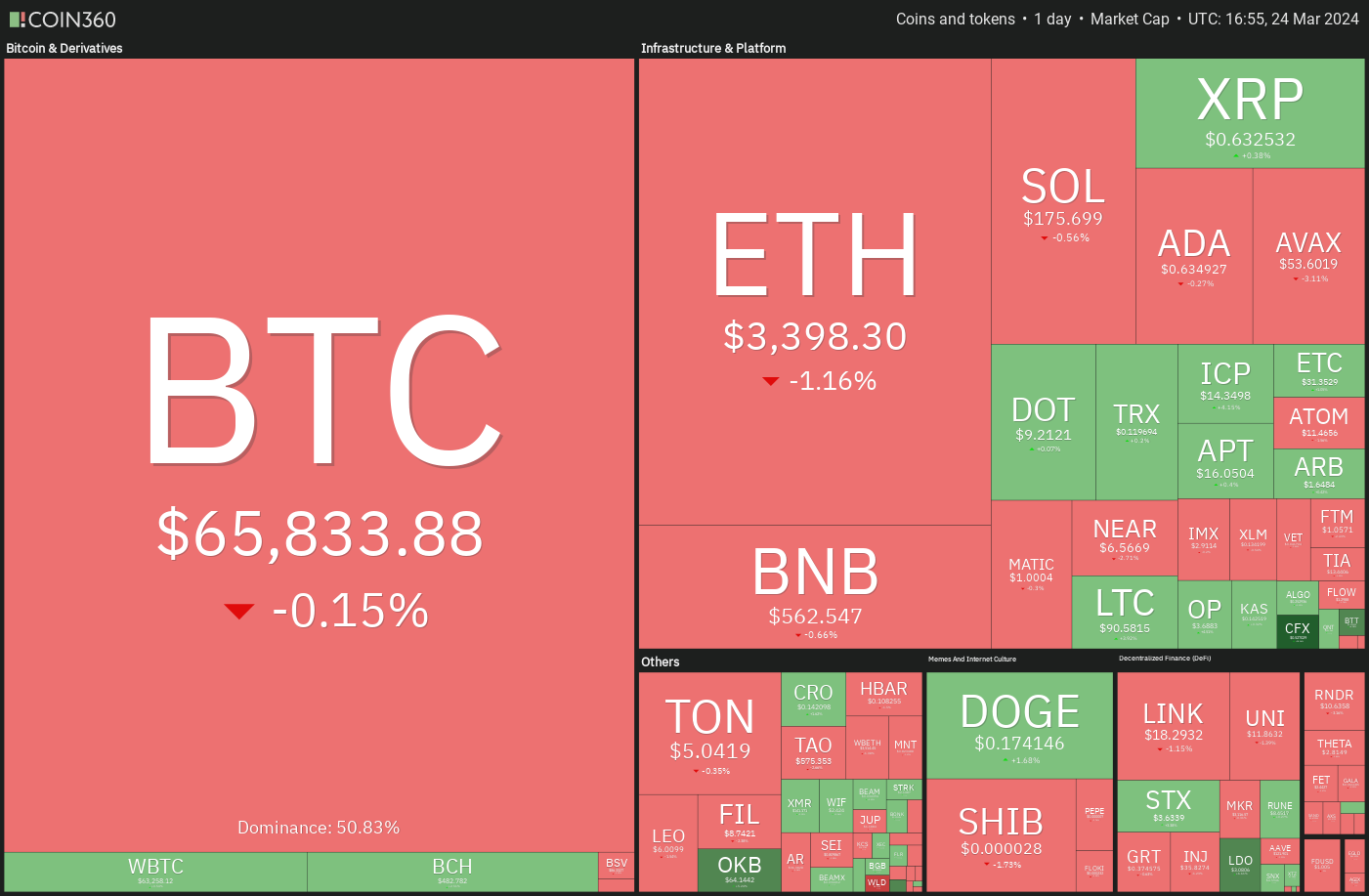

Bitcoin (BTC) is on target to end the week in the red, but a positive sign for the bulls is that the price has recovered from the intra-week low of about $61,000 to over $65,000. This shows that traders remain long-term bullish and are buying the dips.

比特币 (BTC) 预计本周将出现下跌,但对于多头来说,一个积极的信号是价格已从约 61,000 美元的周内低点回升至 65,000 美元以上。这表明交易者仍然长期看涨并逢低买入。

CryptoQuant CEO Ki Young Ju expects inflows into spot Bitcoin exchange-traded funds (ETFs) to increase if Bitcoin nears support levels. Young Ju said the new Bitcoin whales, who purchased Bitcoin ETFs, have an on-chain cost basis of $56,000. He anticipates buying to pick up if Bitcoin’s price reaches $56,000.

CryptoQuant 首席执行官 Ki Young Ju 预计,如果比特币接近支撑位,流入现货比特币交易所交易基金(ETF)的资金将会增加。 Young Ju 表示,购买比特币 ETF 的新比特币鲸鱼的链上成本为 56,000 美元。他预计,如果比特币价格达到 56,000 美元,购买量将会增加。

Another positive sign that could support Bitcoin’s price is that outflows from the Grayscale Bitcoin Trust (GBTC) are slowing down. According to Fairside Investors data, the outflows from GBTC dropped to just $170 million on March 22. This suggests that the selling pressure could be reducing. If Bitcoin ends March above $61,130, it would be the first-ever seven-month winning streak.

另一个可能支撑比特币价格的积极信号是灰度比特币信托基金(GBTC)的资金流出正在放缓。根据 Fairside Investors 的数据,3 月 22 日 GBTC 的资金流出降至仅 1.7 亿美元。这表明抛售压力可能正在减轻。如果比特币在 3 月份结束时突破 61,130 美元,这将是有史以来第一次连续七个月上涨。

Could a recovery in Bitcoin trigger buying in select altcoins? Let’s look at the top 5 cryptocurrencies that look strong on the charts.

比特币的复苏是否会引发对某些山寨币的购买?让我们看看图表上表现最强劲的前 5 种加密货币。

Bitcoin price analysis

比特币价格分析

Bitcoin has been trading near the 20-day exponential moving average ($65,364) for the past few days, indicating a battle between the bulls and the bears for supremacy.

过去几天,比特币一直在 20 天指数移动平均线(65,364 美元)附近交易,这表明多头和空头之间正在争夺霸权。

The 20-day EMA is gradually flattening out, and the relative strength index (RSI) is near the midpoint, indicating a balance between supply and demand. The BTC/USDT pair could swing between $60,775 and $69,000 in the near term.

20日均线逐渐趋平,相对强弱指数(RSI)接近中点,表明供需平衡。 BTC/USDT 货币对短期内可能在 60,775 美元至 69,000 美元之间波动。

If the price remains below the 20-day EMA, the support zone between the 50-day simple moving average ($58,438) and $60,775 may come under pressure. If this zone cracks, the correction could deepen to the 61.8% Fibonacci retracement level of $54,298.

如果价格仍低于 20 日均线,50 日简单移动平均线(58,438 美元)和 60,775 美元之间的支撑区域可能会面临压力。如果该区域破裂,调整可能会加深至 61.8% 斐波那契回撤位 54,298 美元。

On the upside, a break and close above $69,000 could open the doors for a retest of $73,777. If this resistance is scaled, the pair may ascend to $80,000.

从好的方面来看,突破并收盘于 69,000 美元上方可能为重新测试 73,777 美元打开大门。如果突破该阻力位,该货币对可能会升至 80,000 美元。

The 4-hour chart shows the bears are capping the relief rallies at the 50-SMA. Hence, this becomes an important level to watch out for. If bulls push the price above the 50-SMA, it will suggest that the bearish pressure could be reducing. The pair may then rise to $69,000, which is likely to act as a major hurdle.

4 小时图显示,空头正在限制 50 均线的反弹。因此,这成为需要警惕的重要水平。如果多头将价格推高至 50 均线上方,则表明看跌压力可能正在减轻。随后该货币对可能会升至 69,000 美元,这可能会成为一个主要障碍。

The immediate support to watch on the downside is $62,260 and then $60,775. If bears sink the price below this support zone, the selling could pick up, and the pair may slide to $59,000.

下行方面值得关注的直接支撑位是 62,260 美元,然后是 60,775 美元。如果空头将价格压低至该支撑区域以下,则抛售可能会加剧,该货币对可能会滑至 59,000 美元。

Dogecoin price analysis

狗狗币价格分析

Dogecoin (DOGE) has been range-bound between $0.12 and $0.19 for the past few days. The bulls cleared the $0.16 hurdle on March 24, opening the doors for a rise to $0.19.

过去几天,狗狗币(DOGE)一直在 0.12 美元至 0.19 美元之间波动。 3 月 24 日,多头突破了 0.16 美元的关口,为上涨至 0.19 美元打开了大门。

The 20-day EMA ($0.15) has started to turn up, and the RSI is in positive territory, indicating that the bulls are attempting a comeback. A break and close above $0.19 could start the journey toward $0.23 and later $0.30.

20 日均线(0.15 美元)已开始上升,RSI 处于正值区域,表明多头正在尝试卷土重来。突破并收盘于 0.19 美元之上可能会开始走向 0.23 美元,随后走向 0.30 美元。

Instead, if the price turns down sharply from $0.19, it will suggest that the bears remain active at higher levels. The DOGE/USDT pair could slide toward the solid support at $0.12. The bears will have to sink the price below the 50-day SMA ($0.12) to indicate that the uptrend could be over.

相反,如果价格从 0.19 美元大幅下跌,则表明空头在较高水平仍保持活跃。 DOGE/USDT 货币对可能会滑向 0.12 美元的坚实支撑位。空头必须将价格跌破 50 日移动平均线(0.12 美元),以表明上升趋势可能结束。

The 4-hour chart shows that the bulls are buying the dips to the 20-EMA, indicating a positive sentiment. Buyers will try to push the price to the overhead resistance of $0.19, where the bears may again mount a strong defense. If bulls do not cede ground to the bears from $0.19, the likelihood of a rally above $0.20 increases.

4 小时图显示,多头逢低买入 20 日均线,表明市场情绪积极。买家将试图将价格推高至 0.19 美元的上方阻力位,空头可能会再次在此进行强有力的防御。如果多头不从 0.19 美元起让给空头,那么反弹至 0.20 美元以上的可能性就会增加。

The first sign of weakness will be a break and close below the 20-EMA. That may open the doors for a fall to $0.14.

疲软的第一个迹象将是跌破并收于 20 均线下方。这可能为跌至 0.14 美元打开大门。

Toncoin price analysis

通币价格分析

Toncoin (TON) surged above the $4.60 resistance on March 23, indicating the start of the next leg of the uptrend.

Toncoin (TON) 于 3 月 23 日飙升至 4.60 美元阻力位上方,表明下一阶段上升趋势的开始。

The upsloping moving averages and the RSI in the overbought zone signal that buyers are in command. The long wick on the March 23 and 24 candlesticks shows profit booking above $5, but if the bulls do not give up much ground from the current level, the TON/USDT pair could extend the rally to $5.64.

向上倾斜的移动平均线和处于超买区域的 RSI 表明买家处于主导地位。 3 月 23 日和 24 日烛台上的长影线显示利润预定高于 5 美元,但如果多头不从当前水平放弃太多基础,TON/USDT 货币对可能会将涨势扩大至 5.64 美元。

If bears want to prevent the upside, they will have to drag and sustain the price below $4.60. That may tempt short-term traders to book profits, pulling the pair to the 20-day EMA ($3.79).

如果空头想要阻止上涨,他们将不得不将价格拖至并维持在 4.60 美元以下。这可能会吸引短期交易者获利了结,从而将该货币对拉至 20 日均线(3.79 美元)。

The 4-hour chart shows that the bears are aggressively defending the $5 resistance, but have failed to sink the pair below the 20-EMA. This is a positive sign as it suggests that the traders are holding to their positions as they anticipate another leg higher.

4小时图显示,空头正在积极捍卫5美元阻力位,但未能将该货币对跌破20均线。这是一个积极的信号,因为它表明交易者正在持有仓位,因为他们预计还会进一步走高。

The first support on the downside is the 20-EMA. A slide below this support will suggest that the short-term traders may be booking profits. That could pull the price to the 50-SMA and later to $3.50.

下行的第一个支撑位是 20 日均线。跌破该支撑位将表明短期交易者可能会获利了结。这可能会将价格拉至 50 移动平均线,然后拉至 3.50 美元。

Related: Terra founder Do Kwon released in Montenegro

相关:Terra 创始人 Do Kwon 在黑山获释

Stacks price analysis

堆栈价格分析

The bulls propelled Stacks (STX) above the $3.40 overhead resistance on March 20, indicating that the uptrend remains intact.

3 月 20 日,多头将 Stacks (STX) 推升至 3.40 美元上方阻力位,表明上升趋势依然完好。

Both moving averages are sloping up, and the RSI is near the overbought zone, indicating that bulls have an advantage. If buyers maintain the price above $3.40, the uptrend is likely to pick up momentum, and the STX/USDT pair could rally to $4.29.

两条均线均向上倾斜,RSI 位于超买区域附近,表明多头具有优势。如果买家将价格维持在 3.40 美元以上,上升趋势可能会增强,STX/USDT 货币对可能会反弹至 4.29 美元。

Contrary to this assumption, if the price turns down and skids below $3.40, it will signal that the markets have rejected the higher levels. The pair may slump to the 20-day EMA ($3.07). A bounce off this level will suggest that the uptrend remains intact, but a break below the 20-day EMA could sink the pair to the 50-day SMA ($2.65).

与这一假设相反,如果价格下跌并跌破 3.40 美元,则表明市场已经拒绝了更高的水平。该货币对可能会跌至 20 日均线(3.07 美元)。从该水平反弹将表明上升趋势保持完好,但跌破 20 日均线可能导致该货币对跌至 50 日移动平均线(2.65 美元)。

The 4-hour chart shows that the bulls are buying the dips to the 20-EMA, signaling that the sentiment remains positive. There is a minor resistance at $3.75, but if this level is crossed, the pair may reach $4.

4 小时图显示,多头逢低买入 20 日均线,表明市场情绪依然乐观。 3.75 美元有一个小阻力,但如果突破该水平,该货币对可能会达到 4 美元。

The crucial support to watch on the downside is the 20-EMA. If this level gives way, it will suggest that the bulls are rushing to the exit. The pair may then drop to $3.22. A break below this support could accelerate selling and sink the pair below the 50-SMA.

下行方面值得关注的关键支撑是 20 日均线。如果这个水平让步,则表明多头正在急于退出。随后该货币对可能会跌至 3.22 美元。跌破该支撑位可能会加速抛售并使该货币对跌破 50 移动平均线。

Fantom price analysis

幻影价格分析

Fantom’s (FTM) long wick on the March 22 candlestick shows profit booking near $1.23. The selling accelerated on March 23, and the bears are attempting to sink the price below $1.02.

Fantom (FTM) 3 月 22 日烛台上的长影线显示利润预定接近 1.23 美元。 3 月 23 日抛售加速,空头试图将价格压低至 1.02 美元以下。

If they succeed, the FTM/USDT pair could tumble to the 20-day EMA ($0.89). This remains the key short-term level to watch out for. If the price rebounds off the 20-day EMA with strength, it will signal that lower levels continue to attract buyers. The pair may then retest the $1.23 level. A break above it could clear the path for a rally to $1.50 and eventually to $2.

如果成功,FTM/USDT 货币对可能会跌至 20 日均线(0.89 美元)。这仍然是值得关注的关键短期水平。如果价格从 20 日均线强劲反弹,则将表明较低水平继续吸引买家。随后该货币对可能会重新测试 1.23 美元水平。突破该水平可能会为反弹至 1.50 美元并最终至 2 美元扫清道路。

This optimistic view will be negated in the near term if the price turns down sharply and plummets below the 20-day EMA. That could tug the price to the next significant support at $0.72.

如果价格大幅下跌并跌破 20 日均线,这种乐观看法将在短期内被否定。这可能会将价格拉至下一个重要支撑位 0.72 美元。

The bears pulled the price below the 20-EMA on the 4-hour chart, but a positive sign is that the bulls have not allowed the 50-SMA to be challenged. Buyers are trying to push the price back above the 20-EMA. If they manage to do that, the pair could rise to $1.12 and then to $1.16.

空头将价格拉低至 4 小时图上的 20 均线下方,但一个积极的信号是多头不允许 50 均线受到挑战。买家正试图将价格推回到 20 均线上方。如果他们成功做到这一点,该货币对可能会升至 1.12 美元,然后升至 1.16 美元。

Alternatively, if the price turns down from the overhead resistance and breaks below the 50-SMA, it will suggest that the bears are aggressively selling at higher levels. The pair may then start a downward move to $0.80.

或者,如果价格从上方阻力位回落并跌破 50 移动平均线,则表明空头正在更高水平上积极抛售。随后该货币对可能开始下跌至 0.80 美元。

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

本文不包含投资建议或建议。每一项投资和交易行为都涉及风险,读者在做出决定时应自行研究。

DogeHome

DogeHome TheCoinrise Media

TheCoinrise Media Thecoinrepublic.com

Thecoinrepublic.com TheCoinrise Media

TheCoinrise Media TheCoinrise Media

TheCoinrise Media Cryptopolitan_News

Cryptopolitan_News Coin Edition

Coin Edition BlockchainReporter

BlockchainReporter