Bitcoin’s (BTC) sharp rally is showing signs of a short-term pullback, which could be one of the reasons for the mere $132 million in inflows into the spot Bitcoin exchange-traded funds on March 14. A marked slowdown in inflows could start a corrective phase as Bitcoin’s most recent leg of the rally has largely been driven by solid inflows into the Bitcoin ETFs.

比特币 (BTC) 的大幅上涨正显示出短期回调的迹象,这可能是 3 月 14 日仅有 1.32 亿美元流入现货比特币交易所交易基金的原因之一。比特币最近的上涨很大程度上是由比特币 ETF 的大量资金流入推动的。

If a correction starts in Bitcoin, how deep could that be? During previous halving cycles, Bitcoin has seen a drop close to 40%, according to a X (formerly Twitter) post by the pseudonymous trader known as Bags. If history were to repeat, then Bitcoin could plummet to about $45,500.

如果比特币开始调整,调整的深度会有多深?根据化名为 Bags 的 X(前 Twitter)帖子,在之前的减半周期中,比特币下跌了近 40%。如果历史重演,那么比特币可能会暴跌至 45,500 美元左右。

Corrections are a part of every bull market. A positive sign during the current pullback is that it is largely due to profit-booking on hedges and has not led to “panic shorting yet,” according to popular trader Skew.

调整是每个牛市的一部分。受欢迎的交易商 Skew 表示,当前回调期间的一个积极迹象是,这主要是由于对冲获利预订,并且尚未导致“恐慌性做空”。

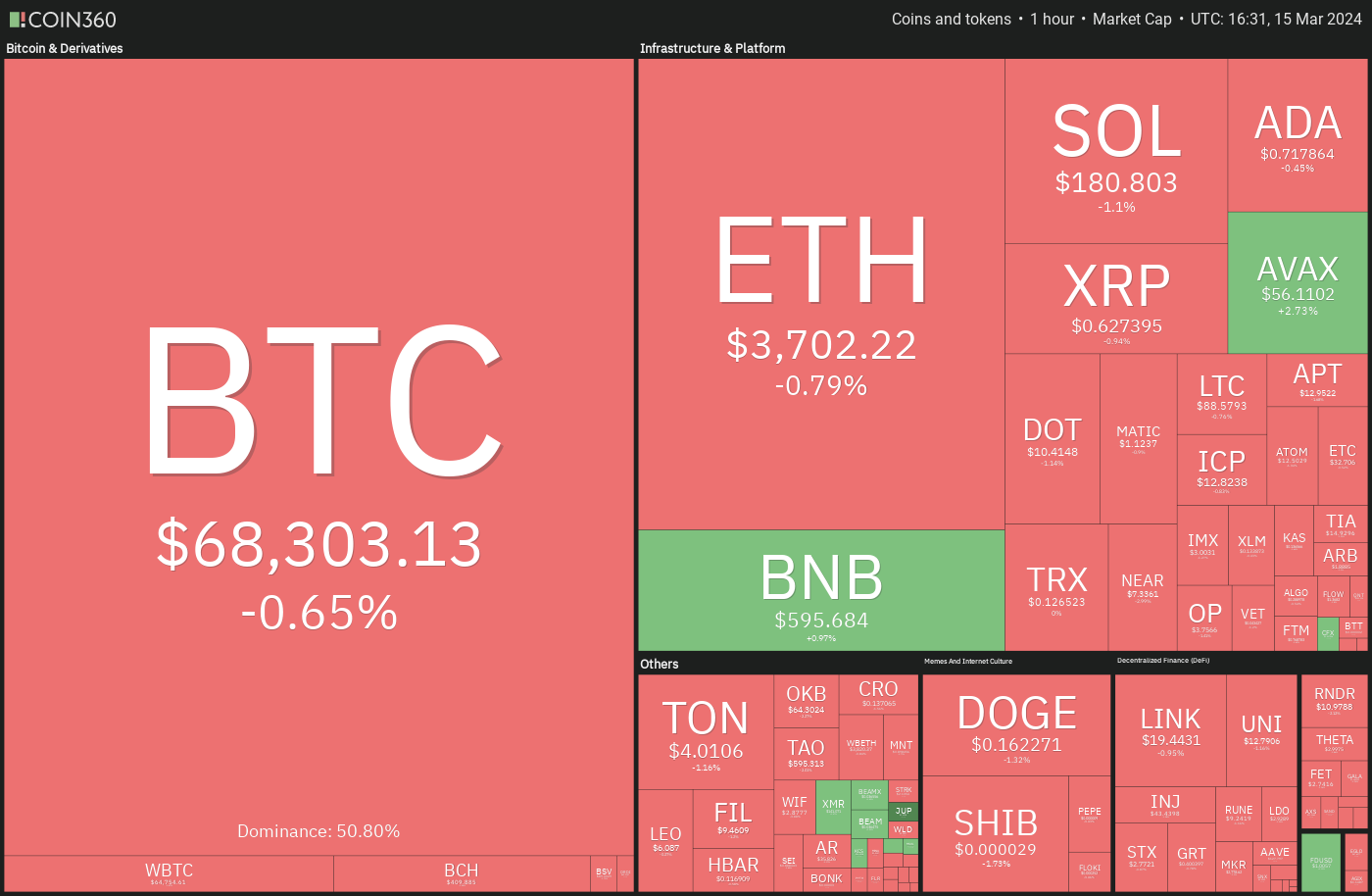

Could the correction in Bitcoin and altcoins deepen, or will the price rebound from the current levels? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

比特币和山寨币的调整是否会加深,或者价格会从当前水平反弹?让我们分析一下前 10 名加密货币的图表来找出答案。

Bitcoin price analysis

比特币价格分析

Bitcoin witnessed profit booking at $73,777 on March 14, but the bulls purchased the dip, as seen from the long tail on the candlestick.

3 月 14 日,比特币利润录得 73,777 美元,但多头逢低买入,从烛台上的长尾可以看出。

However, the failure to build upon the momentum on March 15 attracted strong selling by the short-term traders. The price has reached the support line of the ascending channel pattern, which is an important level to watch out for.

然而,3 月 15 日的势头未能延续,吸引了短期交易者的大力抛售。价格已达到上升通道形态的支撑线,这是一个值得关注的重要水平。

If the price plummets below the channel and the 20-day exponential moving average ($65,195), it will indicate the start of a corrective phase. The BTC/USDT pair could slide to $59,000 and thereafter to the 50-day simple moving average ($54,291).

如果价格跌破通道和 20 天指数移动平均线(65,195 美元),则表明修正阶段的开始。 BTC/USDT 货币对可能会下滑至 59,000 美元,然后跌至 50 天简单移动平均线(54,291 美元)。

Contrarily, if the price bounces off the support line, it will suggest that the pair may remain inside the channel for some more time. The bulls will again try to push the price above the overhead resistance at $73,777.

相反,如果价格从支撑线反弹,则表明该货币对可能会在通道内停留一段时间。多头将再次尝试将价格推高至上方阻力位 73,777 美元。

Ether price analysis

以太币价格分析

Ether’s (ETH) up move stalled near $4,000, tempting short-term traders to book profits. The long tail on the March 14 candlestick shows the bulls tried to flip the $3,600 level into support, but the fall on March 15 shows that the bears have kept up the pressure.

以太坊 (ETH) 的涨势在 4,000 美元附近停滞,吸引短期交易者获利了结。 3 月 14 日烛台上的长尾显示多头试图将 3,600 美元的水平转变为支撑位,但 3 月 15 日的下跌表明空头一直在承受压力。

The bulls and the bears are likely to witness a tough battle near $3,600. If the price rebounds off this support, the bulls will again try to push the ETH/USDT pair to $4,000. The bears are expected to vigorously defend this level.

多头和空头可能会在 3,600 美元附近见证一场硬仗。如果价格从该支撑位反弹,多头将再次尝试将 ETH/USDT 货币对推至 4,000 美元。预计空头将大力捍卫这一水平。

On the downside, the bears will try to yank the price below $3,600. If they do that, the selling could accelerate, and the ETH/USDT pair could slump to $3,200 and later to the 50-day SMA ($2,997). The greater the fall, the longer it will take for the pair to resume the uptrend.

不利的一面是,空头将试图将价格拉至 3,600 美元以下。如果他们这样做,抛售可能会加速,ETH/USDT 货币对可能会跌至 3,200 美元,然后跌至 50 日移动平均线(2,997 美元)。跌幅越大,货币对恢复上升趋势所需的时间就越长。

BNB price analysis

BNB价格分析

BNB (BNB) has pulled back in a strong uptrend, indicating that the traders are booking profits after a sharp rally.

BNB(BNB)在强劲的上涨趋势中出现回调,表明交易者在大幅上涨后正在获利了结。

However, the long tail on the March 15 candlestick shows that the bulls are not ready to give up and are buying at the 38.2% Fibonacci retracement level of $527.50.

然而,3 月 15 日烛台上的长尾表明多头尚未准备好放弃,并在 527.50 美元的 38.2% 斐波那契回撤位买入。

A shallow pullback is a positive sign as it shows the bulls are not waiting for a deeper correction to enter. That increases the possibility of a break above $633. The pair may then climb to the $670 to $692 resistance zone.

小幅回调是一个积极信号,因为它表明多头并没有等待更深的回调进入。这增加了突破 633 美元的可能性。随后该货币对可能会攀升至 670 美元至 692 美元的阻力区。

Contrary to this assumption, if the price turns down from the current level and breaks below $527, it will signal that every rally is being sold into. The BNB/USDT pair may then tumble to the 20-day EMA ($485).

与这一假设相反,如果价格从当前水平下跌并跌破 527 美元,则表明每次反弹都被抛售。随后,BNB/USDT 货币对可能会跌至 20 日均线(485 美元)。

Solana price analysis

Solana 价格分析

Solana (SOL) has been in a strong uptrend for the past few days, indicating solid demand at higher levels.

Solana (SOL) 在过去几天一直处于强劲的上升趋势,表明较高水平的需求强劲。

The up move has pushed the RSI deep into the overbought territory, suggesting that the SOL/USDT pair may have run up too fast in a short time. That could start a correction, which could pull the pair to the 20-day EMA ($142).

此次上涨已将 RSI 推入超买区域,表明 SOL/USDT 货币对可能在短时间内上涨过快。这可能会开始修正,从而将该货币对拉至 20 日均线(142 美元)。

If the price rebounds off the 20-day EMA, it will suggest that the sentiment remains positive and traders are buying on dips. That may enhance the prospects of a rally to $205. This optimistic view will be negated on a break below the 20-day EMA. The pair may then slump to the breakout level at $126.

如果价格从 20 日均线反弹,则表明市场情绪依然乐观,交易者逢低买入。这可能会增强其反弹至 205 美元的前景。如果跌破 20 日均线,这种乐观看法将被否定。随后该货币对可能会跌至 126 美元的突破水平。

XRP price analysis

瑞波币价格分析

XRP (XRP) turned down from $0.74 on March 12, indicating that the bears are fiercely defending the level.

XRP (XRP) 从 3 月 12 日的 0.74 美元下跌,表明空头正在激烈捍卫该水平。

The bulls tried to flip $0.67 into support on March 13, but the bears had other plans. They continued their selling and pulled the price back below the $0.67 level on March 14.

3 月 13 日,多头试图将 0.67 美元推向支撑位,但空头另有计划。他们继续抛售,并将价格拉回到 3 月 14 日的 0.67 美元以下。

The selling increased further on March 15, and the XRP/USDT pair broke below the 20-day EMA ($0.62). This suggests that the pair may consolidate inside a large range between $0.50 and $0.74 for some time. A break and close above $0.74 will signal the start of a new uptrend toward $1.02.

3 月 15 日,卖盘进一步增加,XRP/USDT 货币对跌破 20 日均线(0.62 美元)。这表明该货币对可能会在一段时间内在 0.50 美元至 0.74 美元之间的大范围内盘整。突破并收盘于 0.74 美元之上将标志着新的上涨趋势开始向 1.02 美元迈进。

Cardano price analysis

卡尔达诺价格分析

The bulls tried to kick Cardano (ADA) above the overhead resistance of $0.80 on March 14, but the long wick on the candlestick shows selling at higher levels.

3 月 14 日,多头试图将卡尔达诺 (ADA) 推升至 0.80 美元的上方阻力位之上,但烛台上的长影线显示在更高水平上出现抛售。

The price turned down sharply, and the price dipped to the breakout level of $0.68 on March 15. If bears sink the price below $0.68, it will signal the start of a deeper correction toward the 50-day SMA ($0.61).

价格急剧下跌,并跌至 3 月 15 日的 0.68 美元突破水平。如果空头将价格跌破 0.68 美元,则将预示着将开始向 50 日移动平均线(0.61 美元)进行更深层次的修正。

Alternatively, if the price rebounds off $0.68, it will suggest that the bulls continue to buy near strong support levels. The ADA/USDT pair could then swing between $0.68 and $0.80 for a while. A break above $0.80 could launch the pair to $0.92.

或者,如果价格从 0.68 美元反弹,则表明多头继续在强支撑位附近买入。 ADA/USDT 货币对可能会在 0.68 美元至 0.80 美元之间波动一段时间。突破 0.80 美元可能会使该货币对上涨至 0.92 美元。

Dogecoin price analysis

狗狗币价格分析

Dogecoin (DOGE) rose above the $0.18 resistance on March 14, but the long wick on the candlestick shows selling at higher levels.

狗狗币 (DOGE) 于 3 月 14 日升至 0.18 美元阻力位上方,但烛台上的长影线显示在更高水平上出现抛售。

The price turned down sharply and reached the 20-day EMA ($0.15) on March 15. This suggests that the DOGE/USDT pair may remain stuck inside the range for a few more days. A break and close below $0.15 will tilt the advantage in favor of the bears. The pair could then tumble toward $0.12.

价格急剧下跌,并于 3 月 15 日触及 20 日均线(0.15 美元)。这表明 DOGE/USDT 货币对可能会在该区间内停留几天。突破并收于 0.15 美元下方将使优势向空头倾斜。随后该货币对可能会跌向 0.12 美元。

Contrarily, a rally above $0.18 will suggest that the bulls have absorbed the supply. That will open the doors for a rally to $0.24 and then $0.30.

相反,反弹至 0.18 美元以上将表明多头已经吸收了供应。这将为反弹至 0.24 美元,然后是 0.30 美元打开大门。

Related: Bitcoin overtakes gold in investor portfolio allocation — JPMorgan

相关:比特币在投资者投资组合配置中超过黄金——摩根大通

Avalanche price analysis

雪崩价格分析

Avalanche (AVAX) witnessed a large range day with a long wick and a long tail on March 14, indicating indecision between the bulls and the bears.

3 月 14 日,Avalanche (AVAX) 出现了一个带有长影线和长尾巴的大波动日,表明多头和空头之间犹豫不决。

The bears tried to strengthen their position on March 15, but the long tail on the candlestick shows solid buying near the breakout level of $50. This suggests that the bulls are trying to flip $50 into support. If buyers shove the price above $59, the AVAX/USDT pair could resume its uptrend to $87.

3 月 15 日,空头试图加强仓位,但烛台上的长尾显示出在 50 美元突破位附近的强劲买盘。这表明多头正试图将 50 美元推向支撑位。如果买家将价格推高至 59 美元以上,AVAX/USDT 货币对可能会恢复上涨趋势至 87 美元。

If bears want to prevent the upside, they will have to maintain the price below the 20-day EMA. That could sink the pair to the 50-day SMA ($40).

如果空头想要阻止上涨,他们就必须将价格维持在 20 日均线下方。这可能会使该货币对跌至 50 日移动平均线(40 美元)。

Shiba Inu price analysis

柴犬价格分析

Shiba Inu (SHIB) tumbled below the $0.000029 support on March 15, indicating that the bears are trying to establish their supremacy.

柴犬 (SHIB) 于 3 月 15 日跌破 0.000029 美元的支撑位,表明空头正试图确立其霸主地位。

The bulls are trying to defend the 20-day EMA ($0.000027), but the recovery is expected to face selling at the downtrend line. If the price turns lower from the downtrend line, it will increase the likelihood of a slide to the 61.8% Fibonacci retracement level of $0.000023 and then $0.000019.

多头正试图捍卫 20 日均线(0.000027 美元),但复苏预计将面临下行趋势线的抛售。如果价格从下降趋势线转向走低,则会增加滑向 61.8% 斐波那契回撤位 0.000023 美元,然后是 0.000019 美元的可能性。

Conversely, if the price turns up and breaks above the downtrend line, it will suggest that the markets have rejected the lower levels. The SHIB/USDT pair could rally to the overhead resistance of $0.000039.

相反,如果价格上涨并突破下降趋势线,则表明市场已经拒绝了较低的水平。 SHIB/USDT 货币对可能会反弹至上方阻力位 0.000039 美元。

Polkadot price analysis

波卡价格分析

Polkadot (DOT) turned down from $11.88 on March 14, and the selling picked up momentum on March 15.

Polkadot (DOT) 从 3 月 14 日的 11.88 美元开始下跌,3 月 15 日抛售势头增强。

The negative divergence on the RSI suggests that the bullish momentum is waning. That increases the risk of a drop below the 20-day EMA ($9.93) and the breakout level of $9.59. If that happens, the DOT/USDT pair may start a deeper pullback. The pair could then decline to the 50-day SMA ($8.23).

RSI 的负背离表明看涨势头正在减弱。这增加了跌破 20 日均线(9.93 美元)和突破 9.59 美元的风险。如果发生这种情况,DOT/USDT 货币对可能会开始更深层次的回调。随后该货币对可能会跌至 50 日移动平均线(8.23 美元)。

On the other hand, if the price rebounds off the 20-day EMA with strength, the bulls will again try to push the price to $11.88.

另一方面,如果价格从 20 日均线强势反弹,多头将再次尝试将价格推至 11.88 美元。

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.

本文不包含投资建议或建议。每一项投资和交易行为都涉及风险,读者在做出决定时应自行研究。

Crypto Front News

Crypto Front News DogeHome

DogeHome Crypto Daily™

Crypto Daily™ Crypto News Land

Crypto News Land TheNewsCrypto

TheNewsCrypto CFN

CFN Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™ Crypto Daily™

Crypto Daily™