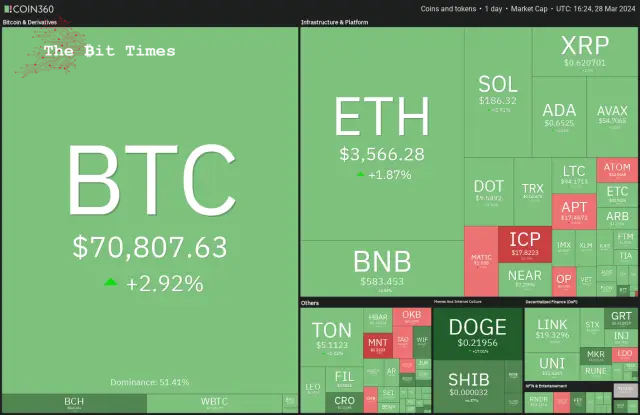

The Bitcoin Market is showing positive signs, though it may encounter significant resistance if it surpasses $72,000.

Despite a recent dip, interest in Bitcoin spot exchange-traded funds (ETFs) remains strong. After a week marked by consecutive net outflows, the tide turned with significant net inflows recorded on March 26th and 27th, totalling $418 million and $243 million, respectively, as reported by Farside Investors.

In an interview with Fox Business, BlackRock CEO Larry Fink has expressed optimism about the firm’s Bitcoin spot ETF. He remarked on the ETF’s rapid growth, noting it as the quickest to expand in the ETF industry’s history. Fink also conveyed his strong confidence in Bitcoin’s prospects.

On-chain analytics platform CryptoQuant said in its latest “Weekly Crypto Report” that Bitcoin’s demand skyrocketed from “40K Bitcoin at the start of 2024 to 213K Bitcoin” on March 26. That could create a “sell-side liquidity crisis” within the following year.

Could Bitcoin continue its recovery and hit a new all-time high before the Bitcoin halving? Will that trigger buying in altcoins? Let’s analyze the charts of the top 10 cryptocurrencies to find out.

Bitcoin (BTC) Market Analysis

The Bitcoin market witnessed profit booking on March 26 and 27, but a positive sign is that the bulls maintained the price above the pennant.

The 20-day exponential moving average (EMA) ($67,069) has started to rise, and the relative strength index (RSI) is in positive territory, suggesting that the path of least resistance is to the upside.

If buyers drive the price above $73,777, the BTC/USDT pair will likely increase momentum and rally to $80,000.

On the contrary, if the price declines from its current level and breaks below the 20-day EMA, it could lead to a potential drop to the 50-day simple moving average ($60,629).

Ether (ETH) Market Analysis

The Ether Market is facing selling near $3,678, but a positive sign is that the bulls are trying to defend the 20-day EMA ($3,530).

If the price breaks above $3,678, the possibility of a rally to $4,100 increases. This level may act as a stiff hurdle, but if the buyers prevail, the ETH/USDT pair could rally to $4,500 and then to $4,868.

Conversely, if the price turns sharply and breaks below $3,460, it will suggest that the bears are unwilling to give up. The pair may then slip to the 50-day SMA ($3,302). A slide below this support could start a deeper correction.

BNB Market Analysis

The long wick on BNB’s March 25 and 26 candlesticks shows that the bears are defending the 61.8% Fibonacci retracement level of $588.

If the price turns down from the current level, the BNB/USDT pair could reach the 20-day EMA ($546). This remains the critical level to watch. If the price rebounds off the 20-day EMA, the pair will again attempt to rise above $600 and reach $645.

On the other hand, if the price drops below the 20-day EMA, it will signal that the bears are trying to gain the upper hand. The pair could then drop to the critical support at $495. The bulls may aggressively buy the dips to this level.

Solana (SOL) Price Analysis

Solana’s recovery is faltering at $196, indicating that the bears sell on relief rallies near the overhead resistance of $205.

The bears will try to pull the price to the 20-day EMA ($173), which is a crucial level to watch. If the price plunges below the 20-day EMA, it will suggest the bears are in the driver’s seat. The SOL/USDT pair could decline to $162 and below that to the 50-day SMA ($140).

Instead, if the price turns up from the current level or rebounds off the 20-day EMA, it will indicate solid demand at lower levels. That will enhance the prospects of a break above $205. If that happens, the pair may start its journey to $267.

XRP Price Analysis

XRP has been stuck between the uptrend line and $0.67 for the past few days, indicating indecision among the buyers and sellers.

If the price maintains below the 20-day EMA ($0.62), the XRP/USDT pair could drop to the uptrend line. A strong rebound off this level will suggest that the range-bound action may continue for a few more days.

The next trending move will likely begin on a break above $0.67 or drop below the uptrend line. Above $0.67, the pair could start a rally to the formidable hurdle at $0.74. On the downside, a break below the uptrend line could sink the pair to $0.52.

Cardano (ADA) Price Analysis

The long wick on Cardano’s March 26 candlestick suggests that the bears are trying to keep the price below $0.68.

If the price remains below the moving averages, it will signal that the ADA/USDT pair could swing between $0.57 and $0.68 for a while. The flattening 20-day EMA ($0.66) and the RSI near the midpoint suggest a consolidation in the near term.

However, if the price turns up from the current level and breaks above $0.70, it will indicate that the bulls are back in the game. The pair may then attempt a rally to $0.81, where the bears may pose a substantial challenge.

Dogecoin (DOGE) Price Analysis

Dogecoin soared above the $0.19 to $0.21 overhead resistance zone on March 28, indicating aggressive bull buying.

The upsloping moving averages and the RSI in the overbought zone suggest that the bulls are in command. There is a minor resistance at $0.23, but if buyers bulldoze their way through, the DOGE/USDT pair could rally to $0.30 and then to $0.35.

Bears must quickly pull the price back below $0.19 if they want to prevent the upside. If they do that, it will trap the aggressive bulls, resulting in long liquidation. The pair could then slump to the 20-day EMA ($0.16).

Avalanche (AVAX) Price Analysis

The past few days’ price action of the Avalanche has formed a pennant, indicating indecision between the bulls and the bears.

The upsloping 20-day EMA ($52) and the RSI in the positive territory indicate a slight advantage to buyers.

The bulls will try to defend the pennant’s support line and push the price toward the resistance line. A break and close above the pennant will signal that the AVAX/USDT pair could resume the uptrend. The pair may rise to $65 and later to the pattern target of $76.

Alternatively, if the price breaks below the pennant, it will suggest that the bears have overpowered the bulls. Strong support is at $50, but if this level gives way, the pair could tumble to the 50-day SMA ($45).

Shiba Inu (SHIB) Price Analysis

Shiba Inu’s recovery climbed above the resistance line on March 26, indicating that the selling pressure is reducing.

The SHIB/USDT pair will likely rise to $0.000035, where the bears are again expected to mount a strong defence. A break above this level could open the doors for a rise to $0.000039.

This optimistic view will be invalidated soon if the price turns down and breaks below the 20-day EMA ($0.000028). If that happens, it will suggest that the break above the resistance line may have been a bull trap. The pair may drop to the 50-day SMA ($0.000021).

Toncoin (TON) Price Analysis

Toncoin (TON) is correcting in an uptrend, but the pullback is finding support at the 38.2% Fibonacci retracement level of $4.78, signalling to buy on dips.

The upsloping moving averages suggest an advantage to the bulls, but the developing negative divergence on the RSI points to a possible consolidation or correction in the short term. If the price turns down and slips below $4.78, it will indicate selling on rallies. The TON/USDT pair could sink to the 20-day EMA ($4.22).

Contrarily, if the rebound sustains, the rally could reach the stiff overhead resistance of $5.69. A break above this level will signal the start of the next leg of the uptrend toward $7.15.

Source – Rakesh Upadhyay

Source: https://thebittimes.com/latest-market-overview-28th-mar-btc-eth-bnb-sol-xrp-ada-doge-avax-shib-ton-tbt86096.html

Crypto News Land

Crypto News Land CoinPedia News

CoinPedia News DogeHome

DogeHome CoinoMedia

CoinoMedia Optimisus

Optimisus Coin Edition

Coin Edition BitcoinWorld

BitcoinWorld Optimisus

Optimisus