Bitcoin Performance Outlook: Mid-Year Weakness Anticipated

比特幣表現展望:預計年中將疲軟

According to crypto analyst Reku, Fahmi Almuttaqin, Bitcoin's performance has historically declined in mid-years, referring to data from the past 11 years. He suggests that this digital asset reflects complex market dynamics. Nonetheless, the significant liquidity of BTC in the market presents positive prospects.

加密貨幣分析師 Reku Fahmi Almuttaqin 表示,根據過去 11 年的數據,比特幣的表現在歷史上將在年中下降。他認為這種數位資產反映了複雜的市場動態。儘管如此,比特幣在市場上的巨大流動性呈現出積極的前景。

Indications of Weakness Similar to 2021

與 2021 年類似的疲軟跡象

Fahmi's analysis draws on data from Coinglass, indicating that in the past eleven years (2013-2023), Bitcoin has seen price declines in August seven times and has only experienced gains four times.

Fahmi 的分析借鑒了 Coinglass 的數據,顯示在過去 11 年(2013-2023)中,比特幣在 8 月出現了 7 次價格下跌,僅經歷了 4 次上漲。

CryptoQuant's analysis reinforces this, highlighting the potential for Bitcoin's price to weaken in the mid-year similar to 2021. The US-based crypto analytics firm employed the Profit & Loss Index, and their Bull-Bear Market Cycle indicator.

CryptoQuant 的分析強化了這一點,強調了比特幣價格在年中(類似於 2021 年)下跌的可能性。

Fahmi explains that this situation mirrors the intricate market dynamics that often occur during transitional periods.

法赫米解釋說,這種情況反映了過渡時期經常發生的複雜的市場動態。

"Within the past year, Bitcoin's price has appreciated by over 100 percent," said Fahmi in a written statement to the media on July 31, 2024. "This growth has been accompanied by a significant rise in the prices of altcoins such as PEPE (782 percent year-on-year), FLOKI (657 percent), and Solana (623 percent)."

Fahmi 在 2024 年 7 月 31 日向媒體發表的書面聲明中表示:「在過去的一年裡,比特幣的價格上漲了 100% 以上。這種增長伴隨著 PEPE 等山寨幣價格的大幅上漲(同比782 %)、FLOKI(657%)和Solana(623%)。

https://blockchainmedia.id/whale-jual-170-milyar-pepe-coin-bagaimana-nasib-token-ini/

https://blockchainmedia.id/whale-jual-170-milyar-pepe-coin-bagaimana-nasib-token-ini/

Fahmi speculates that this may trigger realizations of profit among investors awaiting favorable conditions, such as the end of the Fed's high-interest rate environment and increased adoption of decentralized applications, currently facing a decline.

法赫米推測,這可能會促使等待有利條件的投資者實現利潤,例如聯準會高利率環境的結束以及目前面臨下降的去中心化應用程式的採用增加。

Increased Bitcoin Holdings and Fed Meeting to Shape Market

增加比特幣持有量和聯準會會議塑造市場

However, Fahmi emphasizes the growing interest in Bitcoin displayed by traditional investors in the United States and the recent accumulation of Bitcoin by "whales," or large investors.

然而,法赫米強調美國傳統投資者對比特幣表現出的興趣日益濃厚,以及「鯨魚」或大型投資者最近累積了比特幣。

"Data from Bitcoin Holder CryptoQuant indicates a 6.3 percent increase in Bitcoin ownership by whales within the last month, the highest percentage increase since April 2023," Fahmi said. "This reflects the whales' continued optimism in Bitcoin, despite mid-year price weakness projections from some analysts."

Fahmi 表示:“比特幣持有者 CryptoQuant 的數據顯示,上個月鯨魚的比特幣持有量增加了 6.3%,這是自 2023 年 4 月以來的最高百分比增幅。” “這反映了鯨魚對比特幣的持續樂觀態度,儘管一些分析師預測年中價格將疲軟。”

The Federal Reserve's meeting on July 31 will also be closely monitored by market participants.

7月31日的聯準會會議也將受到市場參與者的密切關注。

"Although it's likely that interest rates will remain unchanged, the perspectives and outlook presented by Fed officials at the meeting will provide crucial insights into policy direction for the months ahead," Fahmi added.

法赫米補充道:“儘管利率可能保持不變,但聯準會官員在會議上提出的觀點和前景將為未來幾個月的政策方向提供重要見解。”

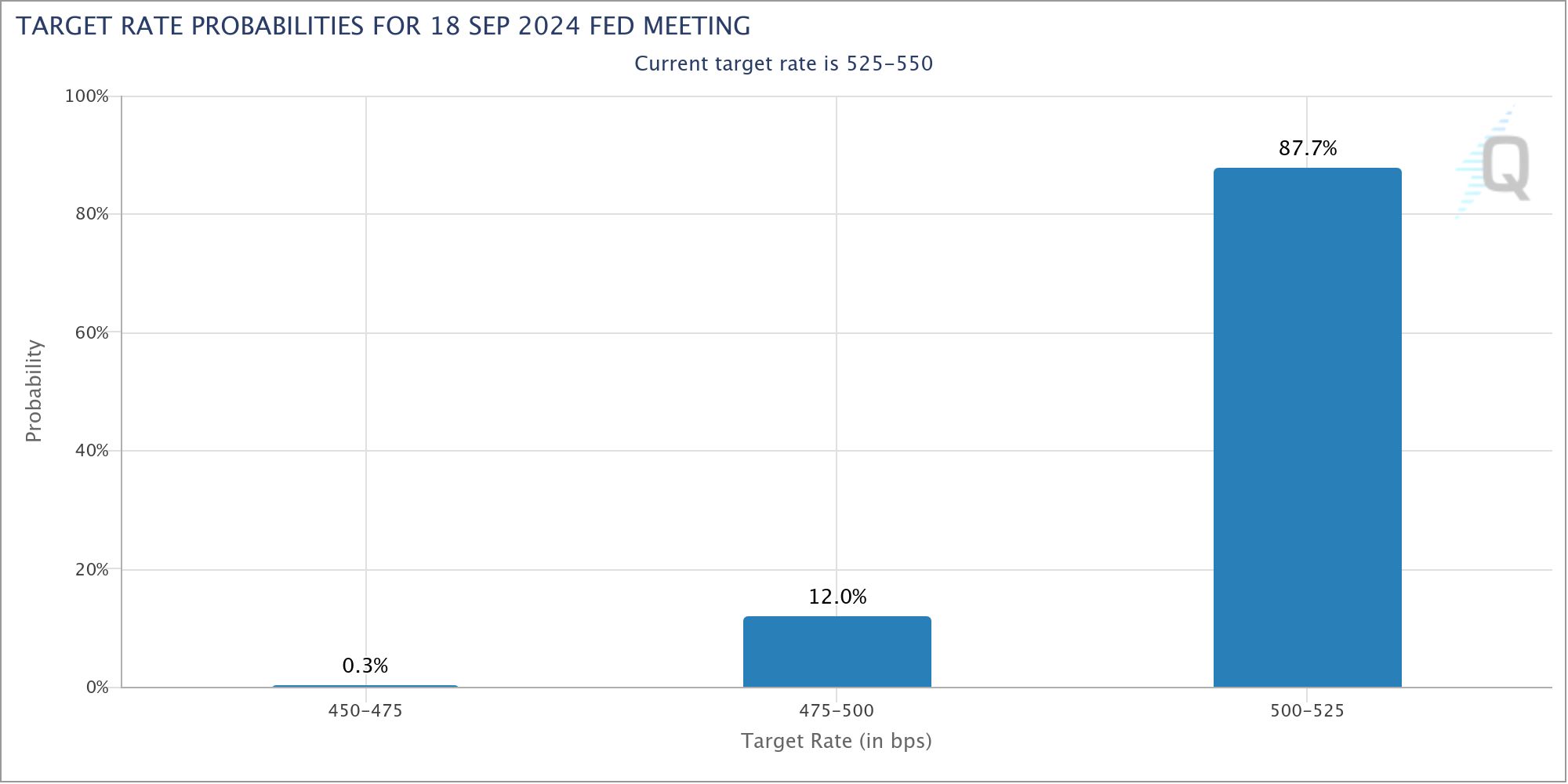

He notes that the market anticipates interest rate reductions beginning in September (see CME FedWatch chart below). Therefore, any indication of an accelerated reduction in interest rates could trigger a strong positive reaction, or vice versa.

他指出,市場預計 9 月開始降息(請參閱下面的 CME FedWatch 圖表)。因此,任何加速降息的跡像都可能引發強烈的正面反應,反之亦然。

Positive Outlook for Investors

投資者前景樂觀

Fahmi highlights that the trend of Bitcoin accumulation by institutional investors, including in the US, is accompanied by a rise in Bitcoin's market liquidity.

Fahmi強調,包括美國在內的機構投資者累積比特幣的趨勢伴隨著比特幣市場流動性的上升。

https://blockchainmedia.id/cco-reku-performa-etf-bitcoin-dorong-pertumbuhan-industri-kripto-indonesia/

https://blockchainmedia.id/cco-reku-performa-etf-bitcoin-dorong-pertumbuhan-industri-kripto-indonesia/

"The magnitude of Bitcoin's liquidity is evident in market dynamics such as the recent influx and subsequent outflow of approximately US$1.15 billion in the futures market on July 29," Fahmi concluded. "[ab]"

Fahmi 總結道:“比特幣流動性的大小在市場動態中顯而易見,例如 7 月 29 日期貨市場近期流入和隨後流出約 11.5 億美元。” “[ab]”

BlockchainReporter

BlockchainReporter DogeHome

DogeHome Inside Bitcoins

Inside Bitcoins Crypto Daily™

Crypto Daily™ Cointribune EN

Cointribune EN CoinPedia News

CoinPedia News BH NEWS

BH NEWS Crypto News Flash

Crypto News Flash