In the world of decentralization, Bitcoin has made a grand comeback, with its value skyrocketing to a whopping $73,000. Not just the OG cryptocurrency, but others like Ethereum and the meme-favorite Dogecoin are enjoying their share of the limelight, propelling the market’s worth over the $2.7 trillion mark for the first time in years. But guess what? You might have missed the memo, considering the buzz isn’t as loud as before. No more chatter about which digital coin will hit the jackpot next or queries about when you’ll be able to buy that Lamborghini. The world’s obsession seems to have dialed down a notch, at least for now.

在去中心化的世界里,比特币卷土重来,其价值飙升至 73,000 美元。不仅是 OG 加密货币,以太坊和最受欢迎的狗狗币等其他加密货币也受到了人们的关注,推动市场价值多年来首次突破 2.7 万亿美元大关。但猜猜怎么了?考虑到嗡嗡声不像以前那么响亮,你可能错过了这份备忘录。不再讨论下一个会中大奖的数字硬币,也不再询问何时可以购买兰博基尼。全世界的痴迷似乎已经减弱了一个档次,至少目前是这样。

The Unexpected Rise

Crypto’s resurgence in 2024 paints a rather muted picture compared to the frenzied rallies of the past. Gone are the days of ICO madness or the NFT craze. This time, the surge seems to be riding on more mundane factors like the upcoming “halving” event, which will slash the bitcoin mining reward by half, whispers of dropping interest rates, and a significant influx of institutional money into bitcoin ETFs, thanks to the green light from the U.S. Securities and Exchange Commission.

与过去的疯狂反弹相比,加密货币在 2024 年的意外崛起描绘了一幅相当平静的景象。 ICO 疯狂或 NFT 热潮的日子已经一去不复返了。这一次,比特币的飙升似乎是基于更平常的因素,比如即将到来的“减半”事件,这将使比特币挖矿奖励减少一半,利率下降的传言,以及机构资金大量涌入比特币 ETF,这要归功于美国证券交易委员会的批准。

BlackRock, the titan of asset management, didn’t just enter the crypto space; it bulldozed its way through, with its ETF quickly becoming a behemoth in the arena. Major banks are also queuing up to dip their toes in the Bitcoin pool, seemingly forgetting the bitter lessons of the past financial crisis. This newfound embrace by the traditional finance sector has turned heads within the crypto community. Bitcoin, after all, was birthed with the vision of bypassing these very institutions, offering a decentralized, censorship-resistant alternative to the conventional financial system.

资产管理巨头贝莱德不仅进入了加密货币领域,还涉足了加密货币领域。它一路高歌猛进,其 ETF 迅速成为竞技场上的庞然大物。各大银行也在排队试水比特币池,似乎忘记了过去金融危机的惨痛教训。传统金融行业的这种新的拥抱已经引起了加密货币社区的关注。毕竟,比特币的诞生就是为了绕过这些机构,为传统金融体系提供一种去中心化、抗审查的替代方案。

The Paradox of Adoption

Yet, the bitcoin faithful aren’t crying foul. On the contrary, they’re all for institutional FOMO, with predictions of bitcoin hitting the $100k milestone sooner rather than later. The sentiment is clear: the more, the merrier. Having bigwigs like BlackRock’s CEO onside is seen as a boon, aligning everyone’s interests under the bitcoin banner. But let’s not kid ourselves. Institutional investors aren’t in this for the revolution. They see bitcoin as another avenue for profit, not as the future of finance. And while they might flirt with the idea of an Ethereum ETF, their core motives remain as traditional as ever.

采用的悖论然而,比特币的忠实信徒并没有大喊大叫。相反,他们都支持机构 FOMO,预测比特币迟早会达到 10 万美元的里程碑。情感很明确:越多越好。有像贝莱德首席执行官这样的大人物在场被视为一种福音,可以将每个人的利益统一在比特币的旗帜下。但我们不要自欺欺人。机构投资者并不是为了这场革命而参与其中。他们将比特币视为另一种盈利途径,而不是金融的未来。尽管他们可能会对以太坊 ETF 的想法感兴趣,但他们的核心动机仍然一如既往地传统。

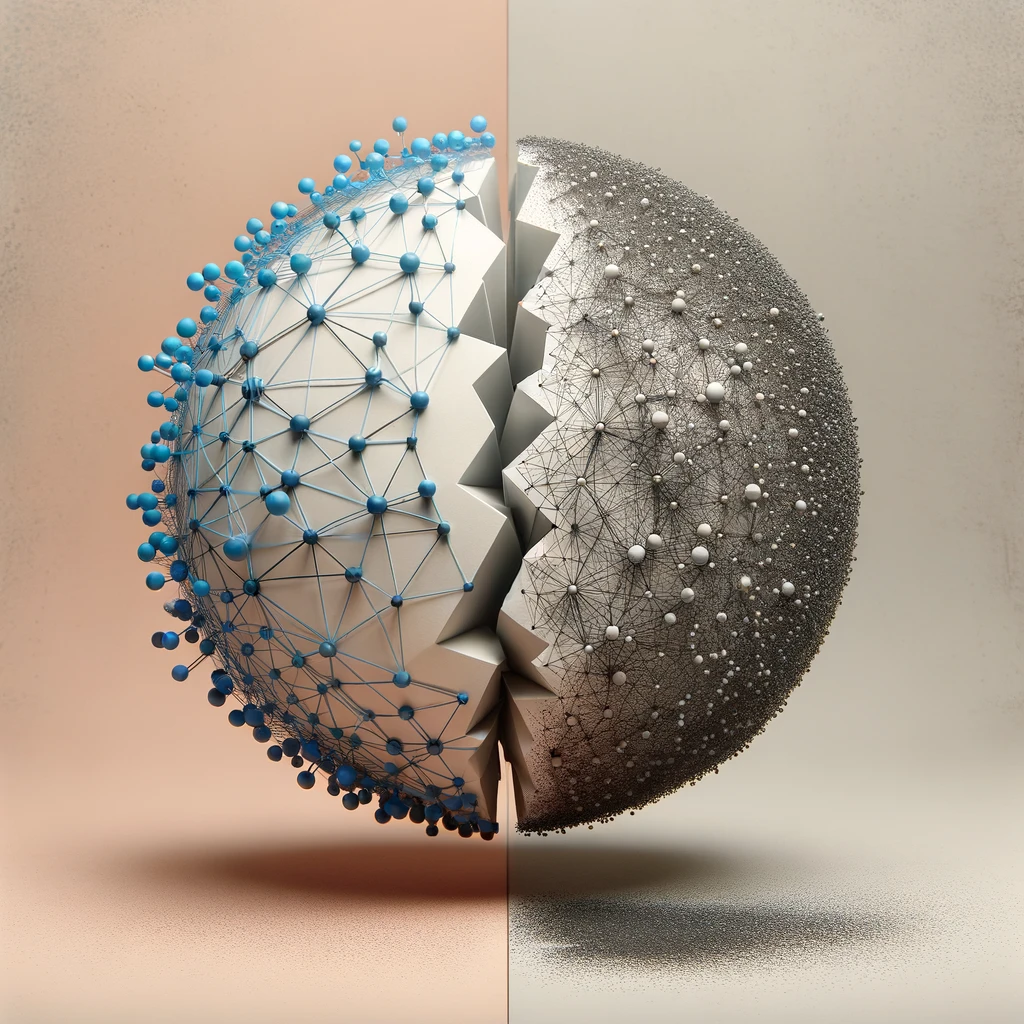

This marriage of convenience between crypto and traditional finance (TradFi) highlights a glaring hypocrisy. Crypto’s acceptance of institutional players and vice versa does not signal a newfound respect or understanding between the two worlds. Instead, it underscores a shared greed, an insatiable hunger for more, regardless of the means. The introduction of bitcoin ETFs has blurred the lines between two supposedly distinct financial realms, proving that the lessons of the financial crisis have been ignored. Both spheres, it turns out, are not so different after all, driven by the same old greed.

加密货币与传统金融(TradFi)之间的这种便利结合凸显了明显的虚伪。加密货币对机构参与者的接受,反之亦然,并不意味着两个世界之间出现了新的尊重或理解。相反,它强调了一种共同的贪婪,一种无论手段如何都对更多的永不满足的渴望。比特币 ETF 的推出模糊了两个本应截然不同的金融领域之间的界限,证明金融危机的教训被忽视了。事实证明,这两个领域毕竟并没有那么不同,都是由同样古老的贪婪驱动的。

And there lies the rub, the shared flaw of both centralization and decentralization: greed. It’s the Achilles’ heel that undermines the ideals and promises each system claims to uphold. For all its talk of disrupting and democratizing finance, crypto, when bedded with traditional finance, reveals a willingness to compromise its principles for profit. Similarly, TradFi’s embrace of crypto, despite its past skepticism and caution, shows a readiness to abandon lessons learned from past disasters at the altar of potential gains.

这就是中心化和去中心化的共同缺陷:贪婪。这是破坏每个系统声称要维护的理想和承诺的致命弱点。尽管加密货币一直在谈论颠覆金融并使金融民主化,但当与传统金融结合在一起时,加密货币却显示出为了利润而牺牲其原则的意愿。同样,尽管 TradFi 过去持怀疑态度和谨慎态度,但它对加密货币的拥抱表明,它准备放弃从过去灾难中吸取的教训,以追求潜在收益。

This convergence of interests might seem like a victory for bitcoin proponents, yet it raises critical questions about the future of finance. Are we merely repackaging old vices in new wrappers? Is the revolutionary potential of cryptocurrencies being diluted as they become just another asset class in the portfolios of the very institutions they sought to challenge?

这种利益的融合对于比特币支持者来说似乎是一场胜利,但它提出了有关金融未来的关键问题。我们只是用新包装重新包装旧的恶习吗?当加密货币成为他们试图挑战的机构投资组合中的另一种资产类别时,加密货币的革命潜力是否会被稀释?

Optimisus

Optimisus Cryptopolitan_News

Cryptopolitan_News DogeHome

DogeHome Cryptopolitan

Cryptopolitan crypto.ro English

crypto.ro English Crypto News Land

Crypto News Land ETHNews

ETHNews