Bitcoin is currently displaying a bullish pattern, although it’s important to note that the RSI exhibits a negative divergence. This situation is creating mixed signals regarding Bitcoin’s short-term directional movement.

比特币目前呈现看涨格局,但值得注意的是 RSI 呈现负背离。这种情况正在产生有关比特币短期方向走势的混合信号。

Bitcoin has retained its gains in early December, indicating a trend where buyers are stepping in during minor dips. According to CoinShares data, there was an influx of $87.6 million into Bitcoin funds for the week ending on December 22nd.

比特币在 12 月初保持了涨幅,表明买家在小幅下跌期间介入的趋势。根据 CoinShares 的数据,截至 12 月 22 日的一周,比特币基金流入了 8760 万美元。

Additionally, data from ETFGI, a research firm specialising in exchange-traded funds (ETFs), reveals that in November, there were inflows of $1.31 billion into cryptocurrency ETFs and exchange-traded products (ETPs). This brings the total inflows for the year to $1.60 billion.

此外,专门研究交易所交易基金(ETF)的研究公司ETFGI的数据显示,11月份,加密货币ETF和交易所交易产品(ETP)的资金流入为13.1亿美元。这使得今年的总流入达到 16 亿美元。

Investors seem to be accumulating Bitcoin before the anticipated approval of a spot Bitcoin ETF in January. Business Intelligence firm MicroStrategy added 14,620 Bitcoin to increase its total stockpile to 189,150. The latest acquisition was made at $42,110 per Bitcoin, taking its total average purchase price to about $31,168.

在预计 1 月份比特币 ETF 现货获得批准之前,投资者似乎正在积累比特币。商业智能公司 MicroStrategy 增加了 14,620 个比特币,使其总库存增加至 189,150 个。最新收购价格为每比特币 42,110 美元,使其平均购买总价达到约 31,168 美元。

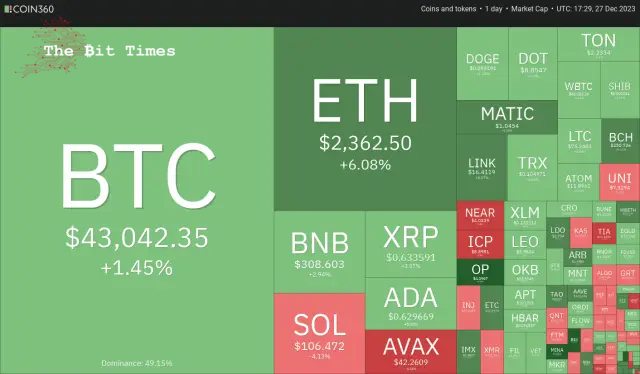

Will Bitcoin and altcoins continue their northward journey in the last few days of the year? Let’s analyse the charts of the top 10 cryptocurrencies to find out.

比特币和山寨币会在今年最后几天继续北上之旅吗?让我们分析一下前 10 名加密货币的图表来找出答案。

Bitcoin (BTC) price analysis

比特币(BTC)价格分析

Bitcoin has been stuck between the 20-day exponential moving average ($42,513) and the overhead resistance at $44,700.

比特币一直徘徊在 20 天指数移动平均线(42,513 美元)和上方阻力位 44,700 美元之间。

The price action of the past few days has formed an ascending triangle pattern that will complete on a break and close above $44,700. The BTC/USDT pair could then start the next leg of the uptrend toward the pattern target of $49,178.

过去几天的价格走势已经形成了一个上升三角形形态,该形态将在突破时完成并收于 44,700 美元上方。然后,BTC/USDT 货币对可能会开始下一阶段的上升趋势,目标为 49,178 美元。

Contrarily, if the price turns down and breaks below the triangle, it will invalidate the positive setup. That may trigger the stops of several traders, pulling the cost to the 50-day simple moving average ($40,022) and later to $37,980.

相反,如果价格下跌并跌破三角形,则积极的设置将失效。这可能会触发一些交易者的止损,将成本拉至 50 日简单移动平均线(40,022 美元),然后拉至 37,980 美元。

Ether (ETH) price analysis

以太币(ETH)价格分析

过去几天,以太币一直在下降通道模式内交易,但一个积极的迹象是,多头不允许价格维持在 2,200 美元以下。

Solid buying on Dec. 27 propelled the price above the descending channel. If bulls maintain the price above the channel, the possibility of a break above $2,403 increases. The ETH/USDT pair could then ascend to $3,000.

12 月 27 日的强劲买盘推动价格突破下降通道。如果多头将价格维持在通道之上,则突破 2,403 美元的可能性就会增加。 ETH/USDT 货币对可能会上涨至 3,000 美元。

Conversely, if the price re-enters the channel, it will signal that higher levels continue to attract sellers. The break below $2,200 could sink the pair to the channel’s support line. This remains critical for the bulls to protect because a drop below the channel may start a deeper correction to $1,900 and then $1,750.

相反,如果价格重新进入该通道,则将表明更高的水平继续吸引卖家。跌破 2,200 美元可能会使该货币对跌至该通道的支撑线。这对于多头的保护仍然至关重要,因为跌破该通道可能会开始更深的回调至 1,900 美元,然后是 1,750 美元。

Solana (SOL) price analysis

Solana (SOL) 价格分析

Solana has been in a strong uptrend for the past several days. The bulls quickly cleared the psychological resistance of $100 on Dec. 23 and pushed the price to $126 on Dec. 25.

Solana 在过去几天一直处于强劲的上升趋势。多头在 12 月 23 日迅速清除了 100 美元的心理阻力位,并于 12 月 25 日将价格推至 126 美元。

Profit booking started a pullback on Dec. 26, but the long tail on the day’s candlestick shows strong buying at the 38.2% Fibonacci retracement level of $103. The price was turned down on Dec. 27, indicating that the bears are in no mood to give up.

利润预订于 12 月 26 日开始回调,但当天烛台上的长尾显示在 38.2% 斐波那契回撤位 103 美元处有强劲买盘。 12月27日价格回落,表明空头没有放弃的心情。

If the price drops below $103, the SOL/USDT pair could decline to the 20-day EMA ($89), near the 61.8% Fibonacci retracement level. A break below the 20-day EMA will suggest a change in the short-term trend. The bulls will regain control if they catapult the price above $126.

如果价格跌破 103 美元,SOL/USDT 货币对可能会跌至 20 日均线(89 美元),接近 61.8% 斐波那契回撤位。跌破20日均线将表明短期趋势发生变化。如果多头将价格推升至 126 美元以上,他们将重新获得控制权。

BNB price analysis

BNB turned up from the 20-day EMA ($262) on Dec. 25 and soared above the neckline on Dec. 26, completing a bullish inverse head-and-shoulders pattern.

BNB 价格分析 BNB 于 12 月 25 日从 20 日均线(262 美元)上涨,并于 12 月 26 日飙升至颈线之上,完成看涨的反向头肩形态。

The bears tried to pull the price down toward the neckline on Dec. 27, but the long tail on the candlestick shows aggressive buying on dips. Buyers will try to maintain the momentum and shove the price to the pattern target of $333 and eventually to $350.

12 月 27 日,空头试图将价格拉向颈线,但烛台上的长尾显示逢低买入的激进行为。买家将努力保持势头,将价格推至 333 美元的模式目标,并最终推至 350 美元。

Meanwhile, the bears are likely to have other plans. They will try to stall the upmove near $317 and start a correction. Sellers must tug the BNB/USDT pair below the neckline to make a comeback.

与此同时,空头可能还有其他计划。他们将试图阻止涨势接近 317 美元并开始修正。卖家必须将 BNB/USDT 货币对拉至颈线下方才能卷土重来。

XRP price analysis

瑞波币价格分析

XRP has been range-bound between $0.56 and $0.67 for the past few days, signalling a balance between buyers and sellers.

过去几天,XRP 一直在 0.56 美元至 0.67 美元之间波动,表明买家和卖家之间存在平衡。

Both moving averages have flattened out, and the RSI is near the midpoint, suggesting that the range-bound action may continue longer. The first sign of strength will be a break and close above $0.67. The XRP/USDT pair may rise to $0.74, where the bears are expected to mount a strong defence.

两条移动平均线均已趋于平缓,RSI 接近中点,表明区间波动可能会持续更长时间。强势的第一个迹象将是突破并收于 0.67 美元上方。 XRP/USDT 货币对可能会上涨至 0.74 美元,预计空头将在此进行强有力的防御。

On the downside, the bears must sink and keep the price below $0.56 to seize control. The pair could then slide to the solid support at $0.46.

不利的一面是,空头必须下沉并将价格保持在 0.56 美元以下才能夺取控制权。随后该货币对可能会下滑至 0.46 美元的坚实支撑位。

Cardano (ADA) price analysis

Cardano has been consolidating in an uptrend. The price action of the past few days has formed a symmetrical triangle pattern, indicating indecision between the bulls and the bears.

卡尔达诺(ADA)价格分析卡尔达诺一直在上升趋势中巩固。过去几天的价格走势形成了对称三角形模式,表明多头和空头之间犹豫不决。

The upsloping moving averages and the positive territory’s RSI signal buyers an advantage. A break and close above the triangle will suggest that the bulls have absorbed the supply. That could propel the price to $0.69 and later to the pattern target of $0.80.

上升的移动平均线和积极的 RSI 区域表明买家有优势。突破并收于三角形之上将表明多头已经吸收了供应。这可能会将价格推高至 0.69 美元,随后达到 0.80 美元的模式目标。

On the contrary, if the price turns down and breaks below the triangle, it will suggest that the bears remain active at higher levels. The ADA/USDT pair could collapse to the strong support at $0.46.

相反,如果价格下跌并跌破三角形,则表明空头在较高水平仍保持活跃。 ADA/USDT 货币对可能会跌至 0.46 美元的强支撑位。

Avalanche (AVAX) price analysis

雪崩 (AVAX) 价格分析

Avalanche turned down from $49.96 on Dec. 24, indicating that the traders booked profits near the psychological level of $50.

Avalanche 从 12 月 24 日的 49.96 美元回落,表明交易者在 50 美元的心理价位附近获利了结。

The selling picked up on Dec. 26, pulling the price to the 20-day EMA ($40.31). The long tail on the day’s candlestick shows that the bulls view the dips as a buying opportunity. Buyers must push the price above $50 to resume the uptrend.

12 月 26 日抛售加剧,将价格拉至 20 日均线(40.31 美元)。当日烛台上的长尾表明多头将下跌视为买入机会。买家必须将价格推高至 50 美元以上才能恢复上升趋势。

The risk to the bullish view is that the RSI is showing signs of forming a bearish divergence. This suggests that the positive momentum may be weakening. That signals a minor correction or consolidation in the near term. The selling could pick up if the AVAX/USDT pair skids below the 20-day EMA. The pair may then slump to $34

看涨观点面临的风险是 RSI 正显示出形成看跌背离的迹象。这表明积极势头可能正在减弱。这标志着近期的小幅调整或盘整。如果 AVAX/USDT 货币对跌破 20 日均线,抛售可能会加剧。随后该货币对可能会跌至 34 美元

Dogecoin (DOGE) price analysis

The bears pulled Dogecoin below the 20-day EMA ($0.09) on Dec. 26, but the long tail on the candlestick shows strong buying at the 50-day SMA ($0.09).

狗狗币 (DOGE) 价格分析 12 月 26 日,空头将狗狗币拉至 20 日均线(0.09 美元)下方,但烛台上的长尾显示在 50 日均线(0.09 美元)处有强劲买盘。

The flattish 20-day EMA and the RSI near the midpoint suggest a balance between supply and demand. This equilibrium could shift in favour of the bears if they sink and sustain the price below the 50-day SMA. The pair may then tumble to $0.07.

持平的 20 日均线和 RSI 接近中点表明供需平衡。如果空头下跌并维持价格低于 50 日移动平均线,这种平衡可能会向空头有利。随后该货币对可能会跌至 0.07 美元。

If buyers want the upper hand, they must drive the price above the $0.10 to $0.11 resistance zone. If they manage to do that, the DOGE/USDT pair could start the next leg of the uptrend to $0.16.

如果买家想要占据上风,他们必须将价格推至 0.10 美元至 0.11 美元的阻力区之上。如果他们成功做到这一点,DOGE/USDT 货币对可能会开始下一阶段的上升趋势,达到 0.16 美元。

Polkadot (DOT) price analysis

Polkadot is correcting in an uptrend. The price turned down from $9.59 on Dec. 26, indicating that the bears are defending the overhead resistance at $10.

Polkadot (DOT) 价格分析 Polkadot 正在上升趋势中进行修正。价格从 12 月 26 日的 9.59 美元下跌,表明空头正在捍卫 10 美元的上方阻力位。

The DOT/USDT pair will likely correct to the breakout level of $7.90. If the price rebounds off this support, it will imply that the sentiment remains positive and traders are buying on dips. The bulls will then make one more attempt to clear the obstacle at $10 and start the journey to $12.

DOT/USDT 货币对可能会修正至 7.90 美元的突破水平。如果价格从该支撑位反弹,则意味着市场情绪依然乐观,交易者逢低买入。然后,多头将再次尝试清除 10 美元的障碍,并开始迈向 12 美元的旅程。

The risk to the upside is that the RSI is forming a negative divergence. This suggests that the bullish momentum could be slowing. The pair may spend some time inside the range between $7.90 and $9.59 in the short term.

上行风险是 RSI 正在形成负背离。这表明看涨势头可能正在放缓。短期内该货币对可能会在 7.90 美元至 9.59 美元的区间内徘徊一段时间。

Polygon (MATIC) price analysis

Polygon bounced off the 20-day EMA ($0.87) on Dec. 25 and rose above the stiff overhead resistance of $1 on Dec. 26.

Polygon (MATIC) 价格分析 Polygon 于 12 月 25 日从 20 日均线(0.87 美元)反弹,并于 12 月 26 日升至 1 美元的上方阻力位。

Buyers are trying to extend the upmove on Dec. 27 but may face selling near $1.20. The MATIC/USDT pair could drop to $1 if the price turns down the overhead resistance. If bulls flip this level into support, it will signal strength. The bulls will then try to overcome the barrier at $1.20 and push the price to $1.50.

买家试图延续 12 月 27 日的涨势,但可能面临 1.20 美元附近的抛售。如果价格降低上方阻力,MATIC/USDT 货币对可能会跌至 1 美元。如果多头将该水平转变为支撑位,则将发出强势信号。然后,多头将尝试克服 1.20 美元的障碍,并将价格推至 1.50 美元。

Instead, if bears pull the price below $1, it may trap the aggressive bulls. That could accelerate selling and pull the pair to the $0.89 support.

相反,如果空头将价格拉低至 1 美元以下,则可能会困住激进的多头。这可能会加速抛售并将该货币对拉至 0.89 美元的支撑位。

Source – Rakesh Upadhyay

来源——Rakesh Upadhyay

Source: https://thebittimes.com/latest-market-overview-27th-dec-btc-eth-sol-bnb-xrp-ada-avax-doge-dot-matic-tbt74987.html

资料来源:https://thebittimes.com/latest-market-overview-27th-dec-btc-eth-sol-bnb-xrp-ada-avax-doge-dot-matic-tbt74987.html

DogeHome

DogeHome BlockchainReporter

BlockchainReporter CoinPedia News

CoinPedia News TheNewsCrypto

TheNewsCrypto CFN

CFN Optimisus

Optimisus Crypto News Land

Crypto News Land