Bitcoin: Hashrate Hiccup or Miner Exodus?

比特幣:算力停滯還是礦工出走?

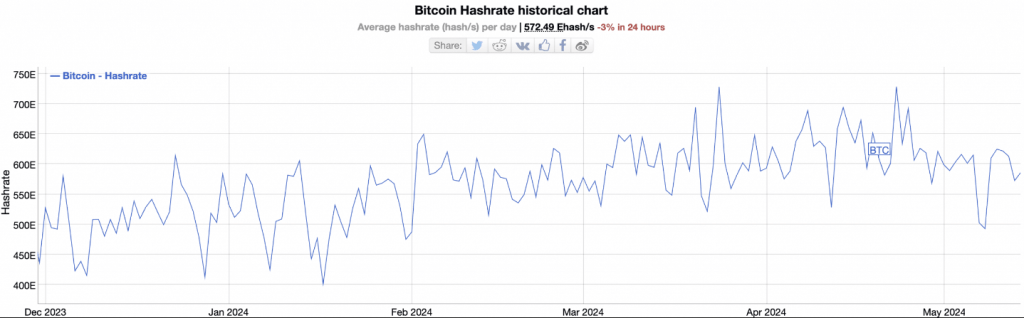

The post-halving world of Bitcoin continues to throw curveballs. After a hashrate surge to celebrate the block reward reduction in April, Bitcoin's computational power has taken a nosedive, dropping 20% in recent weeks.

比特幣減半後的世界繼續出現曲線球。在 4 月慶祝區塊獎勵減少而導致算力激增之後,比特幣的運算能力急劇下降,最近幾週下降了 20%。

Hashrate Hiccup or Miner Exodus?

算力問題還是礦工出走?

Hashrate, a measure of the combined processing power dedicated to securing the Bitcoin network, typically climbs after a halving event as miners invest in more powerful rigs to compete for the reduced rewards. However, this time around, the trend defied expectations.

算力是衡量比特幣網路安全的綜合處理能力的指標,通常在減半事件後攀升,因為礦工投資更強大的礦機來爭奪減少的獎勵。然而,這次的趨勢卻出乎意料。

Experts like Maartunn, a pseudonymous analyst at CryptoQuant, believe this signals a potential "miner capitulation." Less efficient miners are now likely throwing in the towel. The halving, which cut block rewards in half, squeezed profit margins for miners using older equipment. As these miners shut down their operations, the hashrate dips.

CryptoQuant 的化名分析師 Maartunn 等專家認為,這標誌著潛在的「礦工投降」。效率較低的礦工現在可能會認輸。減半導致區塊獎勵減少一半,擠壓了使用舊設備的礦工的利潤率。當這些礦工停止運作時,算力就會下降。

Hash Ribbons Flash Warning Sign

哈希絲帶閃光警告標誌

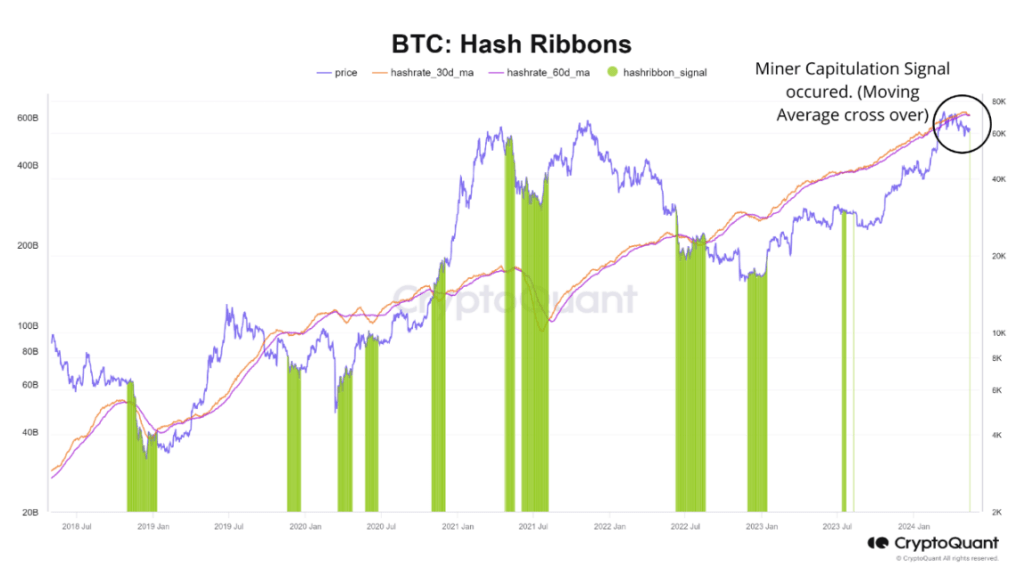

Supporting Maartunn's theory is a technical indicator called Hash Ribbons. This metric tracks the difference between short-term and long-term hashrate averages. When the gap widens, it suggests a decline in mining activity, potentially due to less efficient miners dropping off.

支持 Maartunn 理論的是一個名為「哈希絲帶」的技術指標。此指標追蹤短期和長期算力平均值之間的差異。當差距擴大時,顯示採礦活動下降,可能是由於效率較低的礦工退出所致。

The recent hashrate plunge has triggered a spike in Hash Ribbons, historically a sign of miner capitulation that has often coincided with price lows for Bitcoin.

最近的算力暴跌引發了算力絲帶的飆升,這從歷史上看是礦工投降的跡象,通常與比特幣價格低點同時發生。

Bitcoin Miners Selling Off?

比特幣礦工拋售?

Further fueling the capitulation theory is a decrease in Bitcoin's Miner Reserve. This metric tracks the amount of Bitcoin held in wallets associated with miners. A decline in the reserve suggests miners might be offloading their mined coins, potentially to cover operational costs or to exit the market altogether.

比特幣礦工儲備的減少進一步加劇了投降理論。該指標追蹤與礦工相關的錢包中持有的比特幣數量。儲備的下降表明礦商可能會拋售他們開採的代幣,可能是為了支付營運成本或完全退出市場。

Undervaluation Signal or Cyclical Dip?

低估訊號還是周期性下跌?

Maartunn interprets these signs as a bullish indicator. Hash Ribbons often point to opportune moments to buy, he argues. Backing his claim is the Market Value to Realized Value (MVRV) ratio, which suggests Bitcoin might be undervalued.

Maartunn 將這些跡象解讀為看漲指標。他認為,哈希絲帶通常會指出購買的時機。支持他的主張的是市場價值與已實現價值(MVRV)比率,這表明比特幣可能被低估。

This metric compares the current market price to the average price at which all Bitcoins were acquired. A negative MVRV, like the one Bitcoin currently has, suggests the asset is trading below its historical cost basis, potentially indicating a buying opportunity.

該指標將當前市場價格與購買所有比特幣的平均價格進行比較。負 MVRV(就像比特幣目前的情況一樣)表明該資產的交易價格低於其歷史成本基礎,可能表明存在買入機會。

Related Reading: Buckle Up, XRP Fans: Analyst Eyes Price Explosion To $0.65 In Next 5 Days

相關閱讀:XRP 粉絲們,繫好安全帶:分析師預計價格將在未來 5 天內爆炸至 0.65 美元

Not Everyone on the Capitulation Train

並不是每個人都在投降列車上

However, not all analysts are convinced. Some argue that the hashrate decline could be temporary, perhaps due to factors like extreme weather events disrupting mining operations in certain regions. Additionally, the post-halving period is typically one of adjustment for miners, and a short-term hashrate fluctuation might not necessarily signal a mass exodus.

然而,並非所有分析師都相信這一點。有些人認為,算力下降可能是暫時的,可能是由於極端天氣事件擾亂了某些地區的採礦作業等因素。此外,減半後的時期通常是礦工的調整期之一,短期算力波動不一定意味著大規模外流。

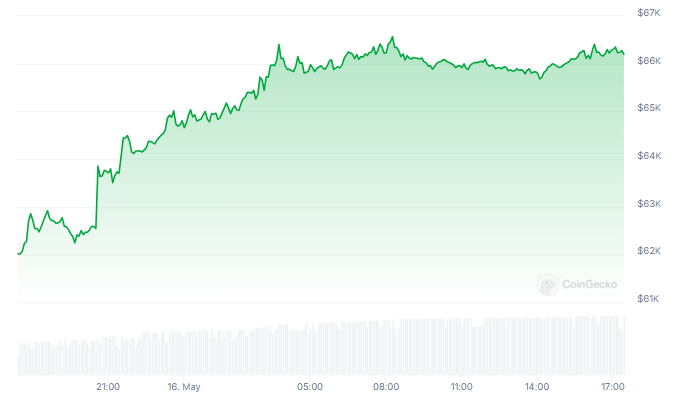

The post-halving Bitcoin landscape is still unfolding. While the hashrate decline and other signs suggest a potential buying opportunity, particularly for long-term investors, the situation remains fluid.

比特幣減半後的景象仍在展開。儘管算力下降和其他跡象表明存在潛在的買入機會,特別是對於長期投資者而言,但情況仍然不穩定。

Featured image from Shutterstock, chart from TradingView

精選圖片來自 Shutterstock,圖表來自 TradingView

Cryptopolitan

Cryptopolitan DogeHome

DogeHome crypto.ro English

crypto.ro English Crypto News Land

Crypto News Land ETHNews

ETHNews CFN

CFN U_Today

U_Today Thecoinrepublic.com

Thecoinrepublic.com